Bookkeeping and Accounting for Distribution Companies

One of the primary functions of accounting is to monitor the business process.

This is essential for all industries, including distribution and trading companies.

Accounting, also known as internal control, is a tool used to provide complete information to management about business activity, financial calculations, asset existence and movement, use of material, labor, and financial resources based on budgets.

Accounting for distribution companies and distributor accounting are two of the most frequent companies in the world.

The activity in a distributor accounting or distribution company is largely dedicated to buying and selling things and delivering services to consumers...

such as buying products and selling them, increasing the cost of the acquired products to generate profit.

There are five factors to remember when learning about accounting for distribution companies or distributor accounting and the distribution business cycle:

Company Account:-

A distributor accounting company requires more diverse accounts than others. Implementing accounting software will be more useful because most software provides the required accounts as established by accounting standards.

Inventory Control:-

Inventory is one of the keys to boosting corporate profit and competitive advantage. The corporation creates a monthly inventory report to keep track of its inventory and costs.

Cash Flow:-

Cash flow is the essence of business management. Properly managed cash flow results in fully sustained business activity, such as business operation, due date receivable-payable, investment, and others. Profits gained by the company are given to business expansion. Without it, the company will stagnate and lose its ability to compete.

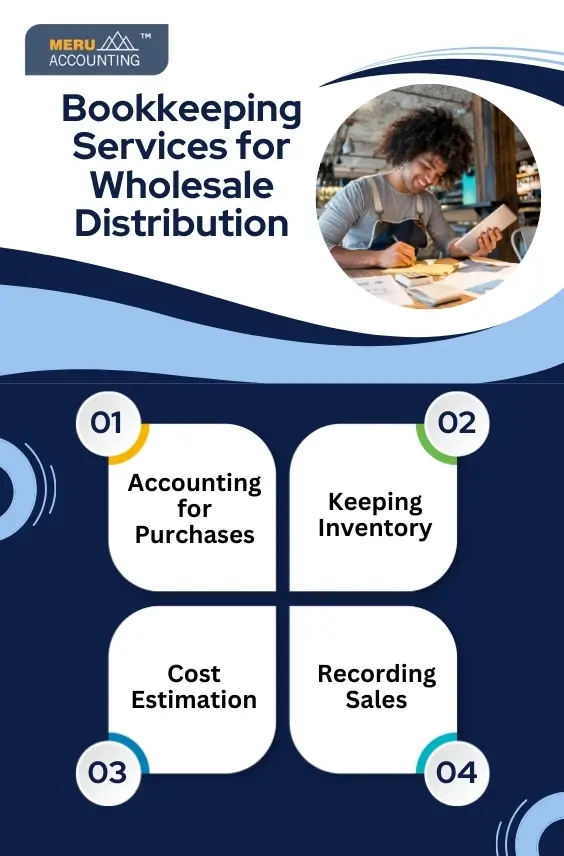

Bookkeeping Services for Wholesale Distribution

Distribution companies buy goods and resell them for a profit, typically from business to business.

Because accounting for wholesale distribution usually transfers a considerable amount of merchandise in and out of their warehouses...

It is critical that they accurately account for the purchasing, inventory, and sales processes.

Accounting for Purchases:-

- Distribution organizations typically have a purchasing department that issues purchase orders to vendors for items. Most businesses buy inventory on credit and pay cash when the goods arrive.

Keeping Inventory:-

- The distribution company normally keeps its inventory as an asset valued at cost. That is, if the company paid $500, it would record $500 in inventory on its balance sheet. However, generally accepted accounting standards require businesses to value inventories at a lower cost or market.

Cost Estimation:-

- When accounting for wholesale distribution receives a purchase order, it will remove the merchandise from its warehouse and distribute it to a customer. When it comes to estimating the cost of products sold, the corporation has a few possibilities.

Recording Sales:-

- The accounting department will record product sales after assessing the cost of goods sold by the company. Accounting must document both the asset flow and the transaction's revenues and expenses.

Accounts Junction, a CPA firm, can provide fully outsourced bookkeeping and accounting solutions to small and medium-sized businesses in the United States, United Kingdom, Australia, New Zealand, Hong Kong, Canada, and Europe.

We also offers bookkeeping services to accounting for distribution companies and wholesale distributors. We have been offering these services since 2009.

We help organizations perform by providing tailored solutions that assist them in making business decisions.

| # | Account Number | Account Name | Account Type |

|---|---|---|---|

| 1 | 1010 | : Cash on Hand | Assets: Curent Assets |

| 2 | 1020 | : Cash in Bank (Operating Account) | Assets: Curent Assets |

| 3 | 1030 | : Accounts Receivable (Customer Invoices) | Assets: Curent Assets |

| 4 | 1040 | : Inventory (Goods Held for Sale) | Assets: Curent Assets |

| 5 | 1050 | : Prepaid Expenses (e.g., insurance, rent) | Assets: Curent Assets |

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categor...

Read MoreLast two decades have seen a considerable change in the trucking industry that has changed the working pattern of trucking companies. This has also changed the needs of the finance and accounting pattern of trucking companie...

Read MoreIndependent contractors will always try to find new projects with bigger ticket sizes to grow their business. Although most of the contractors may have a systematic way of workflow in their work areas, however, very few have...

Read MoreEvery small business owner understands the importance of bookkeeping in ensuring accurate accounting. This necessity for effective bookkeeping is especially critical in petrol stations, where a significant number of transact...

Read MoreA manufacturing company must use a predetermined quantity of raw materials, work-in-process, and finished goods in the course of its operations, and any ending balances must be fairly valued to be recorded on the balance she...

Read MoreOne of the primary functions of accounting is to monitor the business process. This is essential for all industries, including distribution and trading companies. Accounting, also known as internal control, is a tool used to...

Read MoreAccounts Junction provides the best insurance accounting experts for insurance agency accounting and bookkeeping. Our team has years of experience working with insurance agencies. We understand the unique requirements and pr...

Read MoreWhen you are running an event management company, you need to have a very organized approach. It is also important that you are managing your finances properly with proper management of bookkeeping and accounting. Many Event...

Read More

Accounts Junction's bookkeeping and accounting services