How Digital Bookkeeping Improves Team Collaboration in Financial Management

Digital bookkeeping has changed how finance teams work. It helps them stay clear, fast, and on track. These teams handle money, track costs, create reports, and check for errors.

When data is on paper or spread across different devices, it’s hard to stay organized. Teamwork suffers, and mistakes happen more often.

That’s where digital tools help. Modern bookkeeping software makes it easy to work as a team. It lets people share data, act fast, and make smart choices together.

What is Digital Bookkeeping?

Digital bookkeeping is a smart way to keep track of your money records. It uses a computer, cloud apps, and online tools instead of paper or old spreadsheets. Your data stays safe in the cloud. This makes things quicker, more correct, and easy to use.

A business can:

- Track money in and out

- See records anytime, on any device

- Share reports quickly with the team

- Get quick alerts and updates

- Keep up with tax rules

These tools help bookkeepers, small firms, new startups, and big teams. They save time, lower mistakes, and make money tasks simple.

Switching to digital bookkeeping helps your business stay neat, grow well, and get ready for taxes.

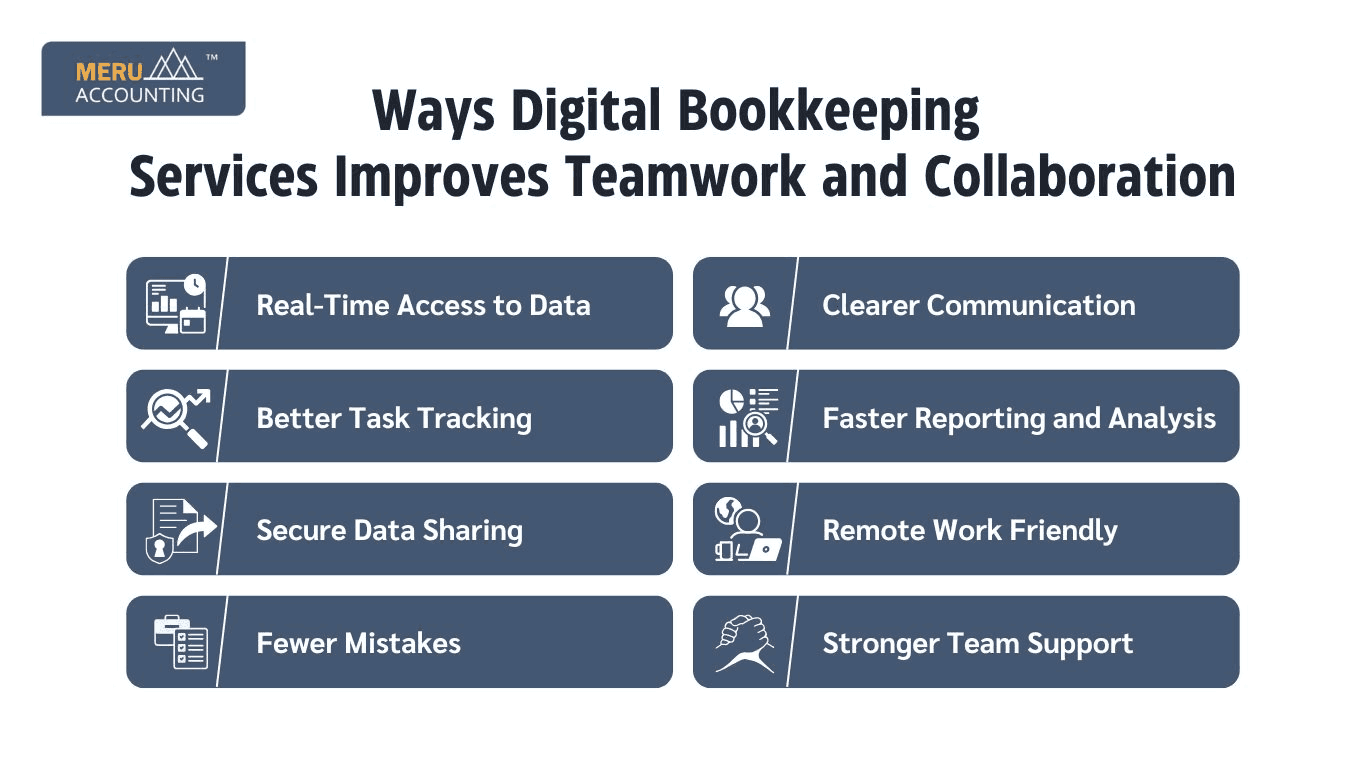

Ways Digital Bookkeeping Services Improves Teamwork and Collaboration

Real-Time Access to Data

- Team members can view the same numbers at the same time. It doesn't matter where they are. This reduces delays and ensures everyone is working with the latest numbers.

