Bookkeeping and Accounting Services for Startups

Are you a start-up that is working to achieve steady growth in your firm? You need to focus on all the important areas of the business.

This will pave the path to achieving early success for your organization. Working on products/services, client requirements, planning, team build-up, organization workflow, payroll, human resource management, etc. are some of the areas which need to be focused on start-ups.

Apart from these core functional areas, accounting for startups plays an important role in their growth. It plays an important role in recording financial transactions in proper accounting books.

Proper bookkeeping for startups can help to analyze the costs of the business and the revenue sources of the business.

Bookkeeping for startups helps to improve the cash flow in the organization. It further helps to improve finances, make proper decisions, and work with proper planning.

It is not possible for all start-ups to have a proficient accounting department, as they have limits on budget. So, outsourcing to any expert accounting firm can be more beneficial.

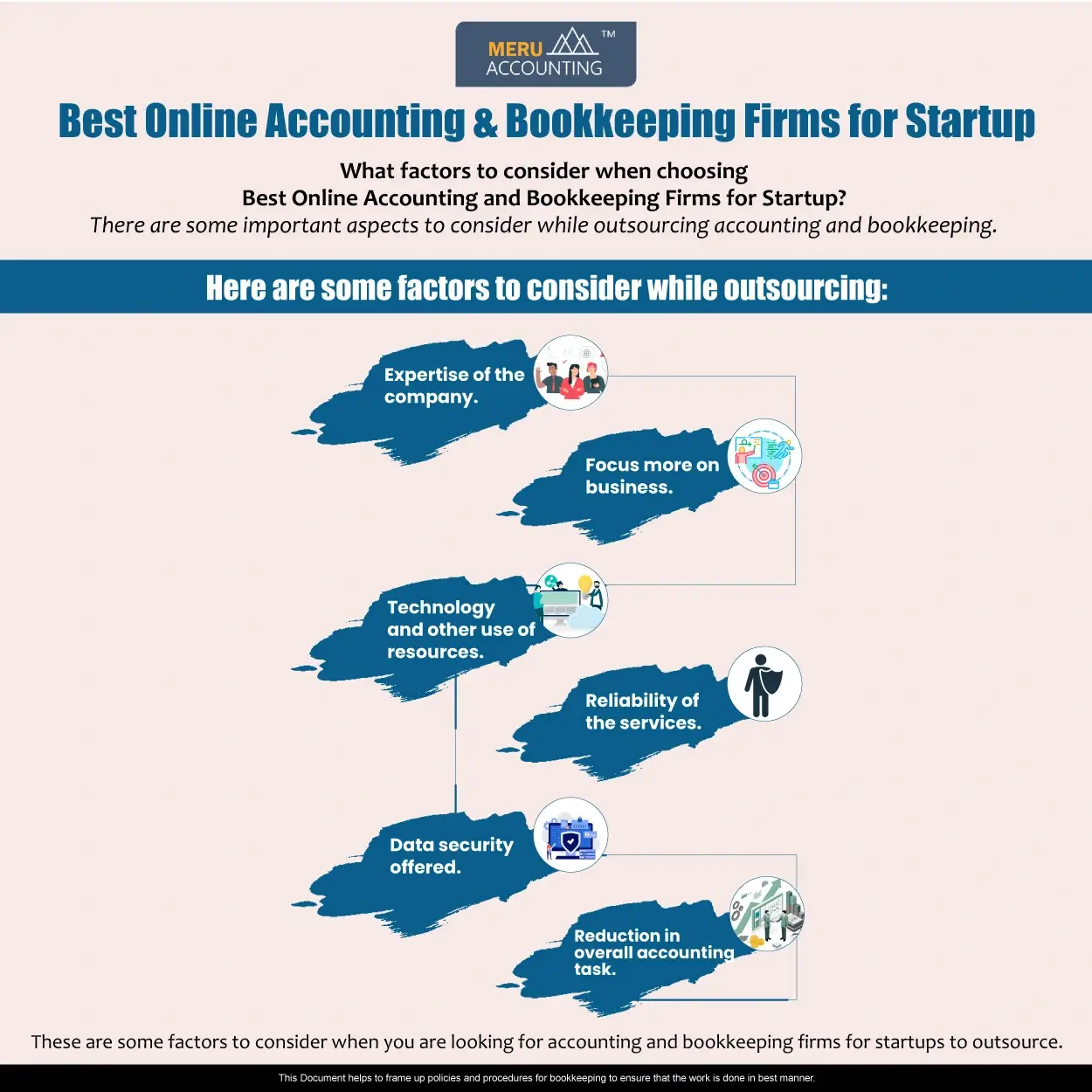

Factors to Consider While Outsourcing Accounting Firms for Startups

Outsourcing simply to any firm cannot give desired results, so there are few aspects to consider while outsourcing.

Here are some important factors to consider when you outsourcing to accounting firms for startups:

1. Expertise of the company

- One of the important things to consider is about the expertise processed by the accounting firms. A team of experts will have better knowledge of working on bookkeeping and accounting. It will be an added advantage if this outsourced firm has experience of working with start-ups. This will ensure that all your bookkeeping and accounting activities are done properly.

2. Focus more on core business activities

- Outsourcing bookkeeping and accounting for startups can help to relieve business owners and other top management from complex bookkeeping and accounting tasks such as receivables management, payables management, payroll processing, financial analytics, and cash flow management. It will encourage business owners to focus more on important business activities. It will help foster business growth considerably.

3. Technology and other resources used

- Now, bookkeeping and accounting activities are done on the accounting software such as Odoo, Xero and QuickBooks. It reduces the time required by automating possible tasks, and also it ensures that there is accuracy in the accounting.

4. Services Reliability

