Bookkeeping Services for Travel Agencies

A more lucrative travel agency is based on timely and accurate financial reporting.

Independent agents, franchisees, and owners of tourist agencies benefit from our bookkeeping services for travel agencies so they may manage their operations with ease.

Travel-specific cashflow requirements, expenses, and revenue can all play a role in a travel agency's bookkeeping.

Years of experience have been accumulated by our staff in assisting small and midsize business owners in managing their finances successfully.

We will work with you to expand your company and overcome any obstacles you may encounter.

To accommodate our client’s needs and financial constraints, we design a unique service plan. Our primary goal is to increase your company's profitability.

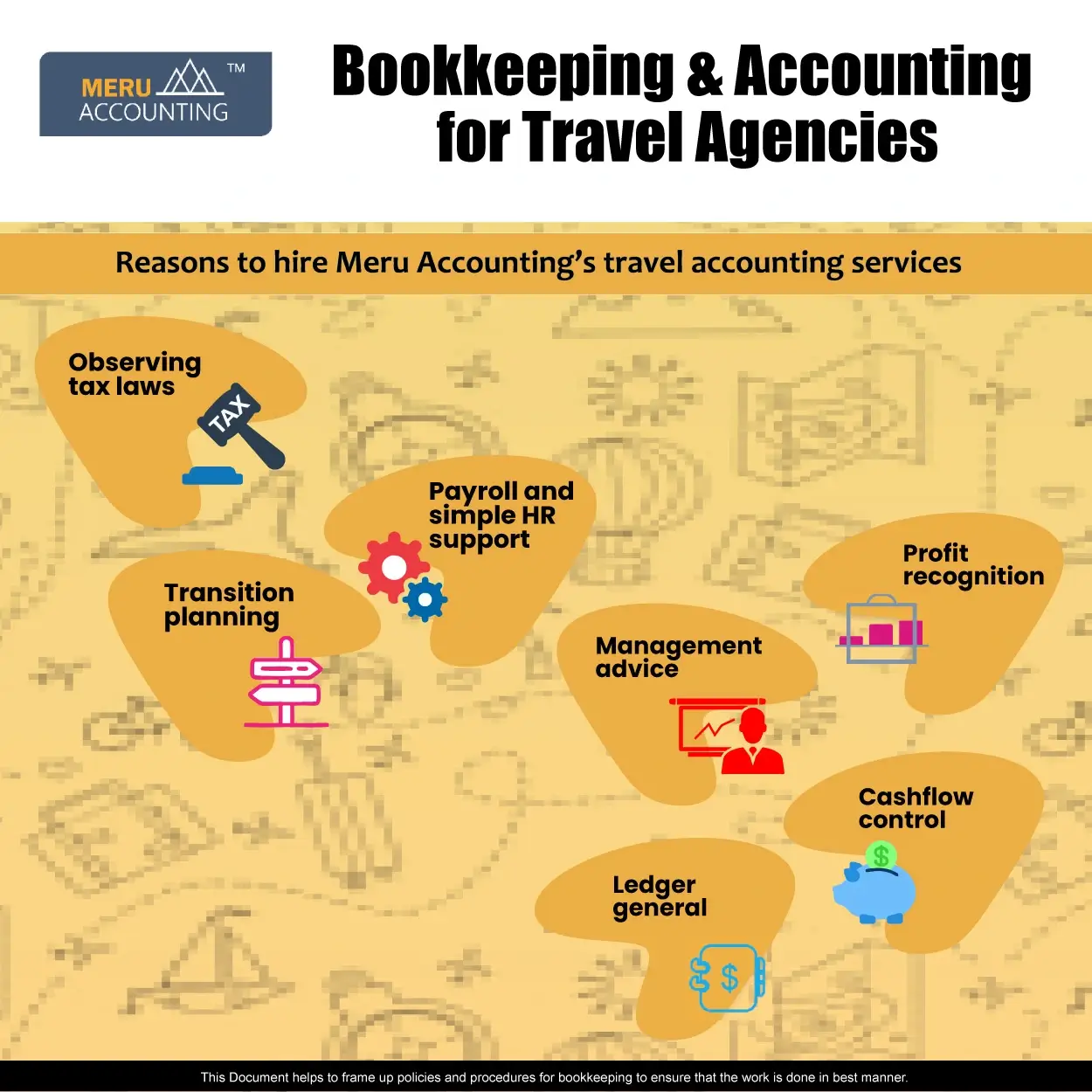

Here are reasons why you need to think about experts that provide accounting for a travel agency.

Services Provided in Accounting for Travel Agency

As a cost-effective and practical alternative for the travel and tourist industry, we provide part-time and virtual CFO and controller services.

Observing Tax Laws

Adequate Bookkeeping for travel agency efficiently manages your tax filing for sales and use taxes as well as employer withholding taxes. Your payroll and sales tax filings can be handled quickly and efficiently by our qualified bookkeepers.

Payroll and Simple HR Support

You can save money by using our payroll and basic HR services instead of paying internal staff to process payroll and issue checks by hiring people to do bookkeeping for travel agency.

Transition Planning

To guarantee a seamless transfer, we support family-run travel and tourism firms and help them include a succession plan in their daily operations.

