How Can QuickBooks Transform the Way Uber Drivers Manage Their Finances?

Driving for Uber is flexible and offers many benefits and ways to earn money. You choose your own hours, and accept rides when it suits you. This makes you work independently. But being an Uber driver also means you’re running your own small business. You’re responsible for your income, expenses, taxes, and financial records. It can get tough without using the right tool. That’s why Uber drivers use QuickBooks.

This software is made to help self-employed workers like you keep track of your earnings, costs, and taxes in an easy way. Tax accountants for Uber drivers understand the complexities of self-employment taxes and 1099 forms.

They provide guidance on deductible expenses such as fuel, insurance, and car maintenance. Hiring tax accountants for Uber drivers ensures compliance with IRS regulations and helps maximize tax savings.

Let’s first understand what QuickBooks is, and then we’ll see how it can transform your financial life as an Uber driver.

What Is QuickBooks?

QuickBooks is a cloud-based accounting software made by Intuit. It’s designed for individuals and small businesses to manage money. It helps to track expenses, send invoices, and prepare for taxes. The version of QuickBooks for Uber drivers is perfect for self-employed professionals. Especially those who need a simple way to keep their finances in order without hiring a full-time bookkeeper.

With QuickBooks, Uber drivers can record income from rides, monitor fuel, and maintain costs. Also, estimate how much they need to set aside for taxes. It saves time, reduces stress, and helps you avoid surprises during tax season.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

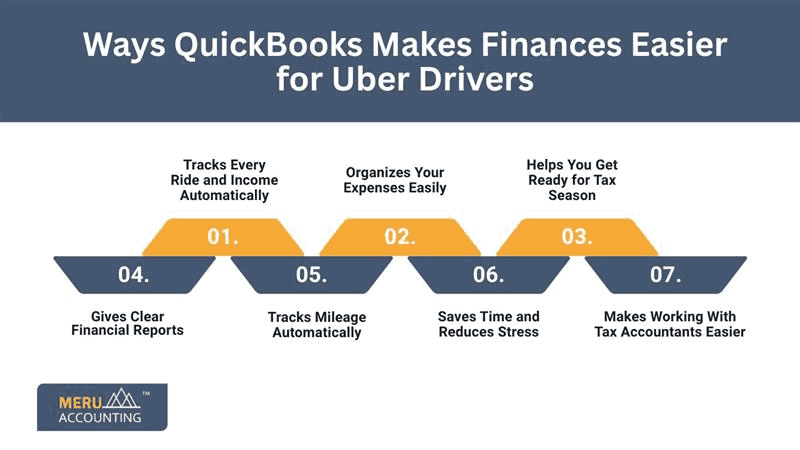

Ways QuickBooks Makes Finances Easier for Uber Drivers

Here are the main ways QuickBooks for Uber drivers transforms how you manage your money:

1. Tracks Every Ride and Income Automatically

- Instead of writing down every trip you make. QuickBooks connects with your Uber account or your bank account and pulls the information in for you. It records how much you earned from each ride. Along with the bonuses and tips. You don’t have to worry about missing income or doing manual work. This makes income tracking simple, clear, and always up to date.

2. Organizes Your Expenses Easily

- As an Uber driver, you probably have regular costs. It includes fuel, car maintenance, car washes, insurance, and even your mobile phone bill. With QuickBooks for Uber drivers, you can connect your bank or credit card. As the software will automatically pull in your transactions.

- You just review the transactions and tag them to the right category. That way, your tax accountants for Uber drivers can easily see your real business costs.

3. Helps You Get Ready for Tax Season

- One of the hardest parts of being self-employed is preparing for taxes. Since Uber doesn’t withhold taxes for you. Because of this, you have to save and pay them yourself. QuickBooks makes this easier by showing you a running total of your income and estimating how much you owe in taxes.

- This means you’re not surprised in April, and you’re always prepared. It also helps tax accountants for Uber drivers by providing neat, organized records.

4. Gives Clear Financial Reports

With just a few clicks, QuickBooks can give you reports that show:

- How much did you earn last month

- What were your biggest expenses?

