Table of Contents

- 1 Introduction to PayPal Software

- 2 Several Alternatives to PayPal

- 3 Criteria to Consider Before Choosing the Option

- 4 Comparison Table of Alternatives to PayPal

- 5 How to Choose the Best Alternative to PayPal for Your Business

- 5.1 1. Fees

- 5.2 2. Transaction Speed

- 5.3 3. Currency Support

- 5.4 4. Ease of Use

- 5.5 5. Customer Support

- 5.5.1 Conclusion

- 5.5.2 FAQs

Alternatives to Paypal

When seeking alternatives to PayPal, many options are reputable and serve varied purposes. Among these, some are more convenient for businesses in terms of how they can implement their e-commerce operations. Some, like Stripe, offer high-end features including subscription billing, as well as global payment capabilities. Others are simple and capable of handling everything from online payments to in-person transactions, as is the case with Square. It also offers a global payment solution with its prepaid card for easy accessibility to funds. Finding the best online money transfer service is key for smooth business transactions. Many companies today are actively exploring alternatives to PayPal for business due to high fees or account limitations.

Introduction to PayPal Software

PayPal is an online payment service. It lets users send and get money safely. They can shop online, move money from bank accounts or cards, and pay fast. PayPal is popular for e-commerce, freelancing, and peer-to-peer transfers. It offers a simpler and safer option than regular banking. Key features include buyer protection, fraud checks, and fast transfers. Looking into the best online money transfer options can help users find what fits their needs best.

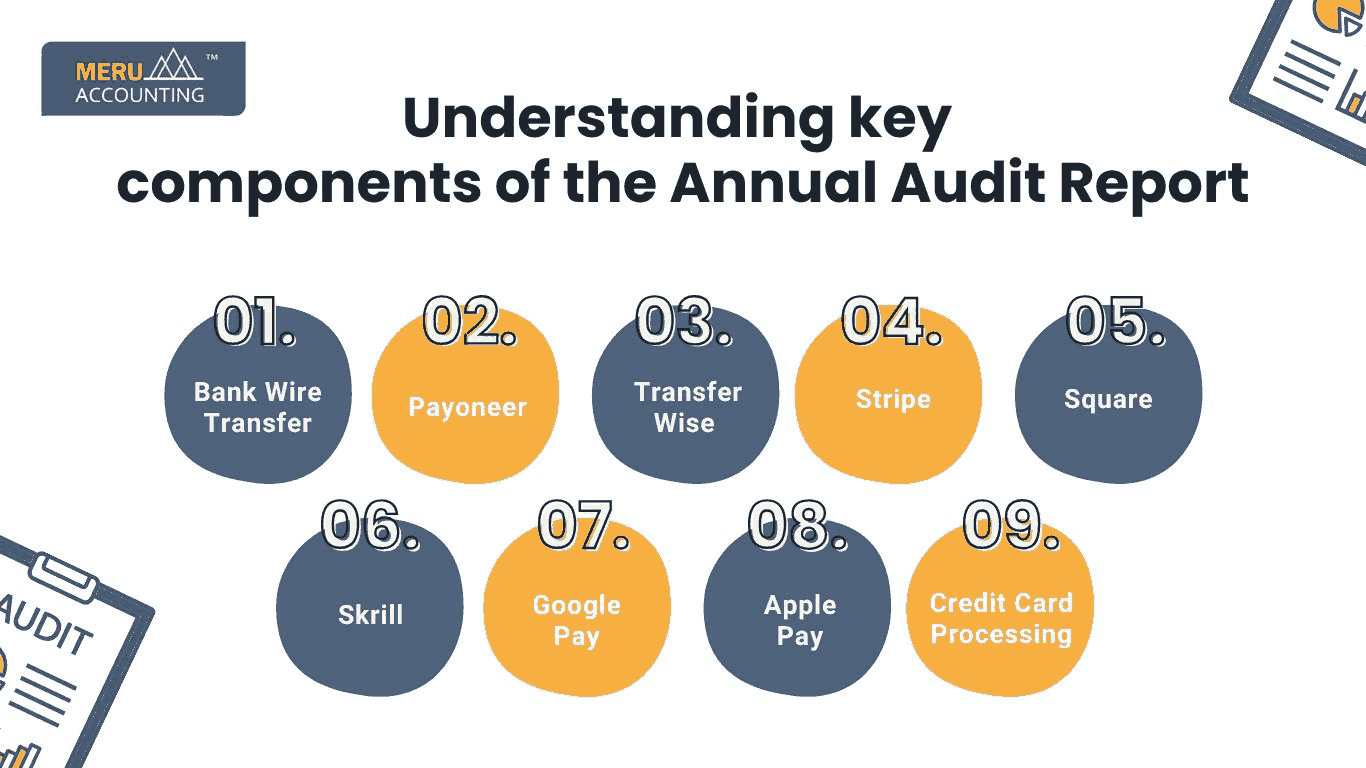

Several Alternatives to PayPal

When considering alternatives to PayPal, it's essential to evaluate platforms that cater to both personal and business needs. Choosing the best online money transfer method can help improve your cash flow and global reach. Reliable alternatives to PayPal for business like Wise, Payoneer, and Stripe are gaining trust worldwide. Here are some notable options:

- Bank Wire Transfer: Using your bank’s online facility for safe, reliable transactions with record recovery.

