Accounting for Hospitality Industry

Hospitality industry has to provide better services to their customers to ensure their business has sustainability. The better they provide service, they have better chances of growing their business. There are broad categories of fields in the hospitality industry which has somewhat similar types of the work patterns. As per the work pattern, the accounting service for hospitality industry also differs considerably. We will check here different accounting patterns in the accounting system for the hospitality industry.

General Ledger for Guest Charger, Fees etc.

Guest charges are generally maintained in the front office accounting system. All the charges related to a guest are maintained in a Guest account. This account is created either during the registration of the guest (at the time of check-in) or during reservation if the guest makes an advance payment.

Financial Statement and Balance Sheet Production Which is Divided into Assets and Liabilities

Balance sheet in the hospitalisation industry is a very important exercise. It is important to classify your assets into current assets and non-current assets. There are no factories but assets like buildings, furniture, cooking equipment form a large part of the assets for the hospitalisation industry. Liabilities may include short term credit from suppliers, working capital loans from banks. Long term borrowings can be present if a hotel is in the process of expansion.

Preparing Cash Flow Statements

To measure the efficiency of the business they are in, the hospitality industry should have a Free Cash Flow ( FCF). FCF is the free cash a company has after they are done with their Capital expenditures. The company’s FCF should be mainly from operating cash flow. If credit terms for the company are favourable and it recovers money from its customers soon, it might have a better cash flow management.

The Profit and Loss Statement is the foremost important financial statement of any company. It reflects the income an organisation makes from its operations, its main expenditures, whether they are recurring in nature, what kind of expenditures make the bulk compared to sales. P&L is the main financial statement for your company. From P&L, Balance sheet and Cash Flow statement are made. It also helps to understand what are your fixed expenses and what variable expenses.

Payroll Control

Employee expenses form a major part of the hospitality industry. Having a Good Payroll Processing system is of utmost importance. A good payroll system can help ascertain the productivity of employees. The entity has to find the right balance to pay the employee so much that he is satisfied and does not leave the company, and also to not to overpay that it becomes an unnecessary expense. A good payroll control ensures that the attrition rate is low and the quality of services offered are consistent. For example, if your best chef is poached by your rival, the taste and quality of the meals you serve may go down drastically and the sales of your rival might increase. It is also very important if the employee is paid well or he is left to be dependent on tips received from customers.

