Table of Contents

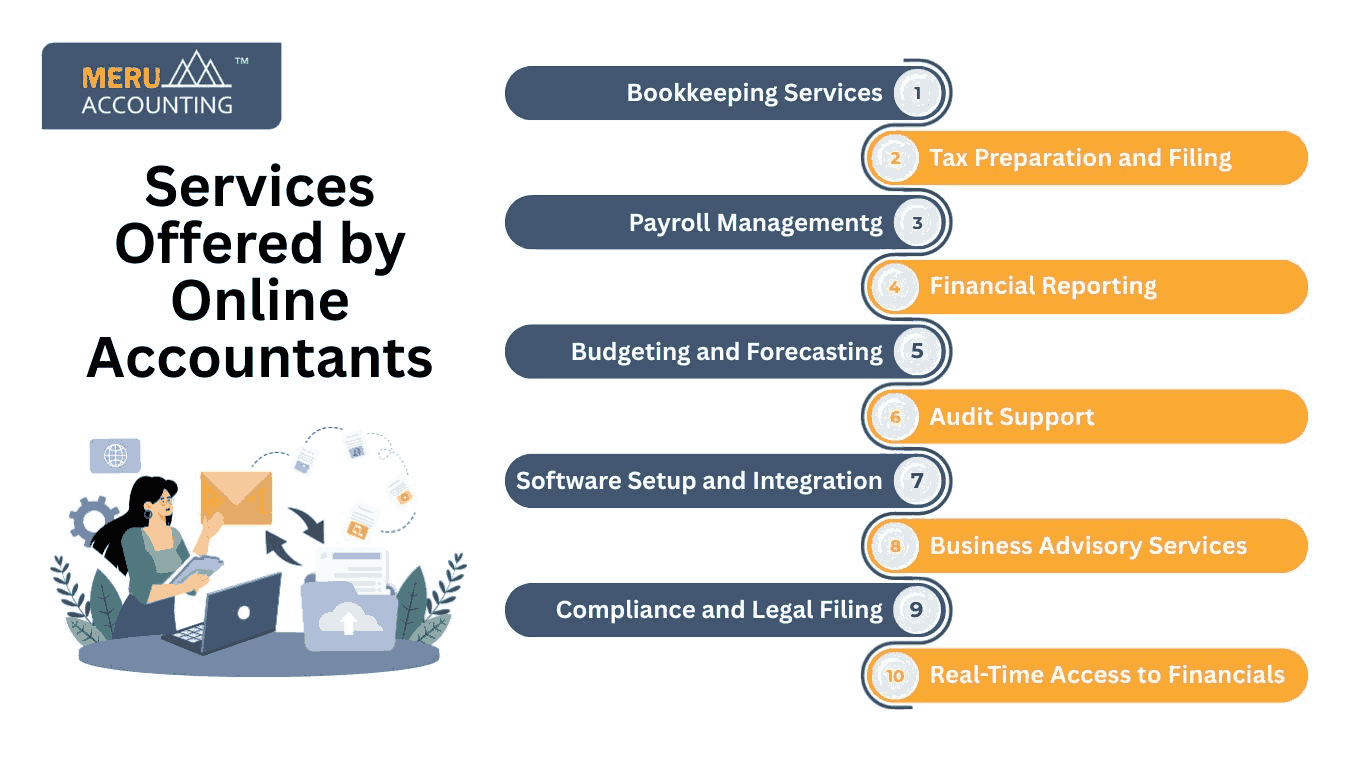

- 1 Services Offered by Online Accountants

- 1.1 1. Bookkeeping Services

- 1.2 2. Tax Preparation and Filing

- 1.3 3. Payroll Management

- 1.4 4. Financial Reporting

- 1.5 5. Budgeting and Forecasting

- 1.6 6. Audit Support

- 1.7 7. Software Setup and Integration

- 1.8 8. Business Advisory Services

- 1.9 9. Compliance and Legal Filing

- 1.10 10. Real-Time Access to Financials

- 2 Why Choose an Online Accountant?

- 3 Who Needs an Online Accountant?

