Journal Entries Accounting: A Complete Guide with Types, Examples, and Best Practices

Journal Entries Accounting is the foundation of accurate bookkeeping and reliable financial reporting. Every business, whether a startup, small business, or growing company, relies on journal entries to track transactions, maintain compliance, and understand financial performance.

If journal entries are recorded incorrectly, financial statements become unreliable. That’s why understanding journal entries accounting is critical for anyone involved in accounting, bookkeeping, or business finance.

In this detailed guide, you’ll learn:

- What journal entries accounting really means

- How journal entries work step by step

- Types of journal entries with examples

- Common mistakes and best practices

- How journal entries support business growth

What Is Journal Entries Accounting?

Journal entries accounting is the process of recording financial transactions in a journal using debit and credit accounts. It is the first step of the accounting cycle and forms the base for ledgers and financial statements.

Each journal entry documents:

- The transaction date

- Accounts affected

- Debit amount

- Credit amount

- A brief explanation

Once recorded, journal entries are posted to the general ledger, which summarizes financial activity.

Why Journal Entries Accounting Is Important

Journal entries accounting ensures financial accuracy and transparency. It helps businesses:

- Keep organized financial records

- Track income, expenses, assets, and liabilities

- Prepare profit and loss statements

- Ensure tax and accounting compliance

- Make confident financial decisions

Without proper journal entries, even the best accounting software cannot generate reliable reports.

How Journal Entries Accounting Works

Journal entries accounting follow the double-entry bookkeeping system. This system requires every transaction to affect at least two accounts.

Debit and Credit Explained Simply

- Debit (Dr): Increases assets and expenses

- Credit (Cr): Increases liabilities, equity, and income

This balance ensures that the accounting equation remains accurate at all times.

Basic Format of Journal Entries Accounting

A standard journal entry follows a simple structure:

- Debit the receiving account

- Credit the giving account

- Add a short narration

Example:

Cash A/c Dr

To Sales A/c

This consistent format makes journal entries easy to track and review.

Types of Journal Entries in Accounting

Understanding different types of journal entries in accounting helps ensure transactions are recorded correctly.

1. Simple Journal Entry

A simple journal entry includes one debit and one credit.

Used for basic transactions such as cash sales or payments.

2. Compound Journal Entry

A compound journal entry involves more than two accounts.

Common when multiple expenses or payments occur in one transaction.

3. Adjusting Journal Entry

Adjusting entries are recorded at the end of an accounting period.

They include depreciation, accrued expenses, prepaid expenses, and outstanding income.

4. Reversing Journal Entry

Reversing entries cancel certain adjusting entries at the start of the next period.

They simplify accounting for recurring transactions.

