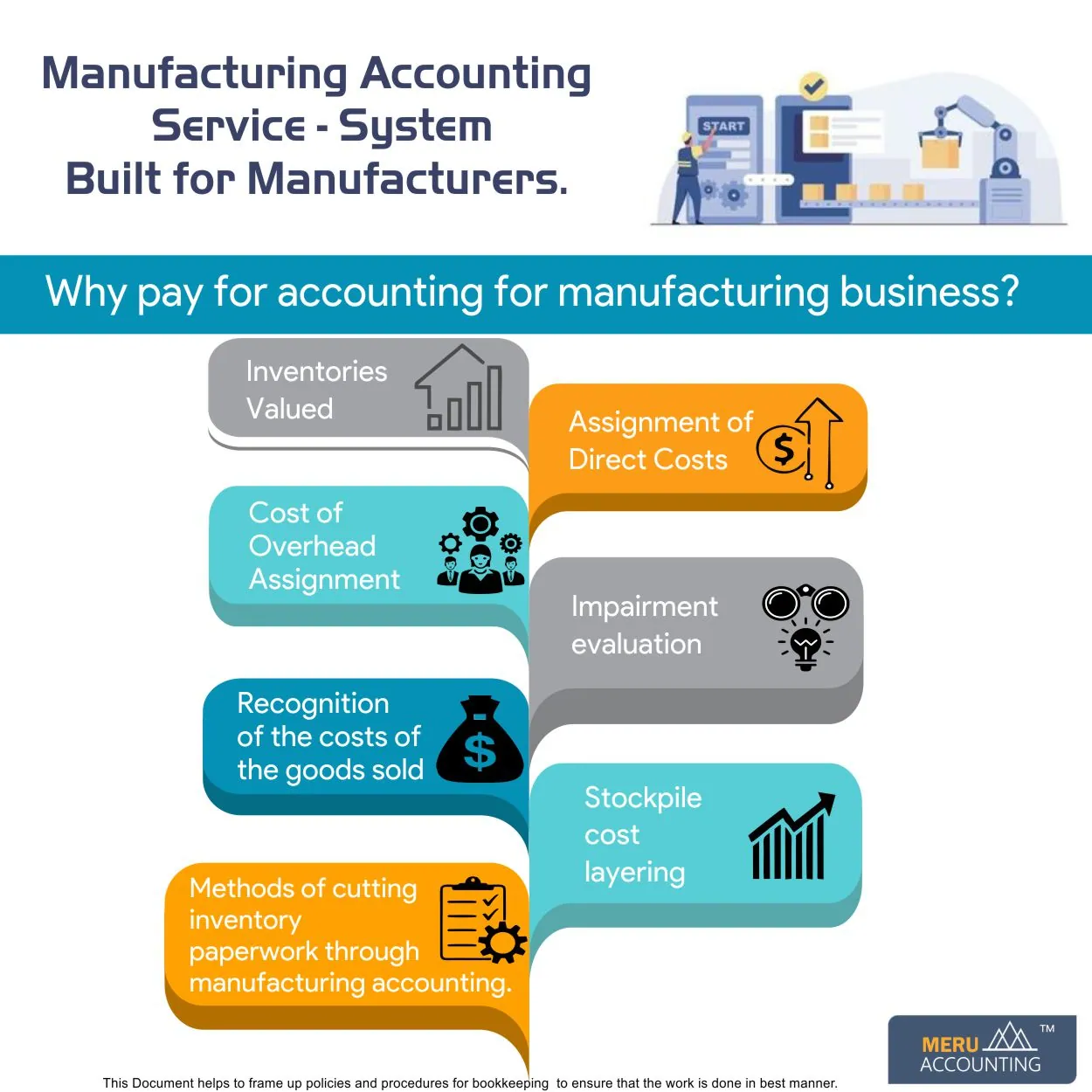

Accounting for a Manufacturing Company

Accounting for a manufacturing business deals with the cost of goods sold and inventory valuation. Other types of entities either don't use these notions very often or do so in a more basic way. The ideas are developed further below:

Inventories valued

A manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance sheet of the business. The following actions are necessary for this valuation which is why you need to look for a manufacturing cost accounting.

Assignment of Direct Costs

A standard costing, weighted-average cost, or cost stacking methodology is used to assign costs to inventory. For more details, refer to the topics on a weighted average, FIFO, LIFO, and standard costing.

Cost of Overhead Assignment

The recorded cost of the inventory rises as a result of the need to pool factory overhead expenditures into cost pools, which are subsequently allocated to the number of units produced within a reporting period. To lessen the accountant's workload in terms of allocation, the number of cost pools should be kept to a minimum.

Impairment Evaluation

Determine whether the price at which inventory goods are recorded is higher than their current market values in this activity, often known as the lower cost or market rule.

If so, the inventory needs to be reduced to reflect market value.

At the end of each year reporting period, for example, this task could be finished after rather long intervals.

Recognition of the Cost of Goods Sold through manufacturing cost accounting

The cost of goods sold is just beginning inventory + purchases less ending inventory at its most basic level. Thus, the accuracy of the inventory valuation techniques that were just outlined significantly determines how the cost of goods sold is derived.

Furthermore, any unusual expenses incurred, like excessive scrap, are not noted in inventory but are instead added straight to the cost of products sold. This necessitates a thorough scrap tracking process.

When the inventory items in those jobs are sold to customers, costs may also be allocated to those jobs (a process known as job costing) and then added to the cost of goods sold.

Stockpile Cost Layering

A manufacturing company must also employ either a perpetual inventory system or a periodic inventory system to keep track of the quantity of inventory it has in stock; this data is essential for figuring out the inventory valuation.

Although the periodic inventory method is simpler to operate, it is not advised because it only produces an accurate number when a physical inventory count is performed.

The perpetual system should always produce precise inventory unit quantities, but to maintain a high level of accuracy, meticulous record keeping and cycle counting are needed.

Methods for Cutting Inventory Paperwork through manufacturing accounting

In conclusion, manufacturing companies must perform far more thorough accounting than a company that doesn't keep any inventory must.

By reducing the amount of inventory on hand, encouraging suppliers to maintain some goods on-site, utilizing supplier drop shipping, and other methods that lower the total level of investment in inventory, a business can lessen the workload associated with this process.