Bookkeeping Costs for Small Businesses – In-house vs. Outsourced

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

In-house Bookkeeping: Costs and Considerations

In-house bookkeeping means hiring staff or doing it yourself. This model gives more control

and instant access to records, but it also comes with a price.

Common Costs in In-house Bookkeeping

- Salaries and Benefits

Hiring a part-time or full-time bookkeeper comes with salary, health coverage, paid leave, and payroll taxes. A full-time bookkeeper in the US can cost $35,000 to $55,000 a year.

- Training and Supervision

In-house bookkeepers need to stay current with laws and software. You might need to pay for courses or spend time reviewing their work.

- Software and Tools

Buying and renewing accounting software adds cost. Tools like QuickBooks, Xero, or FreshBooks often charge monthly or annual fees.

- Office Space and Equipment

If your bookkeeper works from your office, you need to provide space, a computer, and possibly extra supplies.

- Time Cost

If you handle bookkeeping yourself, it eats into time that could be spent growing your business. This time has its own cost.

Pros of In-house Bookkeeping

- Full control over financial records

- Easy access to data anytime

- Quick edits or checks when needed

- Can tailor reports based on what you want

Cons of In-house Bookkeeping

- High fixed cost, even during slow months

- May lack deep expertise

- Risk of errors if the person is not trained well

- Hard to scale if your business grows fast

Outsourced Bookkeeping: Costs and Considerations

Outsourced bookkeeping means hiring a third party to manage your books. It could be a solo expert, a small agency, or a larger firm. You pay them based on time, transactions, or a set fee.

Common Costs in Outsourced Bookkeeping

- Monthly Retainer or Hourly Rate

Most bookkeeping services offer fixed monthly plans based on your business size. Others charge hourly, often between $30 to $90 per hour depending on the service scope.

- Add-on Services

Some providers charge extra for payroll, sales tax filings, or deep financial analysis.

- Setup and Catch-up Fees

If your books are not up to date, you might need to pay a one-time catch-up fee. The same goes for setting up new accounts.

- Software Access

Many outsourced firms use their own software and include access in their fee. This may reduce your software cost.

Pros of Outsourced Bookkeeping

- Lower cost for small or medium businesses

- Access to trained experts and up-to-date tools

- No need to manage or supervise

- Easy to scale based on need

- Only pay for what you use

Cons of Outsourced Bookkeeping

- Less direct access to your books

- Response time might not be instant

- Limited custom reports unless requested

- Risk of sharing financial data with third parties

Bookkeeping Costs for Small Business: In-house vs. Outsourced

Breakdown

|

Cost Item |

In-house Bookkeeping |

Outsourced Bookkeeping |

|

Salary or Fees |

$35,000–$55,000 per |

$150–$1,500 per month |

|

Payroll Taxes |

7.65% of salary or more |

Included or not applicable |

|

Benefits and Insurance |

Varies |

Not required |

|

Software |

$300–$1,000 per year |

Often included |

|

Training |

Ongoing |

Handled by service provider |

|

Supervision |

Required |

Not required |

|

Flexibility |

Fixed staff hours |

Scalable monthly support |

|

Accuracy and |

Varies with hire |

Usually high with firms |

What Type of Business Should Choose In-house?

In-house bookkeeping works best for businesses that:

