Bookkeeping and Accounting for Doctors

Doctors and healthcare professionals work hard to ensure there is no error or failure in performing their duties toward patients.

But what about the financial aspects of the healthcare profession?

Compliance with tax laws, regulations, and healthcare billings is important to increase productivity and profitability.

A healthcare professional must also strive to operate at their full potential, including the financial aspects. Here at Account Junction, we offer accounting services for doctors.

The healthcare profession is one of the largest service-based businesses with respect to revenue and employment.

There are specific accounting and bookkeeping requirements for healthcare professionals that are different. Bookkeeping services for doctors help to meet industry-specific accounting and compliance requirements.

Why is Accounting necessary for Doctors?

Here are some reasons why accounting for doctors is necessary:

Specialized services: A professional accountant for doctors like us ensures that standard cost procedure is followed for setting the value for a product and services offered in your organization.

Compliances: Healthcare professionals such as dentist have no time to keep up with the new laws and regulations related to the medical industry. And hence they may not be completely compliant with US GAAP, Indian GAAP, and International Financial Reporting Standards (IFRS).

Big Data: The healthcare industry has to deal with a large amount of data on a daily basis. Every medical and healthcare professional must place a proper system for recording the data efficiently.

Accounting and Bookkeeping services for Doctors

We offer the following bookkeeping services for doctors and healthcare professionals:

- Bank and Credit Card Reconciliation

- Accounts receivable and payable

- Payroll calculation and taxation

- Filings of TDS return and GST return

- Filing of yearly tax returns

- Preparation of balance sheet and profit and loss statement

- Financial ratio reporting

- Reconciliation and Inventory management

- Cash flow forecasting

- KPI reporting

- Tax planning

- Strategic consulting on revenue, expenses, and cash flow

- Quarterly and Yearly budget reports and more

Why Choose Us for Accounting and Bookkeeping Services

We at Accounts Junction help you focus more on core business functions by taking charge of accounting and bookkeeping functions. As accountants for doctors, we provide comprehensive bookkeeping services specific to the unique requirements of a health professional.

If you are looking for the best accounting services for doctors, here is why you should go for us:

Affordable: Our services help to save around 35% to 40% of the cost of a full-time accountant. We offer affordable hourly rates that fit everyone’s pocket. You have access to a pool of resources under one platform, assuring quality service.

Compliance: Health professionals also need to keep up with laws and regulations concerning their services. Our experts are up to date with existing laws and regulations relevant to the healthcare field. They are well acquainted with accounting principles and the process of reporting for healthcare professionals.

Experienced and professional services: With more than five years of experience and technical know-how of healthcare industry-specific requirements ensure the smooth functioning of bookkeeping and accounting system. With us, you have a professional team of CPAs, CAs, and accountants working for you.

Growth: Focus more on your core functions when we take care of vital bookkeeping and accounting functions. We help you to bring scalability to the business.

24 X 7: We help by providing 24 x7 consultations over the phone, skype, WhatsApp, and email with experienced professionals for quick responses to your queries and issues.

Softwares used for Bookkeeping and Accounting for Doctors in the USA:

There are several software options available for bookkeeping and accounting for doctors in the USA. Some popular choices include:

1. QuickBooks:

- QuickBooks is a widely used accounting software that offers specialized versions for various industries, including healthcare. It allows you to track income and expenses, manage invoices, and generate financial reports. QuickBooks Online, the cloud-based version, is particularly popular for its accessibility and ease of use.

2. Xero:

- Xero is another cloud-based accounting software that offers features specific to healthcare professionals. It provides tools for invoicing, expense tracking, bank reconciliation, and financial reporting. It also integrates with various healthcare practice management systems to streamline workflows.

3. FreshBooks:

- FreshBooks is a user-friendly accounting software that simplifies invoicing, expense tracking, and time management. While it is not specifically designed for healthcare, it can still be a suitable option for doctors with smaller practices.

