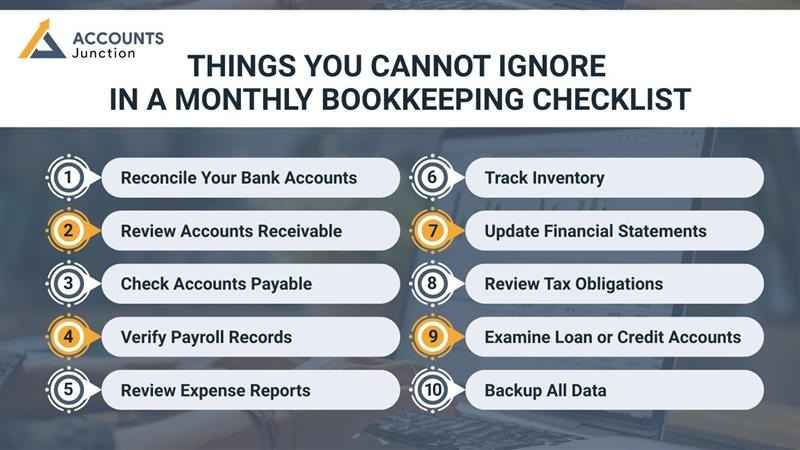

Things You Cannot Ignore in Monthly Bookkeeping Checklist.

Bookkeeping may seem easy, but it is very key. Recording your money each month helps avoid mistakes and stress later. A monthly bookkeeping checklist can guide you to stay on track. Even small firms can use it to manage their cash well. Skipping steps can cause bigger problems later. A monthly checklist will not fix all issues, but it shows a clear view. From bank checks to payroll, each step counts. The points below show what you must not skip each month.

1. Reconcile Your Bank Accounts

Using a monthly bookkeeping checklist may ensure bank accounts are checked for fees or missing deposits that could go unnoticed. Checking them each month may prevent errors in your records. This step may help you find mistakes before they grow. Always compare each entry and fix problems right away.

2. Review Accounts Receivable

Unpaid invoices may cause cash flow problems if ignored. Checking accounts receivable may help you follow up with clients. Doing this each month may increase the chances of getting paid on time. It may also give a clear view of money coming in.

3. Check Accounts Payable

Bills may pile up and cause trouble with suppliers. Checking accounts payable may help you plan payments on time. This step may also avoid late fees and extra charges. Reviewing accounts may keep your cash flow in good shape.

4. Verify Payroll Records

Payroll mistakes may upset staff or cause legal issues. Checking payroll records each month may prevent errors in pay or deductions. This may also improve trust between employees and management. Regular payroll checks may ensure records stay accurate.

5. Review Expense Reports

Expenses may hide mistakes or unneeded spending if not checked. Reviewing them each month may help control costs. This step may show where money is wasted and can be saved. Always check receipts to make sure every expense is correct.

6. Track Inventory

Inventory may be lost, damaged, or counted incorrectly if ignored. Checking stock monthly may prevent shortages or too much stock. Comparing real stock with records may keep costs under control. This step may also spot theft or misplacement quickly.

7. Update Financial Statements

Balance sheets and profit statements may show the business's health. Updating them monthly may give a clear view of money and costs. This step may guide decisions about spending or saving. Regular updates also help during audits or tax checks.

8. Review Tax Obligations

Taxes may surprise you if not tracked monthly. Checking tax duties may reduce stress and missed deadlines. This step may also show ways to save money with correct deductions. A monthly review may keep your business in good legal standing.

9. Examine Loan or Credit Accounts

Loans and credit may change due to interest or fees. Checking them monthly may prevent missed payments or mistakes. This step may also help plan cash flow better. Finding errors early may save money and trouble later.

10. Backup All Data

Financial data may be lost by accident or system failure. Backing up records each month may protect your business. Keep copies in cloud storage or a safe device. This step may help recover information if problems happen.

Additional Considerations

Even after following the monthly bookkeeping checklist, these extra steps may further improve financial control:

- Review vendor contracts to ensure good terms.

