Cost Considerations When You Decide to Hire Bookkeeper

Many small businesses face challenges in managing money on their own. Mistakes, late bills, and missed payments can slow growth. Choosing to hire bookkeeper can save time and reduce errors. A trained bookkeeper keeps all records clear and easy to read.

Costs for hiring vary depending on work type and skill. Extra fees may appear if not planned in advance. Understanding these costs first helps you plan smartly. This guide explains key cost points, hidden fees, and value.

Why Cost Matters When You Hire Bookkeeper

-

Get Records Right

Mistakes in books can cause losses very quickly. A bookkeeper keeps all records right each week.

-

Save Time

Managing books yourself takes many hours each week. Learn how to hire a bookkeeper to free up time for business growth.

-

Avoid Fines

Late payments or wrong reports may bring fines. Many hire bookkeeper services to meet all rules and deadlines.

-

Plan Your Budget

When you hire bookkeeper services, knowing the fees ahead helps control monthly spending.

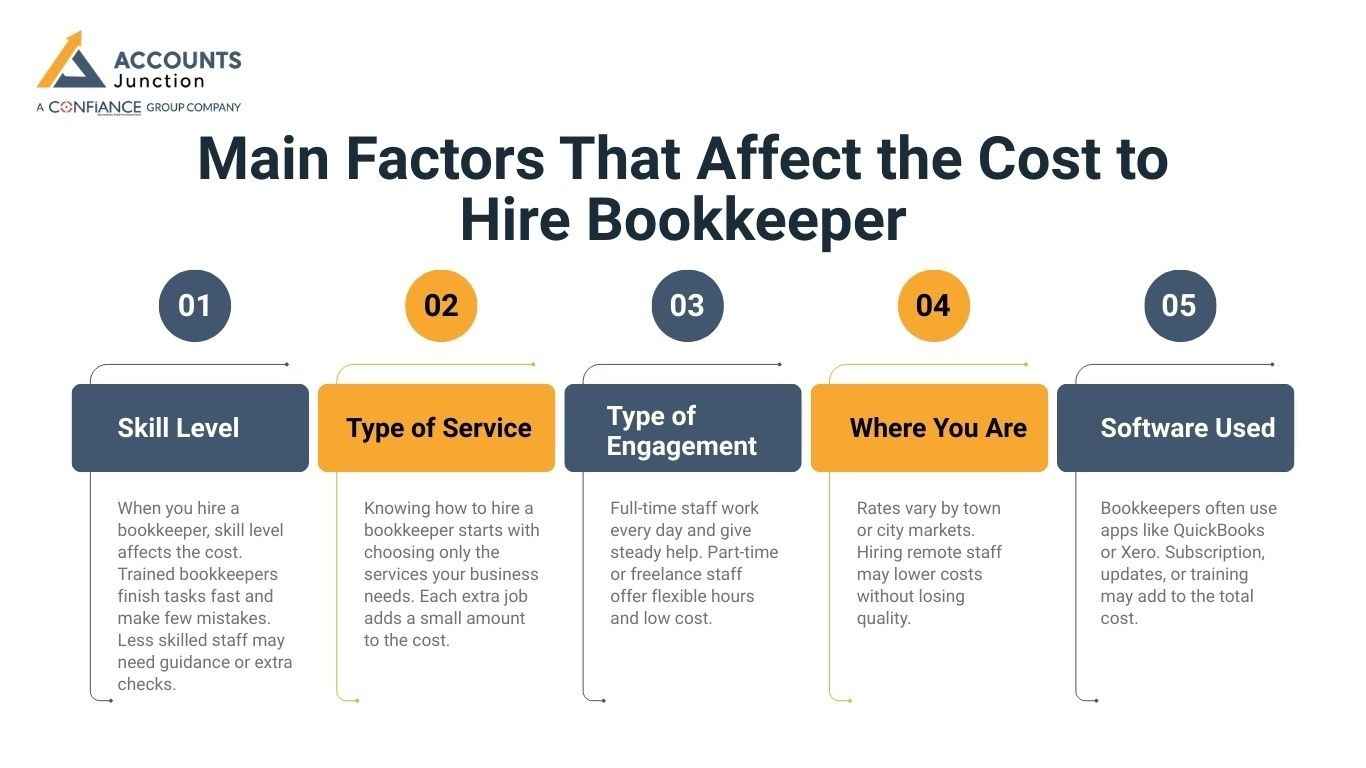

Main Factors That Affect the Cost to Hire Bookkeeper

-

Skill Level

When you hire a bookkeeper, skill level affects the cost. Trained bookkeepers finish tasks fast and make few mistakes. Less skilled staff may need guidance or extra checks.

