Free and Paid Alternatives to QuickBooks: Which One Should You Choose?

QuickBooks is a popular tool for business accounting. It is known for its strong features and ease of use. But it may not suit everyone. Some find it costly. Others feel it has more tools than they need. That’s why many people look for alternatives to QuickBooks, tools that are simpler, cheaper, or even free.

If you are a freelancer, a startup, or a small business, there are many good options. Some are free, while others charge a small fee. Many of them are easy to use and meet most business needs. In this blog, we’ll explore the top free and paid alternatives to QuickBooks to help you choose the right one.

Why Look for Alternatives to QuickBooks?

QuickBooks is a top choice for many when it comes to business accounting, but there are strong alternatives to QuickBooks that better suit some users. Still, it may not fit every business. If you run a small business or want simpler tools, there are good reasons to look at other options.

1. QuickBooks Can Be Costly for Small Businesses

- QuickBooks may be too costly for startups or solo owners. As your needs grow, the price also goes up. You might need to pay more for users, features, or support. In the long run, this can hurt your budget. Cheaper or even free alternatives to QuickBooks might be a better fit.

2. Too Complex or Limited for Some Users

- QuickBooks comes with many tools, but not all users need them. Some may find the system too hard to learn. Others may not get the features they want. If it takes too much time to figure out, it might slow down your work instead of helping.

3. Not Ideal for Every Industry

- QuickBooks is made for general use. But not all businesses have the same needs. Some need to track jobs, manage parts, or handle donor money. If your field has special needs, you may want to explore alternatives to QuickBooks that are built for your niche.

4. Need for a Simpler or Cheaper Solution

- Some users just want a tool that is easy to use and low-cost. Many tools today are made for users with no background in finance. These tools are clean, simple, and fast to set up. If you want to save time and money, such tools may be a better choice.

Best Free Alternatives to QuickBooks

1. Wave Accounting

- 100% free for accounting, invoicing, and receipt scanning.

- Best for freelancers and small service-based businesses.

- No hidden fees or monthly charges.

- Clean and easy-to-use dashboard.

2. ZipBooks

- Offers a free plan with invoicing and basic reports.

- Great for small teams or solo workers.

- Paid upgrades are available for more features.

- Cloud-based and mobile-friendly.

3. Akaunting

- Free and open-source accounting software.

- Works online – no installation needed.

- Supports invoicing, expense tracking, and reporting.

- Good for global businesses (multi-currency feature).

4. GnuCash

- Desktop-based free tool.

- Works well for personal or small business use.

- Includes double-entry accounting.

- Not ideal for teams or cloud access.

5. SlickPie (Note: May have limited updates)

- Free plan with auto data entry and expense tracking.

- Supports online invoices and tax tracking.

- Simple and clean user interface.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Best Paid Alternatives to QuickBooks

1. Xero

- Strong cloud-based accounting platform.

- Starts around $13/month.

- Great for small and mid-sized businesses.

- Offers real-time collaboration with your accountant.

- Integrates with 1000+ business apps.

2. FreshBooks

- Best for service-based businesses and freelancers.

- Starts around $17/month.

- Great invoicing features and time tracking.

- Simple layout and fast support.

- Mobile app for easy on-the-go use.

3. Zoho Books

- Starts at $15/month.

- Ideal for growing businesses.

- Includes inventory, project tracking, and GST support.

- Works well with other Zoho products.

4. Sage Business Cloud Accounting

- Starts around $10/month.

- Good for small businesses and startups.

- Easy invoicing, payment tracking, and cash flow management.

- Offers live support and mobile access.

5. Kashoo

- Offers simple accounting for small business owners.

- Flat fee of $20/month.

- Includes unlimited users, invoices, and support.

- Easy to use and set up.

Other Notable Alternatives to QuickBooks

1. Microsoft Excel + Templates

- If you are good with Excel, you can manage basic accounts.

- Many free templates available for invoices and expenses.

- Best for those who don’t need cloud or automation.

2. Odoo Accounting

- Part of the Odoo business suite.

- Offers full customization.

- Free for one app with paid upgrades.

- Works best for companies needing full ERP systems.

