Bookkeeping vs Accounting: Key Differences in 2026, Benefits, and What Your Business Really Needs

If you're searching for bookkeeping vs accounting, you're not alone. These two terms are frequently confused even by experienced business owners but understanding the difference between bookkeeping and accounting is essential for financial clarity, smart decisions, tax compliance, and scaling your company.

-

Bookkeeping is the day-to-day recording of financial transactions.

-

Accounting analyzes that data to deliver insights, forecasts, and strategic advice.

In this ultimate 2026 guide, we’ll break down:

-

Core differences

-

Side-by-side comparison

-

Real-world examples

-

Bookkeeper vs accountant: who to hire

-

Emerging trends like AI automation

-

Why combining both is the smartest move for modern businesses

What Is Bookkeeping? (The Daily Record-Keeping Foundation)

Bookkeeping is the administrative process of accurately capturing and organizing every financial transaction your business makes. It’s the data collection layer of your financial system ensuring records are complete, consistent, and error-free.

Key Bookkeeping Tasks

-

Recording sales, purchases, receipts, and payments

-

Managing invoices, accounts receivable (money owed to you) and accounts payable (money you owe)

-

Reconciling bank and credit card statements

-

Maintaining the general ledger and categorizing transactions

-

Processing payroll and tracking routine expenses

Why Bookkeeping Matters in 2026

Clean bookkeeping:

-

Prevents IRS or international tax issues

-

Supports accurate financial reporting

-

Feeds reliable data into accounting and AI tools

Most businesses now use cloud-based bookkeeping software like QuickBooks Online, Xero, or FreshBooks, with AI automating categorization and reconciliation.

What Is Accounting? (Insights, Analysis, and Strategy)

Accounting takes raw bookkeeping data and converts it into actionable intelligence. It focuses on interpretation, compliance, forecasting, and big-picture financial health.

Key Accounting Tasks

-

Preparing financial statements

-

Income statement

-

Balance sheet

-

Cash flow statement

-

-

Analyzing profitability, margins, trends, and KPIs

-

Tax planning, preparation, and compliance

-

Budgeting, cash-flow forecasting, and scenario analysis

-

Ensuring compliance with GAAP (US) or IFRS (global)

-

Providing strategic advice for growth and cost control

Questions Accounting Answers

-

Is the business actually profitable?

-

Can you afford expansion or new hires?

-

Where are cost leaks or hidden opportunities?

Bookkeeping vs Accounting: The Core Difference

The simplest way to remember:

-

Bookkeeping records the numbers

-

Accounting explains what the numbers mean—and what to do next

At a Glance

-

Bookkeeping: Transactional, detail-oriented, ongoing

-

Accounting: Analytical, strategic, periodic

Bookkeeping vs Accounting: Side-by-Side Comparison (2026)

Comparison Table Overview

| Aspect | Bookkeeping | Accounting |

|---|---|---|

| Primary Focus | Recording & organizing daily transactions | Analyzing data, reporting, forecasting & advising |

| Scope | Transaction-level detail | Big-picture insights & strategy |

| Frequency | Daily or weekly | Monthly, quarterly, annually |

| Key Deliverables | Ledgers, reconciled accounts, trial balances | Financial statements, tax returns, forecasts, reports |

| Skill Requirements | Attention to detail, basic finance knowledge | Advanced analysis, often CPA/CA certification |

| Tools in 2026 | QuickBooks, Xero, Wave (AI automation heavy) | Advanced dashboards in same tools + AI analytics |

| Professional | Bookkeeper (often virtual or in-house) | Accountant / CPA (strategic advisor) |

| Business Need | Essential for all sizes to stay organized | Critical for growth, funding, compliance & optimization |

Real-World Example: Bookkeeping vs Accounting in Action

Scenario: E-Commerce Business ($150K/month revenue)

Bookkeeping Handles

-

Logging Shopify and Stripe sales

-

Categorizing ad spend, shipping, inventory

-

Reconciling PayPal and bank deposits

-

Tracking customer invoices and vendor bills

Accounting Handles

-

Analyzing declining margins from ad costs

-

Forecasting cash for holiday inventory

-

Identifying tax deductions (e.g., Section 179)

-

Advising on pricing or supplier changes

Result:

Bookkeeping keeps the books clean.

Accounting provides the roadmap to scale to $500K/month sustainably.

