Accounting for Construction Company

With technology advancement and modernization construction companies use programs and resources that you won't find in other businesses such as travel agencies and gas station. From construction cost planning to vendor payment, this industry is unique. However,accounting for construction business is always challenge business owners. FIrstly, it is difficult to get a better qualified and experienced staff to handle the activities. Secondly, it is very difficult to get the work done in a timely and professional manner hence hiring a full-time bookkeeper is extra cost. Whether you are new to construction business or perhaps you have been established construction company for many years, you must need good accounting for construction company. This will help to achieve better milestone in the business.

When contracts are on the line, you can’t afford to waste time with inefficient bookkeeper and incompatible services. The construction accounting need to have a little different approach, as per the nature of business. There are several activities in the real estate business which cannot be considered with general accounting. While doing construction bookkeeping, it is important to make the financial transaction entries at proper places. That’s where Accounts Junction comes in. We have good experience of working on accounting with different real estate companies in the USA.

Accounts Junction understand the challenges your company faces for bookkeeping and accounting. We are highly experienced when it comes to accounting for construction business. Head quartered in India we have served many offshore clients from construction industry in countries like USA, UK, Canada, New Zealand, South Africa, Australia and Singapore. In a very short span of time we have established a great relationship and reputation among construction companies. The key reason behind our cusses is, our team is expertly trained for outsource accounting for construction company work and technically proficient to handle all accounting software's like Xero, Zoho Books, QuickBooks, MYOB, SAASU, Tally, NETSUITE, Sage and Oodo.

Accounting for Construction Company

As we mentioned our team has extensively work in construction sector for various works like:

ON THE ASSETS SIDE:

- Current Asset

- Short Term Investments

- Receivables

- Allowance For Doubtful Debts

- Inventory

- Other Current Assets

- Investments And Other Assets

- Property Plant And Equipment

- Accumulated Depreciation

ON THE LIABILITIES SIDE:

- Over-billings

- Equity

- Non-Current Liabilities

- Tax Payables

- Account Payables

- Current Liabilities

- Deferred Income

- Accrued Interest Payable

- Notes Payable

Most of Accounting firm treats accounting for construction company similar to other business however there is slightly catch in construction accounting. Projects evolves in long run and many phases. This makes it quite difficult for an accountant to evaluate the exact amounts for the work that is not completed yet. However, as an experienced construction accounting firm Accounts Junction developed a mechanism for that also by dividing the bookkeeping work into –

- Accounting for Work-In-Progress

- Accounting for Percentage Completion Basis

Accounts Junction has a very streamlined approach of working for real estate firms. They can help achieve better efficiency in the accounting for these firms. For more information about accounting for construction business services, write us or contact us today! One of our accounting expert will be in touch with you for no obligation quote and assistance.

Bookkeeping and accounting for construction in the US:

Softwares used for bookkeeping and accounting in construction industry in the US:

There are several software options available for bookkeeping and accounting specifically tailored to the construction industry in the US. Here are some popular software tools used for construction bookkeeping and accounting:

1. QuickBooks for Contractors:

QuickBooks is a widely used accounting software that offers specialized versions for the construction industry. QuickBooks for Contractors provides features such as job costing, progress invoicing, tracking expenses by project, and generating financial reports specific to construction businesses.

2. Sage 100 Contractor:

Sage 100 Contractor (formerly known as Sage Master Builder) is a comprehensive accounting and project management software designed specifically for the construction industry. It includes features such as estimating, job costing, project management, payroll processing, and financial reporting.

3. ProContractor by Viewpoint:

ProContractor is a construction-specific accounting software that integrates project management, accounting, and estimating functions. It offers features such as job costing, budgeting, subcontractor management, billing, and document management, providing a complete solution for construction bookkeeping and accounting needs.

4. Foundation Software:

Foundation Software is an all-in-one construction accounting software that covers various aspects of financial management in the construction industry. It includes features like job costing, project management, payroll processing, certified payroll reporting, and financial reporting.

5. ComputerEase:

ComputerEase is a construction-specific accounting software that offers comprehensive features for bookkeeping and accounting in the construction industry. It includes job costing, project management, contract management, estimating, and financial reporting capabilities.

