How Legal Bookkeepers Help With Tax Preparation in Law Firms

Legal bookkeepers play a key role in law firm work. They keep track of money and sort client accounts. Law firms face tax work that can be complex. Legal bookkeeping services give clear ways to track income. Many rely on a Law Office Bookkeeper for daily records. A Law Firm Accountant uses these records for tax work.

Accurate bookkeeping helps law firms avoid errors and fines. Legal bookkeepers keep files correct and easy to read. They make sure income, bills, and payroll are right. Law firms gain calm and smooth tax work using them.

Why Legal Bookkeepers Are Important for Law Firms

Legal bookkeepers know how law firms handle money daily. They focus on billing, client funds, and office costs. Legal bookkeeping services make sure all records follow rules.

Main Benefits Include:

- Keep track of client funds and law firm income. This helps staff plan costs and avoid mistakes.

- Provide clear records for audits and tax work. Clear files reduce stress during review or checks.

- Offer reports for partners and office leaders. Reports show income trends and office cost patterns.

- Reduce mistakes in daily financial tracking. Fewer errors help the firm avoid fines or delays.

- Help plan budgets and track office spending. Budget tracking ensures money is used well each month.

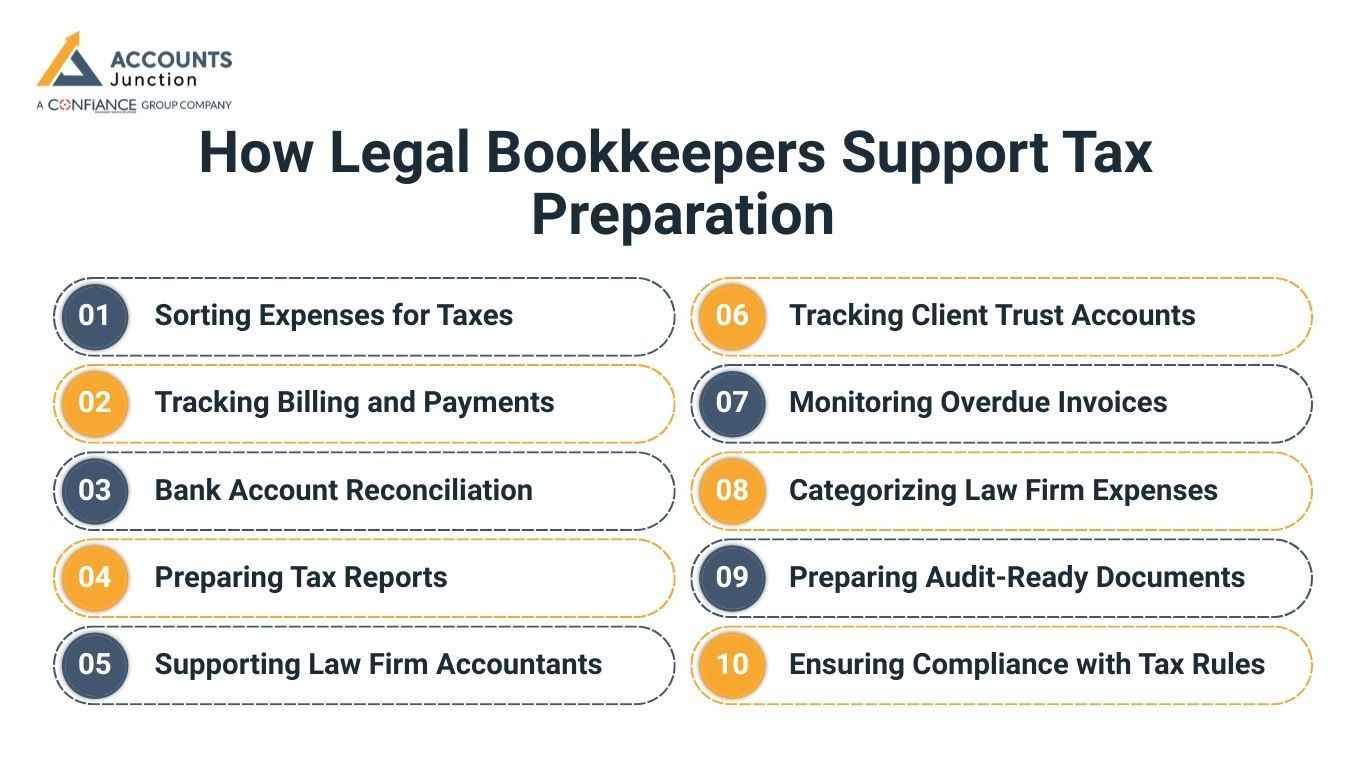

How Legal Bookkeepers Support Tax Preparation

Tax work in law firms can take a long time. Legal bookkeepers make it easier by keeping records organized. They track income, costs, and client payments every day.

