Complete Guide to Filing the T2 Corporation Income Tax Return in 2025

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Understanding the T2 Tax Form

The T2 Tax Form contains several parts. Each part collects details about your corporation’s finances, taxes, and operations.

Key sections include:

- Identification: Company name, business number, and address

- Financial Details: Income, expenses, assets, and liabilities

- Schedules: Additional information such as capital cost allowance or foreign income

- Tax Calculation: Net income, taxable income, and tax payable

Every corporation must complete the basic portion of the T2 corporation income tax return, and add only the schedules that apply to their case.

What Are the Main Schedules in the T2 Corporation Income Tax Return?

There are over 80 possible schedules. Most corporations use only a few. Here are the common ones:

- Schedule 1: Net income for tax purposes

- Schedule 8: Capital cost allowance (depreciation of assets)

- Schedule 50: Shareholder information

- Schedule 100 and 125: Financial statements in GIFI format

- Schedule 4: Corporation loss continuity and application

- Schedule 7: Aggregate investment income and refundable taxes

Using the correct schedules helps avoid delays or reassessments.

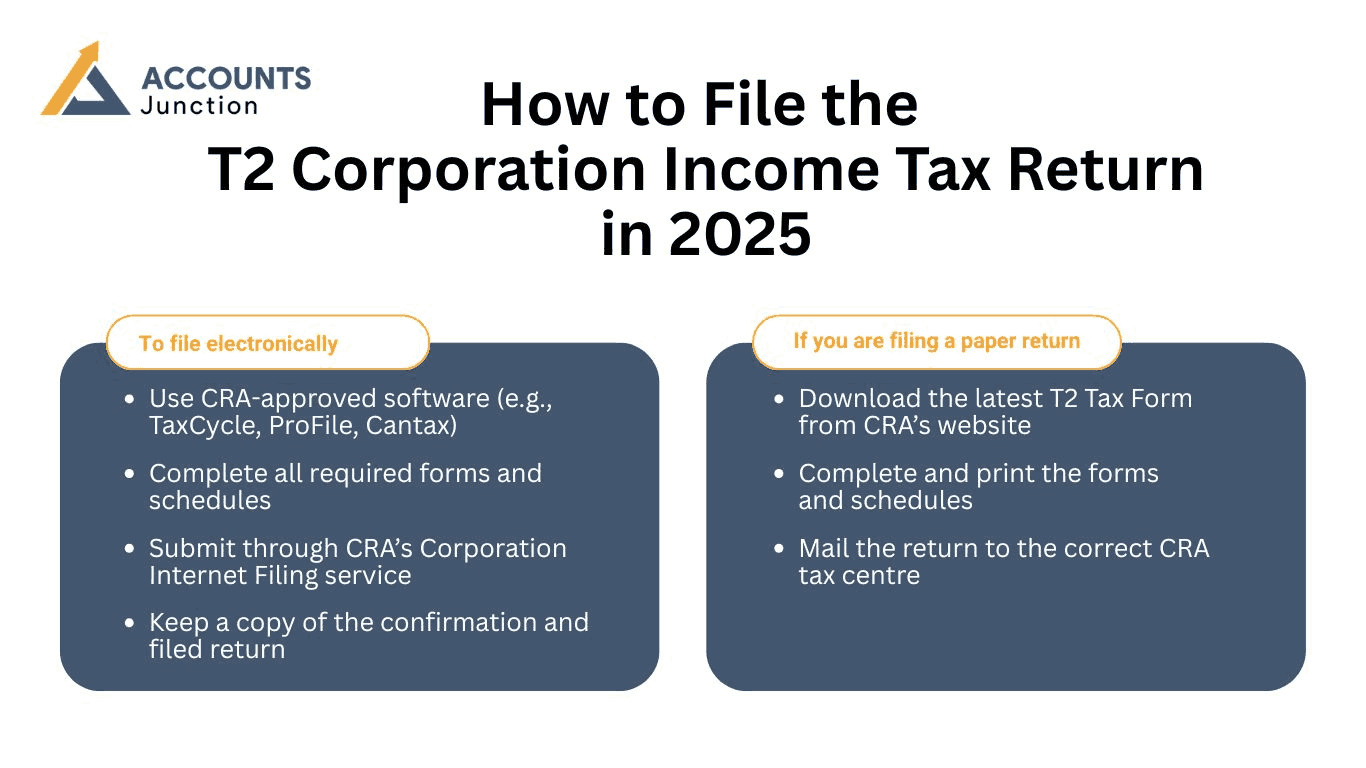

How to File the T2 Corporation Income Tax Return in 2025

Corporations must file the T2 corporation income tax return electronically if they have gross revenue over $1 million. Others can still file a paper return, but electronic filing is preferred for speed and accuracy.