6. Procore Financial Management:

Procore is a cloud-based construction management platform that includes financial management modules. It offers features such as project cost tracking, budget management, change order management, and integration with other construction management functionalities.

7. CMiC Financials:

CMiC is an enterprise-level construction management and accounting software. Its financials module provides features like general ledger, accounts payable and receivable, cash management, job costing, and advanced financial reporting.

These software options are specifically designed to meet the unique accounting needs of construction businesses in the US. They provide tools for tracking job costs, managing project budgets, generating financial reports, and ensuring compliance with industry-specific accounting practices. Selecting the most suitable software depends on the specific requirements and size of your construction business.

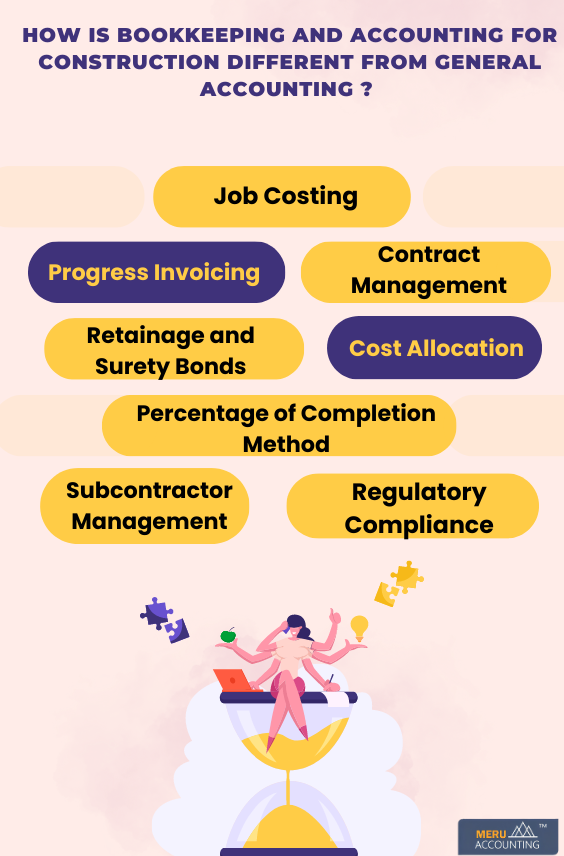

How is bookkeeping and accounting for construction different from general accounting ?

Bookkeeping and accounting for construction differ from general accounting due to the unique characteristics and requirements of the construction industry. Here are some key differences:

1. Job Costing:

Construction projects typically involve multiple jobs or projects simultaneously. Job costing is a crucial aspect of construction accounting, which involves tracking costs and revenue associated with each specific project. This includes recording expenses, labor costs, material costs, equipment usage, and overhead expenses for each job separately.

2. Progress Invoicing:

Construction projects often follow a progress billing system where invoices are generated based on the completion of specific project milestones or stages. Construction accounting involves accurately tracking and managing progress invoices to reflect the work completed and bill clients accordingly.

3. Contract Management:

Construction projects involve contracts with clients, subcontractors, and suppliers. Construction accounting includes managing and tracking the financial aspects of these contracts, such as progress payments, retainage, change orders, and ensuring compliance with contractual obligations.

4. Retainage and Surety Bonds:

Construction projects often involve retainage, which is a portion of the payment withheld by the client until the project is completed satisfactorily. Construction accounting involves managing retainage and ensuring proper tracking and release of these funds. Additionally, surety bonds may be required for construction projects, and accounting for these bonds is specific to the construction industry.

5. Cost Allocation:

Construction accounting requires allocating costs to specific projects or jobs accurately. This includes allocating direct costs, such as labor and materials, as well as indirect costs, such as equipment usage and overhead expenses. Cost allocation methods, such as burden rates or overhead allocation, are commonly employed in construction accounting.

6. Percentage of Completion Method:

The construction industry often uses the Percentage of Completion (POC) method for revenue recognition. This method recognizes revenue and expenses based on the proportion of work completed rather than waiting until the project is fully completed. Construction accounting involves accurately calculating and applying the POC method for revenue recognition and project profitability analysis.

7. Subcontractor Management:

Construction projects frequently involve subcontractors, and construction accounting includes managing subcontractor payments, tracking their costs, and ensuring compliance with tax requirements, such as issuing 1099 forms.

