Outsourced Bookkeeper vs In-House Bookkeeper: Which Is Right for You?

Managing money tasks often feels heavy for business owners. Records must stay clear, clean, and ready at all times. Many leaders think about hiring an outsourced bookkeeper instead of full-time staff.

Others still prefer an in-house bookkeeper for daily tasks. Each option may suit a different business stage. An outsourced bookkeeper can feel flexible and cost-aware. In-house help can feel closer and more direct. The right choice depends on goals, size, and comfort level.

Understanding the Role of an Outsourced Bookkeeper

An outsourced bookkeeper works from outside your business space. They handle records using online tools and shared systems. Many firms use Outsourced Bookkeeping Services to manage daily finance tasks.

These services often support many clients at the same time. Work is done on agreed-upon rules and timelines. Reports are shared through secure tools. This setup suits firms that want expert help without full-time cost.

Common Tasks Managed by an Outsourced Bookkeeper

-

Daily Sales and Cost Record

An outsourced bookkeeper records daily sales and cost details, using shared tools so records stay clean and easy to review.

-

Bill and Payment Tracking

They track bills, vendor payments, and client receipts, so cash movement stays visible and less confusing.

-

Bank and Card Reconciliation

Bank and card records are matched with book entries to help spot gaps before small issues grow larger.

-

Monthly Report Preparation

Simple monthly reports are prepared for review, which helps owners feel more aware of money flow.

-

Payroll Data Support

Payroll data support is provided with care, so pay cycles run smoother without constant follow-ups.

-

Expense Review and Sorting

Business expenses are reviewed and sorted into clear groups for better cost tracking.

-

Account Balance Checks

Key account balances are checked often to ensure figures remain correct and updated.

Understanding the Role of an In-House Bookkeeper

An in-house bookkeeper works inside your office. They focus only on your business needs. Tasks are handled face-to-face with teams.

This setup may feel easy for daily talks. In-house staff learn your process closely. Yet this role comes with fixed costs. Salary, tools, space, and training add to the expense.

Common Tasks Managed by an In-House Bookkeeper

- An in-house bookkeeper enters daily sales and cost records while staying close to teams for quick task updates.

- They work with staff on billing issues to fix errors before clients raise concerns.

- Record gaps are handled as they appear, which may reduce stress during busy work hours.

- Custom reports are prepared for leaders based on internal needs and review habits.

- Tax data support is handled with care to help filers feel more planned and calm.

