5 Signs It’s Time to Hire a Bookkeeper

Many small business owners often ask, Do I need a bookkeeper. At first, handling invoices, bills, and payroll may feel simple. But knowing when to hire a bookkeeper can save time and stress. Over time, errors rise, tasks pile up, and stress grows. Knowing the signs early helps prevent financial mistakes. A skilled bookkeeper brings order, calm, and clear money tracking. A skilled bookkeeper brings order, calm, and clear money tracking. Knowing when to hire a bookkeeper ensures your finances stay organized. This blog shows five signs it may be time to hire a top bookkeeper.

Running a business means managing many tasks each day. Handling client work, bills, and daily payments can feel heavy. Small mistakes in records can quickly become bigger problems. Lost receipts, late payments, or unclear reports often cause stress. A professional bookkeeper handles these tasks with skill and care. This support gives owners more time to focus on business growth.

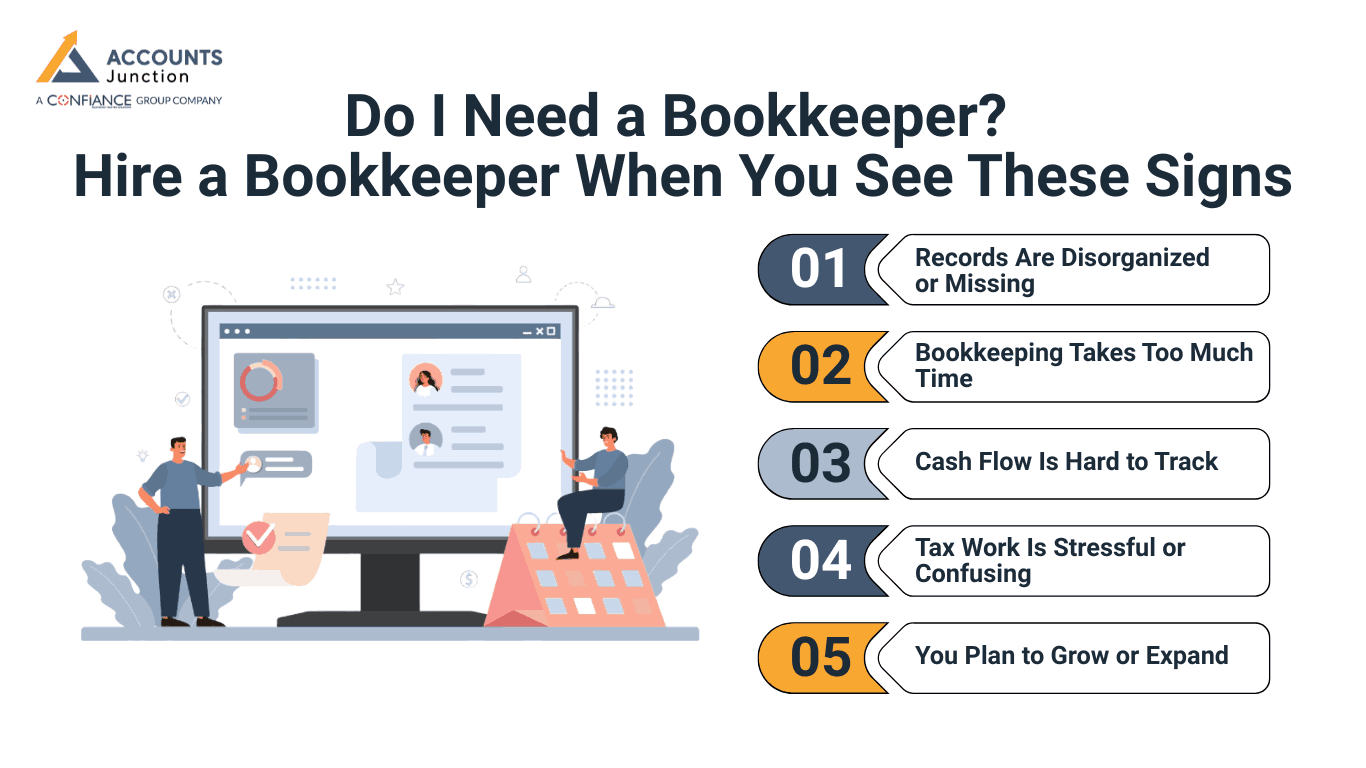

Do I Need a Bookkeeper? Hire a Bookkeeper When You See These Signs

When you wonder, Do I need a bookkeeper, there are clear warning signs. Recognizing these helps you decide when to hire a bookkeeper. Daily bookkeeping may start simple, but quickly becomes complex. Tracking expenses, payments, and invoices may feel like a full-time job. Ignoring these signs can hurt your business. Knowing when to hire a professional is a smart step.