-

Type of Service

Knowing how to hire a bookkeeper starts with choosing only the services your business needs. Each extra job adds a small amount to the cost.

-

Type of Engagement

Full-time staff work every day and give steady help. Part-time or freelance staff offer flexible hours and low cost. Accounting and bookkeeping companies give full packages with many services.

-

Where You Are

Rates vary by town or city markets. Hiring remote staff may lower costs without losing quality.

-

Software Used

Bookkeepers often use apps like QuickBooks or Xero. Subscription, updates, or training may add to the total cost.

Freelance vs Companies

-

Freelancers

Freelancers usually charge less for each hour. Understanding how to hire a bookkeeper helps you pick the right option for your needs. Backup support may be limited if someone is absent.

-

Companies

Companies offer full packages that cover many tasks. Many firms hire bookkeeper teams for speed and accuracy. Firms ensure steady help and follow rules for all jobs.

Comparing these options helps decide how to hire a bookkeeper. The right choice balances cost, skill, and support.

Hidden Costs to Consider When You Hire Bookkeeper

-

Training

Bookkeepers need time to learn your system. Early work may take longer or have small mistakes.

-

Software Fees

App subscriptions, updates, or training may add costs. Some providers include software as part of the fee.

-

Fixing Mistakes

Errors must be fixed, adding unexpected costs. Skilled bookkeepers make fewer errors and save time.

-

Fines

Late or wrong filings may bring fines. Professionals keep deadlines and follow all rules.

-

Time Spent on Talks

Talking with bookkeepers adds a hidden cost. Accounting and bookkeeping companies reduce this by handling tasks internally.

Steps to Hire Bookkeeper Without Overspending

-

List All Tasks

Write down all bookkeeping duties clearly. A clear list avoids extra costs or missed tasks.

-

Check Options

Look at freelancers, part-time staff, and companies. Compare cost and skill to find the best fit.

-

Check Feedback

Past client feedback shows reliability and trust. Reviews are key before you hire bookkeeper.

-

Check Price Plans

Hourly, monthly, or package fees affect the total cost. Choose a plan that fits your business.

-

Check Software

See what apps bookkeepers will use every day. Extra fees may apply if software is not included.

-

Think Long-Term

Good work saves money and avoids trouble later. Skilled bookkeepers reduce mistakes and help plan money.

Benefits of Hiring Accounting and Bookkeeping Companies

-

Team Help

Companies have trained teams for all tasks when you hire bookkeeper services. Teams finish work fast and make fewer mistakes.

-

Backup Staff

If someone is absent, work still goes on. Backup stops delays and keeps records updated.

-

Follow Rules

Companies follow all tax and money rules. This lowers the risk of fines or mistakes.

-

All Services Together

Payroll, reports, and bookkeeping are all included. Bundled service saves time and extra fees.

-

Save Money Later

Higher fees may save costs in the long run. Companies give steady service and help plan finances.

Tips to Control Costs When You Hire Bookkeeper

-

Clear Duties

Write exact duties to avoid extra work. Clear roles lower hidden costs and improve work quality.

-

Negotiate Fees

Ask for fixed prices or bundles when you hire bookkeeper services. Negotiation may reduce the total cost for bookkeeping.

-

Track Hours

Watch freelancers to make sure hours are right. Avoid paying for time not used.

-

Use Apps

Cloud apps cut mistakes and save time. They help manage money and reduce hidden costs.

-

Review Work

Check work monthly or each quarter. Reviews keep books right and tasks done well.

Choosing Between In-House and Outsourced Bookkeepers

-

In-House Staff

Hiring a bookkeeper in-house gives full daily control. You can check work and see each record. Payroll and benefits add extra cost for full-time staff.

-

Outsourced Bookkeepers

Outsourced bookkeepers work flexible hours at a lower cost. Many hire bookkeeper services only when needed. Accounting and bookkeeping companies provide trained staff for remote tasks.