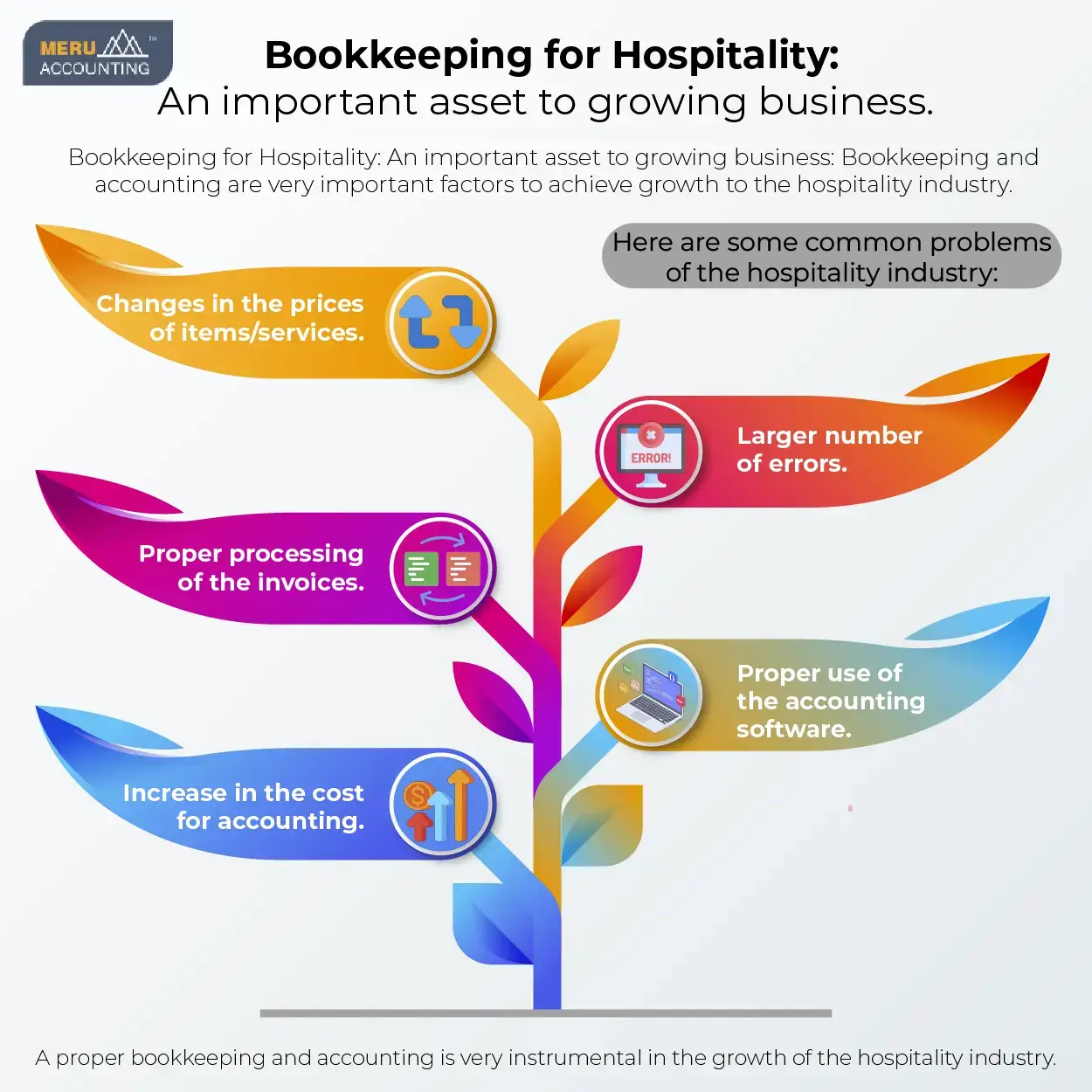

As a business owner, you need to have a clear understanding of what your bookkeeping costs are and how they are benefiting your business. These are some of the different ways of handling the accounting for the hospitality industry. While doing the bookkeeping service for hospitality industry, it is important to consider all the complex regulations of the USA. Many small and medium sized hospitality service providing companies find it difficult to handle the bookkeeping and accounting aspect.

Accounts Junction provides accounting services for the hospitality industry with nice quality. They have experience of working for several companies in the hospitality industry properly. If you have a scope of outsourcing don’t hesitate to call our expert at Accounts Junction for no obligation quote. We not only solve your Tax and Audit problems but also provide timely support on complex financial matters.

What is bookkeeping and accounting for the hospitality business?

Bookkeeping and accounting for a hospitality business in the USA involve managing financial transactions, maintaining accurate records, and preparing financial statements. Here's an overview of the key aspects:

Bookkeeping:

Bookkeeping involves recording and organizing financial transactions on a day-to-day basis. It includes tasks such as:

- Recording sales: Tracking revenue generated from room bookings, restaurant sales, bar sales, and other services.

- Managing accounts payable: Keeping track of invoices, payments to suppliers, and managing expenses.

- Monitoring accounts receivable: Tracking payments from customers, managing outstanding balances, and following up on overdue payments.

- Payroll: Calculating wages, managing employee benefits, and ensuring compliance with employment laws.

- Cash management: Tracking cash inflows and outflows, reconciling bank statements, and maintaining petty cash records.

Chart of Accounts:

Establishing a chart of accounts specific to the hospitality industry helps organize financial information. This chart categorizes accounts such as revenue, expenses, assets, liabilities, and equity, allowing for easy classification and analysis of transactions.

Financial Statements:

Regular preparation of financial statements provides an overview of a hospitality business's financial performance. The main financial statements include:

- Income Statement (or Profit and Loss Statement): Summarizes revenues, expenses, and profits over a specific period, such as a month, quarter, or year.

- Balance Sheet: Provides a snapshot of a business's financial position at a specific point in time, showcasing assets, liabilities, and equity.

- Cash Flow Statement: Tracks cash inflows and outflows, showing the sources and uses of cash over a specific period.

Tax Compliance:

Hospitality businesses must comply with various tax obligations. This includes collecting and remitting sales tax, managing payroll taxes, and filing income tax returns. Maintaining accurate and organized records is crucial for tax compliance.

Accounting Software:

Utilizing accounting software streamlines bookkeeping and accounting processes. There are numerous software options available, such as QuickBooks, Xero, and Sage, specifically designed for small businesses in the hospitality industry.

It's important for hospitality businesses to maintain accurate and up-to-date financial records, as they provide valuable insights for decision-making, financial analysis, and compliance with regulatory requirements. Consulting with an accounting professional or bookkeeper experienced in the hospitality industry like Accounts Junction can provide further guidance tailored to your specific business needs.

Accounts Junction is a reputable company known for its bookkeeping and accounting services. Our expertise in the field allows us to offer comprehensive solutions tailored to the specific needs of hospitality businesses in the USA. Accounts Junction can assist with financial organization, ensuring accurate and up-to-date records of income, expenses, and taxes. We can also ensure compliance with legal and tax obligations, helping businesses avoid penalties and legal issues. With our proficiency in accounting software such as QuickBooks, Xero, or Sage, we can streamline financial processes, providing businesses with efficient and reliable bookkeeping and accounting services. Our expertise and industry knowledge can help hospitality businesses maintain financial stability, make informed decisions, and thrive in a competitive landscape.