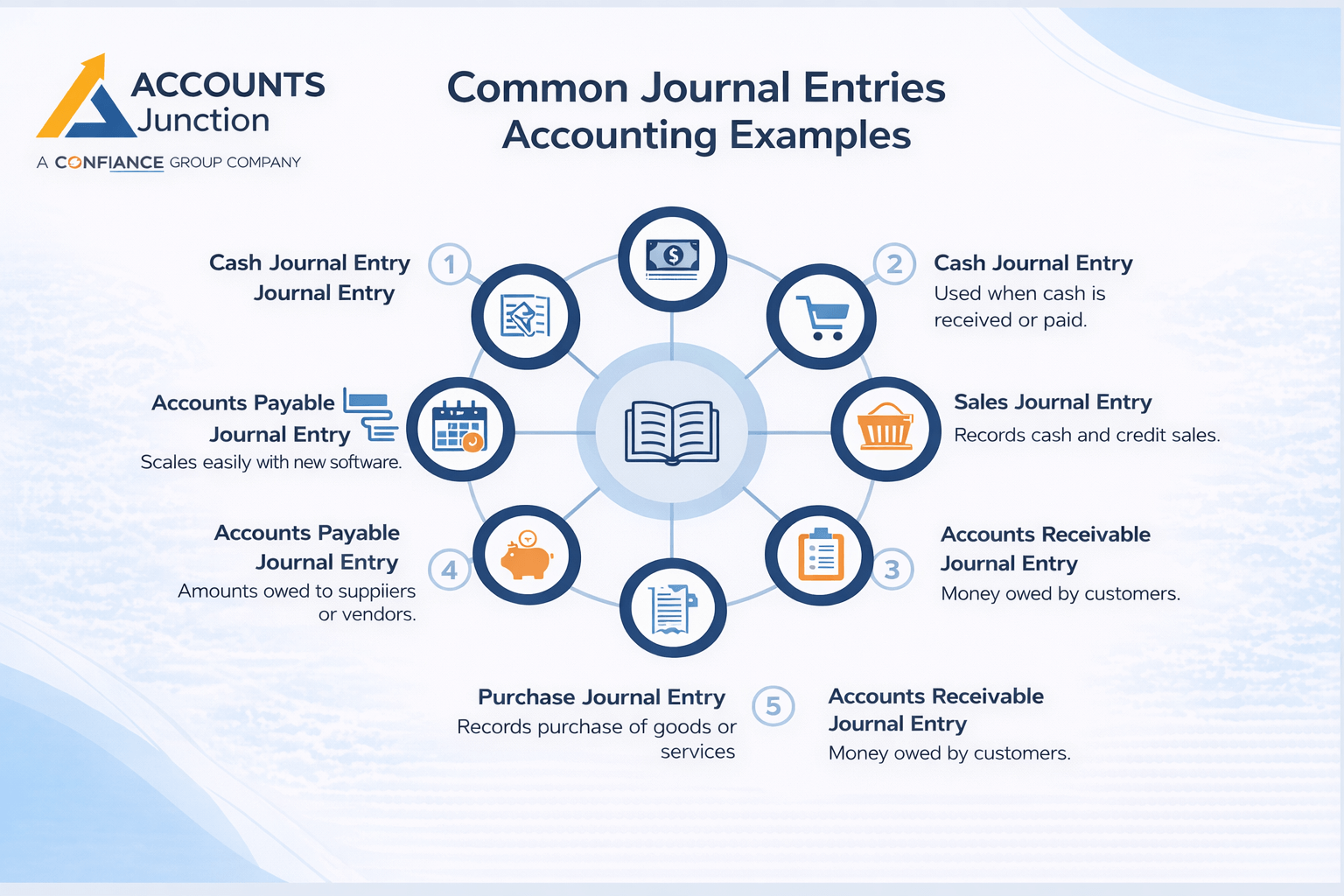

Common Journal Entries Accounting Examples

Cash Journal Entry

Used when cash is received or paid.

Sales Journal Entry

Records both cash and credit sales transactions.

Purchase Journal Entry

Used to record purchases of goods or services.

Expense Journal Entry

Tracks operating costs such as rent, salaries, utilities, and marketing expenses.

Accounts Receivable Journal Entry

Records money owed by customers.

Accounts Payable Journal Entry

Tracks amounts owed to suppliers or vendors.

Journal Entries Accounting for Small Businesses

For small businesses, journal entries play a vital role in:

- Daily bookkeeping accuracy

- Monthly financial reporting

- Tax preparation and audits

- Cash flow monitoring

Many businesses choose outsourced bookkeeping to manage journal entries accurately while focusing on growth.

Journal Entries vs Ledger: Key Differences

| Journal Entries | Ledger |

|---|---|

| First record of transaction | Summary of accounts |

| Chronological order | Account-wise classification |

| Detailed narration | Shows balances |

Journal entries accounting always comes before ledger posting.

Common Mistakes in Journal Entries Accounting

Even experienced teams make mistakes, such as:

- Incorrect debit or credit

- Missing transactions

- Duplicate entries

- Ignoring adjusting entries

These mistakes can lead to inaccurate reports and poor decisions.

Best Practices for Accurate Journal Entries in Accounting

To maintain clean and reliable journal entries for accounting:

- Record transactions daily

- Use consistent account names

- Review entries monthly

- Reconcile bank statements

- Seek professional review

These best practices improve financial clarity and reduce risk.

Journal Entries Accounting in the Digital Age

Modern accounting software automates journal entries, but human understanding remains essential. Automation improves speed, while professional review ensures accuracy, compliance, and judgment.

This balance leads to better financial control and business confidence.

How Journal Entries Support Financial Statements

Journal entries directly impact:

- Income statements

- Balance sheets

- Cash flow statements

Incorrect journal entries lead to incorrect financial statements, making accuracy critical.

Why Journal Entries Matter for Business Growth

Accurate journal entries help businesses:

- Identify profit trends

- Control expenses

- Improve cash flow

- Plan future growth

Strong financial records build trust with investors, lenders, and stakeholders.

Final Thoughts on Journal Entries Accounting

Journal entries accounting is the backbone of bookkeeping and accounting systems. When done correctly, it brings clarity, accuracy, and confidence to financial management.

Whether you manage records yourself or work with professionals, understanding journal entries empowers smarter decisions and long-term success.

At Accounts Junction, we deliver reliable Journal Entries Accounting services to keep your financial records accurate and compliant. Our experts record, review, and maintain journal entries with precision, helping businesses avoid errors and gain clear financial insights. Focus on growth while we handle your accounting needs efficiently. Contact us today!

FAQs

1. What is journal entries accounting?

- Journal entries accounting is the process of recording business transactions using debit and credit accounts.

2. Why is journal entries accounting important?

- It ensures accurate records, supports financial reporting, and helps businesses stay compliant.

3. What is the double-entry system?

- The double-entry system records every transaction with one debit and one credit to maintain a balance.

4. What is the difference between a journal and a ledger?

- The journal records transactions first, while the ledger summarizes them by account.

5. Are journal entries required for small businesses?

- Yes, journal entries accounting is essential for tracking finances and preparing reports.