How to set up Quickbooks online account

Managing business finances may feel overwhelming for many owners. QuickBooks Online may offer tools to simplify accounting tasks effectively. It may help track payments, record expenses, and create invoices easily. Learning how to set up QuickBooks Online may reduce errors and save time.

For new business owners, accounting may feel confusing and slow. QuickBooks Online may provide automation and real-time reports. It may also support collaboration with accountants or team members. Following a structured setup process may make implementation smooth and reliable.

Why QuickBooks Online May Be Useful

-

Access Anytime, Anywhere

QuickBooks Online may allow access from any device.

It may help manage accounts even when traveling or working remotely.

-

Automatic Updates

The system may update tax rates and software automatically.

It may reduce mistakes caused by outdated financial information.

-

Expense Tracking

Expenses may be tracked instantly after bank integration.

It may help identify unnecessary spending and save money efficiently.

-

Invoice Management

Invoices may be created, sent, and tracked within minutes.

It may also send reminders to customers for timely payments.

-

Reports and Insights

QuickBooks Online may generate real-time financial health reports.

It may allow easy evaluation of profits, expenses, and cash flow.

What You May Need Before Setup

-

Business Information

Legal name, address, and contact details may be required.

Providing accurate information may prevent future tax and compliance issues.

-

Bank Account Details

Bank accounts may need a connection for automated transaction tracking.

QuickBooks Online may update balances daily after linking accounts.

-

Financial Records

Previous invoices, receipts, and bills may be prepared.

These may help maintain accurate historical data for accounting.

-

Tax Information

Tax identification numbers may be required for proper filing.

Correct tax information may simplify compliance and reporting procedures.

-

Device and Internet

A reliable computer or tablet may be needed.

Stable internet may ensure smooth access to QuickBooks Online.

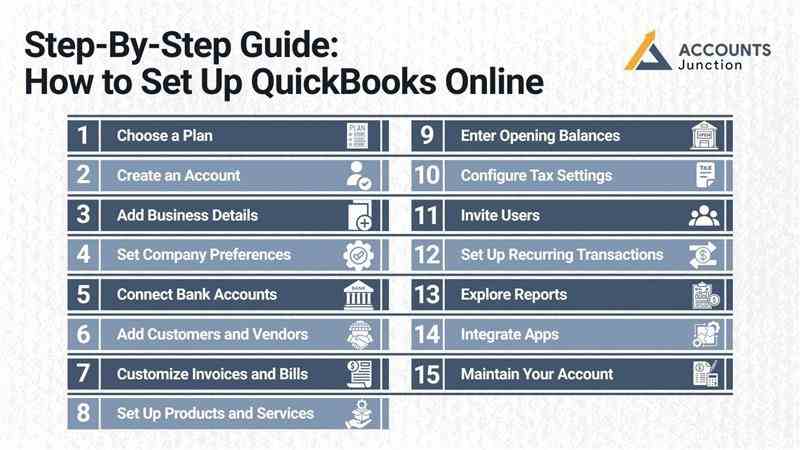

Step-By-Step Guide: How to Set Up QuickBooks Online

Step 1: Choose a Plan

Different plans may suit various business needs and sizes.

Choosing the right plan may prevent extra monthly expenses later.

- Simple Start: May work for freelancers and small businesses.

- Essentials: Supports multiple users and bill management efficiently.

- Plus: Handles larger teams and inventory tracking easily.

- Advanced: Designed for complex businesses needing analytics and reports.

Step 2: Create an Account

Visit the QuickBooks Online website and click Sign Up.

Your email and password may be entered to activate your account.

Step 3: Add Business Details

Enter legal name, type, and industry carefully.

It may help QuickBooks suggest templates and features suited for business.

Step 4: Set Company Preferences

Customize invoices, fiscal year, and accounting method.

Payment terms and tax defaults may also be configured.

Step 5: Connect Bank Accounts

Link bank accounts to import transactions automatically.

This may reduce manual errors and simplify reconciliation.

Step 6: Add Customers and Vendors

Enter client and supplier contact information accurately.

It may help streamline invoices, payments, and purchase tracking.

Step 7: Customize Invoices and Bills

Add logo, colors, and payment terms to invoices.

Customization may improve brand identity and payment efficiency.

Step 8: Set Up Products and Services

Add product details, prices, and tax information.

Inventory quantity may also be tracked to avoid stock issues.