- 4 How to Hire the Right Online Tax Accountant

- 4.1 Online Accountant vs. Traditional Accountant

- 5 Benefits of Using an Online Tax Accountant

- 6 Challenges to Consider

- 7 Tips for Working with an Online Accountant

- 7.1 Conclusion

- 7.2 FAQs

What do online accountants do?

Many firms now take the help of an online accountant to keep their books in check. These accountants work from afar but do the same tasks as those in an office.

They help keep your cash flow correct and organized. They use tools to track costs, file tax forms, and give tips. You don’t need them on-site.

Small firms, new brands, and big shops all gain from this. It saves cash and gives you the skill you need. This guide explains what online accountants do and how they can help your business grow.

Services Offered by Online Accountants

Online accountants support businesses in many ways. They manage finances, prepare reports, and give useful advice. Each service plays a role in helping businesses grow and stay compliant. Below are the key services provided:

1. Bookkeeping Services

An online accountant does basic bookkeeping. They record payments, sort costs, and keep receipts. Good bookkeeping helps keep your money in order.

- Financial records are updated regularly.

- Income and expenses are tracked.

- Monthly and quarterly reports are prepared.

- Bank and credit card accounts are reconciled.

2. Tax Preparation and Filing

An online tax accountant is skilled at managing tax matters. They prepare tax returns and help businesses stay compliant with changing tax laws. They also help clients avoid costly penalties.

- Taxes are filed on time.

- They provide guidance on deductions and credits.

- Assistance is given to reduce tax liabilities.

- They keep up with the newest tax rules.

- Support is provided during tax audits.

3. Payroll Management

Many small businesses use an online accountant to manage payroll. They handle salaries, deductions, and bonuses. Online payroll services save time and reduce errors.

- Ensures employees are paid correctly.

- Files payroll taxes on time.

- Prepares employee tax forms (e.g., W-2s, 1099s).

- Manages direct deposits.

- Ensures payroll compliance in multiple areas.

4. Financial Reporting

An online accountant makes financial reports. These reports show how the business is doing and help owners decide what to do next.

- Income statements show your profit or loss.

- Balance sheets show your money status.

- Cash flow reports track your cash.

- Custom reports are made for investors or partners.

5. Budgeting and Forecasting

Planning is key to any business's success. An online tax accountant helps by preparing budgets and forecasting future expenses and revenue. Budget tools help manage resources and aid growth.

- Forecast income based on trends.

- Tips to save costs and work better.

- Review your numbers each month or quarter.

- Plan for different business outcomes.

6. Audit Support

During an audit, an online accountant is a valuable partner. They know your financial system and reporting structure, making audit support more efficient.

- Organized records are easy to find and access.

- Clear explanations back up money moves.

- Answer the auditor's questions clearly.

- They help reduce stress during audits.

7. Software Setup and Integration

Online accountants suggest using tools like Xero, QuickBooks, and Zoho Books. These tools simplify tasks and boost accuracy.

- Software setup helps with the start.

- Links banking and payment systems.

- Syncs with platforms like Shopify.

- Gives basic tool training.

- Fixes issues and updates settings.

8. Business Advisory Services

An online tax accountant helps guide business growth. They use financial data to spot opportunities and risks.

- Expense Management – Suggests ways to reduce costs and boost revenue.

- Smart Investments – Helps plan investments that align with goals.

- Financial Insights – Offers guidance on cash flow, profit margins, and ROI.

- Funding Support – Assists with proposals and loan applications.

9. Compliance and Legal Filing

An online accountant ensures your business follows local, state, and international laws. They stay updated on regulations, helping you avoid fines and penalties.

- Reports & Filings – Prepares annual reports and filings.

- Tax Handling – Manages GST, VAT, and sales tax.

- Record Keeping – Maintains documents for audits.

- Compliance Support – Guides you through new legal changes.

10. Real-Time Access to Financials

Cloud-based accounting gives you 24/7 access to your finances, helping you make quick decisions.

- Access anywhere to view data.

- Make quick choices for your business.

- Get updates and reports often.

- Track key data with dashboards.

Why Choose an Online Accountant?