- Handle sensitive data and prefer in-person oversight

- Have complex and frequent transactions

- Need daily or real-time updates

- Have the budget to hire skilled staff

- Prefer to train and grow a finance team internally

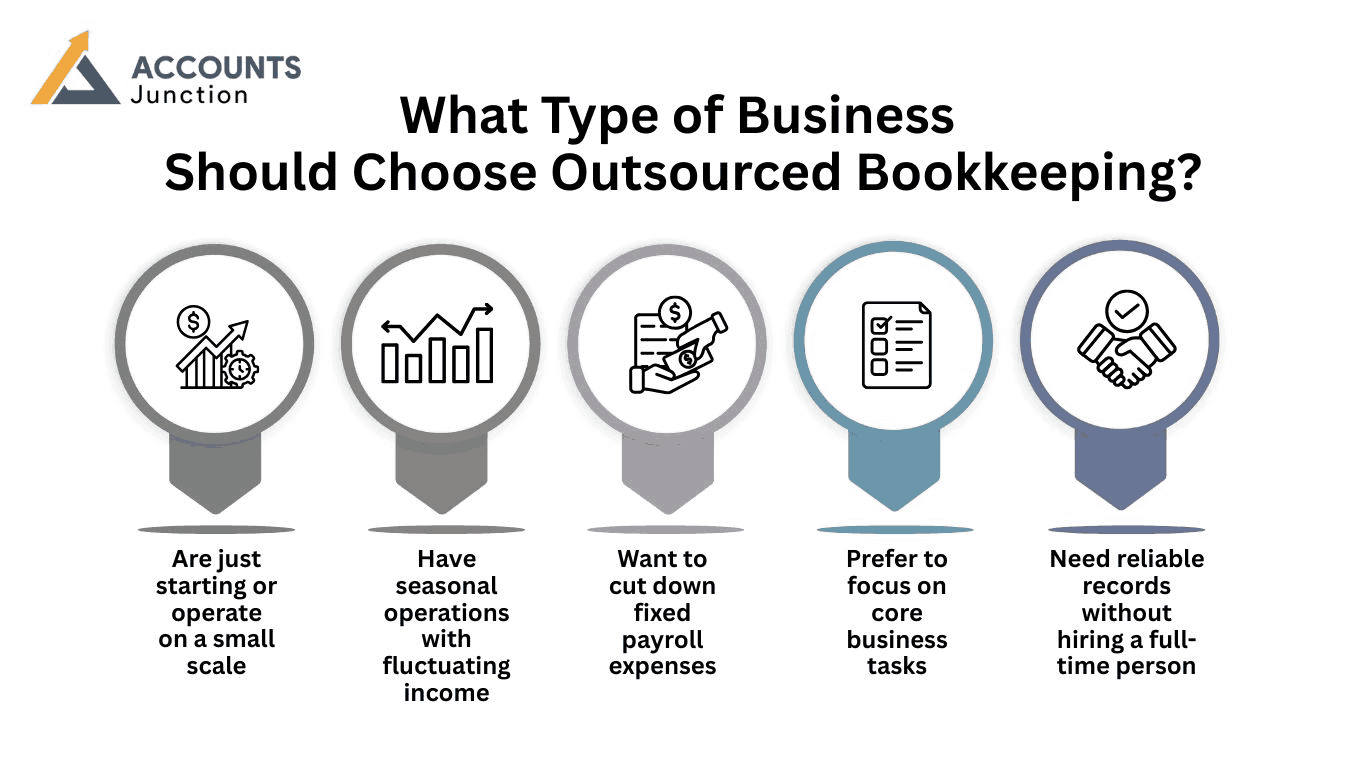

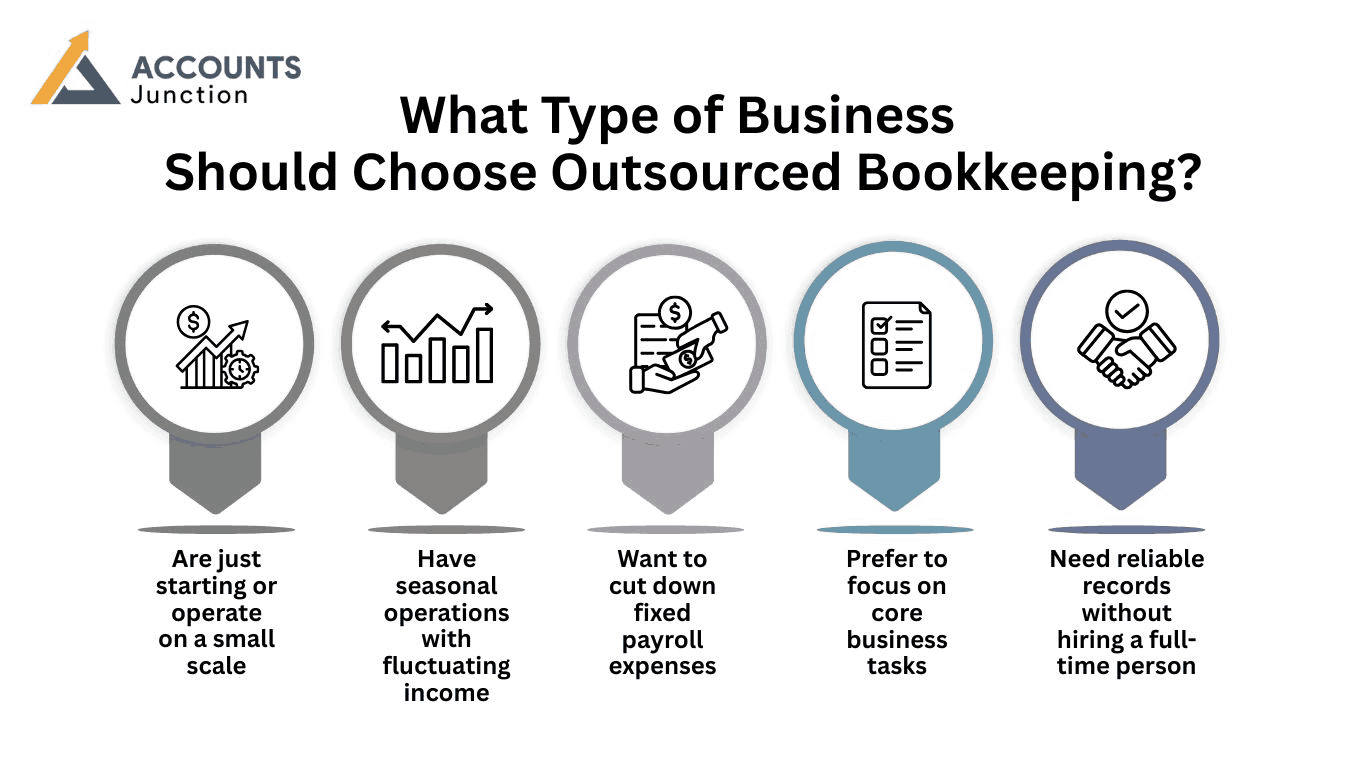

What Type of Business Should Choose Outsourced Bookkeeping?

Outsourced bookkeeping is ideal for businesses that:

- Are just starting or operate on a small scale

- Have seasonal operations with fluctuating income

- Want to cut down fixed payroll expenses

- Prefer to focus on core business tasks

- Need reliable records without hiring a full-time person

Making the Right Choice

Your bookkeeping method should match your business goals, budget, and comfort level. If you want to stay lean and cut overheads, outsourcing makes sense. If control and direct handling matter more to you, in-house is a better pick.

It also depends on your skill level. If you have no finance background, hiring or outsourcing becomes a must. If you enjoy numbers and are willing to learn, managing books in-house might be manageable at the start.

Some business owners also use a mix. They might handle day-to-day records but outsource tax filings and year-end reports. Others hire part-time staff and bring in outside experts for tasks like audits.

How to Reduce Bookkeeping Costs for Small Business

No matter which model you choose, you can take steps to keep costs under control:

- Stay Organized

Keep your receipts, invoices, and records in one place. Use digital tools to avoid paper clutter.

- Use Simple Tools

Pick easy software that fits your business. You do not need the most advanced system if your needs are basic.

- Outsource Only What You Need

You can hire help just for payroll or taxes, not the whole process.

