Accounting and Bookkeeping Service for Veterinarians

As a passionate Veterinarian, you certainly are working very dedicatedly to give the best services. However, while doing veterinarian practice it is also important to consider the financial aspects of the organization. You need to ensure that your expenses are tracked properly and cash flow is in the proper way. A systematic approach to accounting for veterinarians is very important to maintain financial aspects properly. The veterinarian has a different type of working pattern compared to the other types of organization.

The general type of accounting has a different type of approach. So, they always struggle to achieve efficiency in accounting for veterinary practices. Veterinarians need to maintain a proper record of the animal history and the financials related to each of the patients. They have to take special efforts in bookkeeping and avoid commonly occurring mistakes like duplicate entries. As it is very difficult to get a proper veterinary bookkeeper and accountant, outsourcing it to an expert agency will be better. It will help to get better efficiency in bookkeeping and accounting.

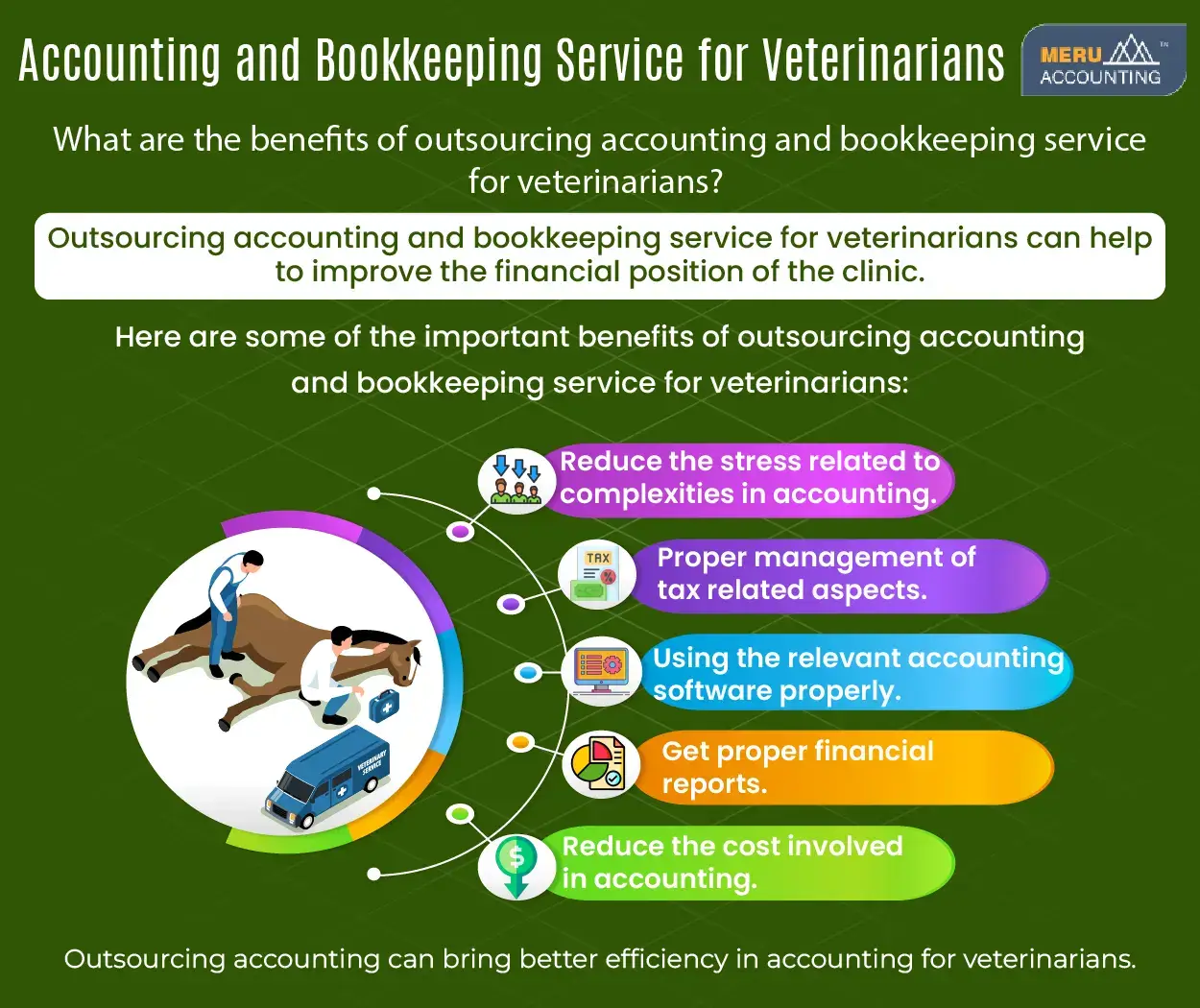

Benefits of Outsourcing Bookkeeping and Accounting for veterinarians

Outsourcing bookkeeping and accounting can be more beneficial for veterinarians.

Here are some benefits of outsourcing accounting for veterinary practices professionals:

1. Reduce stress

An inefficient accounting team or individuals can cause a lot of irregularities in bookkeeping and accounting. This can affect the accounting books, tax filing, and other aspects. It can cause a lot of stress for veterinarians making it complicated to deal with it. Outsourcing to experts can reduce the stress on veterinarians to focus more on their core work.

2. Deal with the tax-related aspects

It is very complicated to deal with the tax-related aspects and if the accountants are not experts they can cause a lot of problems. Tax filing errors might result in severe penalties. So, outsourcing can help give knowledgeable and experienced people working for handling taxes properly. They will also ensure that tax filing is done as per the changing rules.

3. Access to relevant accounting software

By outsourcing accounting, veterinarians do not have to purchase any separate accounting software. Outsourced agencies will have all the necessary accounting software to do relevant activities. Accounting software can reduce efforts and improve accuracy in accounting.