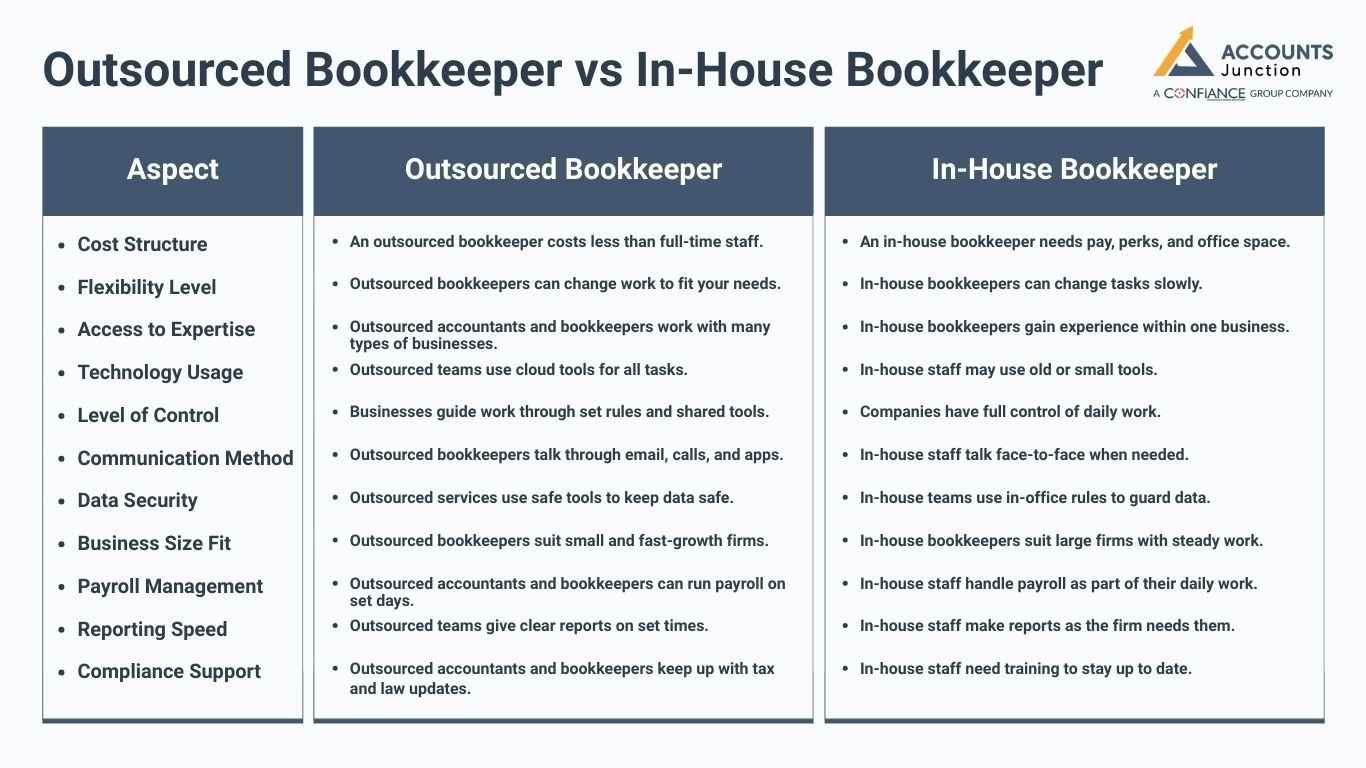

Outsourced Bookkeeper vs In-House Bookkeeper

|

Aspect |

Outsourced Bookkeeper |

In-House Bookkeeper |

|

Cost Structure |

An outsourced bookkeeper costs less than full-time staff. |

An in-house bookkeeper needs pay, perks, and office space. |

|

Flexibility Level |

Outsourced bookkeepers can change work to fit your needs. |

In-house bookkeepers can change tasks slowly. |

|

Access to Expertise |

Outsourced accountants and bookkeepers work with many types of businesses. |

In-house bookkeepers gain experience within one business. |

|

Technology Usage |

Outsourced teams use cloud tools for all tasks. |

In-house staff may use old or small tools. |

|

Level of Control |

Businesses guide work through set rules and shared tools. |

Companies have full control of daily work. |

|

Communication Method |

Outsourced bookkeepers talk through email, calls, and apps. |

In-house staff talk face-to-face when needed. |

|

Data Security |

Outsourced services use safe tools to keep data safe. |

In-house teams use in-office rules to guard data. |

|

Business Size Fit |

Outsourced bookkeepers suit small and fast-growth firms. |

In-house bookkeepers suit large firms with steady work. |

|

Payroll Management |

Outsourced accountants and bookkeepers can run payroll on set days. |

In-house staff handle payroll as part of their daily work. |

|

Reporting Speed |

Outsourced teams give clear reports on set times. |

In-house staff make reports as the firm needs them. |

|

Compliance Support |

Outsourced accountants and bookkeepers keep up with tax and law updates. |

In-house staff need training to stay up to date. |

Pros of Using an Outsourced Bookkeeper

- Fixed costs often feel lower for finance work, since payment matches task level and business pace.

- Workload levels can change with business needs, without stress linked to hiring or staff limits.

- Access to trained finance staff feels useful,when rules or tools change during the year.

- Modern record tools are used each day, which may help keep data clear and current.

- Hiring pressure feels reduced for owners, who prefer to focus on growth and core work.

Drawbacks of Hiring an Outsourced Bookkeeper

-

Lack of Daily Face-to-Face Access

Outsourced bookkeepers work from home, so daily contact is not possible. Teams may find this odd at first and need some time to adapt.

-

Need for Clear Task Rules

Clear rules and instructions are needed from the start. This keeps work smooth and helps everyone know what to do.

-

Dependence on Online Access

All work relies on a stable internet and simple tools. Any tech issue may slow progress or delay updates.

-

Time Zone Differences

Teams may get slower replies if the bookkeeper works in another zone. Planning is needed to meet deadlines across time differences.

-

Less Day-to-Day Control

Some team members may feel less control over daily finance work. Clear workflows and check-ins can help reduce this concern.

Pros of Hiring an In-House Bookkeeper

-

Direct Daily Access

In-house bookkeepers are present daily and can discuss work face-to-face. Immediate questions get quick answers, which makes work run faster.

-

Knowledge of Internal Steps

Staff learn the company steps over time, which makes the work smooth. They get used to rules and ways to do tasks properly.

-

Fast Response During Busy Hours

Teams get fast replies for urgent issues or deadlines. This reduces delays and lowers the risk of mistakes.

-

Quick Error Resolution

In-house staff can spot and fix errors without delay. This stops small mistakes from becoming bigger problems.