- Watch cash flow trends to avoid shortages.

- Check recurring payments for errors or unneeded charges.

- Stay updated with new financial rules to avoid penalties.

- Talk with accountants or bookkeepers to clear doubts.

Small adjustments every month may save big problems later. Consistent tracking may make running a business easier.

Why a Monthly Bookkeeping Checklist Matters

A well-used monthly bookkeeping checklist may guide businesses in keeping money matters clear and organized. Following it may prevent mistakes, help plan better, and reduce stress during audits. Small misses may grow into big issues if ignored. Regular checks may show cash flow trends and help with decisions.

By reviewing accounts, tracking spending, reconciling statements, and saving data, businesses may gain control. A monthly routine may reduce year-end work and make taxes easier. Even small steps each month may build confidence in your numbers.

Tips for Using Your Monthly Bookkeeping Checklist

- Be consistent: Following it every month may form a habit.

- Use software: Programs may help, but do not replace checks.

- Set reminders: Alerts may prevent missed steps or deadlines.

- Document changes: Notes may explain corrections and keep records.

- Review and improve: Update the checklist to match business needs.

Common Mistakes to Avoid

- Ignoring small differences in accounts while using a monthly bookkeeping checklist may still cause problems if not addressed.

- Forgetting inventory updates may affect record accuracy.

- Delaying payroll or tax checks may create issues.

- Not backing up data may risk permanent loss.

- Overlooking recurring payments may cause errors.

Even minor mistakes may build up and make fixes harder.

Tools That Can Simplify Monthly Bookkeeping

1. Use Accounting Software

- Programs can track income, expenses, and invoices automatically.

- They reduce manual errors and save time on calculations.

2. Try Spreadsheets

- Simple sheets may organize data if budgets are tight.

- They allow quick updates and easy categorization of transactions.

3. Use Cloud-Based Apps

- Cloud apps may let multiple users access records at once.

- They often provide reminders, alerts, and instant reporting features.

4. Mobile Apps for On-the-Go Tracking

- Mobile apps may allow business owners to check records anytime.

- They may send notifications for invoices, payments, or expenses.

Benefits of Following a Monthly Bookkeeping Routine

1. Detect Errors Early

- Reviewing records monthly may highlight mistakes before they grow.

- It helps prevent costly corrections at year-end.

2. Improve Cash Flow Awareness

- Regular checks may show money coming in and going out.

- This helps avoid surprises and plan spending better.

3. Support Better Business Planning

- Monthly reviews can guide hiring and buying choices.

- You can make smart moves in ads and stock control.

4. Build Confidence with Stakeholders

- Clear books help assure funders and banks of your money health.

- Good records show skill and control in the business.

5. Reduce Risk of Fraud

- Monthly reviews can spot odd or false deals early.

- Quick action can stop loss and save you from trouble.

How Monthly Bookkeeping Can Improve Business Decisions

1. Track Profitable Areas

- Monthly records show which products or services make money.

- This information may guide resource allocation and focus areas.

2. Identify Loss-Making Areas

- Repeated losses in specific areas may become visible.

- You may take action to reduce costs or improve performance.

3. Adjust Budgets Early

- Insights from monthly data may help tweak spending.

- Early adjustments may prevent cash flow problems later.

4. Turn Numbers into Insights

- Data from bookkeeping may show trends over months.

- These trends may guide strategies and operational decisions.

5. Plan for Future Growth

- Monthly bookkeeping may help set realistic business goals.

- Insights may guide investment and expansion decisions carefully.

Keeping Records Organized

1. Label Folders Clearly

- Both digital and physical folders may make documents easy to find.

- Proper labels reduce the time spent searching for receipts.

2. Categorize Expenses and Income

- Grouping similar items may simplify the monthly review.

- It may also help in budgeting and reporting.

3. Maintain a Consistent System

- Regular filing habits may prevent clutter and confusion.

- Consistency ensures that nothing is missed during monthly checks.