Clearer Communication

- With digital bookkeeping services, you can leave comments, ask questions, and tag other team members within the platform. Because of this the clarity is improved and reduces the need for back-and-forth emails.

Better Task Tracking

- Many services allow you to assign tasks and track progress. This helps teams stay on top of important deadlines and responsibilities.

Faster Reporting and Analysis

- Reports are created quickly. This allows the team to analyze financial data and make decisions.

Secure Data Sharing

- These services offer safe ways to share financial information with selected team members or advisors. This keeps private data safe.

Remote Work Friendly

- Cloud-based tools allow teams to work from anywhere. This supports flexible working styles. It helps businesses continue running smoothly even when staff aren’t in the same place.

Fewer Mistakes

- Automation features reduce the chance of manual errors. This means more accurate records and fewer problems to fix later on.

Stronger Team Support

- When everyone uses the same system, it builds trust. Each team member knows the data is right and up to date.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Benefits of Digital Bookkeeping Services for Team Collaboration

Digital bookkeeping services helps teams work better. Here are the key benefits:

1. Faster Tasks

- It speeds up work. Tasks like bank reconciliations and data entry are done in minutes. This gives more time for other important work.

2. Clearer Information

- Everyone sees the same data. This reduces confusion and builds trust. It helps teams stay accountable.

3. Works with Other Tools

- It links to tools like payroll and inventory software. This makes work easier across teams.

4. Grows with Your Business

- As your business grows, digital bookkeeping grows with it. You can add users and handle more tasks without changing systems.

5. Saves Money

- Less time spent on manual work saves on labor costs. It also catches mistakes early to avoid bigger problems.

6. Safer Data

- It keeps data secure. Only authorized people can access it, protecting it from errors or fraud.

7. Better Decisions

- With quick access to accurate data, your team can make decisions faster. Having the right information helps everyone act confidently.

Challenges of Digital Bookkeeping

It has many benefits, but it also comes with challenges. Here are some common ones:

1. Learning Curve

- It can be hard for some team members to learn new software. This is especially true if they’re used to old ways of doing things.

2. Internet Dependency

- Digital tools need a stable internet connection. If the internet goes down, it can stop work and slow down productivity.

3. Security Concerns

- Even though digital tools use encryption, businesses must stay careful. Strong passwords and regular updates help protect data.

4. Software Costs

- Some digital bookkeeping tools can be expensive. This is especially true if you need special features or multiple users.

5. Over-reliance on Automation

- Sometimes teams depend too much on automation. This can lead to mistakes if they don’t double-check the data.

6. Data transfer Issues

- When switching to digital tools, moving old data can be tricky. It takes extra time to make sure everything is correct.

7. Integration with Other Tools

- Sometimes, tools don’t work well with other business systems. This can create extra work to keep everything working together.

8. Ongoing Maintenance

- Digital tools need regular updates and care. Without them, the system can have problems or security risks.

Despite these issues, most of these challenges can be solved with proper training. As with regular backups, and choosing the right service provider.

Conclusion

With digital tools, teams save time and make fewer mistakes. This helps them choose what’s best for the business.

Your team may work in one office or in different locations. Either way, digital bookkeeping keeps everyone on track. It stores all data in one place and makes teamwork clear and safe.

If your team wants to work better, now is the time to try digital bookkeeping. Accounts Junction gives you simple and safe services built for your team. We help you stay on track so your team can focus on business growth.

FAQs

1. What makes digital bookkeeping better than paper methods?

- Digital bookkeeping is quicker, more correct, and easier to use than paper or spreadsheets.

2. Can small businesses use digital bookkeeping?

- Yes. Many services are made for small or mid-sized businesses. They are easy to use and cost less, which helps growing companies.

3. Is it safe to keep financial data online?

- Yes. Most services use strong security and data locks. You can also choose who can see private info in your team.

4. Can digital bookkeeping help with taxes?

- Yes. It keeps your records in order all year. That makes tax time easier. You can also send records straight to your accountant.

5. Do I need tech skills to use digital bookkeeping?

- No. Most tools are made to be simple. They often include help guides, training, and support for new users.