8. Regulatory Compliance:

The construction industry has specific regulatory requirements related to taxes, insurance, labor laws, and financial reporting. Construction accounting involves staying up to date with these regulations and ensuring compliance in areas such as certified payroll reporting, prevailing wage requirements, and sales tax rules for construction materials.

These are some of the key differences between construction accounting and general accounting. Construction accounting requires specialized knowledge and expertise to address the unique financial aspects of the construction industry, such as job costing, progress invoicing, contract management, and compliance with industry-specific regulations.

How Accounts Junction helps in bookkeeping and accounting for construction business in the USA?

Accounts Junction's bookkeeping and accounting services are highly beneficial for construction businesses in the USA. By leveraging our expertise, construction businesses can experience the following advantages:

1. Expert Financial Organization:

Accounts Junction ensures that construction businesses maintain organized and accurate financial records. Our professional bookkeeping services track income, expenses, project costs, and other financial transactions. With our support, businesses have access to well-organized financial information, facilitating informed decision-making, budgeting, and financial analysis.

2. Specialized Cost Tracking and Job Costing:

Accounts Junction understands the unique requirements of the construction industry and provides specialized cost tracking and job costing services. We help construction businesses track project costs, analyze profitability, and identify areas of cost overruns or inefficiencies. This enables businesses to optimize project management and increase profitability.

3. Comprehensive Budgeting and Financial Planning:

With Accounts Junction's assistance, construction businesses can develop realistic budgets and financial plans. Our accounting services help track actual costs against projected costs, identify variances, and make necessary adjustments. This supports effective financial planning, ensuring businesses maintain financial stability throughout their projects.

4. Streamlined Invoicing and Billing:

Accounts Junction's expertise ensures accurate invoicing and efficient billing processes for construction businesses. By tracking work completed, materials used, and associated costs, they generate precise and timely invoices. This helps construction businesses maintain a healthy cash flow, minimize payment disputes, and enhance client relationships.

5. Accurate Financial Reporting:

Accounts Junction generates accurate financial reports, including income statements, balance sheets, and cash flow statements. These reports provide construction businesses with critical insights into their financial health and performance. We help businesses analyze their profitability, secure financing, and foster transparency and credibility with stakeholders.

6. Tax Compliance:

Accounts Junction's tax expertise ensures construction businesses remain compliant with tax regulations. We accurately record income, expenses, and deductions, enabling businesses to meet tax obligations and file returns correctly and on time. Compliance reduces the risk of penalties and audits, providing peace of mind to construction businesses.

7. Business Analysis and Growth Strategies:

Accounts Junction's financial analysis services help construction businesses evaluate their financial performance, identify trends, and assess profitability. This analysis empowers businesses to make informed decisions, identify areas for improvement, and develop effective growth strategies.

8. Audit Preparedness:

Accounts Junction's services ensure that construction businesses are well-prepared for audits by tax authorities, lenders, or stakeholders. Our organized financial records and accurate reporting streamline the audit process and demonstrate compliance and transparency. This instills confidence and saves time during audits.

By utilizing Accounts Junction's specialized bookkeeping and accounting services, construction businesses can streamline their financial management processes, optimize profitability, and focus on their core operations with confidence. Accounts Junction's expertise in construction accounting ensures that businesses receive tailored and reliable support that addresses the unique needs and challenges of the construction industry.

Accounts Junction's bookkeeping and accounting services are specifically designed to address the unique needs and challenges of construction businesses in the USA. Our expertise in financial organization, specialized cost tracking, accurate invoicing, and comprehensive financial reporting aligns perfectly with the requirements of the construction industry. By leveraging Accounts Junction's services, construction businesses can benefit from their in-depth knowledge and experience in construction accounting. Accounts Junction ensures accurate recording and tracking of project costs, efficient invoicing and billing processes, and the generation of reliable financial reports tailored to the construction industry. With our support, construction businesses can optimize profitability, maintain financial stability, and focus on their core operations, knowing that their financial management is in capable hands. The specialized bookkeeping and accounting services provided by Accounts Junction offer construction businesses a competitive edge, enabling them to navigate the complexities of the industry and achieve long-term success.