- One of the important aspects of outsourcing accounting for startups is that businesses can rely on them. If there is any kind of issue, it is expected the outsourced firm should give a possible solution. This will help the organization to remove all worries regarding the work.

5. Data Security

- One of the primary things that every business is worried about is the data security of their firm’s financial data. Outsourced firms must ensure that there is no misuse or loss of the data. They must have a strong security system that ensures better security for the firms.

6. Cost reduction

- When you are outsourcing the accounting task, it is important that there is a reduction in the overall cost involved in the accounting. So, the pricing of the outsourcing firm must be comparatively lower which can reduce overall costs.

These are some important aspects to consider while outsourcing accounting and bookkeeping for startups. The accounting firms for startups must provide a better level of services for the start-ups to help them achieve their goals.

Accounts Junction is one of the better accounting firms for startups to outsource accounting tasks. They have a reliable team that can understand your business and provides accounting for startups. They have all the accounting software to handle the accounting task. Accounts Junction is a well-known accounting agency across the globe.

What are the benefits of Bookkeeping for start-ups

Here are the benefits of bookkeeping and accounting summarized into points:

1. Expense and income tracking:

- Bookkeeping allows you to keep accurate records of your financial transactions, helping you make informed decisions about resource allocation and identifying areas for cost reduction or revenue increase.

2. Tax compliance:

- Detailed financial records make it easier to prepare tax returns and comply with regulatory requirements.

3. Cash flow management:

- Proper bookkeeping helps monitor accounts receivable and payable, ensuring timely payments from customers and effectively managing obligations to suppliers, resulting in a healthy cash flow position.

4. Investor and lender confidence:

- Well-organized financial statements demonstrate transparency, accountability, and professionalism, which can instill confidence in potential investors or lenders.

5. Strategic planning:

- Bookkeeping provides a foundation for strategic planning by analyzing trends, identifying customer behavior patterns, evaluating market opportunities, setting goals, and developing growth strategies.

6. Time savings:

- Investing in professional bookkeeping services or using user-friendly accounting software tailored for startups' needs can save valuable time, allowing you to focus on other aspects of your business such as sales, marketing, and innovation.

