Accounting for Film Producers

The film and television industry are one of those very dynamic industries that have a very informal way of working. So, they also have challenges in proper financial management in their business. If the film and television industry want to increase their profit and improve the finances then they have to implement a proper financial management system. The accounting for the film and television industry is done in a totally different pattern that can have a systematic approach. Production accounting for film and television industry would involve several activities like controlling the cash flow, proper calculation of production cost, finance calculations, etc. The proper system of accounting can help to achieve better financial management of the business. Here, you need to find film production accounting service provider who will have the experience working in the relevant industry.

At Accounts Junction, we have been providing outsourced finance and accounting solutions to our clients worldwide which includes USA, UK, South Africa, Australia, New Zealand, Singapore and Canada. With a wide range of accounting experience of many sectors, we have demonstrated the ability to deliver a tailored solution to film industry as well. We provide production accounting for film and television industry with better quality. Working for several other similar kind of firms has made us proficient in handling film production accounting. In a recent times we have done scalable accounting for film producers. Although we are not directly involved with creative art work however we can proud to be the part of their success hence our hassle-free work enables them to work freely on creative aspect of film making.

Accounting for the Film Industry

While doing accounting for film producers we involve ourselves from very first step of film making which is known as Pre-production work. Our expert accountants help the producers and production managers to prepare financial plans, budgets and estimated final cost reports. Our role becomes very critical during production because we oversee all payments, manage payroll, petty cash and foreign currency and keep accurate financial records. We can provide the required discipline in handling the film production accounting. We can give a better insights of the financial insights with proper accounting. As well all know transparency and full proof planning is the key of any firm’s success hence our accounting for film producers’ services help you to monitor budgets, analyse spending and provide daily or weekly cost reports. Our film production accountant can make your task work easily. Film producers will improve the quality of their work with efficient accounts handling. Film production is very creative field and during production there are stages where you need some extra arrangements and that cost you some extra money. By keeping this nitty-gritty in mind, we also produce cost forecasts to evaluate the impact of any production changes.

Be a forward-thinking film production house and talk to us to see how we can reduce costs, increase quality of information and help you achieving your strategic aims by our outsource accounting solutions. Accounts Junction can make your accounting task simpler to give better accounting service for film production. Do not miss this nice opportunity to outsource the accounting task where you can get many benefits. To contact us directly, please complete contact form our accounting experts will be in touch with you for further assistance.

Types of bookkeeping and accounting done for film producers in the USA:

Film producers in the USA employ different types of bookkeeping and accounting methods to manage their financial records effectively. Here are some common types used in the film production industry:

1. Production Accounting:

This specialized form of accounting focuses on the financial management of film production activities. Production accountants handle the financial aspects of the production, including budgeting, expense tracking, payroll processing, vendor payments, and financial reporting specific to film production.

2. Cost Accounting:

Cost accounting involves tracking and analyzing the costs associated with film production. It includes categorizing expenses by line items, monitoring budgeted versus actual costs, analyzing cost variances, and identifying cost-saving opportunities.

3. Revenue Accounting:

Revenue accounting in film production involves tracking and recording revenue generated from various sources such as box office sales, streaming platforms, licensing agreements, merchandising, and sponsorships. This accounting ensures accurate revenue recognition and reporting.

4. Guild and Union Accounting:

If the film production involves working with guilds or unions, specific accounting methods are required to comply with their regulations. This includes handling payroll and benefit contributions according to union agreements, reporting requirements, and tracking guild residuals and contributions.

5. Project Accounting:

Film producers use project accounting to monitor the financial aspects of individual film projects. This involves budgeting, expense tracking, and financial reporting specific to each project. Project accounting helps evaluate the financial performance and profitability of each film.

6. Investor Accounting:

Film producers may have investors who contribute funds to the production. Investor accounting involves tracking investments, allocating profits or losses, and providing periodic financial reports to investors. This ensures transparency and accurate accounting for investor-related transactions.

7. Rights and Royalty Accounting:

Film producers handle rights and royalty accounting, which involves tracking and managing intellectual property rights, licensing agreements, royalty calculations, and payments related to the distribution, broadcasting, and merchandising of the film.

8. Tax Accounting:

Film producers must comply with federal, state, and local tax regulations. Tax accounting includes accurately reporting income and expenses, applying relevant tax incentives or credits specific to the film industry, and meeting tax filing and payment obligations.

9. Financial Reporting:

Film producers generate financial statements, such as profit and loss statements, balance sheets, and cash flow statements, to evaluate the financial performance and position of the production company. These statements provide insights into the revenue, expenses, assets, and liabilities of the film production.

10. Cost Reports and Auditing:

Film producers may prepare cost reports, which track and analyze the financial progress of the film production. These reports provide detailed information about costs incurred, variances, and any financial risks or issues. Cost reports may be used for internal purposes or required by stakeholders, investors, or financing institutions.

The specific types of bookkeeping and accounting methods used by film producers may vary based on the scale of production, industry practices, and the complexity of financial transactions. It is recommended for film producers to consult with accounting professionals or specialists experienced in the film production industry to ensure accurate and compliant financial management.

