What Role Does a Sole Trader Accountant Play in Financial Planning?

As a sole trader you’re in charge of everything in a business. That includes from finding clients to delivering services, and managing your money. It can be exciting but also tough. Especially when it comes to finances. This is where a sole trader accountant becomes a valuable partner. Even if you are just starting out or have been in business. Working with someone who understands sole trader accounting can help you grow. It also helps save money, and feel more confident about your financial future.

In this blog, we’ll explain what sole trader accounting is, and how a sole trader accountant supports financial planning.

What Is Sole Trader Accounting?

Sole trader accounting refers to the process of keeping financial records for a business owned and run by one individual. If you’re a sole trader, there’s no legal difference between you and your business. It means you have income as personal income. Also the only one that is responsible for all debts, taxes, and records is you.

Because there’s no separation between personal and business finances. It's even more important to keep things organized. It involves tracking income, expenses, taxes, profits, and ensuring everything is reported correctly.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

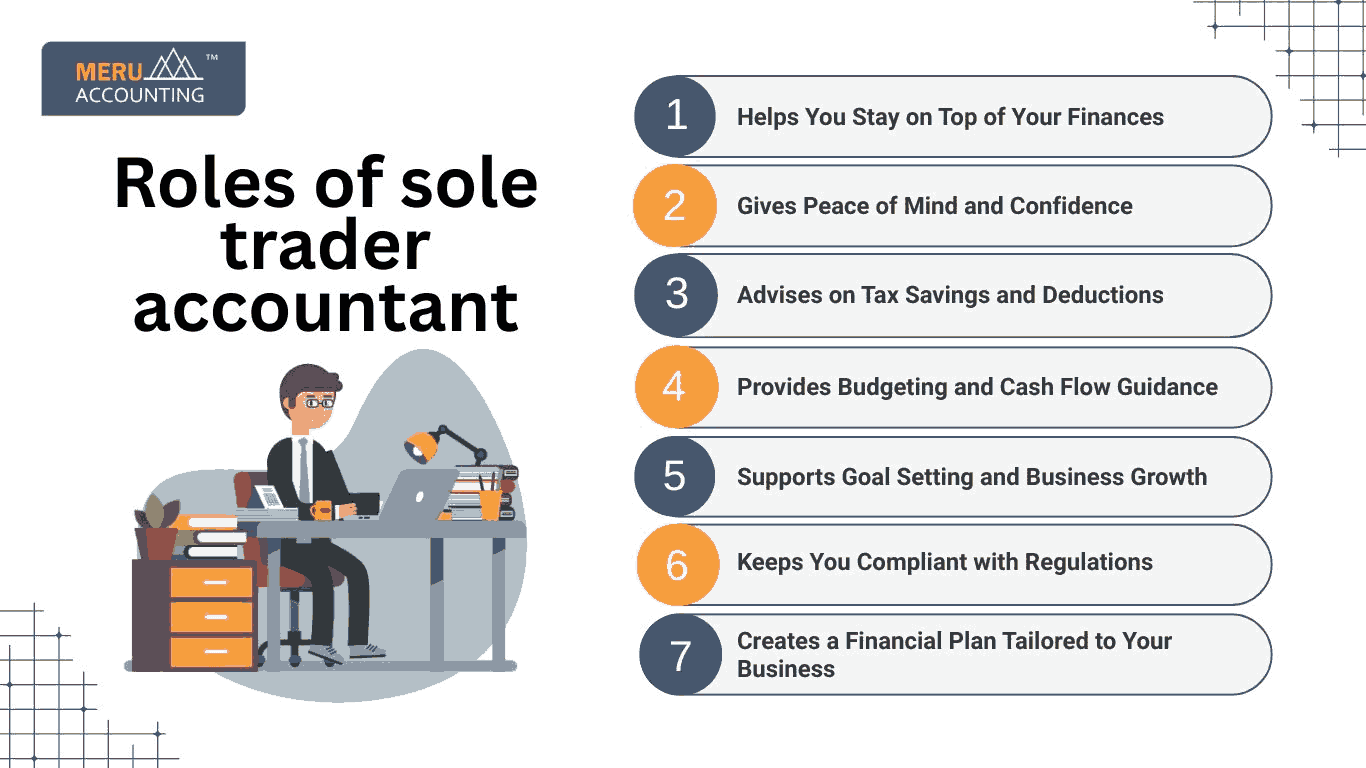

Roles of sole trader accountant

1. Helps You Stay on Top of Your Finances

- A sole trader accountant makes sure your books are in order. They record all your income and expenses. By making it easy to see how much you’re earning and spending. This is the first step in good financial planning.