Profit Recognition

The most effective revenue recognition tactics are used by our experts. For this, we also employ the effective cash method.

Management Advice

The best management consulting services are offered by Adequate Bookkeeping, helping small business owners get the best results.

Cash Flow Control

A successful travel and tourism business must effectively manage its cash flow. We keep track of incoming costs, payments, and net cash flow from sales using the most recent accounting software.

Ledger General

Using the greatest accounting software, we update your general ledger on a regular basis. This general ledger is used to keep track of debts, assets, and the effects of daily and weekly transactions.

Our travel accounting services offer the precise and comprehensive financial data that travel agencies require to survive and function. You can hire us to handle your bookkeeping if you want the desired results.

Additionally, we assist you with more particular duties like producing profit and loss statements. Our experts are skilled in using any online accounting platform, including Xero, Zoho Books, and QuickBooks, with efficiency.

Why Choose Accounts Junction?

If cloud-based accounting is unfamiliar to you, we will also give you the support you need and outline the advantages of choosing it.

We have extensive knowledge in offering the best bookkeeping and accounting services to the travel and tourist sector. Our aggressive pricing strategy reduces the number of overhead expenses.

Benefits of Bookkeeping for Travel Agencies:

1. Financial Performance Analysis:

- Track income and expenses to analyze the financial performance of your travel agency.

- Identify trends, assess profitability, and make informed decisions for growth.

2. Effective Cash Flow Management:

- Maintain accurate records of incoming funds and outgoing payments.

- Monitor cash flow to ensure liquidity, timely payments, and positive supplier relationships.

3. Simplified Tax Compliance:

- Proper record-keeping throughout the year simplifies tax return preparation.

- Avoid errors, omissions, and penalties by having all necessary documentation readily available.

4. Facilitates Financing Options:

- Organized financial records enhance your credibility when seeking financing.

- Lenders require detailed financial information for loan approval, expansion, or investment.

5. Operational Efficiency:

- Bookkeeping streamlines administrative processes and improves overall efficiency.

- Save time and resources by having organized financial records readily accessible.

6. Budgeting and Forecasting:

- Accurate financial records help in setting budgets and making realistic forecasts.

- Plan for expenses, marketing campaigns, and future investments effectively.

7. Cost Control and Expense Reduction:

- Analyze expenses and identify areas where costs can be reduced.

- Optimize spending to increase profitability and operational efficiency.

8. Business Performance Evaluation:

- Use financial data to evaluate the success of marketing strategies and product offerings.

- Determine the profitability of specific services, destinations, or customer segments.

9. Compliance and Audit Preparedness:

- Proper bookkeeping ensures compliance with regulatory requirements.

- Minimize the risk of audits and penalties by maintaining accurate records.

10. Business Decision-Making:

- Make informed decisions based on real-time financial data.

- Evaluate the financial viability of new projects or ventures.

In conclusion, Accounts Junction stands as an indispensable ally for travel agencies, offering a comprehensive suite of bookkeeping services that streamline financial operations and enhance overall efficiency. Through our tailored solutions, precise record-keeping, and expert financial insights, travel agencies can focus on delivering exceptional travel experiences while leaving the complexities of financial management in capable hands. With Accounts Junction as a reliable partner, travel agencies can confidently navigate the dynamic landscape of the travel industry, secure in the knowledge that their financial affairs are managed with utmost professionalism and precision. By fostering a strong foundation of financial stability, Accounts Junction empowers travel agencies to thrive and grow, ensuring a seamless journey towards continued success.

How does Accounts Junction help in bookkeeping for travel agencies?

1. Revenue Tracking:

Accounts Junction allows travel agencies to track different sources of revenue. Our firm establishes separate income from flight bookings, hotel reservations, tour packages, and other travel-related services. This helps in accurately recording and analyzing revenue streams.

2. Expense Allocation:

Accounts Junction assists in allocating expenses to specific categories within a travel agency. This can include costs related to accommodations, transportation, marketing, staff salaries, or office supplies. By properly categorizing expenses, it becomes easier to track spending, monitor budget adherence, and identify areas for cost control.

3. Cost of Goods Sold (COGS):

For travel agencies that provide tangible products such as travel packages or promotional items, Accounts Junction aids in calculating the cost of goods sold. By connecting expenses related to the production or procurement of these goods with revenue generated from their sales, COGS can be accurately determined for financial reporting and analysis.

4. Commission Tracking:

Travel agencies often earn commissions from airlines, hotels, and other service providers. Accounts Junction helps in tracking and recording these commissions separately, allowing for a clear view of income derived from commission-based arrangements. This assists in assessing the profitability of different partnerships and adjusting commission structures if necessary.

5. Financial Analysis:

Accounts Junction enables the generation of financial statements for travel agencies. By consolidating data from different accounts, including revenue, expenses, and assets, financial reports such as income statements, balance sheets, and cash flow statements can be prepared. These statements provide valuable insights into the financial health and performance of the travel agency.

6. Tax Compliance:

Accounts Junction aids in tax compliance for travel agencies. By categorizing transactions appropriately, travel agencies can accurately determine their taxable income, claim eligible deductions, and ensure compliance with tax regulations. This simplifies the tax filing process and minimizes the risk of errors or discrepancies.