Law firms accounting requirements and service

Law firm accounting involves more than just monitoring income and expenses. Legal professionals must follow strict rules that protect client funds, ensure ethical billing, and maintain proper trust account records. These rules form the foundation of legal compliance. Meeting all Law Firms Accounting Requirements needs the right structure, accurate tools, and expert support. In this guide, we’ll explore what these requirements involve and how professional help can make accounting easier for legal practices.

Introduction to Law Firms Accounting Requirements

Law firms handle large sums of client money. They must keep clear records and follow legal and tax rules. Law firms accounting requirements differ from other businesses. They include managing client trust accounts, tracking billable hours, and handling retainers. Missing these steps can lead to penalties or even legal trouble.

Law firms must also regularly compare their financial records with bank statements to ensure accuracy and compliance. This confirms every dollar is in the right place. Without a clear plan, even small firms can run into issues. That’s why law firms accounting requirements must be a top priority.

Key Components of Law Firm Accounting

Understanding the key parts of law firm accounting helps firms avoid mistakes. These tasks are not just about taxes. They affect how firms operate and grow.

• Client trust accounting

Law firms are required to maintain client funds in different trust accounts. They must track every withdrawal and deposit with detailed records.

• Revenue tracking

Firms need to record all payments received from clients. This includes hourly fees, retainers, and case-based billing.

• Expense management

Every firm should review office costs, payroll, and other expenses. This helps control spending and improve profit margins.

• Billing

Correct invoicing makes sure clients are charged appropriately and on schedule. It also supports steady cash flow and trust in the firm.

• Reconciliation

Reconciling bank accounts each month prevents errors. It confirms that all transactions match the firm’s internal records.

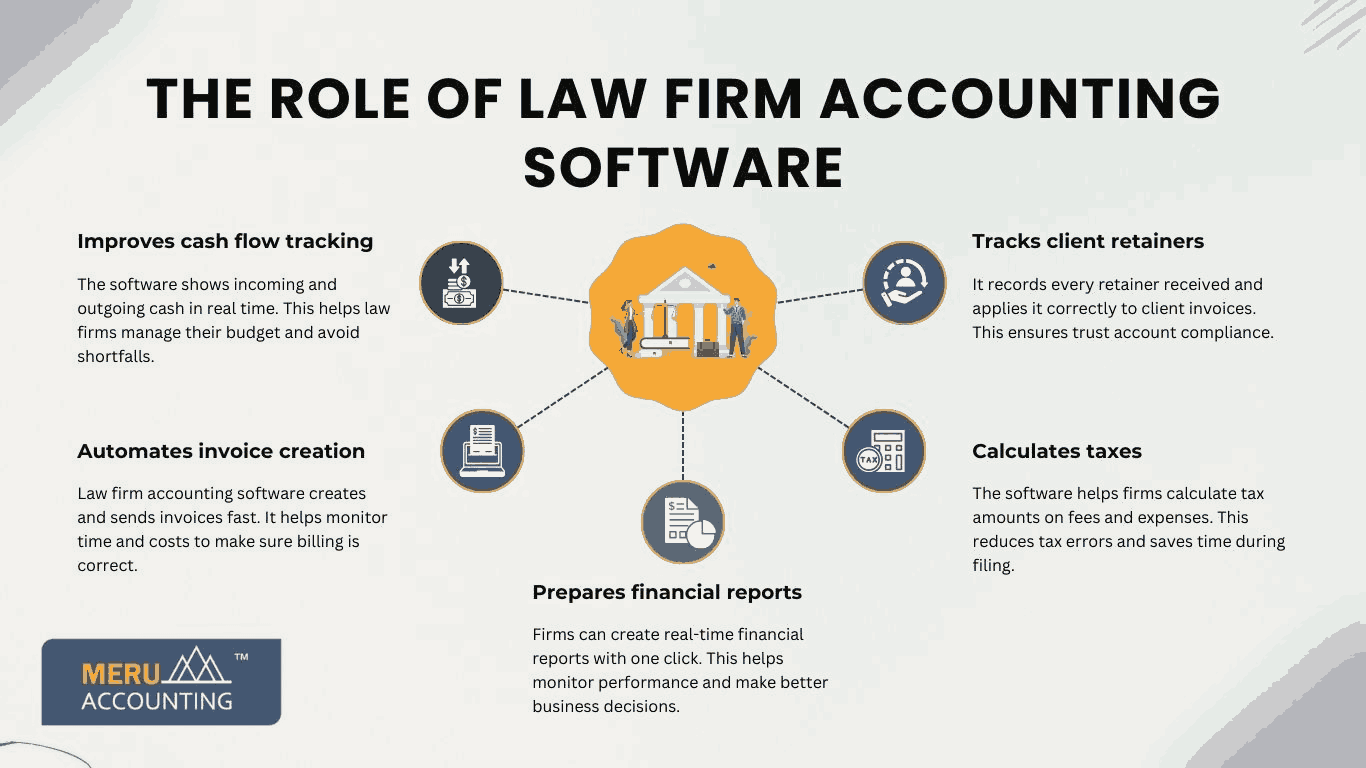

The Role of Law Firm Accounting Software

Manual tracking doesn’t cut it anymore. Law firm accounting software provides firms with the tools to remain precise and follow regulations.

