Alternatives to Paypal

When seeking alternatives to PayPal, many options are reputable and serve varied purposes. Among these, some are more convenient for businesses in terms of how they can implement their e-commerce operations. Some, like Stripe, offer high-end features including subscription billing, as well as global payment capabilities.

Others are simple and capable of handling everything from online payments to in-person transactions, as is the case with Square. It also offers a global payment solution with its prepaid card for easy accessibility to funds. Finding the best online money transfer service is key to smooth business transactions. Many companies today are actively exploring alternatives to PayPal for business due to high fees or account limitations.

Introduction to PayPal Software

PayPal is an online payment service. It lets users send and get money safely. They can shop online, move money from bank accounts or cards, and pay fast. PayPal is popular for e-commerce, freelancing, and peer-to-peer transfers. It offers a simpler and safer option than regular banking. Key features include buyer protection, fraud checks, and fast transfers. Looking into the best online money transfer options can help users find what fits their needs best.

Several Alternatives to PayPal

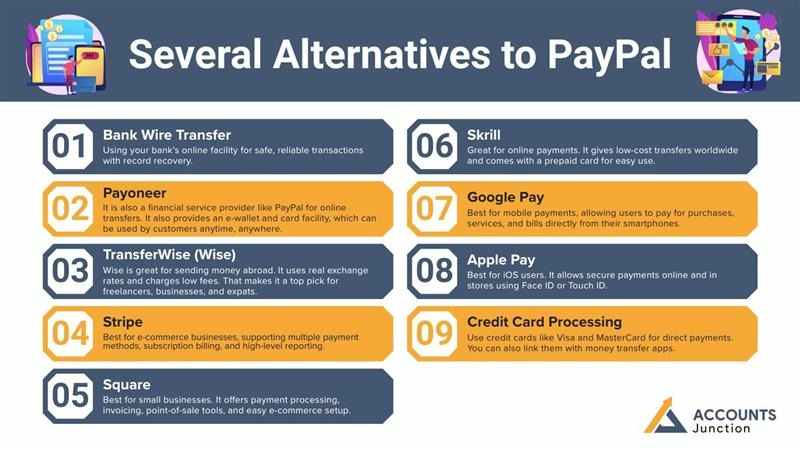

When considering alternatives to PayPal, it's essential to evaluate platforms that cater to both personal and business needs. Choosing the best online money transfer method can help improve your cash flow and global reach. Reliable alternatives to PayPal for business, like Wise, Payoneer, and Stripe, are gaining trust worldwide. Here are some notable options:

- Bank Wire Transfer: Using your bank’s online facility for safe, reliable transactions with record recovery.

- Payoneer: It is also a financial service provider like PayPal for online transfers. It also provides an e-wallet and card facility, which can be used by customers anytime, anywhere. Best for freelancers and small businesses, offering global transactions with no fees on certain international payments.

- TransferWise (Wise): Wise is great for sending money abroad. It uses real exchange rates and charges low fees. That makes it a top pick for freelancers, businesses, and expats.

- Stripe: Best for e-commerce businesses, supporting multiple payment methods, subscription billing, and high-level reporting. It is a top choice among alternatives to PayPal for business due to its developer-friendly features.

- Square: Best for small businesses. It offers payment processing, invoicing, point-of-sale tools, and easy e-commerce setup. The prepaid card gives quick access to funds. This makes it a smart and flexible choice for online money transfer.

- Skrill: Great for online payments. It gives low-cost transfers worldwide and comes with a prepaid card for easy use.

- Google Pay: Best for mobile payments, allowing users to pay for purchases, services, and bills directly from their smartphones. Businesses looking for mobile-centric alternatives to PayPal for business can consider Google Pay for its wide user adoption.

- Apple Pay: Best for iOS users. It allows secure payments online and in stores using Face ID or Touch ID.

- Credit Card Processing: Use credit cards like Visa and MasterCard for direct payments. You can also link them with money transfer apps.