Their work gives correct data for audits and filings. Law firms rely on them to keep tax work smooth. Legal bookkeepers work with accountants daily.

They cut errors and make tax preparation faster. Organized bookkeeping ensures all financial data is ready when needed.

1. Sorting Expenses for Taxes

Professional bookkeepers sort expenses for tax rules. This makes filing taxes faster for accountants. They put costs in the right categories. Sorting also prevents mistakes that could cause fines.

2. Tracking Billing and Payments

They track invoices and payments to report income correctly. Clear reports help during audits or tax checks. Skilled law bookkeepers make sure client bills are recorded properly. They match each payment with the right client account.

3. Bank Account Reconciliation

Legal bookkeepers check bank accounts and client trust funds. Matching accounts stops loss or wrong money. They review deposits, withdrawals, and transfers daily. This keeps the client and the firm's money correct.

4. Preparing Tax Reports

They make reports for tax work and review. These give accountants all the data needed for filing. Reports summarize income, costs, and trust activity. This makes tax prep faster and more accurate.

5. Supporting Law Firm Accountants

They help accountants check data carefully. Correct numbers ensure taxes are right and on time. Bookkeepers fix errors before submission. They help accountants solve reporting issues fast.

6. Tracking Client Trust Accounts

Legal bookkeepers keep trust account records daily. This keeps client funds safe and separate. They log deposits, withdrawals, and earned interest. Correct tracking avoids legal or audit issues.

7. Monitoring Overdue Invoices

They watch unpaid bills and overdue invoices. Following up ensures income comes in on time. Bookkeepers make reports for management on unpaid bills. This helps cash flow, and revenue stays steady.

8. Categorizing Law Firm Expenses

They sort daily costs like rent, salaries, and bills. Clear categories reduce tax errors. Sorting also helps with budgets and spending choices. Proper tracking lets accountants claim the right deductions.

9. Preparing Audit-Ready Documents

Bookkeepers make files ready for audits. Organized records make audits fast and easy. They check that all data follows rules. Audit-ready files lower the risk of fines or corrections.

10. Ensuring Compliance with Tax Rules

Legal bookkeepers make sure records follow tax rules. Compliance cuts the risk of fines and keeps the firm safe. They check reports and fix errors fast. They keep records clear for clients and management.

Law Firm Accountant vs Legal Bookkeepers

Some firms mix up a Law Firm Accountant and legal bookkeepers. Both handle money, but tasks differ clearly.

Law Firm Accountant

- Files tax returns for the firm. Gives advice on taxes and money planning.

- Handles complex tax rules and reports. They plan strategies for firm tax work.

Legal Bookkeepers

- Keep daily records of all transactions. Track client trust and office accounts daily.

- Provide data for accountants and tax work. They make numbers ready for filing.

Legal bookkeeping services focus on daily money work. Law Firm Accountants use this data for tax planning. Firms often need both for smooth finances.

Key Legal Bookkeeping Services in Law Firms

Legal bookkeepers offer many services to law firms. They make tax work and audits easier.

Common Services Include:

-

Client Trust Accounting

Record all deposits and withdrawals. Proper trust accounting keeps client funds safe.

-

Invoice Management

Track client billing and ayments. This makes sure the firm gets paid fast.

-

Expense Tracking

Log office costs like rent and software. Tracking costs avoids waste or extra spending.

-

Bank Reconciliation

Match accounts with bank statements. Reconciliation keeps records correct and complete.

-

Financial Reporting

Make balance sheets and money reports. Reports help partners plan and make decisions.

-

Audit Support

Help with internal and outside audits. Organized records reduce stress in any review.

How a Law Office Bookkeeper Makes Tax Work Easy

A Law Office Bookkeeper handles daily records for taxes. They keep accounts organized and ready for review.

1. Record Client Payments and Expenses Carefully

Record client payments and expenses carefully every single day. This keeps all money details correct for tax work. The accounting staff checks each transaction to avoid mistakes. Accuracy ensures all client and firm records are right.

2. Sort Costs for Deductions and Tax Rules

Sort costs for deductions and all tax rules carefully. Proper sorting helps prevent errors when filing taxes. The finance team tracks expenses and tags them correctly. This ensures tax returns are accurate and complete.

3. Keep Financial Records Updated and Clear

Keep financial records updated and clear for reviews. Updated files make it simple to check all numbers. The bookkeeping staff organizes reports for staff and accountants. This ensures smooth workflows during tax preparation periods.