To file electronically:

- Use CRA-approved software (e.g., TaxCycle, ProFile, Cantax)

- Complete all required forms and schedules

- Submit through CRA’s Corporation Internet Filing service

- Keep a copy of the confirmation and filed return

If you are filing a paper return:

- Download the latest T2 Tax Form from CRA’s website

- Complete and print the forms and schedules

- Mail the return to the correct CRA tax centre

Common Mistakes to Avoid

Filing the T2 corporation income tax return with errors can cause delays and lead to penalties. Watch out for these common issues:

- Missing schedules

- Incorrect GIFI codes

- Typing errors in income or deductions

- Not reporting all taxable benefits

- Forgetting to sign or include the date on paper returns

Double-check all entries before submission. Use checklists to track each part of the return.

What Happens After Filing the T2 Tax Form?

After you file the T2 Tax Form, CRA will review it. If everything checks out, you will receive a Notice of Assessment. This confirms the tax assessed and shows any balance due or refund.

If the CRA needs more information, they may contact you. They may ask for supporting documents or clarification. Respond promptly to avoid penalties.

Penalties for Late or Incorrect Filing

The T2 corporation income tax return must be filed on time. If you miss the deadline, CRA may apply late filing penalties.

The penalty is 5 percent of the unpaid tax, plus 1 percent per month for up to 12 months. If you have filed late before, the penalty can rise to 10 percent of the unpaid tax, plus 2 percent per month.

Interest also applies to unpaid balances and late payments.

Filing for a Corporation With No Income

Even if your corporation made no income during the year, you still need to file the T2 corporation income tax return. Use your financial statements to show that no income was earned.

You can also mark the return as a “nil return.” CRA still expects the T2 to be submitted unless the company has been formally dissolved.

Carrying Losses to Future Years

One feature of the T2 Tax Form is the ability to carry non-capital losses to future tax years. These losses can offset future income and reduce taxes.

To claim a loss carryforward:

- Use Schedule 4 to show prior losses

- Apply them to current or future years

- Keep supporting documents to show the loss was real

Losses can be carried back three years or forward up to twenty years.

Claiming Tax Credits on the T2 Return

Your corporation may qualify for federal or provincial tax credits. These reduce your tax payable and support business growth.

Common credits include:

- Scientific Research and Experimental Development (SR&ED)

- Investment tax credit

- Apprenticeship job creation tax credit

- Film and video production credits (in some provinces)

Use the right schedules and forms to apply each credit. Add the credit to the T2 in the appropriate section.

How to Amend a Filed T2 Corporation Income Tax Return

If you find a mistake after submitting the T2 corporation income tax return, you can amend it.

Submit the revised return by:

- Preparing a new version of the T2 with the corrections

- Marking it as an amended return

- Sending it through the same channel used for the original (online or paper)

Include a letter explaining the changes, especially if the correction affects the tax owed.

Dissolving a Corporation and Final T2 Filing

If your corporation is closing down, a final T2 Tax Form is still required. This is called a final return.

You must:

- Indicate on the form that this is the final return

- Include all outstanding balances

- Pay any taxes owed

- File within six months of the closing date

Once CRA accepts your final return and you pay all dues, the account can be closed.

When to Use a Tax Professional

The T2 corporation income tax return can be filed by business owners or in-house staff. However, many companies choose to hire a tax accountant to reduce the risk of errors.

Use a professional if:

- Your corporation has complex revenue streams

- You claim multiple tax credits

- You own assets across provinces

- You missed filing in previous years

Tax professionals are skilled at finding deductions and meeting CRA standards.

CRA My Business Account and T2 Filing

You can track the status of your T2 filing using CRA’s My Business Account portal. It allows you to:

- View return status

- Receive notices

- Make payments

- Send documents securely

Sign up with your business number to access these services online.

Digital Tools for T2 Filing

Many software options are available to help file the T2 Tax Form. Some are cloud-based, others are desktop programs. Look for CRA-certified options with features like:

- Auto-fill from previous years

- GIFI code integration

- Schedule selection

- Built-in error checks

- Electronic submission tools

Popular options include TaxCycle, Profile, Cantax, and TurboTax Business.

Conclusion:

The T2 corporation income tax return is a yearly duty for every corporation in Canada. It keeps your business compliant and helps you take advantage of available credits and deductions. Filing on time and with accuracy can save you money and reduce stress.

