Table of Contents

- 1 What is a Tax Return in Australia?

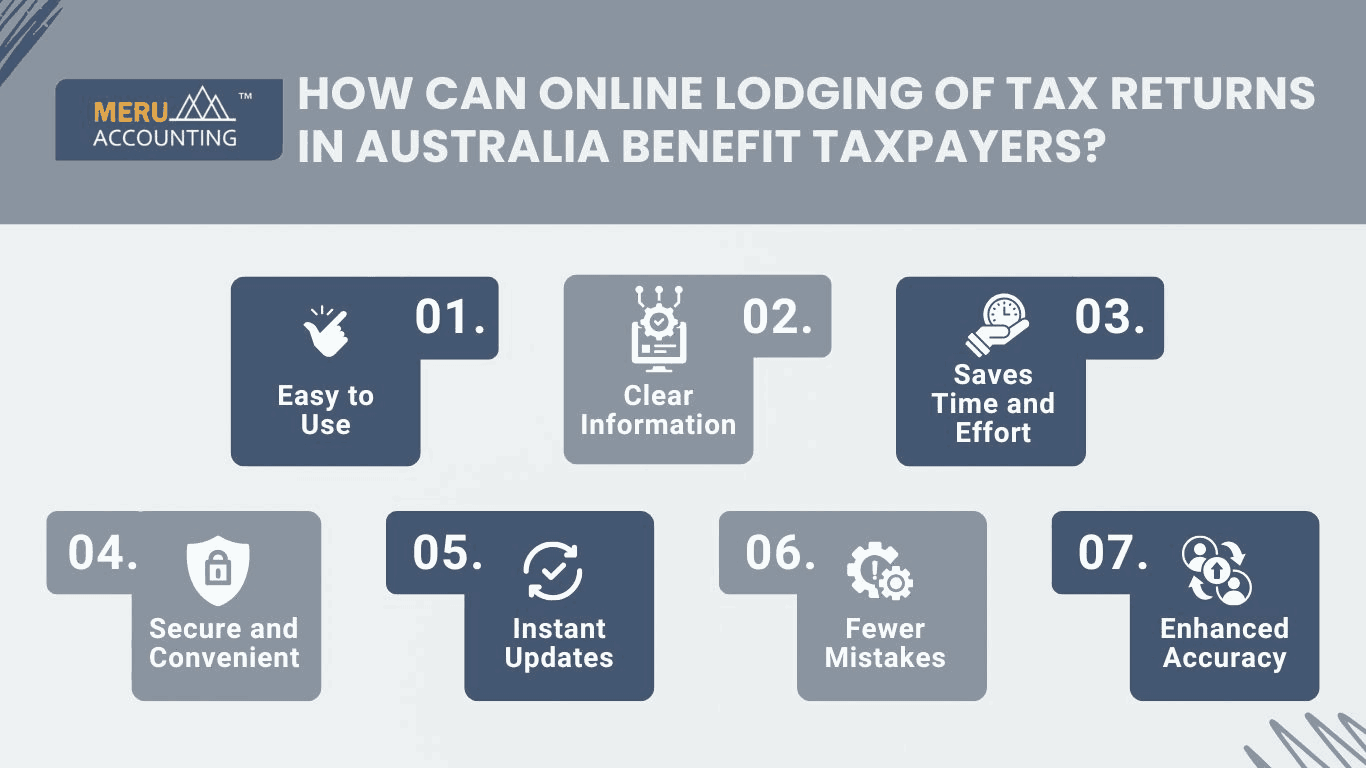

- 2 How can online lodging of tax returns in Australia benefit Taxpayers?.

- 2.1 Easy to Use

- 2.2 Clear Information

- 2.3 Saves Time and Effort

- 2.4 Secure and Convenient

- 2.5 Instant Updates

- 2.6 Fewer Mistakes

- 2.7 Enhanced Accuracy

- 3 Important Information on Online Tax Payment in Australia

- 3.1 1. Get Your Papers Ready

- 3.2 2. Report All Income

- 3.3 3. Track Deductible Expenses

- 3.4 4. Know What You Can Claim

- 3.5 5. Use the ATO Online Tools

- 3.6 6. Check Before You Submit

- 3.6.1 Conclusion

- 3.6.2 FAQs

Tax return in Australia

If you're running a business in Australia or planning to start one, it's essential to understand how the Tax Return in Australia works. Managing taxes might seem complex, but when approached systematically, online income tax filing makes it far more manageable. Before getting the notices from the ATO (Australian Tax Office), you must make all the tax-related calculations with a proper tax consultant. It will ease your lodging tax return to a large extent.

As per the nature of the work, the ATO expects that every business files its tax as per the guidelines. The government is extremely encouraging online income tax filing as the preferred method. A third-party agency can handle these taxes perfectly for your business.

What is a Tax Return in Australia?