- Limit Errors

The fewer mistakes you make, the less time and money you spend fixing them.

- Bundle Services

Some firms offer bundles like bookkeeping plus tax filing at lower rates.

Conclusion

There is no single answer when it comes to choosing between in-house and outsourced bookkeeping. Each small business is unique, with its own needs, size, and budget.

Outsourced bookkeeping usually works well for small businesses that want to keep their costs low while maintaining accurate records. It provides access to expert services without the need to hire full-time staff. In-house bookkeeping gives you control and in-person support but at a higher price. What matters most is to ensure that your records are clear, up to date, and ready when you need them. That way, you can make smart decisions based on facts, not guesses.

If you are looking to compare your current costs or explore outsourcing options, take time to get quotes, check client reviews, and look at what each service includes. Many firms offer free consultations or trials, which can help you make a smarter choice. At Accounts Junction, we maximize savings for our clients. All our accounting and bookkeeping services are cost-effective for businesses of all types. Contact us now to know about our pricing plans.

FAQs

1. What is the average bookkeeping cost for small business?

- Costs vary by location and size, but many small businesses pay between $300 and $800 per month for basic bookkeeping.

2. Can I do bookkeeping myself to save money?

- Yes, if your business is simple and you have time. But mistakes can lead to fines or missed tax deductions.

3. How often should bookkeeping be done?

- Ideally, weekly. At the very least, update your records monthly to avoid backlog and confusion.