Sign 1 – Records Are Disorganized or Missing

- Receipts and bills are hard to locate quickly.

- Spreadsheets often have missing or wrong data.

- Bank statements do not match expense logs.

- Reports take long hours to reconcile each month.

- Tracking payments manually leads to repeated mistakes. This is another reason to hire a bookkeeper.

Disorganized records are more than annoying. They make decisions hard. A professional bookkeeper can fix records and bring order fast. Clear logs prevent costly errors and confusion.

Sign 2 – Bookkeeping Takes Too Much Time

- Accounting tasks consume most of your daily hours.

- Invoices, bills, and payroll take away focus.

- Daily business tasks may fall behind or wait. This is a strong sign to hire a bookkeeper to handle day-to-day accounting.

- Important deadlines get missed despite working overtime.

- Stress rises as numbers do not match reports.

Time lost on bookkeeping is time lost for growth. If you ask, ‘Do I need a bookkeeper?’ the answer may be yes. Hiring a top bookkeeper lets you focus on key work.

Sign 3 – Cash Flow Is Hard to Track

- Payments arrive late and affect spending plans.

- Forecasting is tricky without clear income records.

- Running out of cash surprises business owners often.

- Vendors or staff may get paid late sometimes.

- Emergency funds seem low and hard to plan. A top solution is to hire a bookkeeper who keeps cash flow clear.

Cash flow is the key part of a small business. A skilled bookkeeper ensures money flows smoothly every month.

Sign 4 – Tax Work Is Stressful or Confusing

- Filing taxes causes long hours of stress.

- Missed deadlines lead to fines or penalties.

- Deduction rules are confusing and hard to track.

- Preparing returns eats time from key tasks. Many business owners hire a bookkeeper to handle taxes efficiently.

- Year-end reconciliation takes more hours than expected.

If tax work feels stressful, it’s time to ask how to find a bookkeeper. They reduce errors and meet deadlines easily.

Sign 5 – You Plan to Grow or Expand

- Scaling requires clear records and smart forecasts.

- Profit margins must be tracked for future plans.

- Banks and investors need clean, clear records.

- More staff or stores mean complex finances quickly.

- Mistakes at the growth stage may cost much later.

A skilled bookkeeper supports growth with clean books and advice. Early on, it’s smart to hire a bookkeeper to manage finances as your business expands.

How to Find a Bookkeeper That Fits Your Business

Knowing how to find a bookkeeper matters more than picking someone fast. Not all bookkeepers work the same way. Choosing the right one saves time, avoids mistakes, and improves clarity. Here are the steps to hire someone who suits your business needs.

Look for Experience and Skill

- When deciding how to find a bookkeeper, choose one with experience in your field.

- Certification or training shows knowledge and skill.

- When you hire a bookkeeper, skilled professionals reduce errors quickly, saving time and stress.

- They handle payroll, invoices, and reports well.

- Proven experience is a key factor when you want to hire a bookkeeper you can trust long-term.

Experience matters for accuracy and smooth daily work.

Check Tools and Software Knowledge

- Good bookkeepers know modern tools and apps. If you wonder, ‘do I need a bookkeeper?’, this skill ensures fast, reliable work.

- Cloud software makes reporting and tracking simple.

- When you hire a bookkeeper, check that they use automation tools to reduce errors and save hours each day.

- Digital systems let you check records anytime.

- Proper software use improves speed and reliability.

Ask for References or Reviews

- When you hire a bookkeeper, past client feedback shows their real-world performance.

- Positive reviews suggest trust and good service.

- Direct references give honest opinions about work.

- Communication and reliability matter as much as skill.

- References are essential when learning how to find a bookkeeper who suits your needs.

Clarify Scope of Work and Fees

- Discuss what tasks are included in the service.

- Fees may vary by workload and complexity.

- When you hire a bookkeeper, clear pricing avoids surprises and ensures smooth work.

- Before you hire a bookkeeper, decide whether services are needed monthly, quarterly, or yearly.

- Transparent agreements ensure smooth, long-term relationships.

Communication and Support Are Important

- Regular updates help track your business health.

- Clear reports help plan future actions effectively.

- Fast responses reduce stress and confusion for owners.

- Support includes advice on simple financial choices.

- Good bookkeepers become trusted partners for decisions.

Benefits of Hiring a Top Bookkeeper

Hiring a top bookkeeper brings many advantages. They do more than log numbers. They bring clarity, save time, reduce errors, and help with growth.

Clean and Accurate Financial Records

- Every transaction is logged clearly and on time.