Use this guide to prepare ahead, choose the right tools, and avoid costly mistakes. Keep records organized and reach out for help when needed. The T2 Tax Form may seem complex, but with the right steps, you can handle it smoothly each year. If you need more help with it, contact Accounts Junction now!

FAQs

1. What is the T2 corporation income tax return?

- It is a form all Canadian corporations must file each year, even if they owe no tax.

2. Who is required to file a T2 Tax Form?

- All resident corporations except registered charities. Non-residents with Canadian income must also file.

3. What happens if I file the T2 late?

- CRA charges penalties and interest. The basic penalty is 5 percent plus 1 percent for each month late.

4. Can I file the T2 Tax Form myself?

- Yes, but you can also use a certified accountant or CRA-approved software to avoid errors.

5. Is the T2 different from the T1 return?

- Yes. The T2 is for corporations. The T1 is for individuals, including sole proprietors.

6. Can I file a nil T2 return if my business had no activity?

- Yes. You must still file the T2 showing no income or expenses if your company is still active.

Filing the T2 corporation income tax return is a key responsibility for every incorporated business in Canada. Whether your business made a profit or not, submitting the T2 Tax Form each year is required by law. This guide explains the full process in plain terms, so business owners can file correctly and on time.

Who Must File the T2 Corporation Income Tax Return?

All corporations in Canada, except for registered charities, must file the T2 corporation income tax return. This includes inactive corporations and those with no taxable income. Foreign corporations with income from Canada must also file if they carry on business in the country or have taxable capital gains.

Corporations must file the T2 Tax Form within six months after the end of their fiscal year. Even if your business owes no taxes, you must still file the return.

When Is the T2 Tax Form Due?

The T2 Tax Form is due six months after your fiscal year ends. The exact date depends on the year-end your business has set. For example, if your fiscal year ends on March 31, your T2 return is due by September 30.

If your due date falls on a weekend or public holiday, you must file the return on the next business day.

What Documents Are Needed to File the T2 Corporation Income Tax Return?

Before you begin filing the T2 corporation income tax return, collect the required documents:

- Financial statements for the year

- Balance sheet and income statement

- General index of financial information (GIFI) codes

- CRA-issued business number

- Previous year’s tax return, if available

- Schedules for specific deductions, credits, or carryovers

These records will help complete the T2 accurately and support your claims.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Understanding the T2 Tax Form

The T2 Tax Form contains several parts. Each part collects details about your corporation’s finances, taxes, and operations.

Key sections include:

- Identification: Company name, business number, and address

- Financial Details: Income, expenses, assets, and liabilities

- Schedules: Additional information such as capital cost allowance or foreign income

- Tax Calculation: Net income, taxable income, and tax payable

Every corporation must complete the basic portion of the T2 corporation income tax return, and add only the schedules that apply to their case.

What Are the Main Schedules in the T2 Corporation Income Tax Return?

There are over 80 possible schedules. Most corporations use only a few. Here are the common ones:

- Schedule 1: Net income for tax purposes

- Schedule 8: Capital cost allowance (depreciation of assets)

- Schedule 50: Shareholder information

- Schedule 100 and 125: Financial statements in GIFI format

- Schedule 4: Corporation loss continuity and application

- Schedule 7: Aggregate investment income and refundable taxes

Using the correct schedules helps avoid delays or reassessments.

How to File the T2 Corporation Income Tax Return in 2025

Corporations must file the T2 corporation income tax return electronically if they have gross revenue over $1 million. Others can still file a paper return, but electronic filing is preferred for speed and accuracy.

To file electronically:

- Use CRA-approved software (e.g., TaxCycle, ProFile, Cantax)

- Complete all required forms and schedules

- Submit through CRA’s Corporation Internet Filing service

- Keep a copy of the confirmation and filed return

If you are filing a paper return:

- Download the latest T2 Tax Form from CRA’s website

- Complete and print the forms and schedules

- Mail the return to the correct CRA tax centre

Common Mistakes to Avoid

Filing the T2 corporation income tax return with errors can cause delays and lead to penalties. Watch out for these common issues:

- Missing schedules

- Incorrect GIFI codes

- Typing errors in income or deductions

- Not reporting all taxable benefits

- Forgetting to sign or include the date on paper returns

Double-check all entries before submission. Use checklists to track each part of the return.

What Happens After Filing the T2 Tax Form?