4. Do bookkeeping services also handle tax filing?

- Some do. Many offer it as an extra service, or bundle it with year-end reporting and compliance checks.

5. Is outsourced bookkeeping secure?

- Reputable providers use secure systems and follow strict data rules. Always check their privacy policy and reviews.

6. Can I switch from in-house to outsourced later?

- Yes. You can shift models anytime. Keep records clean to make the switch smooth.

Bookkeeping is one of the basic needs of any business. It records income, expenses, payments, receipts, and every money move the business makes. For small business owners,the question is not whether to do bookkeeping but how to manage it. Two options stand out—in-house and outsourced. Bookkeeping costs for small businesses varies for both the types and has its pros and cons.

This blog breaks down the bookkeeping costs for small business operations and explains the difference between doing it in-house and outsourcing it. You will see what affects the cost, what each model offers, and what to consider when choosing the right option for your business.

Why Bookkeeping Matters for Small Businesses

Good bookkeeping helps keep your business organized. It supports tax filing, loan applications,and investor talks. It also shows where your money goes and how much you earn. When you track income and expenses correctly, you avoid mistakes that cost you time and money.

For small businesses, staying lean is key. That means you need to watch costs closely.Bookkeeping helps you do that. But how much should you spend on it?

Factors That Affect Bookkeeping Costs for Small Business

The cost of bookkeeping depends on several factors. Not all small businesses have the same

needs, and costs can vary even within the same field. Here are the main factors that shape how

much you spend:

- Size of Business

More clients, vendors, or staff means more records to track. A business with ten clients has a lighter load than one with two hundred. This directly affects the time and effort needed.

- Number of Transactions

A high number of transactions each month means more time spent on data entry, reconciliations, and report reviews.

- Complexity of Services

If your business needs payroll, inventory tracking, tax prep, and detailed reports, the cost goes up. A simple cash-based shop will cost less to manage than a business with many payment types and cost centers.

- Software Used

Some bookkeeping software tools cost more than others. Some offer built-in payroll or tax features, which might reduce outside help but raise software fees.

- Reporting Needs

If you need monthly reports, cash flow charts, or sales insights, the cost rises. Regular reports take more time to prepare and check.

- Tax Season Support

Some businesses want help during tax season only, while others need year-round support. Ongoing services are usually more cost-efficient.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

In-house Bookkeeping: Costs and Considerations

In-house bookkeeping means hiring staff or doing it yourself. This model gives more control

and instant access to records, but it also comes with a price.

Common Costs in In-house Bookkeeping

- Salaries and Benefits

Hiring a part-time or full-time bookkeeper comes with salary, health coverage, paid leave, and payroll taxes. A full-time bookkeeper in the US can cost $35,000 to $55,000 a year.

- Training and Supervision

In-house bookkeepers need to stay current with laws and software. You might need to pay for courses or spend time reviewing their work.

- Software and Tools

Buying and renewing accounting software adds cost. Tools like QuickBooks, Xero, or FreshBooks often charge monthly or annual fees.

- Office Space and Equipment

If your bookkeeper works from your office, you need to provide space, a computer, and possibly extra supplies.

- Time Cost

If you handle bookkeeping yourself, it eats into time that could be spent growing your business. This time has its own cost.

Pros of In-house Bookkeeping

- Full control over financial records

- Easy access to data anytime

- Quick edits or checks when needed

- Can tailor reports based on what you want

Cons of In-house Bookkeeping

- High fixed cost, even during slow months

- May lack deep expertise

- Risk of errors if the person is not trained well

- Hard to scale if your business grows fast

Outsourced Bookkeeping: Costs and Considerations

Outsourced bookkeeping means hiring a third party to manage your books. It could be a solo expert, a small agency, or a larger firm. You pay them based on time, transactions, or a set fee.

Common Costs in Outsourced Bookkeeping

- Monthly Retainer or Hourly Rate

Most bookkeeping services offer fixed monthly plans based on your business size. Others charge hourly, often between $30 to $90 per hour depending on the service scope.

- Add-on Services

Some providers charge extra for payroll, sales tax filings, or deep financial analysis.

- Setup and Catch-up Fees

If your books are not up to date, you might need to pay a one-time catch-up fee. The same goes for setting up new accounts.

- Software Access

Many outsourced firms use their own software and include access in their fee. This may reduce your software cost.