Important documents required for bookkeeping and accounting for hospitality business in USA:

For bookkeeping and accounting in a hospitality business in the USA, several important documents and records are required to maintain accurate financial records. Here are some key documents:

Sales Records:

- Point of Sale (POS) System Reports: These reports capture sales transactions, including details of products or services sold, quantities, prices, discounts, and payment methods.

- Guest Folios or Invoices: Documents provided to guests or customers detailing the breakdown of charges for services rendered, such as room charges, food and beverage expenses, and additional services.

Purchase and Expense Records:

- Supplier Invoices: Invoices received from suppliers for purchases of inventory, food and beverage supplies, equipment, and other goods or services.

- Expense Receipts: Receipts for expenses incurred, such as office supplies, utility bills, repairs and maintenance, marketing expenses, and other operational costs.

Payroll and Employee Records:

- Employee Timesheets: Records of hours worked by employees, including regular hours, overtime, and any additional time-off or leave taken.

- Payroll Registers: Documents summarizing employee wages, deductions, and taxes withheld for each pay period.

- Employment Contracts: Agreements outlining the terms and conditions of employment for each employee.

Bank and Financial Statements:

- Bank Statements: Statements received from the business's bank(s), detailing transactions, deposits, withdrawals, and balances.

- Credit Card Statements: Statements from credit card processors or companies, providing a record of credit card transactions made by the business.

- Financial Statements: Prepared statements such as income statements, balance sheets, and cash flow statements, which summarize the financial position and performance of the business.

Tax-related Documents:

- Sales Tax Records: Reports and documentation related to the collection and remittance of sales tax, including sales tax returns filed with the relevant tax authorities.

- Payroll Tax Records: Documents related to payroll tax withholdings, employer contributions, and filings, such as Form 941 or state-specific payroll tax returns.

- Income Tax Records: Documentation supporting the business's income, deductions, and credits for filing federal and state income tax returns, including financial statements, expense records, and receipts.

Contracts and Agreements:

- Vendor Contracts: Agreements with suppliers, service providers, and contractors specifying terms, pricing, and deliverables.

- Rental/Lease Agreements: Contracts for leasing or renting business premises, equipment, or vehicles.

It's important to maintain these documents in an organized and secure manner, as they serve as evidence of financial transactions and provide necessary support for audits, tax filings, and financial analysis. Consider consulting with an accounting professional or bookkeeper like Accounts Junction for specific requirements and recommendations tailored to your hospitality business.

Softwares used for bookkeeping and accounting for hospitality business in USA:

There are several popular accounting and bookkeeping software options used by hospitality businesses in the USA. Here are some commonly used software:

1. QuickBooks:

QuickBooks is a widely recognized and widely used accounting software. It offers various versions tailored to different business sizes and needs, such as QuickBooks Online, QuickBooks Desktop, and QuickBooks Self-Employed. It provides features for invoicing, expense tracking, bank reconciliation, financial reporting, and integration with other business tools.

2. Xero:

Xero is another popular cloud-based accounting software that offers a range of features suitable for hospitality businesses. It includes tools for invoicing, inventory management, expense tracking, bank reconciliation, and financial reporting. Xero also integrates with many third-party applications commonly used in the hospitality industry.

3. Sage Intacct:

Sage Intacct is a robust cloud-based financial management system suitable for larger or more complex hospitality businesses. It offers features for general ledger, accounts payable and receivable, financial reporting, cash management, and multi-entity consolidations.

4. FreshBooks:

FreshBooks is a user-friendly cloud-based accounting software primarily designed for small businesses and self-employed professionals. It provides features for invoicing, expense tracking, time tracking, and financial reporting. FreshBooks also offers integration with popular payment gateways to facilitate online payment collection.

5. Zoho Books:

Zoho Books is an affordable and intuitive cloud-based accounting software suitable for small and medium-sized hospitality businesses. It offers features for invoicing, expense tracking, bank reconciliation, financial reporting, and inventory management.

6. Wave Accounting:

Wave Accounting is a free accounting software option ideal for small businesses, including hospitality establishments. It provides features for invoicing, expense tracking, bank reconciliation, and basic financial reporting. Wave also offers additional paid services for payroll and payment processing.

It's important to evaluate the specific needs of your business and choose a software that aligns with your requirements in terms of functionality, scalability, integration capabilities, and budget.

Accounts Junction is a reputable company known for its bookkeeping and accounting services. Our expertise in the field allows us to offer comprehensive solutions tailored to the specific needs of hospitality businesses in the USA. Accounts Junction can assist with financial organization, ensuring accurate and up-to-date records of income, expenses, and taxes. We can also ensure compliance with legal and tax obligations, helping businesses avoid penalties and legal issues. With our proficiency in accounting software such as QuickBooks, Xero, or Sage, we can streamline financial processes, providing businesses with efficient and reliable bookkeeping and accounting services. Our expertise and industry knowledge can help hospitality businesses maintain financial stability, make informed decisions, and thrive in a competitive landscape.