Outsourcing vs In-house Bookkeeping for Attorneys: Pros and Cons

Bookkeeping for attorneys is key to keeping a firm's money clear. It helps track client funds, income, and bills each day. Errors can cost time, money, and trust in your firm. Many firms must choose between in-house staff and outside help.

Both options can support legal financial management in a firm. In-house teams give control and keep data private. Hiring outside help gives skill, speed, and cost savings. The right choice depends on firm size, staff, and cash. Smart choice keeps records clear and work smooth.

Understanding the Role of Bookkeeping for Attorneys

Bookkeeping for attorneys means keeping all firm and client money clear and correct. It includes tracking client funds, bills, income, and daily entries each day. Proper bookkeeping helps lawyers see how money moves, check client payments, and make sure invoices are right. It also logs all costs and receipts, cuts mistakes, and gets the firm ready for checks or reports.

Good bookkeeping is key to legal financial management and smart planning. It helps plan budgets, keep costs low, and know which cases earn money or need more work. Clear books build client trust, cut disputes, and keep the firm within rules. Using simple and clear bookkeeping also helps both in-house staff and outside teams, making reports, data access, and safe storage easy for the firm each day.

Pros and Cons of In-house Bookkeeping for Law Firms

-

Control Over Money

In-house staff lets you keep full control of all funds in bookkeeping for attorneys. You can check records daily and fix mistakes fast.

-

Faster Internal Response

Staff in the office can solve problems right away, which helps smooth legal and financial management. Urgent issues do not wait, and keep the work smooth.

-

Knowledge of the Firm

Staff know firm routines and client needs well. They can follow your ways and reduce simple mistakes.

-

Data Privacy

Client money and firm data stay inside the firm. Private details are not shared with outside people.

-

Higher Personnel and Operational Costs

In-house teams need pay, benefits, and some training. Software, space, and systems add more yearly cost.

-

Limitations in Expertise

Staff may lack full skill in rules and updates. Extra training or advice may be needed sometimes.

-

Heavy Workload During Peak Times

Busy days can overload staff and raise error risk in legal financial management tasks. Extra help or overtime may be needed during peaks.

-

Technology and System Requirements

Staff must run software and keep it up to date. Backups and security need care and cost some money.

Pros and Cons of Hiring Outside Bookkeeping Support

-

Cost Savings

Hiring outside help can cost less than full-time staff. You only pay for work done, not fixed salaries.

-

Access to Broader Expertise

Outside experts know the rules and trust account handling. They bring skills your in-house team may not have.

-

Improved Time Management

Outsourcing lets attorneys focus on client work better. Daily records, reports, and checks are done by experts.

-

Advanced Tools and Systems

Experts use secure tools to track and report funds. Automation helps cut errors in bookkeeping for attorneys and saves time each day.

-

Need for Clear Communication

Attorneys may not see all entries at once, which may slow legal financial management. Urgent changes may require a call to the service.

-

Communication Needs

Clear rules are needed for updates and work checks. Missed messages may slow work or cause small mistakes.

-

Potential Data Exposure

Data leaves the firm when outside help is used. Trusted providers lower risk and keep client money safe.

-

Dependency on External Providers

The firm depends on providers for correct records. Errors may need audits or extra review by staff.