2. Creates a Financial Plan Tailored to Your Business

- Every business is different. A sole trader accountant will look at your income, goals, and expenses and help you build a financial plan. This might include saving for tax bills, planning future investments, or deciding when to hire help.

3. Advises on Tax Savings and Deductions

- One of the biggest benefits of working with a sole trader accountant is understanding your tax responsibilities. They help you with the expenses to claim. And on how to reduce your tax bill and when to keep the money aside for taxes.

- This is a key part of sole trader accounting. By saving you money legally and helping you avoid penalties.

4. Provides Budgeting and Cash Flow Guidance

- Budgeting helps you avoid surprises. Your accountant will guide you in setting realistic budgets for different parts of your business. They also help with cash flow planning. That helps you always have enough money to pay bills and invest in your growth.

5. Supports Goal Setting and Business Growth

- A good accountant doesn’t just look at the past. They help you look forward. They’ll help you set clear financial goals. Increasing profits, buying new equipment, or expanding your services. Then, they’ll create a step-by-step financial plan to reach those goals.

6. Keeps You Compliant with Regulations

- Rules around taxes and business reporting can be confusing. A sole trader accountant makes sure you file your taxes on time and follow all rules. This gives you peace of mind and avoids fines.

7. Gives Peace of Mind and Confidence

- Finally, working with a sole trader accountant gives you the confidence to make better financial decisions. You’ll have someone on your side who knows the numbers and wants to see your business succeed.

Benefits of Hiring a Sole Trader Accountant

- Saves time: You can focus on your work . The accountant will handle the numbers.

- Improves accuracy: Avoid costly mistakes in tax returns and reporting.

- Boosts profits: Better planning often means better income management.

- Reduces stress: Knowing your finances are in expert hands is a huge relief.

- Assist you in future planning: Guide you to grow your business with a solid financial strategy.

Common Challenges Sole Traders Face in Financial Planning

1. Mixing Personal and Business Expenses

- Many sole traders use the same account for personal and business spending. This makes it hard to track your true business costs. It can also cause confusion during tax time.

2. Forgetting to Save for Taxes

- Since taxes aren’t taken out of your income. As you need to save for them yourself. If you forget to put money aside, you may be surprised by a big tax bill. This can lead to stress or even penalties.

3. Inconsistent Income

- Some months may be busy, and others may be quiet. This makes it harder to plan your spending and savings. It’s tough to stick to a budget when your income changes a lot.

4. Lack of Financial Knowledge

- Not everyone is confident about handling money matters. When you don't know what you can claim or how to manage taxes. This can lead to missed opportunities and mistakes.

Conclusion

Financial planning is the key step for the success of any company. Particularly for sole traders who do it all by themselves. A sole trader accountant is not a person who assists you at tax time. They're a long-term collaborator who assists you in managing money, creating goals, staying away from expensive errors, and developing a solid financial future.

Whether you're just beginning or you have experience. This method of sole trader bookkeeping will save you stress, money, and time.

If you need expert assistance in this field, Accounts Junction provides professional and trustworthy services specifically designed for the needs of sole traders. Our experts know the difficulties of operating business and are here to assist you at every step.

FAQs

1. Do I really need an accountant as a sole trader?

- Yes. They help you avoid mistakes that could cost you

2. What’s the difference between an accountant and a bookkeeper?

- A bookkeeper records daily transactions, while an accountant analyzes them, gives advice, and helps with planning.

3. Can a sole trader accountant help with business loans?

- Yes, they can prepare financial reports and forecasts. That are often needed when applying for a loan or credit.

4. How often should I meet with my accountant?

- Some sole traders meet quarterly, while others meet only during tax season. However, regular check-ins (even once a month) are helpful for planning and tracking goals.