The types of Bookkeeping and Accounting used for start-ups:

When it comes to bookkeeping and accounting, there are various types that start-ups can choose from based on their specific needs. Let's explore some of these options.

1. Traditional Bookkeeping:

- This is the most basic form of bookkeeping, where financial transactions are recorded manually in physical ledgers or journals. While it may seem old-fashioned, some start-ups prefer this method for its simplicity and control over data.

2. Cloud-based Bookkeeping:

- With advancements in technology, many businesses now opt for cloud-based bookkeeping services. This involves using online software to record and store financial information securely on the cloud. It offers accessibility, real-time updates, and easy collaboration with accountants.

3. Outsourced Bookkeeping

- Start-ups often find outsourcing their bookkeeping tasks a cost-effective solution. By hiring a professional third-party service provider or virtual assistant, they can ensure accurate records without investing in full-time staff or expensive software.

4. Accounting Software:

- Many start-ups take advantage of user-friendly accounting software like QuickBooks or Xero to manage their finances efficiently. These platforms offer features such as invoicing, expense tracking, tax calculations, and reporting tools that simplify the entire process.

5. In-House Accountant/Bookkeeper:

- As your business grows and becomes more complex financially, you might consider hiring an in-house accountant/bookkeeper who will handle all aspects of your company's finances internally.

How does Accounts Junction help in Bookkeeping and Accounting for start-ups

Accounts Junction provides comprehensive bookkeeping and accounting services tailored specifically for start-ups. Here's how we can help:

1. Accurate Financial Recording:

- Accounts Junction ensures that all financial transactions of the start-up are accurately recorded. We maintain meticulous records of income, expenses, assets, and liabilities, ensuring that no transactions are missed or improperly categorized.

2. Timely Bank Reconciliations:

- We reconcile the start-up's bank statements with the financial records, ensuring that all transactions are accounted for and discrepancies are identified and resolved promptly.

3. Accounts Payable and Receivable Management:

- Accounts Junction handles the management of accounts payable (payments to suppliers, vendors, etc.) and accounts receivable (invoices, customer payments, etc.). We track outstanding payments and ensure timely collection of receivables, helping to maintain a healthy cash flow for the start-up.

4. Financial Reporting:

- We generate accurate and detailed financial reports that provide insights into the start-up's financial performance. These reports include balance sheets, income statements, cash flow statements, and other customized reports as required. These reports help start-up owners and stakeholders make informed decisions about the business.

5. Strategic Financial Analysis:

- We analyze the financial data of the start-up to identify trends, patterns, and areas of improvement. This analysis helps start-up owners make strategic decisions regarding resource allocation, cost reduction, revenue generation, and business growth.

6. Expert Advice and Support:

- Accounts Junction's team of experienced accountants provides expert advice and support to start-ups. We offer insights on financial management, budgeting, financial forecasting, and other financial matters, helping start-ups make informed decisions and achieve their financial goals.

Conclusion:

By partnering with Accounts Junction, start-ups can leverage our professional bookkeeping services, which include recording financial transactions, maintaining ledgers, and generating financial reports. These services help start-ups stay organized and gain valuable insights into their financial health, enabling them to make informed decisions.

Accounts Junction's team of experienced accountants also offers comprehensive accounting services. We can analyze financial data, interpret trends, and provide valuable advice on cost reduction, revenue optimization, and strategic planning. Our expertise can prove invaluable for start-ups seeking to grow and scale their operations.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1010 | : Cash on Hand | Assets: Curent Assets |

| 2 | 1020 | : Cash in Bank (Operating Accounts, Business Checking Accounts) | Assets: Curent Assets |

| 3 | 1030 | : Accounts Receivable (Amounts owed by customers or clients) | Assets: Curent Assets |

| 4 | 1040 | : Inventory (Products or raw materials held for resale or production) | Assets: Curent Assets |

| 5 | 1050 | : Prepaid Expenses (Insurance, rent, subscriptions paid in advance) | Assets: Curent Assets |

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services