Step 9: Enter Opening Balances

Enter bank balances and accounts receivable accurately.

It may help ensure reports are correct from the start.

Step 10: Configure Tax Settings

Set sales tax rates and assign tax agencies.

Review tax settings periodically to prevent compliance errors.

Step 11: Invite Users

Add team members or accountants with assigned roles.

User permissions may prevent unauthorized access to sensitive information.

Step 12: Set Up Recurring Transactions

Schedule invoices, bills, and payments for regular tasks.

Automation may save time and reduce missed payments.

Step 13: Explore Reports

Access profit, loss, and balance sheet reports easily.

Reports may help understand trends and financial performance quickly.

Step 14: Integrate Apps

Connect payment processors and CRM tools for efficiency.

Integration may reduce manual entry and improve workflow management.

Step 15: Maintain Your Account

Reconcile accounts, review overdue invoices, and monitor reports.

Regular maintenance may prevent errors and support accurate forecasting.

Quick Tips for Efficient Setup

- Keep login credentials secure and use strong passwords.

- Enable multi-factor authentication for added account protection.

- Backup financial data externally to prevent accidental loss.

- Train team members to reduce input errors consistently.

- Follow tutorials for proper navigation and usage techniques.

Common Mistakes to Avoid

- Ignoring the tax rate setup may cause filing problems.

- Failing to reconcile accounts may result in errors.

- Using default templates without customization may reduce professionalism.

- Skipping user permissions may compromise sensitive financial data.

- Omitting opening balances may distort reports and insights.

How to Import Data Into QuickBooks Online

-

Bank Transaction Imports

Bank transactions may be imported when learning how to set up QuickBooks Online.

-

Customer List Upload

Customer lists may be added, including emails, contacts, and addresses.

-

Vendor List Upload

Vendor data may be imported for managing bills and payments efficiently.

-

Products and Services Import

Products may include SKU, price, and relevant tax information accurately.

-

Entering Opening Balances

Entering opening balances may prevent mismatched reports when setting up QuickBooks Online.

-

Data Accuracy Check

Reviewing imported data may ensure reports are reliable and complete.

Setting Up User Roles and Permissions

-

Admin User Role

Admin users may access all features when setting up QuickBooks Online.

-

Accountant User Role

Accountants may access reports and prepare taxes without changing settings.

-

Standard User Role

Standard users may manage invoices, expenses, and daily transactions efficiently.

-

Time Tracking Role

Time tracking users may record hours for billing and payroll accurately.

-

User Permissions Importance

Assigning correct permissions may prevent unauthorized access or financial mistakes.

How to Set Up Bank Rules for Automation

-

Creating Bank Rules

Bank rules may automate the categorization of transactions when setting up QuickBooks Online.

-

Defining Conditions

Conditions may include payee name, amount, or transaction description.

-

Assigning Categories

Transactions may be assigned automatically to correct income or expense accounts.

-

Reviewing Transactions

Periodic review may ensure that rules categorize transactions accurately and correctly.

Using QuickBooks Online for Tax Preparation

-

Track Income and Expenses

QuickBooks may track income and expenses when setting up QuickBooks Online.

-

Generate Tax Reports

Reports may provide the required information for quarterly or annual filings.

-

Sales Tax Setup

Sales tax items may be set up to collect accurate taxes.

-

Accountant Collaboration

Sharing access with accountants may simplify tax preparation efficiently.

Tips for Integrating Payroll With QuickBooks Online

-

Payroll Setup

QuickBooks may manage salaries, deductions, and employee benefits efficiently.

-

Direct Deposit

Direct deposit setup may reduce manual work during payroll processing.

-

Automated Tax Filings

Federal and state tax filings may be automated using QuickBooks.

-

Payroll Reporting

Payroll reports may track employee costs, overtime, and labor efficiently.

How to Track Projects and Time in QuickBooks Online

-

Project Assignment

Projects may be assigned income and expense tracking when setting up QuickBooks Online.

-

Record Hours

Employee hours may be recorded accurately for billing and payroll purposes.

-

Link Expenses

Expenses may be linked directly to projects for cost tracking.

-

Project Profitability

Profitability reports may help evaluate performance and budget for projects.

Advanced Features to Explore in QuickBooks Online

-

Automated Invoice Reminders

Invoice reminders may reduce late payments when setting up QuickBooks Online.