4. Sage Intacct:

- Sage Intacct is a comprehensive cloud-based accounting software that offers advanced features for financial management. It provides tools for billing, revenue recognition, budgeting, and reporting. While it is more robust and may be better suited for larger practices, it can be customized to fit the needs of doctors.

5. PracticeSuite:

- PracticeSuite is a healthcare-specific practice management and medical billing software that also includes accounting functionalities. It offers tools for patient billing, insurance claims management, and financial reporting, making it suitable for doctors who want an all-in-one solution.

6. AccountEdge:

- AccountEdge is a desktop-based accounting software that offers industry-specific versions, including one for medical practices. It allows you to track income and expenses, manage inventory, and generate financial reports. While it may not have all the cloud-based features, it can still be a reliable option for doctors who prefer locally installed software.

When choosing accounting software, consider factors such as your practice size, specific accounting needs, budget, and whether you prefer cloud-based or desktop software. It is also a good idea to consult with your accountant or financial advisor to select the software that best suits your requirements.

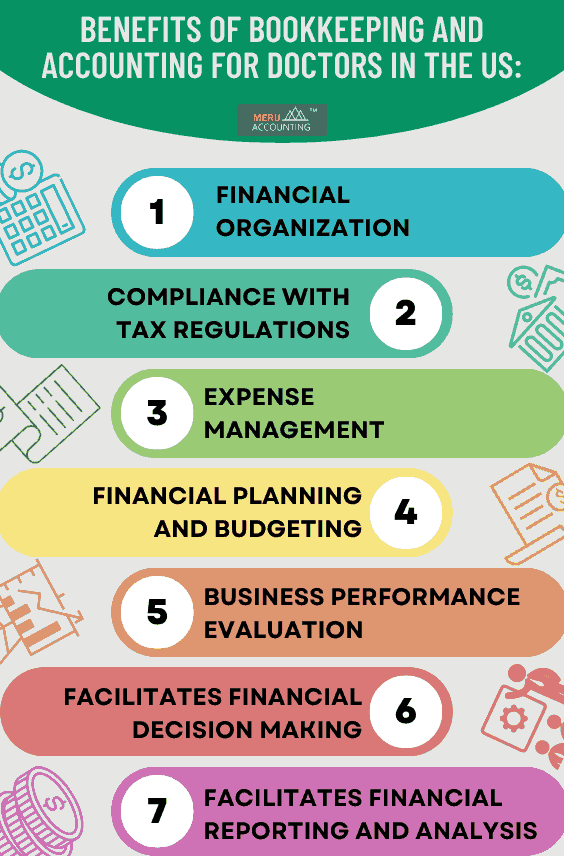

Benefits of Bookkeeping and Accounting for Doctors in the US:

Bookkeeping and accounting play a crucial role in the financial management of doctors in the US. Here are some benefits of implementing bookkeeping and accounting practices:

1. Financial Organization:

- Bookkeeping and accounting help doctors maintain organized and accurate financial records. This includes tracking income from various sources, managing expenses, and recording transactions. By keeping financial records in order, doctors can easily access information when needed and make informed financial decisions.

2. Compliance with Tax Regulations:

- Doctors are subject to complex tax regulations, and accurate bookkeeping and accounting are essential for compliance. By maintaining proper records of income, expenses, and deductions, doctors can ensure they meet their tax obligations and avoid penalties or legal issues.

3. Expense Management:

- Effective bookkeeping and accounting enable doctors to track and analyze their expenses. By categorizing expenses and monitoring trends, doctors can identify areas where costs can be reduced or optimized, leading to improved financial efficiency.

4. Financial Planning and Budgeting:

- With accurate financial data at their disposal, doctors can create realistic budgets and develop effective financial plans. This allows for better financial forecasting, setting financial goals, and monitoring progress over time. It also helps doctors make strategic decisions regarding investments, practice growth, and cash flow management.

5. Business Performance Evaluation:

- Bookkeeping and accounting provide doctors with key financial metrics and reports that help evaluate the performance of their practice. By analyzing financial statements, such as profit and loss statements, balance sheets, and cash flow statements, doctors can identify strengths, weaknesses, and areas for improvement. This information is crucial for making informed business decisions and assessing the overall financial health of the practice.