After you file the T2 Tax Form, CRA will review it. If everything checks out, you will receive a Notice of Assessment. This confirms the tax assessed and shows any balance due or refund.

If the CRA needs more information, they may contact you. They may ask for supporting documents or clarification. Respond promptly to avoid penalties.

Penalties for Late or Incorrect Filing

The T2 corporation income tax return must be filed on time. If you miss the deadline, CRA may apply late filing penalties.

The penalty is 5 percent of the unpaid tax, plus 1 percent per month for up to 12 months. If you have filed late before, the penalty can rise to 10 percent of the unpaid tax, plus 2 percent per month.

Interest also applies to unpaid balances and late payments.

Filing for a Corporation With No Income

Even if your corporation made no income during the year, you still need to file the T2 corporation income tax return. Use your financial statements to show that no income was earned.

You can also mark the return as a “nil return.” CRA still expects the T2 to be submitted unless the company has been formally dissolved.

Carrying Losses to Future Years

One feature of the T2 Tax Form is the ability to carry non-capital losses to future tax years. These losses can offset future income and reduce taxes.

To claim a loss carryforward:

- Use Schedule 4 to show prior losses

- Apply them to current or future years

- Keep supporting documents to show the loss was real

Losses can be carried back three years or forward up to twenty years.

Claiming Tax Credits on the T2 Return

Your corporation may qualify for federal or provincial tax credits. These reduce your tax payable and support business growth.

Common credits include:

- Scientific Research and Experimental Development (SR&ED)

- Investment tax credit

- Apprenticeship job creation tax credit

- Film and video production credits (in some provinces)

Use the right schedules and forms to apply each credit. Add the credit to the T2 in the appropriate section.

How to Amend a Filed T2 Corporation Income Tax Return

If you find a mistake after submitting the T2 corporation income tax return, you can amend it.

Submit the revised return by:

- Preparing a new version of the T2 with the corrections

- Marking it as an amended return

- Sending it through the same channel used for the original (online or paper)

Include a letter explaining the changes, especially if the correction affects the tax owed.

Dissolving a Corporation and Final T2 Filing

If your corporation is closing down, a final T2 Tax Form is still required. This is called a final return.

You must:

- Indicate on the form that this is the final return

- Include all outstanding balances

- Pay any taxes owed

- File within six months of the closing date

Once CRA accepts your final return and you pay all dues, the account can be closed.

When to Use a Tax Professional

The T2 corporation income tax return can be filed by business owners or in-house staff. However, many companies choose to hire a tax accountant to reduce the risk of errors.

Use a professional if:

- Your corporation has complex revenue streams

- You claim multiple tax credits

- You own assets across provinces

- You missed filing in previous years

Tax professionals are skilled at finding deductions and meeting CRA standards.

CRA My Business Account and T2 Filing

You can track the status of your T2 filing using CRA’s My Business Account portal. It allows you to:

- View return status

- Receive notices

- Make payments

- Send documents securely

Sign up with your business number to access these services online.

Digital Tools for T2 Filing

Many software options are available to help file the T2 Tax Form. Some are cloud-based, others are desktop programs. Look for CRA-certified options with features like:

- Auto-fill from previous years

- GIFI code integration

- Schedule selection

- Built-in error checks

- Electronic submission tools

Popular options include TaxCycle, Profile, Cantax, and TurboTax Business.

Conclusion:

The T2 corporation income tax return is a yearly duty for every corporation in Canada. It keeps your business compliant and helps you take advantage of available credits and deductions. Filing on time and with accuracy can save you money and reduce stress.

Use this guide to prepare ahead, choose the right tools, and avoid costly mistakes. Keep records organized and reach out for help when needed. The T2 Tax Form may seem complex, but with the right steps, you can handle it smoothly each year. If you need more help with it, contact Accounts Junction now!

FAQs

1. What is the T2 corporation income tax return?

- It is a form all Canadian corporations must file each year, even if they owe no tax.

2. Who is required to file a T2 Tax Form?

- All resident corporations except registered charities. Non-residents with Canadian income must also file.

3. What happens if I file the T2 late?

- CRA charges penalties and interest. The basic penalty is 5 percent plus 1 percent for each month late.

4. Can I file the T2 Tax Form myself?

- Yes, but you can also use a certified accountant or CRA-approved software to avoid errors.

5. Is the T2 different from the T1 return?

- Yes. The T2 is for corporations. The T1 is for individuals, including sole proprietors.

6. Can I file a nil T2 return if my business had no activity?

- Yes. You must still file the T2 showing no income or expenses if your company is still active.