-

Recurring Bills

Recurring bills may save time for routine monthly payments.

-

Custom Reports

Custom reports may track metrics specific to your business needs.

-

Audit Log

Audit logs may help monitor user actions for accountability purposes.

-

App Integrations

QuickBooks may integrate with CRM, Shopify, or other software tools.

Security Measures to Protect QuickBooks Online Account

-

Multi-Factor Authentication

Multi-factor authentication may prevent unauthorized access when setting up QuickBooks Online.

-

Strong Passwords

Passwords with letters, numbers, and symbols may increase account security.

-

Limit User Access

User access should be limited based on roles and responsibilities.

-

Backup Data

External backups may protect critical financial records from accidental loss.

-

Monitor Activity

Reviewing account activity may detect suspicious actions or errors promptly.

How to Troubleshoot Common QuickBooks Online Issues

-

Login Problems

Clearing the browser cache or resetting passwords may solve login issues quickly.

-

Bank Feed Errors

Verify credentials and reconnect accounts to fix bank feed problems.

-

Missing Transactions

Check date ranges and filters to locate missing transactions effectively.

-

Invoice Mistakes

Review templates and customer details to correct invoice errors immediately.

-

App Integration Issues

Reauthorize connected apps if data fails to sync correctly.

Best Practices for Maintaining QuickBooks Online

-

Monthly Reconciliation

Reconcile bank accounts monthly to detect discrepancies early when setting up QuickBooks Online.

-

Report Reviews

Regularly reviewing reports may help monitor financial trends accurately.

-

Archive Data

Old data may be archived, but essential backups should be maintained.

-

Update Settings

Update QuickBooks settings as your business grows or changes.

-

Employee Training

Training employees may reduce errors and improve system efficiency.

Learning how to set up QuickBooks Online may simplify business finances. A clear setup process may save time and reduce errors. Regular maintenance and user training may ensure system efficiency.

Accounts Junction may provide expert guidance for setting up QuickBooks Online. They may help manage accounts, reconcile banks, and optimize invoices. Their team may support small businesses with easy financial solutions. Using professional assistance may save time and improve accounting accuracy. Accounts Junction may also offer training and ongoing support for smooth operations.

FAQs

1. What is QuickBooks Online?

- QuickBooks Online may manage accounting and finance efficiently.

2. Why may businesses choose QuickBooks Online?

- It may simplify bookkeeping and automate routine financial tasks.

3. Can I try QuickBooks Online before purchase?

- Yes, free trials may allow full feature exploration.

4. How to set up QuickBooks Online quickly?

- Select plan, create account, connect banks, and configure settings.

5. Do I need accounting knowledge to use QuickBooks?

- Basic knowledge may help, but beginners can use it easily.

6. Can I import old accounting data into QuickBooks Online?

- Yes, QuickBooks may allow CSV or Excel file imports easily.

7. How do I add customers in QuickBooks Online?

- Go to Sales > Customers and enter contact information.

8. Is QuickBooks Online secure?

- Yes, it may use encryption and strong security protocols.

9. Can QuickBooks track inventory?

- Yes, certain plans may handle products and stock levels.

10. Can QuickBooks Online help with payroll management?

- Yes, payroll features may calculate salaries, taxes, and deductions automatically.

11. Can I integrate QuickBooks with other tools?

- Yes, CRM, payment processors, and project management tools may connect.

12. How to update tax rates in QuickBooks?

- Rates may update automatically, but review them periodically.

13. Can multiple users access QuickBooks Online?

- Yes, permission roles may control access and prevent errors.

14. Can QuickBooks handle multiple currencies?

- Yes, specific plans may allow multi-currency transactions easily.

15. Does QuickBooks support freelancers?

- Yes, it may manage invoices, expenses, and tax records effectively.

16. Can I export data from QuickBooks Online?

- Yes, reports may export to Excel or PDF for records.

17. How to contact QuickBooks support?

- Online chat, phone, or community forums may provide assistance.

18. How to correct mistakes in QuickBooks entries?

- You may edit transactions directly or create adjustment entries if needed.

19. Does QuickBooks Online support multiple businesses?

- Yes, separate accounts may be set up for each business entity.

20. Can I set up custom reports in QuickBooks Online?

- Yes, reports may be customized by date, customer, or transaction type.

21. Does QuickBooks Online support automatic bank reconciliation?

- It may suggest matches for transactions, but manual review is recommended.