When looking for PayPal alternatives for your business, check how each platform fits your invoicing tools, customer needs, and global payouts.

Criteria to Consider Before Choosing the Option

There are multiple digital fund transfer options available online. The dilemma is to choose which one? Selecting the right online money transfer service involves assessing various factors:

- Fees Charged: Some applications charge a convenience fee. Check and compare before using.

- Trustworthiness: Research the company, read customer reviews, and ensure reliability.

- Time Involved in Generating Receipts: Most applications generate receipts immediately and show transfer status.

- Popularity: Widely accepted applications offer excellent services and easy accessibility.

- Friendly Customer Support: Ensure responsive support for issues like internet failures or transaction errors.

How Integration Impacts Your Business

-

Linking Payment Platforms

Integrating payment platforms with websites or accounting tools may reduce manual work. Platforms like Stripe and Square can connect with invoicing systems, shopping carts, or POS software.

-

Benefits of Integration

Automation can save time, prevent errors, and simplify record-keeping. Businesses may get real-time insights and better reporting options.

-

Choosing the Right Level

The level of integration may affect workflow efficiency. Platforms with strong connectivity may help businesses scale without adding technical complexity.

-

Impact on Customer Experience

Seamless integration may enhance customer satisfaction. Fast checkout, instant invoicing, and multiple payment options may improve loyalty.

-

Reducing Operational Costs

Integrated systems may lower labor and administrative costs. Fewer manual entries and automatic reporting may save both time and money.

Security Practices for Online Money Transfers

-

Basic Security Measures

Even secure platforms may require additional precautions. Using strong passwords, two-factor authentication, and verified devices may help prevent fraud.

-

Monitoring Transactions

Regularly reviewing accounts and transaction history may catch errors early. Some platforms may provide alerts for unusual activity.

-

Additional Protections

Buyer protection, insurance, and fraud detection features may reduce financial risk. Staying informed about updates and security policies may help maintain trust with customers.

-

Educating Employees and Users

Training staff or users about phishing, scams, and secure password practices may reduce risks. Awareness may prevent many common mistakes.

-

Platform Updates and Maintenance

Keeping apps and platforms updated may enhance security. Developers often release patches to fix vulnerabilities and protect transactions.

Comparison Table of Alternatives to PayPal

When evaluating PayPal alternatives, it's essential to compare them based on various factors. Below are the key points to consider, including an additional criterion for a well-rounded decision:

|

Platform |

Transaction Fees |

Availability |

Security Features |

Ease of Use |

Transaction Speed |

E-commerce Integration |

Customer Support |

Cryptocurrency Support |

|

Payoneer |

1%–3% |

200+ countries |

PCI DSS compliant |

User-friendly |

1–2 days |

Yes |

24/7 support |

No |

|

Wise |

0.35%–3% |

50+ currencies |

Two-factor auth |

Intuitive |

Instant to 2 days |

Limited |

Email support |

No |

|

Stripe |

2.9% + $0.30 |

Global |

PCI Level 1 |

Developer-friendly |

2–3 days |

Extensive |

24/7 support |

Yes |

|

Square |

2.6% + $0.10 |

US, Canada, etc. |

End-to-end encryption |

Simple setup |

Next day |

Yes |

Phone & email |

No |

|

Skrill |

1.45%–3.99% |

120+ countries |

Anti-fraud tools |

Easy to use |

Instant |

Yes |

24/7 support |

Yes |

|

Google Pay |

Varies |

Select countries |

Tokenization |

Seamless |

Instant |

Yes |

Online help center |

No |

|

Apple Pay |

Varies |

Select countries |

Biometric auth |

Seamless |

Instant |

Yes |

Online support |

No |

How to Choose the Best Alternative to PayPal for Your Business

When selecting the best online money transfer solution, there are a few key factors to consider:

1. Fees

- Each platform charges different fees. Compare the cost to send and receive money, especially for transfers across countries.