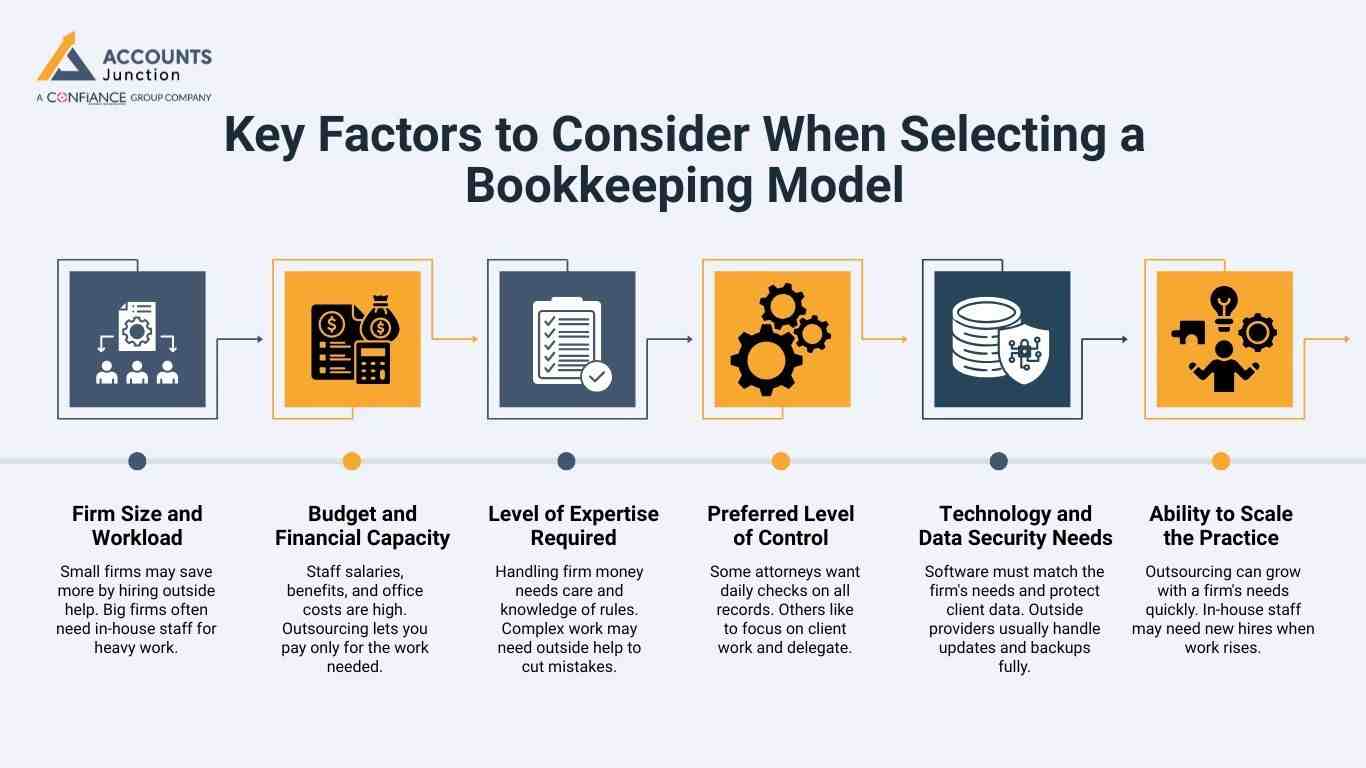

Key Factors to Consider When Selecting a Bookkeeping Model

-

Firm Size and Workload

Small firms may save more by hiring outside help. Big firms often need in-house staff for heavy work.

-

Budget and Financial Capacity

Staff salaries, benefits, and office costs are high. Outsourcing lets you pay only for the work needed.

-

Level of Expertise Required

Handling firm money needs care and knowledge of rules. Complex work may need outside help to cut mistakes.

-

Preferred Level of Control

Some attorneys want daily checks on all records. Others like to focus on client work and delegate.

-

Technology and Data Security Needs

Software must match the firm's needs and protect client data. Outside providers usually handle updates and backups fully.

-

Ability to Scale the Practice

Outsourcing can grow with a firm's needs quickly. In-house staff may need new hires when work rises.

Cost Comparison Between In-house and Outsourced Bookkeeping

-

Expenses Related to Internal Teams

Staff salaries, benefits, and office space cost a lot. Software, systems, and training add more yearly expenses.

-

Costs Associated With Outsourced Providers

Experts charge by task or hour worked in the firm. Software and tools are often included without extra fees.

-

Efficiency vs Cost

Small firms save more using outside help than full-time staff. Big firms may gain from in-house control despite the higher cost.

Impact of Bookkeeping on Legal Financial Management

-

Accuracy of Financial Records

Good bookkeeping for attorneys keeps client money and firm funds correct. Mistakes can cause fines or loss of client trust.

-

Compliance With Legal Standards

Firms must follow strict rules for trust and firm money. Both in-house and outside help need checks to comply.