-

Improved Collaboration

Close presence allows a better understanding of company goals. Team members can share ideas and plan work together easily.

Drawbacks of Hiring an In-House Bookkeeper

-

High Fixed Costs

Monthly pay, benefits, and office space make staff expensive. Costs remain high even when work is low or slow.

-

Limited Skill Exposure

Staff focus on one firm and one system most of the time. This limits learning new tools or methods from other firms.

-

Scaling Challenges

Adding more work is hard without hiring more staff. Businesses may struggle to handle extra work in busy periods.

-

Impact of Absences

Time off or sickness may stop daily bookkeeping work. Backup staff or plans are needed to avoid delays.

-

Training Time

New staff need training, which slows work for a while. It can take weeks before staff work well on their own.

When Outsourced Bookkeeping Services Make Sense

-

Early Growth Stages

Outsourced bookkeeping costs less for new or small firms. It keeps records correct without needing a full-time staff member.

-

Seasonal Workload Changes

Flexible outsourced teams handle changing work during busy months. Extra work can be done without hiring staff permanently.

-

Limited Office Space

Remote bookkeeping avoids an office setup and saves money. This works well for small offices or startups.

-

Focus on Core Work

Owners can focus on business instead of daily finance work. Time saved can be spent on sales, marketing, or operations.

-

Access to Multiple Skills

Outsourced bookkeepers bring skills a single staff member may not have. They offer experience with different tools, firms, and processes.

When an In-House Bookkeeper Makes Sense

-

High Daily Record Volume

Businesses with many daily financial tasks need on-site staff. Staff can handle records directly and keep books up to date.

-

Stable Cash Flow

Firms with steady revenue can afford fixed staff costs. They can pay full-time staff without stress or worry.

-

Instant Access for Leaders

Leaders get fast answers to finance questions on-site. This helps them make quick decisions on spending and work.

-

Daily Team Coordination

Teams that need close daily work do better with staff on-site. Tasks can be divided and tracked faster within the office.

-

Managing Complex Processes

In-house staff can manage internal workflows and hard tasks. They follow company rules and work with other teams easily.

How to Decide the Right Option

- Review the task load each month before choosing an outsourced bookkeeper.

- Check the cost and comfort of outsourced bookkeeping services each month.

- Track growth plans that affect outsourced bookkeeper work needs.

- Check the need for control before using outsourced bookkeeping services.

- Check the tool use when hiring an outsourced bookkeeper.

- A clear choice comes from a slow and honest review.

- Check free time before hiring an outsourced bookkeeper.

Working Smoothly With an Outsourced Bookkeeper

- Share clear task lists early with an outsourced accountant and bookkeeper.

- Set clear due dates with outsourced bookkeeping services teams.

- Use safe shared tools with an outsourced bookkeeper.

- Check work each month for outsourced bookkeeping services goals.

- Keep open communication with your outsourced bookkeeper at all times.

- A strong setup helps outsourced bookkeeping services work well.

- Set a clear scope early for outsourced accountant and bookkeeper work.

Working Smoothly With an In-House Bookkeeper

- Set clear task limits for your in-house bookkeeper.

- Give the tool help often to aid in-house bookkeeper work.

- Check work quality each month with the in-house bookkeeper.

- Help keep a fair task load for the in-house bookkeeper.

- Plan staff coverage for the in-house bookkeeper's leave time.

- Good help keeps in-house bookkeeping work on track.

- Ask for notes to boost the in-house bookkeeper's work workflow.

Choosing between outsourced bookkeeping and in-house help depends on what fits your comfort and budget. Outsourced services offer expert support and great flexibility, while in-house staff provide daily access and close control. Picking the right option today means cleaner books and stress-free growth tomorrow. Contact Accounts Junction to find the best fit for your business!

FAQs

1. Is an outsourced bookkeeper costly for small firms?

- Costs often feel lower than the full-time staff needs. They let small firms save on pay and perks.

2. Can outsourced bookkeeping services handle payroll work?

- Yes, many teams support payroll data and reviews. They can run salaries, deductions, and bonuses on time.

3. Do outsourced bookkeepers use safe systems?

- Most use secure cloud tools with access control. Data is kept private with strict rules and passwords.

4. Is in-house bookkeeping better for fast growth?

- Growth often suits flexible outsourced support better. In-house staff may struggle with sudden work surges.

5. Can reports be customized by outsourced bookkeepers?

- Yes, reports can match business needs closely. Reports can be made for owners or team review.

6. When is an in-house bookkeeper more suitable?

- In-house bookkeepers work best for large, stable companies. They offer direct control and quick responses to issues.