An online accountant offers several advantages for your business:

- Lower Costs: More affordable than hiring a full-time in-house team.

- Remote Access: Access support from anywhere, at any time.

- Expert Professionals: Work with certified accountants with experience.

- Scalable Services: Services grow alongside your business needs.

- Industry Knowledge: Specializes in sectors like eCommerce, healthcare, and real estate.

Who Needs an Online Accountant?

Almost every business can benefit from hiring an online accountant. Here’s how different groups can gain from their services:

- Small and mid-sized companies aiming to reduce operational costs.

- Freelancers and solo professionals looking for peace of mind.

- Startups and e-commerce stores needing efficient financial systems.

- International businesses that manage multiple currencies and tax regulations.

How to Hire the Right Online Tax Accountant

When picking an online tax accountant, keep these tips in mind:

- Verified credentials (e.g., CPA, EA).

- Experience in your industry.

- Knowledge of cloud accounting tools.

- Clear, upfront pricing.

- Fast response and clear communication.

- Positive client reviews and references.

Online Accountant vs. Traditional Accountant

|

Feature |

Online Accountant |

Traditional Accountant |

|

Location |

Remote |

Office-based |

|

Cost |

More affordable |

Usually higher |

|

Flexibility |

High |

Limited |

|

Real-time Updates |

Yes |

No |

|

Software Integration |

Strong |

Moderate to Low |

|

Accessibility |

24/7 via cloud tools |

Office hours only |

Tools Used by Online Accountants

Online accountants rely on cloud-based software to ensure accuracy and efficiency. Here are some commonly used tools:

- Xero: Best for small businesses.

- QuickBooks Online: Complete solution with bank sync.

- Zoho Books: Good for automation and many users.

- FreshBooks: Great for freelancers and services.

- Wave Accounting: Easy and free, perfect for small businesses.

These tools assist with easy bookkeeping, invoicing, expense tracking, payroll, and tax reporting.

Benefits of Using an Online Tax Accountant

- It allows you to save time and cut costs.

- It lowers the risk of making manual mistakes.

- You get tax planning support throughout the year.

- Compliance becomes easier with expert help and advice.

- It simplifies reports and improves cash flow tracking.

- Automation reduces stress and handles repeat tasks easily.

Challenges to Consider

While there are many benefits, a few challenges remain.

- You must ensure strong data privacy and online security.

- A stable internet connection is needed at all times.

- Business owners should be open to using digital tools.

- Time zone gaps may arise when working with global teams.

Tips for Working with an Online Accountant

- Keep your financial records updated on a regular basis.

- Communicate often and stay open about your business needs.

- Review your financial reports every month or quarter.

- Use safe tools like Google Drive or Dropbox to share files.

- Set clear goals and agree on deadlines and deliverables.

Conclusion

An online accountant adds flexibility, knowledge, and reliable support. They help keep your financial records clear and up to date. You get timely tax advice and fewer costly errors. This support saves time, lowers costs, and boosts productivity.

During tax season, they simplify tasks and reduce your stress. They also help increase profits through better financial decisions. With the right accountant, your business stays financially healthy. You gain peace of mind knowing your books are accurate.

Choose someone trusted and keep communication open and consistent. Let them handle numbers while you focus on business growth. Contact Accounts Junction to manage your cash flow and finances.

FAQs

1. What does an online accountant do?

Handles bookkeeping, taxes, payroll, budgeting, and reporting remotely via cloud tools.

2. Can an online tax accountant file my taxes?

Yes, they are licensed to file both business and personal taxes online.

3. Is it safe to use an online accountant?

Yes, as long as secure, encrypted platforms and software are used.

4. How do I pay an online accountant?

Payments are made via bank transfers, credit cards, or online apps.

5. How often should I talk to my online accountant?

Monthly check-ins are ideal, with more frequent contact during busy financial periods.

6. Are online accountants only for small businesses?

No, businesses of all sizes can benefit from their services. Online accountants help save time, cut costs, and improve efficiency.

7. What software do online accountants use?

Popular choices include QuickBooks, Zoho Books, Xero, and FreshBooks.