Choosing between in-house and outsourced affects your monthly budget. Compare costs to find the best fit for needs.

Understanding Hourly Rates vs Fixed Fees Before You Hire Bookkeeper Services

-

Hourly Rates

Freelancers may charge by the hour when you hire bookkeeper. Hours can change each month based on work volume. Watch hours carefully to avoid high costs.

-

Fixed Fees

Some bookkeepers and companies offer set monthly fees. Packages may include many tasks for one cost. Fixed fees give more control over bookkeeping expenses.

Understanding fee types helps you plan money wisely. You can mix hourly and fixed work for the best results.

Impact of Business Size on Costs

-

Small Firms

Small firms should plan how to hire a bookkeeper for basic tasks first. Tracking bills and income may be enough at first. Freelancers can reduce costs in early business months.

-

Medium or Large Firms

Larger firms need payroll, reports, and taxes handled. Accounting and bookkeeping companies provide teams for multiple tasks. Extra staff ensures work is done on time and right.

Cost rises with firm size and task amount. Early planning prevents surprises in monthly or yearly budgets.

How Technology Affects Bookkeeping Costs

-

Cloud Tools

Cloud apps like QuickBooks or Xero save time and reduce mistakes. Less manual work lowers cost and improves record clarity.

-

Automation

Automated reports, invoices, and payment tracking help bookkeepers work fast. Combined with skilled staff, tasks get done on time.

-

Setup and Training

Setting up tools and teaching staff adds cost. Long-term savings from fast, correct work outweigh start-up fees.

Using the right tools helps when you hire bookkeeper services and want to control costs.

Evaluating the Return on Investment (ROI)

-

Time Saved

Hiring a bookkeeper frees hours for core work. More time spent on growth can increase revenue over months.

-

Fewer Mistakes

Right records reduce fines, lost payments, or wrong reports. Every saved mistake is real money saved for the shop.

-

Better Planning

Clear reports explain how to hire a bookkeeper that fits future plans. The right data helps you make smart, safe money choices.

Spending on a bookkeeper often pays off quickly. ROI can outweigh monthly service fees easily.

Seasonal and Part-Time Bookkeeping Needs

-

Busy Times

Firms need more support during busy months. Temporary or part-time bookkeepers handle extra work without high cost.

-

Flexible Work

Freelancers or accounting and bookkeeping companies offer short-term or contract work. Paying only for actual hours keeps costs low.

-

Year-End Work

Extra work, like tax filings, may need help. Planning for busy months avoids surprise charges.

Flexible options help manage cost without paying year-round for extra help.

Benefits of Early Cost Planning

-

Hidden Fees

Know the cost for tools, training, and extra tasks. Early planning avoids surprise bills later.

-

Better Deals

Understanding cost helps you ask for fair rates. Clear tasks lead to lower monthly bills.

-

Smooth Hiring

Pre-planned budget makes hiring faster and easier. You can quickly decide how to hire a bookkeeper.

Planning ahead reduces stress and keeps money under control.

Deciding to hire bookkeeper keeps all records right and easy. Freelancers give flexible help but may lack full support. Accounting and bookkeeping companies give trained teams, packages, and steady work. Hidden fees like software or mistake fixing must be planned.

Accounts Junction offers expert accounting and bookkeeping for all business types. Their team keeps records right and follows rules. Services are tailored to each business's needs. Working with Accounts Junction saves time and reduces stress. Businesses can trust that their money is handled well and safely.

FAQs

1. How much does it cost to hire a bookkeeper?

- The cost to hire a bookkeeper depends on the work. Rates change by place, skill, and type of service.

2. Should small businesses hire a bookkeeper full-time or part-time?

- Small firms can hire a bookkeeper part-time or freelance. This gives more space as the business grows or shifts.

3. How can I find a skilled bookkeeper?

- Compare freelancers and firms to find a skilled bookkeeper. Check reviews, past work, and valid certifications.

4. Do bookkeeping software fees affect the cost?

- Yes, tools, updates, or training can add to the cost. The right software can save time and cut errors.

5. Can companies cut hidden bookkeeping costs?

- Yes, trained bookkeepers make fewer mistakes and follow rules. Clear checks and rules help lower extra costs.