Pros of Outsourced Bookkeeping

- Lower cost for small or medium businesses

- Access to trained experts and up-to-date tools

- No need to manage or supervise

- Easy to scale based on need

- Only pay for what you use

Cons of Outsourced Bookkeeping

- Less direct access to your books

- Response time might not be instant

- Limited custom reports unless requested

- Risk of sharing financial data with third parties

Bookkeeping Costs for Small Business: In-house vs. Outsourced

Breakdown

|

Cost Item |

In-house Bookkeeping |

Outsourced Bookkeeping |

|

Salary or Fees |

$35,000–$55,000 per |

$150–$1,500 per month |

|

Payroll Taxes |

7.65% of salary or more |

Included or not applicable |

|

Benefits and Insurance |

Varies |

Not required |

|

Software |

$300–$1,000 per year |

Often included |

|

Training |

Ongoing |

Handled by service provider |

|

Supervision |

Required |

Not required |

|

Flexibility |

Fixed staff hours |

Scalable monthly support |

|

Accuracy and |

Varies with hire |

Usually high with firms |

What Type of Business Should Choose In-house?

In-house bookkeeping works best for businesses that:

- Handle sensitive data and prefer in-person oversight

- Have complex and frequent transactions

- Need daily or real-time updates

- Have the budget to hire skilled staff

- Prefer to train and grow a finance team internally

What Type of Business Should Choose Outsourced Bookkeeping?

Outsourced bookkeeping is ideal for businesses that:

- Are just starting or operate on a small scale

- Have seasonal operations with fluctuating income

- Want to cut down fixed payroll expenses

- Prefer to focus on core business tasks

- Need reliable records without hiring a full-time person

Making the Right Choice

Your bookkeeping method should match your business goals, budget, and comfort level. If you want to stay lean and cut overheads, outsourcing makes sense. If control and direct handling matter more to you, in-house is a better pick.

It also depends on your skill level. If you have no finance background, hiring or outsourcing becomes a must. If you enjoy numbers and are willing to learn, managing books in-house might be manageable at the start.

Some business owners also use a mix. They might handle day-to-day records but outsource tax filings and year-end reports. Others hire part-time staff and bring in outside experts for tasks like audits.

How to Reduce Bookkeeping Costs for Small Business

No matter which model you choose, you can take steps to keep costs under control:

- Stay Organized

Keep your receipts, invoices, and records in one place. Use digital tools to avoid paper clutter.

- Use Simple Tools

Pick easy software that fits your business. You do not need the most advanced system if your needs are basic.

- Outsource Only What You Need

You can hire help just for payroll or taxes, not the whole process.

- Limit Errors

The fewer mistakes you make, the less time and money you spend fixing them.

- Bundle Services

Some firms offer bundles like bookkeeping plus tax filing at lower rates.

Conclusion

There is no single answer when it comes to choosing between in-house and outsourced bookkeeping. Each small business is unique, with its own needs, size, and budget.

Outsourced bookkeeping usually works well for small businesses that want to keep their costs low while maintaining accurate records. It provides access to expert services without the need to hire full-time staff. In-house bookkeeping gives you control and in-person support but at a higher price. What matters most is to ensure that your records are clear, up to date, and ready when you need them. That way, you can make smart decisions based on facts, not guesses.

If you are looking to compare your current costs or explore outsourcing options, take time to get quotes, check client reviews, and look at what each service includes. Many firms offer free consultations or trials, which can help you make a smarter choice. At Accounts Junction, we maximize savings for our clients. All our accounting and bookkeeping services are cost-effective for businesses of all types. Contact us now to know about our pricing plans.

FAQs

1. What is the average bookkeeping cost for small business?

- Costs vary by location and size, but many small businesses pay between $300 and $800 per month for basic bookkeeping.

2. Can I do bookkeeping myself to save money?

- Yes, if your business is simple and you have time. But mistakes can lead to fines or missed tax deductions.

3. How often should bookkeeping be done?

- Ideally, weekly. At the very least, update your records monthly to avoid backlog and confusion.

4. Do bookkeeping services also handle tax filing?

- Some do. Many offer it as an extra service, or bundle it with year-end reporting and compliance checks.

5. Is outsourced bookkeeping secure?

- Reputable providers use secure systems and follow strict data rules. Always check their privacy policy and reviews.

6. Can I switch from in-house to outsourced later?

- Yes. You can shift models anytime. Keep records clean to make the switch smooth.