3. Manager.io

- Free desktop version available.

- It has a clean interface and supports many features.

- Paid cloud and server versions are also offered.

- Good for international use (multi-currency, tax support).

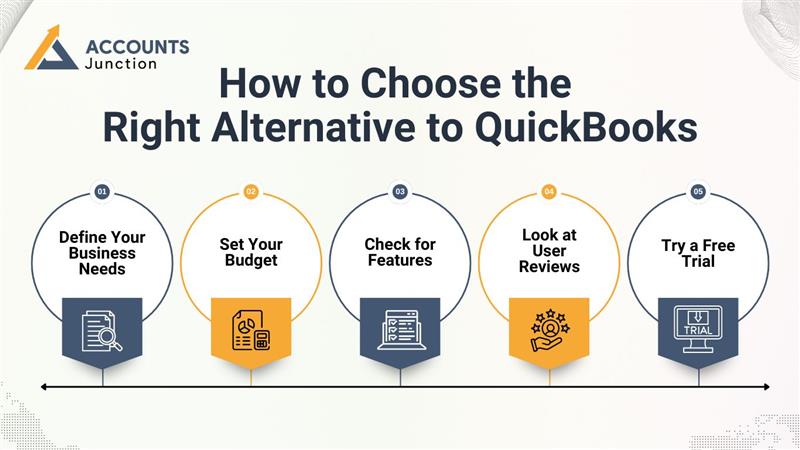

How to Choose the Right Alternative to QuickBooks

1. Define Your Business Needs

- Are you a freelancer or a small business?

- Do you need project tracking or just invoices?

- Cloud access or desktop-based?

2. Set Your Budget

- Free tools can do a lot.

- Paid plans offer more automation and support.

3. Check for Features

- Do you need time tracking?

- Do you want bank sync or payroll support?

- Does it offer tax compliance?

4. Look at User Reviews

- See what other users say.

- Focus on ease of use and customer support.

5. Try a Free Trial

- Most paid software offers trials.

- Try before you buy to ensure it fits.

Feature Comparison Table

|

Software |

Free/Paid |

Best For |

Key Features |

|

Wave |

Free |

Freelancers, small biz |

Invoicing, receipts, reports |

|

ZipBooks |

Both |

Small teams |

Invoicing, smart tagging |

|

Xero |

Paid |

Mid-sized businesses |

Real-time data, integrations |

|

FreshBooks |

Paid |

Service businesses |

Time tracking, invoicing |

|

Zoho Books |

Paid |

Growing businesses |

Project management, tax, integrations |

|

GnuCash |

Free |

Personal use |

Double-entry, reports |

|

Sage |

Paid |

Startups |

Invoicing, cash flow, mobile app |

|

Akaunting |

Free |

Global users |

Multi-currency, reports |

|

Kashoo |

Paid |

Small business owners |

Easy setup, flat pricing |

|

Manager.io |

Both |

All business sizes |

Tax support, reports, cloud & desktop |

Pros and Cons of Free Alternatives to QuickBooks

Pros:

- Free tools cost nothing, which helps new or small firms save money.

- They work well for solo owners, freelancers, or startups with low funds.

- Many free apps give key tools like invoicing, cost tracking, and basic reports.

Cons:

- Some free alternatives to QuickBooks may lack smart features or automation, which can slow you down.

- Support is often weak, with few help options when you face issues.

- They may not give full reports, payroll, or tax tools that big firms need.

Pros and Cons of Paid Alternatives to QuickBooks

Pros:

- Paid apps give more tools, smart features, and smooth use.

- They come with strong help and keep your data safe.

- These paid alternatives to QuickBooks work well with teams and bookkeepers, making tasks smooth.

Cons:

- You must pay each month or year, which adds to your cost.

- Some apps have extra tools you may not need or use.

When Should You Switch from QuickBooks?

1. When It Becomes Too Costly

- If the price of QuickBooks is more than what your business can afford, it may be time to look at other tools. High monthly or yearly fees can hurt your cash flow.

2. When Features Are Hard or Too Few

- You may find that QuickBooks has tools you don’t use or that it lacks what you need. If the setup feels too complex or too basic, a better match may be out there.