4. Prepare Reports for Law Firm Accountants Regularly

Prepare reports for Law Firm Accountants on a schedule. Reports help accountants file taxes fast and correctly. The accounting team includes all income, costs, and client funds. This keeps the firm ready for audits and reviews.

5. Track Overdue Invoices to Ensure Correct Income

Track overdue invoices and unpaid bills each day. Following up on payments keeps firm revenue steady and correct. The finance team alerts staff about late payments promptly. This ensures income records match bank deposits precisely.

Benefits of Legal Bookkeepers in Tax Work

Legal bookkeeping services give key help to law firms. They keep daily records clear and reduce all mistakes. Firms rely on legal bookkeepers to make tax work easy. Right bookkeeping ensures smooth audits and correct filing.

1. Accuracy in Financial Records

Legal bookkeepers cut mistakes in records each day. This helps the firm avoid fines or audit issues. They track each payment and cost with care. Accuracy ensures all income and costs are correct.

2. Time-Saving for Staff and Accountants

Money reports are ready faster for all accountants. Less time spent on taxes lets staff focus on clients. Legal bookkeepers sort and keep data in order. Staff can finish other tasks without delays or stress.

3. Rules Compliance and Regulation Adherence

Records meet law and tax rules at all times. Compliance cuts financial and legal risks for the firm. Legal bookkeepers know the tax dates and forms needed. This lowers errors and makes filings on time.

4. Transparency for Firm Management

A clear view of the firm's income and costs is shown. Transparency helps partners make fast and wise decisions. Skilled Bookkeepers give easy-to-read reports and charts. Staff and leaders see financial trends very clearly.

5. Audit Readiness and Support

Documents are kept ready for review anytime needed. Organized files cut stress during audit checks or reviews. Legal bookkeepers track trust accounts and office accounts. This helps auditors check numbers without delay or problem.

6. Better Financial Planning and Control

Legal bookkeepers help plan budgets and track costs. This keeps the money spent right across all departments. They watch expenses and income every single month. Firms gain control of costs and spend smarter.

Choosing the Right Legal Bookkeeping Services

Picking the right service is key for law firm taxes. Legal bookkeepers make sure records are correct and ready.

1. Experience in Law Firm Money Work

Experience in law firm money work is very important. Skilled bookkeepers handle tasks quickly and do them right. They know how to track client payments carefully. This ensures all money records are always accurate.

2. Skill in Managing Client Trust Accounts

Bookkeepers must manage client trust accounts securely each day. Proper handling keeps clients’ money safe and separate. They check deposits and withdrawals every single time. This reduces the risk of errors or lost funds.

3. Knowledge of Tax Rules and Office Laws

Legal bookkeepers must know tax rules and office laws. Understanding rules helps avoid mistakes when filing taxes. They keep up with deadlines and required forms. This ensures filings happen on time, without errors.

4. Use of Updated Bookkeeping Tools and Software

Bookkeepers should use updated tools and simple software. Modern tools make tracking and reporting fast and easy. They sort accounts, create reports, and track payments. This helps law firms save time and reduce mistakes.

5. Positive Feedback from Other Law Firms

Positive feedback from other law firms shows trustworthiness. References prove that bookkeepers give reliable and quality service. Good reviews show staff handle tasks quickly and well. This gives confidence when hiring for firm records.

Legal bookkeepers do more than track office money. They keep daily records, check trust accounts, and make reports. Legal bookkeeping services help law firms stay organized and ready. Law Office Bookkeepers work with Law Firm Accountants for smooth tax work. Firms that hire professional bookkeepers save time, avoid mistakes, and gain clear money records.

At Accounts Junction, we provide expert accounting and bookkeeping services for law firms. Our legal bookkeeping services ensure accurate records and smooth tax work. Law Office Bookkeepers work with your Law Firm Accountant to keep finances organized. Firms using Accounts Junction gain peace of mind, reduce errors, and save time. Partnering with skilled legal bookkeepers helps your firm focus on clients.

FAQs

1. What do legal bookkeepers do in law firms?

- They keep records and track client money daily. Legal bookkeepers help staff avoid errors in records.

2. How do legal bookkeepers help with tax work?

- They sort accounts and give reports to accountants. This makes filing taxes much faster and easier.

3. Difference between a Law Firm Accountant and a bookkeeper?

- Accountants handle tax work; bookkeepers track daily money. Bookkeepers prepare files for accurate tax reporting.

4. Can legal bookkeepers handle audits?

- Yes, they prepare records and help with reviews. Organized records reduce errors during audit processes.

5. Are legal bookkeeping services needed for small firms?

- Yes, even small firms gain from clear records. Accurate files prevent mistakes and support smooth taxes.