• Tracks client retainers

It records every retainer received and applies it correctly to client invoices. This ensures trust account compliance.

• Calculates taxes

The software helps firms calculate tax amounts on fees and expenses. This reduces tax errors and saves time during filing.

• Prepares financial reports

Firms can create real-time financial reports with one click. This helps monitor performance and make better business decisions.

• Automates invoice creation

Law firm accounting software creates and sends invoices fast. It helps monitor time and costs to make sure billing is correct.

• Improves cash flow tracking

The software shows incoming and outgoing cash in real time. This helps law firms manage their budget and avoid shortfalls.

Common Accounting Challenges Faced by Law Firms

Law firms deal with unique accounting issues that can affect accuracy and compliance. Key challenges include:

1. Compliance Issues

Law firms must follow strict rules when handling client trust accounts. Inappropriate recordkeeping can lead to penalties or loss of license.

2.Tracking Billable Hours

It’s hard to track every billable hour, especially when managing many clients and tasks. Errors can lead to lost revenue.

3. Cash Flow Management

Income may not be steady. Late payments and long case timelines can make it tough to maintain a stable cash flow.

4. Client-Related Expenses

Firms often pay costs upfront for clients. These expenses must be tracked and billed correctly to avoid profit loss.

5. Fraud Risk

Large amounts of money flow through law firms. Without proper checks, firms become targets for fraud.

6. Lack of Financial Oversight

Without regular reviews, mistakes go unnoticed. This can lead to incorrect reports and compliance issues.

Choosing the Right Law Firm Accounting Software

Using the right law firm accounting software can make accounting tasks more accurate and faster.

-

Trust Accounting

The software should track client trust funds properly. This helps meet legal and ethical rules. - Time and Billing Integration

Select software that tracks time and creates invoices. It should connect smoothly with billing tools.

- Expense Tracking

The software must record and sort expenses. It should also support billing by client or case.

- Built-In Compliance Tools

Pick a system that helps your firm follow laws. This is key when handling trust accounts and reports.

- User-Friendly Interface

A simple design saves time and reduces errors. Everyone in the firm should use it with ease.

- Secure Data Storage

Choose software that keeps data safe. Search for encryption and regular backups to protect client info.

Popular options include Clio, QuickBooks for Law Firms, and Xero. The best choice depends on your firm’s size, specialty, and needs.

Best Practices for Managing Law Firm Finances

To stay financially strong and avoid errors, law firms should follow these simple practices:

1. Keep Trust and Operating Accounts Separate

Use different accounts for client trust money and firm expenses. This prevents mixing funds and keeps you compliant.

2. Do Regular Account Reconciliation

Check your bank and trust accounts often. This helps catch mistakes and keeps records accurate.

3. Send Bills on Time

Always bill clients quickly and on a set schedule. Use billing software to make this easier and faster.

4. Hire a Skilled Accountant

For larger firms, hiring a bookkeeper or outsourcing to an expert helps ensure correct financial work.

5. Track All Client Costs

Record every cost spent for a client. This prevents billing mistakes and helps recover expenses.

6. Use Budgeting Tools

Create and follow a budget to plan expenses. Budgeting helps avoid overspending and keeps goals on track.

7. Review Financial Reports Often

Check financial reports monthly. This gives you insight into income, spending, and profit trends.

Conclusion

Law firms must follow set rules to handle money the right way. Good software helps track trust funds, send bills, and make reports. Accounts Junction gives easy and clear help with law firm accounts. This makes daily money tasks simple and correct.

FAQs

1. What is trust accounting in law firms?

A: Trust accounting refers to the management of client funds that are held in trust by the firm until they are needed for specific purposes. Law firms must track and manage these funds separately to comply with legal regulations.

2. What is the best law firm accounting software?

A: The best accounting software for law firms depends on their specific needs. Popular options include Clio, QuickBooks for Law Firms, and Xero. Choose software that offers trust accounting and time-billing capabilities.

3. Why is accurate billing important for law firms?

A: Accurate billing ensures that law firms are paid for the work they perform. It helps maintain good client relationships and ensures compliance with agreed terms.