2. Transaction Speed

- Some payment processors offer instant transfers. Others may take a few business days. If speed matters to your business, choose platforms with instant or same-day transfers.

3. Currency Support

- If you work with international customers, pick a platform that supports multiple currencies. It should also offer good exchange rates.

4. Ease of Use

- Pick platforms that are easy to link with your website or sales system. A simple setup helps both you and your customers.

5. Customer Support

- Good customer service can make or break a relationship. Pick a platform with strong support for any issues you may face.

Choose an online money transfer service by checking key points like fees, reliability, transfer time, popularity, and support. These help you make a smart, safe, and low-cost choice. PayPal is still a top option, but many alternatives to PayPal offer useful features for different needs.

To keep your records clear and up to date, Accounts Junction provides reliable accounting and bookkeeping services. We have certified experts who manage each transaction accurately.

FAQs

1. What are the best alternatives to PayPal for business?

- Stripe, Payoneer, and Wise may serve as strong alternatives. They support global payments and invoicing.

2. Which PayPal alternative is best for online money transfer?

- Wise may be ideal for international money transfers. It uses real exchange rates and low fees.

3. Can Payoneer replace PayPal for freelancers?

- Payoneer may suit freelancers well. It allows receiving global payments directly to a card or bank.

4. Is Stripe a better choice than PayPal for e-commerce?

- Stripe may be more flexible for online stores. Subscription billing and multiple payment methods are included.

5. Which platform is easiest to use as a PayPal alternative?

- Square may be simplest for small businesses. Its point-of-sale and invoicing tools are user-friendly.

6. Can I use Google Pay as a PayPal alternative for businesses?

- Google Pay may allow fast mobile payments. It works best for in-person and online customer transactions.

7. Do PayPal alternatives charge high fees for international payments?

- Platforms like Wise and Payoneer may charge lower fees. Costs vary by country and transfer type.

8. Which alternatives to PayPal offer prepaid cards for quick access?

- Payoneer and Skrill may provide prepaid cards. Funds can be accessed instantly for business needs.

9. Are there secure alternatives to PayPal for online transfers?

- Stripe, Wise, and Payoneer may provide strong encryption and fraud protection. Two-factor authentication adds safety.

10. How fast can payments be received using PayPal alternatives?

- Some platforms offer instant transfers, others one to two days. Speed depends on the platform and currency.

11. Can PayPal alternatives integrate with my website or online store?

- Stripe and Square may integrate with e-commerce tools. This may simplify payments and reporting automatically.

12. Which PayPal alternative is suitable for recurring payments or subscriptions?

- Stripe may handle subscriptions easily. This may help businesses automate recurring billing.

13. Can I use PayPal alternatives for global customers?

- Wise, Payoneer, and Stripe may support multiple currencies. This allows sending and receiving money worldwide.

14. Are refunds simple with these PayPal alternatives?

- Most platforms may allow quick refunds. Policies vary, but customer-friendly options are common.

15. Which alternatives to PayPal are popular among small businesses?

- Square, Payoneer, and Stripe may be widely adopted. Their features support online and in-store sales.

16. Do PayPal alternatives provide transaction tracking for accounting?

- Yes, platforms like Stripe and Payoneer may include dashboards. They help monitor transfers and record payments.

17. Can these PayPal alternatives handle large transactions safely?

- Most platforms may offer fraud protection and encryption. Limits may vary by account type.

18. Are mobile-focused alternatives better than PayPal for in-person payments?

- Google Pay and Apple Pay may simplify mobile payments. They can reduce reliance on cards or cash.

19. Can businesses use multiple PayPal alternatives at once?

- Yes, using multiple platforms may increase flexibility. This may help accept payments from different customer regions.

20. How do I select the right PayPal alternative for my business?

- Compare fees, transfer speed, security, and integration. Choose platforms that fit your business workflow best.