- Payoneer: It is also a financial service provider like PayPal for online transfers. It also provides an e-wallet and card facility, which can be used by customers anytime, anywhere. Best for freelancers and small businesses, offering global transactions with no fees on certain international payments.

- TransferWise (Wise): Wise is great for sending money abroad. It uses real exchange rates and charges low fees. That makes it a top pick for freelancers, businesses, and expats.

- Stripe: Best for e-commerce businesses, supporting multiple payment methods, subscription billing, and high-level reporting. It is a top choice among alternatives to PayPal for business due to its developer-friendly features.

- Square: Best for small businesses. It offers payment processing, invoicing, point-of-sale tools, and easy e-commerce setup. The prepaid card gives quick access to funds. This makes it a smart and flexible choice for online money transfer.

- Skrill: Great for online payments. It gives low-cost transfers worldwide and comes with a prepaid card for easy use.

- Google Pay: Best for mobile payments, allowing users to pay for purchases, services, and bills directly from their smartphones. Businesses looking for mobile-centric alternatives to PayPal for business can consider Google Pay for its wide user adoption.

- Apple Pay: Best for iOS users. It allows secure payments online and in stores using Face ID or Touch ID.

- Credit Card Processing: Use credit cards like Visa and MasterCard for direct payments. You can also link them with money transfer apps.

When looking for PayPal alternatives for your business, check how each platform fits your invoicing tools, customer needs, and global payouts.

Criteria to Consider Before Choosing the Option

There are multiple digital fund transfer options available online. The dilemma is to choose which one? Selecting the right online money transfer service involves assessing various factors:

- Fees Charged: Some applications charge a convenience fee. Check and compare before using.

- Trustworthiness: Research the company, read customer reviews, and ensure reliability.

- Time Involved in Generating Receipts: Most applications generate receipts immediately and show transfer status.

- Popularity: Widely accepted applications offer excellent services and easy accessibility.

- Friendly Customer Support: Ensure responsive support for issues like internet failures or transaction errors.

Comparison Table of Alternatives to PayPal

When evaluating PayPal alternatives, it's essential to compare them based on various factors. Below are the key points to consider, including an additional criterion for a well-rounded decision:

|

Platform |

Transaction Fees |

Availability |

Security Features |

Ease of Use |

Transaction Speed |

E-commerce Integration |

Customer Support |

Cryptocurrency Support |

|

Payoneer |

1%–3% |

200+ countries |

PCI DSS compliant |

User-friendly |

1–2 days |

Yes |

24/7 support |

No |

|

Wise |

0.35%–3% |

50+ currencies |

Two-factor auth |

Intuitive |

Instant to 2 days |

Limited |

Email support |

No |

|

Stripe |

2.9% + $0.30 |

Global |

PCI Level 1 |

Developer-friendly |

2–3 days |

Extensive |

24/7 support |

Yes |

|

Square |

2.6% + $0.10 |

US, Canada, etc. |

End-to-end encryption |

Simple setup |

Next day |

Yes |

Phone & email |

No |

|

Skrill |

1.45%–3.99% |

120+ countries |

Anti-fraud tools |

Easy to use |

Instant |

Yes |

24/7 support |

Yes |

|

Google Pay |

Varies |

Select countries |

Tokenization |

Seamless |

Instant |

Yes |

Online help center |

No |

|

Apple Pay |

Varies |

Select countries |

Biometric auth |

Seamless |

Instant |

Yes |

Online support |

No |

How to Choose the Best Alternative to PayPal for Your Business

When selecting the best online money transfer solution, there are a few key factors to consider:

1. Fees

Each platform charges different fees. Compare the cost to send and receive money, especially for transfers across countries.

2. Transaction Speed

Some payment processors offer instant transfers. Others may take a few business days. If speed matters to your business, choose platforms with instant or same-day transfers.

3. Currency Support

If you work with international customers, pick a platform that supports multiple currencies. It should also offer good exchange rates.

4. Ease of Use

Pick platforms that are easy to link with your website or sales system. A simple setup helps both you and your customers.

5. Customer Support

Good customer service can make or break a relationship. Pick a platform with strong support for any issues you may face.

Conclusion

Choose an online money transfer service by checking key points like fees, reliability, transfer time, popularity, and support. These help you make a smart, safe, and low-cost choice. PayPal is still a top option, but many alternatives to PayPal offer useful features for different needs.

To keep your records clear and up to date, contact Accounts Junction. We provide trusted accounting and bookkeeping services. Our team helps you track each transaction with ease.

FAQs

1. What is the best online alternative to PayPal for an online business?

Stripe is ideal for e-commerce. It offers multiple payment options and subscription billing.

2. How do I select a suitable payment service?

Before choosing a provider, consider fees, security, global support, and ease of use.

3. How can I secure my online transactions?

Pick platforms with strong security. Make sure they have encryption, two-factor authentication, and fraud detection.

4. What service would I best use for international transfers?

Wise (formerly TransferWise) offers low fees. It also provides fair exchange rates for global payments.

5. How can Accounts Junction help businesses using multiple platforms?

Accounts Junction tracks payments from different platforms. It helps reconcile them for accurate financial records.

6. Which platform is most scalable as an alternative to PayPal for business?

Stripe and Payoneer are considered scalable alternatives to PayPal for business, offering APIs, international payouts, and enterprise-level support.