6. Facilitates Financial Decision Making

- Accurate financial records enable doctors to make well-informed decisions related to investments, equipment purchases, staffing, and practice expansion. By having a clear understanding of the financial position and performance of their practice, doctors can assess the feasibility and potential impact of various decisions on their bottom line.

7. Facilitates Financial Reporting and Analysis:

- Bookkeeping and accounting provide the necessary data for generating financial reports and conducting financial analysis. These reports and analyses offer valuable insights into the financial performance and stability of the practice, helping doctors identify trends, patterns, and opportunities for growth.

Challenges Faced in Bookkeeping and Accounting for Doctors in the USA:

While bookkeeping and accounting are crucial for doctors in the US, there are several challenges they may face in managing these tasks. Some common challenges include:

1. Time Constraints:

- Doctors have demanding schedules, with patient care taking priority. This leaves limited time for managing bookkeeping and accounting tasks. Balancing patient care with administrative responsibilities can be challenging, leading to potential delays or neglect in bookkeeping duties.

2. Complexity of Healthcare Accounting:

- Healthcare accounting involves unique considerations, such as insurance reimbursements, medical billing, and compliance with healthcare regulations. The complexity of these financial transactions and the need to understand industry-specific accounting principles can pose challenges for doctors who may not have an accounting background.

3. Compliance with Regulatory Requirements

- Doctors must comply with various financial regulations, including tax laws and healthcare industry regulations (such as HIPAA compliance). Staying up to date with changing regulations and ensuring accurate reporting and documentation can be time-consuming and complex.

4. Limited Accounting Knowledge:

- Doctors typically receive extensive medical training but may have limited accounting knowledge. Lack of familiarity with accounting principles, software, and financial terminology can make it challenging to manage bookkeeping tasks effectively.

5. Integration with Practice Management Systems

- Many doctors use practice management systems for scheduling, patient records, and billing. Integrating these systems with accounting software can be challenging and may require technical expertise or assistance from IT professionals.

6. Cash Flow Management:

- Doctors often face fluctuations in cash flow due to factors like insurance reimbursement delays, seasonal variations in patient volume, and unexpected expenses. Effectively managing cash flow, tracking receivables, and planning for financial contingencies can be a challenge for doctors.

7. Hiring and Managing Accounting Staff:

- Some doctors opt to hire accounting professionals or outsource their bookkeeping tasks. However, finding qualified professionals who understand the unique financial needs of healthcare practices can be difficult. Managing accounting staff or outsourced services also requires effective communication and oversight.

8. Technology Adoption and Security:

- Embracing accounting software and digital tools may be a challenge for doctors who are not technologically inclined or accustomed to using such systems. Additionally, ensuring the security and privacy of financial and patient data is critical, requiring robust cybersecurity measures and compliance with regulations like HIPAA.

- Overcoming these challenges may involve seeking assistance from professional accountants or bookkeepers with healthcare expertise like Accounts Junction.

Accounts Junction provides comprehensive bookkeeping and accounting services that can greatly benefit doctors in the USA. With our expertise in financial management, we offer a range of services tailored to the specific needs of medical professionals. Accounts Junction can help doctors maintain organized and accurate financial records, ensuring compliance with tax regulations and facilitating expense management. Our experienced team can assist in financial planning and budgeting, providing valuable insights to support informed decision-making and practice growth. By leveraging our services, doctors can overcome the challenges associated with bookkeeping and accounting, allowing them to focus on providing exceptional patient care while having confidence in their financial management.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1000 | Bank & Cash Accounts: | Bank |

| 2 | 1001 | Operating Bank Account | Bank |

| 3 | 1002 | Petty Cash | Bank |

| 4 | 1200 | Accounts Receivables: | Accounts Receivable |

| 5 | 1201 | Patient Receivables | Accounts Receivable |

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services