- How much profit did you make

- What you might owe in taxes

These reports are great for understanding how your driving business is doing. Also, help tax accountants for Uber drivers give you better advice.

5. Tracks Mileage Automatically

- Mileage is one of the biggest problems for tax accountants for Uber drivers. You save as per the miles you track, the more it is the more you can save on taxes. QuickBooks has a built-in mileage tracker. It uses your phone’s GPS to track every drive. Whether it’s for Uber or personal use.

- You just swipe to separate business trips from personal ones. This saves time and ensures you don’t forget to log miles.

6. Saves Time and Reduces Stress

- You don't have to spend hours with a calculator, a spreadsheet, or a pile of receipts. QuickBooks for Uber drivers does most of the work for you. Your financial information is in one place, easy to read, and always up to date.

- This means less stress during tax season. As it gives more time to focus on driving and earning.

7. Makes Working With Tax Accountants Easier

- You can give access to your QuickBooks account when working with tax accountants for Uber drivers. This lets them see all your records, reports, and income. And doesn't need to ask you for paper documents or email files.

Benefits of QuickBooks for Uber Drivers

Tax accountants for Uber drivers help track daily income and mileage. They guide drivers on paying taxes every three months to avoid a big year-end bill.

1. Saves Time with Automation

- QuickBooks does many tasks automatically. It is more like pulling in ride earnings and sorting expenses.

2. Keeps Everything Organized in One Place

- All your income, expenses, and reports are stored in one easy-to-use platform.

3. Helps Avoid Tax Mistakes

- QuickBooks tracks your income and expenses clearly. Because of this, you don’t forget to report anything during tax season.

4. Gives Peace of Mind During Tax Season

- With everything recorded and up to date. This makes it easier when it’s time to file your taxes. You’ll know exactly where you stand.

5. Tracks Mileage and Expenses with Ease

- The built-in mileage tracker and expense categorization. These features help you keep records effortlessly.

6. Works on Mobile – Manage Finances on the Go

- You can access QuickBooks from your phone anytime. Whether you’re in your car or at home, you can check your finances wherever you are.

7. Improves Accuracy for You and Your Tax Advisor

- QuickBooks reduces human error and keeps everything neat. This helps you and your tax accountant. Also works more accurately and efficiently.

Challenges

While QuickBooks is very helpful, here are a few challenges you might face:

- Learning Curve: It takes time if you are using accounting software for the first time. It might take a few days to learn how everything works.

- Monthly Subscription: There’s a small cost each month. It often pays for itself in saved time and tax deductions.

- Too Many Features: Some features may be more than what you need. It’s important to pick the version that’s right for Uber drivers.

- Phone Battery Use: Using the mileage tracker on your phone. It may use up some battery, so keeping a car charger is helpful.

Conclusion

QuickBooks for Uber drivers is a smart way to handle finances. It works with less stress and more clarity. It saves time, avoids errors, and keeps everything organized, perfect for busy drivers. When combined with the expert support of tax accountants for Uber drivers, you get even better results. With help from tax accountants for Uber drivers, you can drive more and worry less. They also know how to claim simple tax write-offs like phone use and car wear.

If you need professional help managing your books and taxes. Accounts Junction is here to assist. Our team understands your unique needs and can guide you with QuickBooks setup. Along with financial tracking and tax filing, you can focus on the road while they handle the numbers.

FAQs

1. Do I really need accounting software as an Uber driver?

- Yes, if you drive regularly. It helps you track income, expenses, and mileage—all of which are important for taxes.

2. Is QuickBooks expensive?

- QuickBooks Self-Employed is made for drivers and self-employed workers. It’s affordable and can save you more money in tax deductions than it costs.

3. Can I share QuickBooks with my accountant?

- Yes. You can invite tax accountants for Uber drivers to access your records directly in QuickBooks.

4. Does QuickBooks work on my phone?

- Yes, there’s a mobile app. You can use it to track miles, check income, and categorize expenses while you're on the road.

5. Is my data safe?

- QuickBooks uses secure encryption to keep your financial information safe in the cloud.