Table of Contents

- 1 What is IR35?

- 2 Why IR35 Compliance Matters

- 3 How to Determine IR35 Status

- 3.1 1. Control

- 3.2 2. Substitution

- 3.3 3. Mutual Obligation

- 3.4 4. Financial Risk

- 3.5 5. Equipment

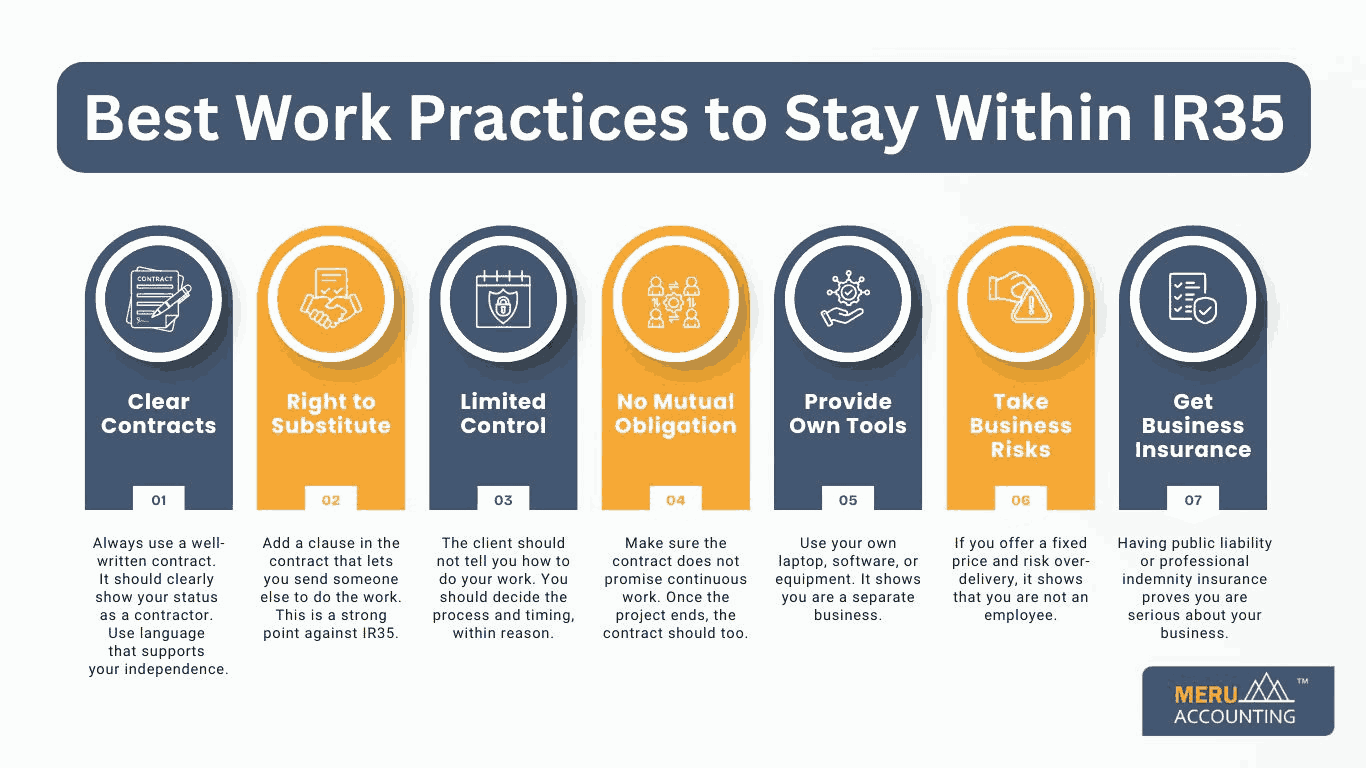

- 4 Best Work Practices to Stay Within IR35

- 4.1 1. Clear Contracts

- 4.2 2. Right to Substitute

- 4.3 3. Limited Control

- 4.4 4. No Mutual Obligation

- 4.5 5. Provide Own Tools

- 4.6 6. Take Business Risks

- 4.7 7. Get Business Insurance

- 5 How Clients Can Stay Compliant

- 6 Mistakes to Avoid

- 7 Benefits of Being Outside IR35

- 7.1 Conclusion

- 7.2 FAQs

keeping work practices inside of IR 35 for UK

Understanding and following IR35 is very important for businesses and contractors in the UK. The law is designed to stop tax avoidance through false self-employment. If a contractor works like an employee, then they should pay tax like one. This is the main idea behind the IR35 UK rules.

If you are a business hiring contractors or a freelancer working for a client, then knowing how to stay within IR35 is important. In this article, we will explain how to stay compliant, what practices to follow, and what mistakes to avoid.

What is IR35?

IR35 is a UK tax law. It checks if a contractor is really self-employed or working as an employee in disguise. Many people set up limited companies and offer their services to one client. They take benefits of tax savings while still working like a regular employee. The government created IR35 to stop this.