- Reports show the true state of business finances.

- Organized logs save hours each month easily.

- Errors are spotted and fixed quickly by an expert.

- Proper records support audits or bank checks smoothly.

Smarter Business Decisions

- Data-driven insight helps owners make clear choices.

- Forecasting is easy with correct financial records.

- Cash flow analysis guides better spending and saving.

- Budgeting becomes simple with clear, accurate reports.

- Avoids errors from unclear or scattered records often.

Stress-Free Tax Work

- Tax preparation is easier and less stressful now.

- Deadlines are met without last-minute rushes often.

- Deductions are tracked to maximize savings legally.

- Avoid fines or penalties with professional work.

- Keeps your business in good standing always.

Time and Stress Reduction

- Focus shifts back to key business activities. Owners who hire a bookkeeper often regain hours and peace of mind.

- Daily books get done fast, so you save your time.

- Less work stress helps you focus and do more each day.

- Clear money logs help you make smart moves every day.

- Calm comes from books that are neat and have no errors.

Support for Long-Term Growth

- An expanding business runs smoothly with clean financials.

- Investors trust well-kept and accurate records easily.

- Scaling decisions rely on proper money tracking.

- Mistakes at the growth stage are avoided entirely.

- Hiring early sets your business up for future success.

Common Mistakes Businesses Make Without a Bookkeeper

Many small business owners try to handle money themselves. If you ask, ‘Do I need a bookkeeper?’ repeated errors are a key sign that it’s time to hire a bookkeeper.

Ignoring Small Errors Can Grow Problems

- Small errors can go unseen for weeks at times.

- Missing transactions may leave gaps in money records.

- Errors may cause bank statements to not match.

- Wrong records make tax work long and risky.

- A professional bookkeeper can fix errors before problems grow.

Overlooking Invoices and Receivables

- Late invoices often cause slow payments from clients.

- Missing payments can lower monthly cash flow fast.

- Follow-ups are missed without clear and simple records.

- Slow payments can hurt business growth over time.

- Proper tracking by a bookkeeper keeps income clear.

Mixing Personal and Business Finances

- Using personal accounts for business leads to mix-ups.

- Tracking costs becomes harder and is full of errors.

- Tax deductions can be lost with unclear records.

- Accounting tools work less well with mixed funds.

- A top bookkeeper keeps all business money separate.

How a Bookkeeper Improves Decision Making

Clear records help owners make better choices for their business.

Understanding Profit and Loss

- Clear records show which items or services earn money.

- Wrong data can hide losses or wasted costs.

- Trends show clearly when the data is right and simple.

- Owners can cut waste and spend smartly on growth.

- A skilled bookkeeper keeps reports clear and easy to read. Knowing how to find a bookkeeper ensures you pick someone who makes data simple to act on.

Planning for Expenses and Growth

- Knowing exact costs helps plan for new projects.

- Wrong cash estimates can hurt growth and plans.

- Expanding business needs clear and simple financial insight.

- Key choices need books that are right and clear.

- When you hire a bookkeeper, they help plan expenses and growth without guesswork or errors.

Setting Goals with Confidence

- When you hire a bookkeeper, clear data helps you set realistic goals and track progress easily.

- Owners can plan monthly or yearly growth steps.

- Tracking progress becomes simple and easy to see.

- Mistakes in books can mislead choices and focus.

- A top bookkeeper keeps numbers true and reliable.

Asking do I need a bookkeeper is wise for business owners. Signs like messy records, late payments, and tax stress show a need. Learning how to find a bookkeeper helps select someone skilled and reliable. A top bookkeeper gives clarity, saves time, reduces errors, and supports growth. Act early and secure calm, clean, and correct financial records today.

Accounts Junction provides accounting and bookkeeping for small and mid-size firms. We keep clear records, track daily money, and meet all rules. Our team has certified experts who do work with care and skill. With clear financial data, owners can run their business and grow with ease. Partner with us for clear, reliable, and precise bookkeeping services.

FAQs

1. How do I know I need a bookkeeper?

- Check if records are messy and errors happen often. If tasks take too long, a professional is needed.

2. How to find a bookkeeper for my business?

- Look for certified professionals with experience in your field. Ask for references to confirm reliability and past performance.

3. What tasks does a top bookkeeper handle?

- They manage invoices, payroll, taxes, and daily reports. They also track spending and provide financial insights.

4. Can a bookkeeper help with tax filing?

- Yes, they prepare returns correctly and meet deadlines. They also advise on deductions to reduce tax legally.

5. Will hiring a bookkeeper reduce stress?

- Yes, clear books save time and improve decision-making. Professional support frees time for core business activities.