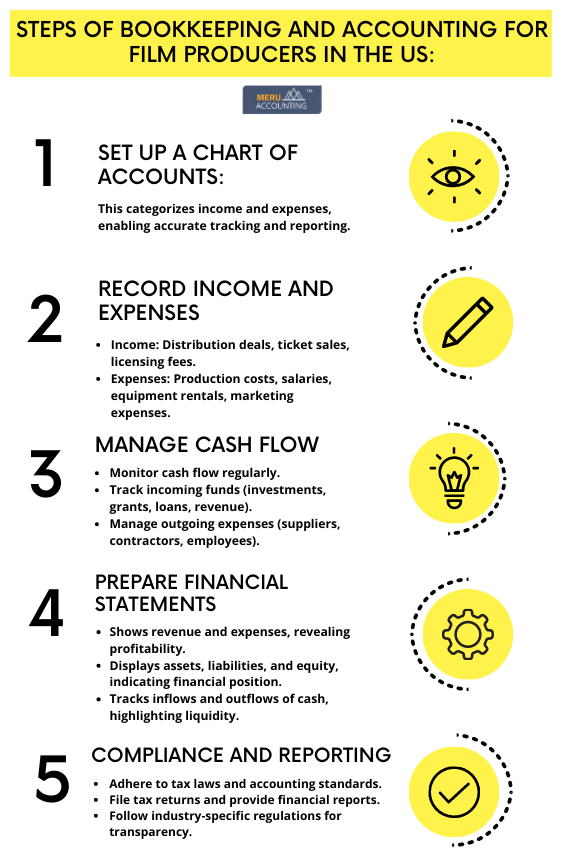

Steps of bookkeeping and accounting for film producers in the US:

There are five key steps of bookkeeping and accounting for film producers in the USA:

1. Set up a Chart of Accounts:

Create a specific chart of accounts tailored to the film production industry.

2. Record Income and Expenses:

Maintain a system to record all financial transactions related to film production, including income from distribution deals, ticket sales, and licensing fees, as well as expenses such as production costs, salaries, equipment rentals, and marketing expenses.

3. Manage Cash Flow:

Monitor cash flow regularly to ensure sufficient funds are available to cover production expenses. Keep track of incoming funds, such as investments, grants, loans, and revenue from distribution or licensing deals. Also, manage outgoing expenses to make timely payments to suppliers, contractors, and employees.

4. Prepare Financial Statements:

Generate financial statements like income statements, balance sheets, and cash flow statements. These statements provide a comprehensive overview of the film production company's financial performance, assets, liabilities, and cash flow, aiding in decision-making and financial analysis.

5. Compliance and Reporting:

Adhere to applicable tax laws, accounting standards, and reporting requirements. This involves filing tax returns, providing financial reports to stakeholders and investors, and following industry-specific regulations and guidelines to ensure compliance and transparency.

These steps provide a foundation for effective bookkeeping and accounting practices in the film production industry. The complexity and specific requirements may vary based on the size, nature, and intricacies of each film production project.

How Accounts Junction helps in bookkeeping and accounting for film producers in the US?

1. Pre-production Financial Planning:

Accounts Junction's expert accountants assist film producers and production managers in preparing financial plans, budgets, and estimated final cost reports during the pre-production stage.

2. Comprehensive Financial Management:

Accounts Junction takes on the role of overseeing all payments, managing payroll, petty cash, and foreign currency, and maintaining accurate financial records throughout the film production process.

3. Enhanced Financial Insights:

By employing proper accounting practices, Accounts Junction provides film producers with better insights into the financial aspects of their productions, ensuring transparency and supporting decision-making.

4. Budget Monitoring and Cost Analysis:

Accounts Junction helps clients monitor budgets, analyze spending, and provides regular cost reports (daily or weekly). This allows for effective cost control measures and informed decision-making during the production phase.

5. Streamlined Accounting Processes:

Accounts Junction's film production accountants bring our expertise to streamline accounting operations, ensuring accuracy and efficiency in financial tasks.

6. Adaptability to Production Changes:

Accounts Junction prepares cost forecasts that evaluate the financial impact of any production changes. This helps film producers make informed decisions and maintain financial stability throughout the production process.

7. Outsourced Accounting Solutions:

Accounts Junction offers outsourced accounting solutions, allowing film producers to reduce costs, improve the quality of financial information, and focus on their strategic goals, while leaving the accounting tasks in the hands of specialized professionals.

Accounts Junction offers comprehensive bookkeeping and accounting services tailored to the unique needs of film producers. With our expert accountants, we assist in pre-production financial planning, ensuring budgets and estimated cost reports are well-prepared. Throughout the production process, we provide meticulous financial management, overseeing payments, managing payroll, and maintaining accurate records. Our services offer enhanced financial insights, empowering producers with transparency and informed decision-making. By monitoring budgets, analyzing spending, and providing regular cost reports, we enable effective cost control measures. With streamlined accounting processes and the ability to adapt to production changes, Accounts Junction ensures financial stability and optimal resource allocation.