A tax return in Australia is a yearly form you send to the ATO. It shows what you earn, what you spend, and any tax breaks you can get.

The ATO uses this information to figure out how much tax you need to pay or if you’ll get a refund. Both individuals and businesses must follow the rules for filing taxes online. If you don’t file your tax return on time or make errors, you could face fines or audits. You can lower your taxable income by using legal tax deductions offered in Australia.

How can online lodging of tax returns in Australia benefit Taxpayers?.

Online income tax filing offers several advantages for individuals and businesses alike:

Easy to Use

Online filing is simple. The platform helps you step-by-step, making it easier to file your tax return.

Clear Information

Digital platforms provide clear summaries of your income, expenses, and possible tax deductions in Australia. You’re better equipped to understand your financial situation and maximize your refund.

Saves Time and Effort

Filing online means no long waits, no delays, and less paper. It speeds up the process and helps you get your refund quicker.

Secure and Convenient

You can file your tax return from home or work. There’s no need to visit any offices, making it more secure and easy.

Instant Updates

You get real-time updates on your filing. This helps you track your submission and make sure everything is on track. If there are any issues, you can resolve them quickly, without waiting for long periods.

Fewer Mistakes

Online filing has checks to reduce errors, helping you file a more accurate tax return. These checks can catch common mistakes, making it less likely that your return will be flagged for review. This saves you time and stress in the long run.

Enhanced Accuracy

Online income tax filing systems include in-built checks and auto-fill options. This lowers the chances of common mistakes and makes your tax return in Australia more accurate.

Important Information on Online Tax Payment in Australia

Filing a tax return is a key task. It helps you stay on the right side of tax laws. This applies to both people and businesses. To get the best tax refunds and avoid trouble, stay ready and informed. Follow these easy steps to file your taxes online.

1. Get Your Papers Ready

Before using online income tax filing, collect all essential documents, such as:

- Payslips and job income

- Super fund details

- Bank interest slips

- Income from shares

- Rent income and costs

- Private health cover info

Having all the papers helps you file the right numbers. Wrong or missed info may cause delays or audits.

2. Report All Income

You must list all the money you made. This includes:

- Job pay or wages

- Freelance or side work

- Money from bank or shares

- Profit from sold things

- Money from overseas

- Government help or benefits

Make sure nothing is left out. Errors can mean fines or fewer refunds. Check twice before you submit.

3. Track Deductible Expenses

You’re allowed to claim various tax deductions in Australia, including:

- Travel or car for work

- Repairs on rental homes

- Work gear or tools

- Bills for home office (power, phone, web)

- Insurance to cover lost income

- Loan interest for things you invest in

Proper documentation of these costs is essential for maximizing your tax deductions in Australia.

4. Know What You Can Claim

The tax office lets you claim some costs. These lower the tax you pay. Some of these are:

- Course fees linked to your job

- Fees for work licenses or unions

- Gifts to charities

- Value drop-in tools or rental stuff

Check the ATO site to be sure. It helps you claim what’s fair and stay safe.

5. Use the ATO Online Tools

The ATO’s MyGov site makes tax work simple. With it, you can:

- Auto-fill your pay and costs

- Lodge your tax online

- Track your refund

- Get alerts and messages

It also checks for small mistakes. This makes the process smooth.

6. Check Before You Submit

Look over your return before you send it. Make sure all numbers are right. Check your bank info too.

A quick check can catch missed claims or errors. This helps you avoid stress and get paid faster.

Conclusion

Filing a tax return in Australia is a key task for both people and businesses. The government supports online tax payments to make things faster and easier. It’s important to keep clear records of your income, costs, and claims. Being aware of available tax deductions in Australia can make a major difference in your tax outcome.

If your business needs help with tax work, Accounts Junction is here for you. We are a trusted accounting firm that helps businesses file tax returns in Australia. Our team gives fast, expert service. We make sure your tax filing is smooth and meets all ATO rules.

FAQs

1. Who needs to file a tax return in Australia?

Individuals earning above the tax-free threshold, businesses, and sole traders must file an annual tax return with the ATO.

2. When is the tax return deadline in Australia?

The deadline for individuals is October 31st for self-filing. If using a tax agent, extensions may be available.

3. What happens if I don't file my tax return on time?

Late tax returns may attract penalties and interest charges from the ATO. It is advisable to file on time or request an extension through a tax agent.

4. How much time does it take to receive a tax refund?

Once your tax return is processed, refunds are typically issued within two weeks if filed online.

5. Can I amend my tax return after submission?

Yes, you can amend your tax return if errors are found. The ATO allows corrections through its online portal.

6. How can Accounts Junction assist with tax return lodgment in Australia?

Accounts Junction provides expert accounting services to ensure accurate tax lodgment. We handle all tax-related calculations, helping businesses comply with ATO guidelines effortlessly.