4. Get proper financial reports

Most veterinarians do not have an expert in-house accounting team to get reliable financial reports. Outsourcing accounting for veterinarians to expert agencies can help you get better financial reports. These reports will give better insights into the financials of the clinic. Profitability, data analysis, budgeting, cash-flow reports, etc. can be given properly.

5. Reduce accounting cost

In-house accounting has many costs like recruitment, training, allocation of resources, etc. Outsourcing will eliminate all these costs drastically. It will help save much of the amount spent on these activities. Veterinarians can outsource and reduce accounting costs to a great extent.

These are some of the benefits of outsourcing accounting for veterinarians. It will improve the financial aspects of the clinic greatly.

Accounts Junction provides outsourced accounting for veterinary practices. They have experienced staff to handle the bookkeeping and accounting of veterinarians. They can streamline all activities by using relevant accounting software. Accounts Junction is a well-known accounting service-providing agency across the globe.

How to get started with bookkeeping and accounting for veterinarians in the USA?

Getting started with bookkeeping and accounting for veterinarians in the USA is crucial for maintaining financial stability and success in their veterinary practices. Here's a step-by-step guide on how to begin the bookkeeping and accounting process:

1. Understand the Basics:

As a veterinarian, it's essential to have a basic understanding of bookkeeping and accounting principles. Familiarize yourself with terms like revenue, expenses, assets, liabilities, and equity, as well as the different financial statements like the balance sheet and income statement.

2. Separate Personal and Business Finances:

Open a separate business bank account for your veterinary practice. This clear distinction between personal and business finances will make bookkeeping much more manageable and help you accurately track business transactions.

3. Choose an Accounting Method:

Decide whether you'll use cash-basis or accrual-basis accounting. Cash-basis records income when received and expenses when paid, while accrual-basis records transactions when they occur, regardless of when money changes hands. The accrual method is more complex but can provide a more accurate picture of your practice's financial health.