4. Keep a Backup Filing System

- Separate backup folders may protect important documents.

- They provide an extra layer of security in case of loss.

How to Train Staff for Better Bookkeeping

1. Teach Proper Entry Methods

- Staff may be trained to input transactions correctly.

- Correct entries reduce errors in financial records.

2. Provide Simple Guides

- Step-by-step instructions may help staff follow processes easily.

- Guides may cover invoices, payments, and reconciliations.

3. Conduct Monthly Review Sessions

- Staff may meet to review records and discuss issues.

- This may improve accuracy and reduce repeated mistakes.

4. Encourage Feedback and Questions

- Staff may report unclear processes or difficulties.

- Feedback may help improve bookkeeping practices and reduce errors.

Integrating Bookkeeping With Other Business Processes

1. Link with Sales Systems

- Syncing sales records may reduce duplicate entries.

- It ensures that revenue is recorded correctly each month.

2. Integrate with Inventory

- Inventory updates may automatically reflect in accounts.

- This helps track stock value and reduce mistakes.

3. Connect Payroll Systems

- Payroll data may flow directly into accounting records.

- Integration reduces errors and saves time.

4. Coordinate With Project Tracking

- Linking bookkeeping with project costs may track spending precisely.

- It may improve reporting for budgets and client billing.

Preparing for Year-End Financial Review

1. Reduce Last-Minute Stress

- Following a monthly bookkeeping checklist ensures monthly updates prevent missing documents at year-end.

- It makes audits and tax filing simpler and faster.

2. Keep Documents Ready

- Organized monthly records may make reporting easy.

- You can locate invoices, receipts, and statements quickly.

3. Plan for Audits

- Continuous monitoring may prepare for external audits.

- Monthly bookkeeping reduces the risk of surprises.

4. Track Year-End Adjustments Early

- Detect discrepancies early to avoid large corrections later.

- This ensures financial statements are ready without delays.

Using a monthly bookkeeping checklist may seem small, but it can prevent errors and reduce stress significantly. Following it may help track money, control spending, and plan better. Businesses like Accounts Junction may guide companies in bookkeeping tasks. Their team may help track invoices, manage payroll, and reconcile accounts. Regular monthly checks with their help may make finances simple. Even small businesses may gain control and save time using these practices.

FAQs

1. What is a monthly bookkeeping checklist?

- It is a list of tasks to check the money records each month.

2. Why reconcile bank accounts each month?

- It may find errors and make records match reality.

3. How often should accounts receivable be checked?

- Monthly checks may prevent late payments and cash problems.

4. Can payroll mistakes affect staff?

- Yes, errors in pay may upset workers or cause disputes.

5. Should expenses be reviewed monthly?

- Yes, it may show overspending and save money.

6. Why track inventory every month?

- It may stop shortages, theft, or wrong records.

7. How do updated statements help?

- They may show trends and guide better decisions.

8. What if taxes are ignored?

- Late checks may cause penalties and extra stress.

9. Should loans be checked each month?

- Yes, to track payments and avoid extra costs.

10. How important is backup?

- It may prevent permanent loss of important money records.

11. Can software replace a checklist?

- No, programs help, but humans still must check records.

12. How detailed should a checklist be?

- It may cover the main accounts and monthly tasks fully.

13. Should vendor contracts be reviewed monthly?

- Not always, but checking may prevent bad terms.

14. How do reminders help bookkeeping?

- They may ensure tasks are done without forgetting.

15. Can small businesses follow the same checklist?

- Yes, key steps are the same for all businesses.

16. Does monthly bookkeeping reduce year-end stress?

- Yes, it may make audits and tax work easier.

17. Is it useful to document changes?

- Yes, notes explain corrections and avoid confusion later.

18. Why check recurring payments?

- It may find errors in subscriptions or repeated charges.

19. Can bookkeeping show cash flow issues?

- Yes, it may reveal problems before they get bigger.

20. How flexible should the checklist be?

- It may adjust with changes, but keep the core steps.