If you fall inside IR35, it means you are seen as an employee for tax. You must pay income tax and National Insurance like a normal worker. If you are outside IR35, then you are treated as a self-employed person. You can pay yourself through dividends and save some tax.

Why IR35 Compliance Matters

If you don’t follow the IR35 UK rules, it can lead to trouble. Here’s why compliance is important:

- You may have to pay back taxes for past years.

- HMRC can add penalties and interest.

- Your business or personal name can suffer.

- You may lose contracts or face legal problems.

To avoid these problems, it is best to follow the correct practices and check your status clearly.

How to Determine IR35 Status

Checking IR35 status is not always easy. It depends on how you work and what your contract says. The following are a few important points to consider:

1. Control

Who controls the work? If the client tells you when, where, and how to work, you may fall inside IR35.

2. Substitution

Can you send someone else to do the job for you? If yes, this shows you are a true business and may be outside IR35.

3. Mutual Obligation

Is the client required to give you work? Are you required to accept it? If yes, then it may be an employment-like relationship.

4. Financial Risk

Do you bear the risk if something goes wrong? Do you have your own insurance? If yes, you may be working outside IR35.

5. Equipment

Are you using your own tools or those provided by the client? Using your own tools may support your case for being outside IR35.

You can also use HMRC’s online CEST (Check Employment Status for Tax) tool. It gives a basic idea, but your working practices should always match the contract.

Best Work Practices to Stay Within IR35

Here are simple ways to make sure your working practices stay IR35 UK compliant:

1. Clear Contracts

Always use a well-written contract. It should clearly show your status as a contractor. Use language that supports your independence.

2. Right to Substitute

Add a clause in the contract that lets you send someone else to do the work. This is a strong point against IR35.

3. Limited Control

The client should not tell you how to do your work. You should decide the process and timing, within reason.

4. No Mutual Obligation

Make sure the contract does not promise continuous work. Once the project ends, the contract should too.

5. Provide Own Tools

Use your own laptop, software, or equipment. It shows you are a separate business.

6. Take Business Risks

If you offer a fixed price and risk over-delivery, it shows that you are not an employee.

7. Get Business Insurance

Having public liability or professional indemnity insurance proves you are serious about your business.

How Clients Can Stay Compliant

If you are a client hiring contractors, follow these tips:

- Provide a Status Determination Statement (SDS) for each contractor.

- Clearly state whether the contract is inside or outside IR35.

- Include the reasoning for the decision.

- Review contracts regularly and keep working practices in line.

- Don’t make blanket decisions. Check each case separately.

Mistakes to Avoid

Many people make simple mistakes that can cause trouble under IR35 UK. Here are a few:

- Using the same contract for all contractors.

- Not matching the contract with real work practices.

- Letting the client control all aspects of the work.

- Using company email or attending staff meetings like an employee.

- Staying with the same client for many years without changes.

These actions can make it look like employment. Always keep a line between employee behavior and contractor behavior.

Benefits of Being Outside IR35

Being outside IR35 has many key benefits for real contractors working through their own firm:

- It is easier to plan and handle taxes.

- More of the pay can come through dividends.

- Contractors have full control of their work and deals.

- There is more freedom to pick how, when, and where to work.

These perks only apply if one acts like a true contractor. To stay outside IR35 UK, it is key to stay clear of terms that look like a job role. Work style and contract must show that the business is free and not tied to the client’s rules.

Conclusion

Sometimes, IR35 status can be hard to figure out. In these situations, seeking expert advice is recommended. Speak to a tax consultant or legal advisor. They can assess both your contract and your work practices. Getting help early can save you from problems later.

Staying compliant with IR35 UK is not hard if you follow the rules. Always remember that the contract and working style must match. Keep your business separate from your clients, take responsibility, and maintain your independence.

Whether you are a contractor or a client, being clear and honest helps avoid trouble. With the right practices, you can stay out of risk and keep your work running smoothly.

If you need help, don’t wait for a problem to come. Get advice early and protect your income, your business, and your future. Accounts Junction offers expert guidance and contract reviews to help you stay IR35 compliant and avoid legal or tax issues. Our tailored support ensures peace of mind for both contractors and businesses.

FAQs

Q1: What is IR35?

IR35 is a UK law that checks if a contractor should be taxed as an employee or self-employed.

Q2: What does “inside IR35” mean?

It means you work like an employee and must pay regular income tax and National Insurance.

Q3: Can I be outside IR35?

Yes, if you work independently, have control, and take business risks, you may be outside IR35.

Q4: What is SDS in IR35?

It’s a Status Determination Statement. It shows if the contract is inside or outside IR35 with reasons.

Q5: Can I use HMRC’s CEST tool to check my status?

Yes, it is free and can help, but your actual working pattern matters more.

Q6: Do clients need to review IR35 regularly?

Yes, if contracts or roles change, clients must reassess the IR35 status.

Q7: Is it illegal to be inside IR35?

No, but if you are inside IR35, you must pay taxes like an employee.