4. Invest in Accounting Software:

Consider investing in accounting software like QuickBooks or Xero that caters to small businesses. These tools can streamline bookkeeping tasks, track income and expenses, and generate financial reports. They also offer cloud-based options, allowing you to access your financial data from anywhere.

5. Hire a Professional Bookkeeper or Accountant:

If managing finances becomes overwhelming or time-consuming, consider hiring a professional bookkeeper or accountant who specializes in small businesses or veterinary practices. They can ensure your financial records are accurate and help you stay compliant with tax regulations

6. Track Income and Expenses:

Regularly record all sources of income, such as fees for veterinary services, medications, and any other revenue streams. Additionally, track expenses like rent, utilities, medical supplies, equipment, and staff salaries. Properly categorize each transaction to facilitate financial reporting.

7. Maintain Receipts and Invoices:

Keep all receipts and invoices organized, as they serve as evidence for expenses and income. Digitizing receipts using apps or scanners can be beneficial for easy record-keeping.

8. Monitor Inventory:

If your practice sells medications or products, track inventory regularly to manage stock levels and identify any discrepancies that might affect your financial reports.

9. Reconcile Bank Statements:

Regularly reconcile your business bank account with your accounting records to ensure accuracy and identify any discrepancies.

10. Generate Financial Statements:

Periodically generate financial statements such as income statements, balance sheets, and cash flow statements. These reports offer valuable insights into your practice's financial performance and aid in decision-making.

11. Tax Compliance:

Comply with all tax regulations, including income tax, sales tax, and payroll tax. Stay updated on tax laws and deadlines to avoid penalties.

12. Seek Professional Advice:

Consult with a qualified accountant or tax professional for any complex financial matters or to ensure compliance with tax laws specific to veterinarians and healthcare practices.

By following these steps and maintaining consistent bookkeeping and accounting practices, veterinarians in the USA can effectively manage their financials, make informed business decisions, and ensure the long-term success of their veterinary practices.

Need of Bookkeeping and accounting for veterinarians in the USA:

1. Organization:

Bookkeeping and accounting help veterinarians stay organized by tracking income, expenses, and financial transactions, streamlining the financial management process.

2. Informed Decision-Making:

Accurate financial records provide valuable insights into revenue streams and expenses, enabling veterinarians to make strategic decisions that contribute to business growth.

3. Tax Compliance:

Proper bookkeeping ensures that financial records are up-to-date and by tax regulations, reducing the risk of errors during tax filing and potential penalties.

4. Financial Stability:

Having transparent and up-to-date financial statements enhances the veterinarian's ability to secure loans or attract investors, demonstrating the practice's financial stability and potential for growth.

5. Time-Saving:

Outsourcing bookkeeping and accounting services allows veterinarians to focus on their core expertise of providing quality care to animal patients, freeing up time that would have been spent managing financial tasks.

6. Expertise:

Specialized bookkeeping and accounting services tailored for veterinarians offer industry-specific knowledge and understanding of unique financial challenges faced by veterinary practices.

7. Budgeting and Planning:

Accurate financial records enable veterinarians to create realistic budgets and forecast future financial needs, contributing to effective financial planning for the practice.

8. Financial Analysis:

Regular financial reports help veterinarians analyze key performance indicators, identifying areas for improvement, cost-saving opportunities, and overall practice efficiency.

In this digital age, bookkeeping, and accounting have become essential for veterinarians in the USA. By maintaining accurate financial records and utilizing professional accounting services of Accounts Junction, veterinary practices can streamline their operations, make informed business decisions, and ensure compliance with tax regulations.

From tracking expenses and revenue to managing payroll and taxes, proper bookkeeping provides veterinarians with valuable insights into their practice's financial health. By implementing proper bookkeeping practices alongside Accounts Junction, you'll not only gain peace of mind but also unlock growth opportunities for your veterinarian business! So go forth confidently knowing that every dollar is accounted for!