-

Quality of Financial Reporting

Clear records make timely reports and tracking easy. Reports help plan costs, cash flow, and staff needs.

-

Improved Use of Attorney Time

Good bookkeeping saves staff time and reduces stress. Attorneys can spend more time on clients and cases.

Workflow and Efficiency in Different Bookkeeping Models

-

Internal Workflow Processes

Staff follow clear daily steps to keep records right. Immediate requests or fixes are done without delay.

-

External Workflow Processes

Experts use strong systems and clear steps for work. Work is steady but may need scheduled updates for urgent needs.

-

Comparison of Both Approaches

Both need clear rules to cut mistakes and slowdowns. Structured steps make work faster and reduce errors.

Technology Use in Law Firm Bookkeeping

-

Software and Tools Managed Internally

Staff must keep software, run updates, and secure data for smooth bookkeeping for attorneys. Custom settings help match software to firm routines.

-

Technology Managed by Outsourced Providers

Providers handle updates and keep data safe automatically. Cloud tools give fast access and quick reporting.

-

Overall Benefits of Modern Systems

Good tools boost the speed and accuracy of records in legal financial management. They also protect client and firm money data well.

Understanding Potential Risks and Compliance Issues

-

Risks Linked to Internal Teams

Staff may miss rules or make small errors in core bookkeeping for attorneys work. Regular checks are needed to avoid fines or issues.

-

Risks Linked to Outsourced Teams

Errors may happen if providers delay work or misread rules. Contracts and reviews reduce the chances of major mistakes.

-

Ways to Minimize Bookkeeping Risks

Audits and checks keep records right all the time. Following rules builds client trust and keeps funds safe.

Hybrid Bookkeeping: A Combined Approach

Hybrid bookkeeping uses both staff and outside experts together. It gives control, skill, and cost savings for firms.

-

Routine Work by Staff

Staff handles daily entries and small tasks efficiently. This lowers reliance on outside help for simple work.

-

Tasks Managed Externally

Outside teams handle reports, audits, and rule checks. They make sure records follow legal financial management guidelines.

-

Benefits of Hybrid Systems

Hybrid setups cut mistakes and save the firm money in bookkeeping for attorneys. Client money is safe, and all records stay correct.

How to Choose the Most Suitable Bookkeeping Approach

-

Evaluate Current Workload

Look at how many entries and tasks you have. High volume may require in-house or hybrid support.

-

Assess the Expertise Available

Staff or providers must know bookkeeping for attorneys well. Experience keeps trust funds and records correct at all times.

-

Compare Total Costs

Look at long-term costs for staff vs outside help. Include office, software, and training in the check.

-

Review Technology Requirements

Software must fit the firm's needs and keep client data safe. Good tools make records faster, clearer, and safer.

-

Ensure Data Privacy Standards

Client money and data must stay safe at all times. Use trusted providers or strong in-house safeguards.

-

Start With a Trial Run

Try outside help for a few tasks first. Test quality and reliability before adding more work.

-

Commit to Regular Audits

Check books regularly to cut mistakes and follow rules. Both in-house and outside help need frequent audits.

Bookkeeping for attorneys is key to smooth legal financial management. Clear records help track money, build trust, and plan for costs. In-house staff gives control, privacy, and fast fixes. Outside experts bring skill, speed, and low cost.

Hybrid setups often give the best results for many firms. Accounts Junction helps law firms with bookkeeping for attorneys, keeping records clear, handling client funds, and guiding them on rules. Our service saves time, lowers mistakes, and improves legal financial management. Firms can rely on Accounts Junction for reports, audits, and guidance every day. We ensure records are correct and support steady growth.

FAQs

1. What is bookkeeping for attorneys?

- It tracks all firm money and client funds clearly.

2. Is outside help safe for law firms?

- Yes, if privacy and safety rules are fully followed.

3. Can in-house teams handle high workloads?

- Yes, but extra staff or overtime may sometimes be needed.

4. Does outside help reduce mistakes?

- Yes, experts follow rules and keep records correct.

5. Which is cheaper for small firms?

- Outside help saves money on staff, office, and tools.

6. Can hybrid bookkeeping work for law firms?

- Yes, it mixes control, cost savings, and expert help.