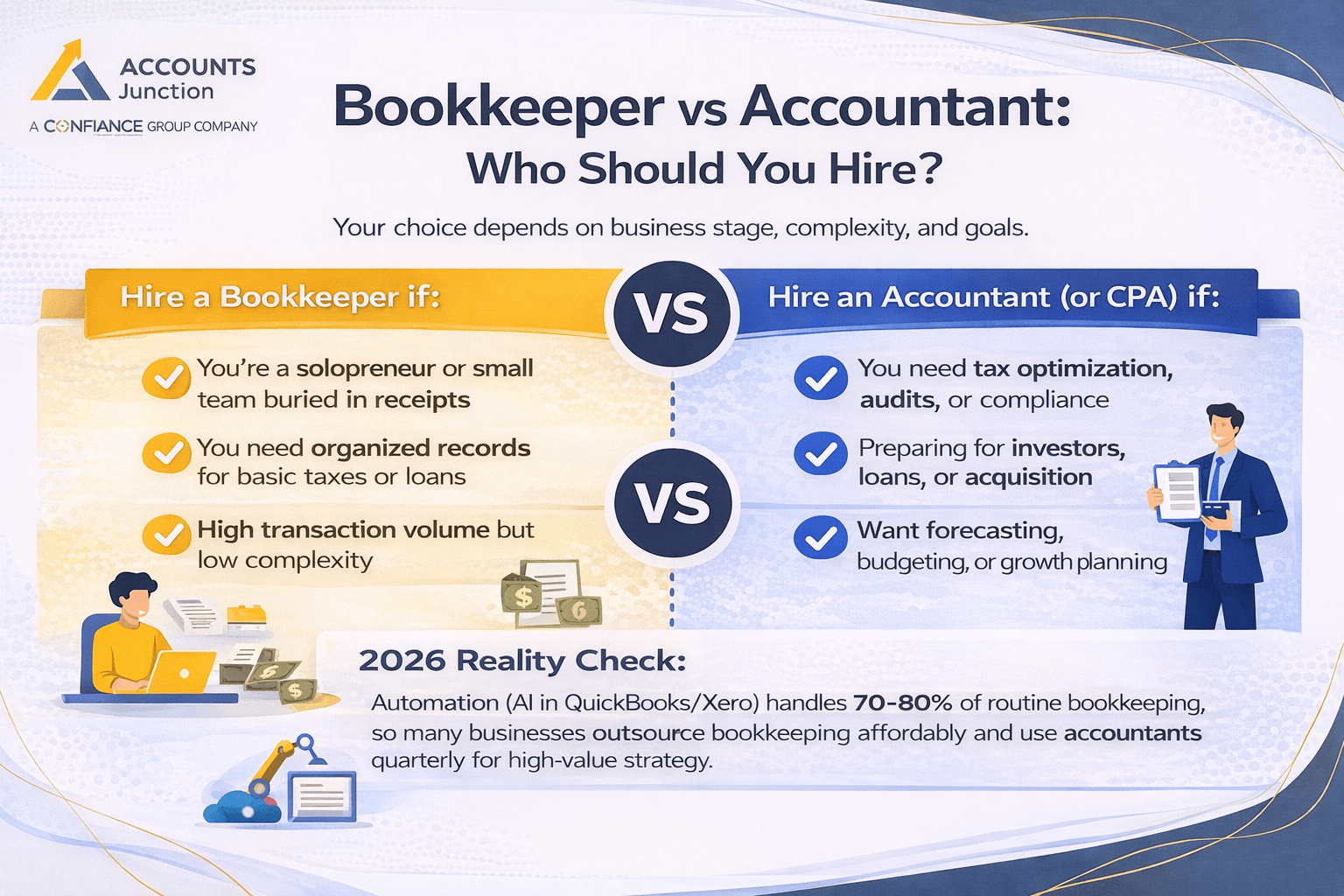

Bookkeeper vs Accountant: Who Should You Hire?

Your choice depends on business size, complexity, and goals.

Hire a Bookkeeper If

-

You’re a solopreneur or small team

-

You’re buried in receipts and transactions

-

You need organized records for taxes or loans

Hire an Accountant (or CPA) If

-

You need tax optimization or audits

-

You’re preparing for investors or funding

-

You want forecasting, budgeting, and strategy

2026 Reality Check

AI handles 70–80% of routine bookkeeping, so many businesses:

-

Outsource bookkeeping affordably

-

Use accountants quarterly for high-value advice.

Do Small Businesses and Startups Need Both?

Yes especially after $100K–$500K in revenue.

-

Bookkeeping prevents errors and penalties

-

Accounting unlocks insights, savings, and scalability

Many startups begin DIY, then transition to professionals to save time and reduce risk.

Global Perspective: Bookkeeping & Accounting Standards (2026)

The distinction is universal:

-

US: GAAP

-

International: IFRS

Bookkeeping ensures consistent data; accounting adapts it to local tax and compliance rules (IRS, HMRC, etc.).

Emerging 2026 Trends

-

AI-driven bookkeeping automation

-

Accountants shifting to advisory roles

-

Real-time cloud-based financial visibility

Benefits of Combining Bookkeeping and Accounting

Integrated services deliver:

-

Complete financial visibility

-

Better decision-making

-

Optimized cash flow

-

Easier, compliant tax filing

-

Confidence to focus on growth

Common Myths About Bookkeeping vs Accounting

Myth 1: They’re the same

Reality: Bookkeeping feeds accounting—they’re connected but different.

Myth 2: Small businesses don’t need accounting

Reality: Accounting insights drive profitable growth.

Myth 3: Software replaces professionals

Reality: Tools assist; expertise prevents costly mistakes.

Myth 4: One person can do both forever

Reality: Specialization and outsourcing scale better.

Get a Free Quote

At AccountsJunction, we deliver expert bookkeeping, full accounting, tax compliance, and strategic advisory for US and global businesses.

Contact us today for a no-obligation consultation stop guessing and start growing with confidence!

FAQs

1. Is bookkeeping part of accounting?

- Yes. Bookkeeping is the foundational step of accounting. It records financial transactions, which accounting then analyzes and interprets for reporting, compliance, and strategy.

2. Which is easier: bookkeeping or accounting?

- Bookkeeping is generally easier because it is routine and process-driven.

- Accounting requires deeper analysis, professional judgment, and a strong understanding of tax laws and financial standards.

3. Can one person handle both bookkeeping and accounting?

- Yes for small businesses or early-stage startups. However, as transaction volume and complexity grow, professionals typically specialize to ensure accuracy, compliance, and scalability.

4. How much do bookkeeping and accounting cost in 2026?

-

Bookkeeping: $300–$1,500 per month (virtual services)

-

Accounting: $1,000–$5,000+ per quarter, depending on complexity and advisory needs

5. Do AI tools eliminate the need for bookkeeping or accounting professionals?

- No. AI automates data entry and categorization, but human expertise is essential for compliance, tax strategy, forecasting, and business decision-making.