3. When You Want a Free or Local Option

- Some users prefer tools that are free or that work without the cloud. If that’s what you want, switching from QuickBooks makes sense.

4. When Your Accountant Recommends a Change

- If your bookkeeper or tax pro says another tool fits your needs better, it’s smart to take their advice. They may know software that will save you time and stress.

Industry Fit for QuickBooks Alternatives

For Freelancers and Creators:

- Need easy tools for bills and payments.

- Tools like Wave or FreshBooks work well.

For Shops and Online Stores:

- Need help with stock, sales tax, and orders.

- Zoho Books and Xero offer good options.

For Agencies and Teams:

- Need time tracking and project billing.

- Try tools like Harvest or FreshBooks.

For NGOs and Nonprofits:

- Need donor tracking and grant reports.

- Look for tools that offer clear reports and low fees.

For Startups:

- Need simple, low-cost tools with room to grow.

- Free plans or low-cost plans are best here.

Integration with Other Business Tools

A good accounting tool should work well with the tools you already use. This helps save time and avoid manual tasks. Let’s look at what to check when picking a tool that fits your business needs.

1. Bank Feeds and Auto Import

- Choose a tool that links with your bank account.

- This helps you auto-import and match your bank deals.

- You don’t need to type every expense by hand.

- Paid tools often support most big banks.

- Some free tools like Wave also offer bank feeds.

2. CRM Integration

- CRM means Customer Relationship Management.

- If you use a CRM, your accounting tool should connect with it.

- This helps you see client bills, payments, and project costs in one place.

- Zoho Books works great with Zoho CRM.

- FreshBooks can connect with HubSpot and other CRMs.

3. Payroll Tool Support

- Payroll tools help pay your staff and track wages.

- Some accounting tools are linked with payroll software.

- This helps you handle taxes, pay slips, and reports with ease.

- Xero has built-in payroll in some plans.

- QuickBooks and Zoho Books also offer payroll add-ons or links.

4. Payment Gateways

- You should be able to take payments online.

- Tools that link with Stripe, PayPal, or Razorpay are helpful.

- This makes it easy for clients to pay their bills.

- Many paid and free tools offer these links.

5. E-commerce and POS Systems

- If you run an online store, choose tools that work with Shopify or WooCommerce.

- For shops, it should link with POS (Point of Sale) systems.

- Zoho Books and Xero work with many store platforms.

- This helps track sales, tax, and stock in real time.

6. Project and Time Tracking Apps

- For service firms, time tracking is key.

- Your accounting tool should link with apps like Trello or Asana.

- This helps you track time spent and turn it into client bills.

- FreshBooks and Harvest are great for this.

7. Other Useful Apps

- Look for tools that work with Google Drive, Dropbox, or Slack.

- These links help you share files, send alerts, and stay in sync.

- Paid tools often have more app links.

- Free tools may offer only basic ones.

There are many alternatives to QuickBooks in the market. Some are free and simple, while others are rich in features and built for scale. Your choice depends on your needs, budget, and how you run your business.

Take time to test and compare tools. Start with a free version if unsure. Paid plans work best if you want full support and automation. At Accounts Junction, we help you in finding the best accounting tool for your business. We help with setup, data transfer, and linking other apps you use. With our support, switching from QuickBooks becomes smooth and stress-free.

FAQs

1. Are there any good free alternatives to QuickBooks?

- Yes, tools like Wave, ZipBooks, and Akaunting offer free plans.

2. Which paid tool is most like QuickBooks?

- Xero and Zoho Books are the closest in terms of features and usability.

3. Is Excel a good alternative to QuickBooks?

- Excel works for very simple needs, but lacks automation and reports.

4. Can I use QuickBooks alternatives for tax filing?

- Yes, most alternatives support tax features and reports.

5. Is Wave completely free?

- Yes, Wave is free for accounting and invoicing with no hidden charges.

6. Which alternative is best for freelancers?

- FreshBooks or Wave are great choices for freelancers.

7. What if I want to move data from QuickBooks?

- Most paid tools help you import data or offer migration support.