Table of Contents

- 1 What is the Accounts Payable Process?

- 2 What are Some Payables Management Tips to Improve Accounts Payable?

- 2.1 1. Regular Reviewing of Data

- 2.2 2. Make a Proper System for the Payable Process

- 2.3 3. Prioritize the Invoices

- 2.4 4. Check for Duplicate Payments

- 2.5 5. Grab the Early Payments Discount

- 2.6 6. Tracking Disputes and Resolving Them

- 2.7 7. Reconciling Accounts Regularly

- 3 Additional Accounts Payable Tips and Insights for 2025

- 3.1 Automate Where Possible

- 3.2 Integrate With Your Accounting Software

- 3.3 Train Your Staff

- 3.4 Centralized Vendor Communication

- 4 How to Handle the Accounts Payable Process

- 4.1 Receive and Record the Invoice

- 4.2 Verify the Invoice Details

- 4.3 Get Internal Approval

- 4.4 Schedule the Payment

- 4.5 Process the Payment

- 4.6 Record the Transaction

- 5 Common Challenges in Managing Accounts Payable

- 6 Benefits of an Efficient Accounts Payable Process

- 7 Best Accounts Payable Tips for Small Businesses

- 7.1 Conclusion

- 7.2 FAQs

How Can You Manage Accounts Payable Process With Accounts Payable Management Tips?

Managing accounts payable is essential for every business. It helps you maintain good vendor relationships, stay financially healthy, and avoid late payments. By following the right steps and applying effective accounts payable management tips, you can make the entire process more efficient and less stressful. Although there are many factors that contribute to the growth of any business, accounts payable is one of the most important among them. Accounts payable is simply the amount a business organization owes to its service providers, creditors, and suppliers.

A few years back, accounts payable was not taken as a separate entity, nor was it given more prominence. Studies show that efficient accounts payable management is key to business success. It plays a big role in the growth of many businesses.

Many businesses have experienced inefficiency in their cash flow due to improper accounts payable handling. However, with proper payables management, businesses have made on-time payments with efficient cash flow management.

It is always found that managing accounts payable has been a challenge for many businesses. In 2025, with automation and structured planning, businesses can follow useful accounts payable tips to stay ahead. We'll also share useful accounts payable management tips and show how you can start improving accounts payable process step by step.

What is the Accounts Payable Process?

The accounts payable process involves everything from receiving an invoice to making a payment. It covers verifying the bill, getting approval, and recording the payment correctly. If not managed well, unpaid bills can pile up. This may lead to penalties, broken vendor trust, and poor cash flow. Managing the process properly keeps your finances organized and vendors satisfied.

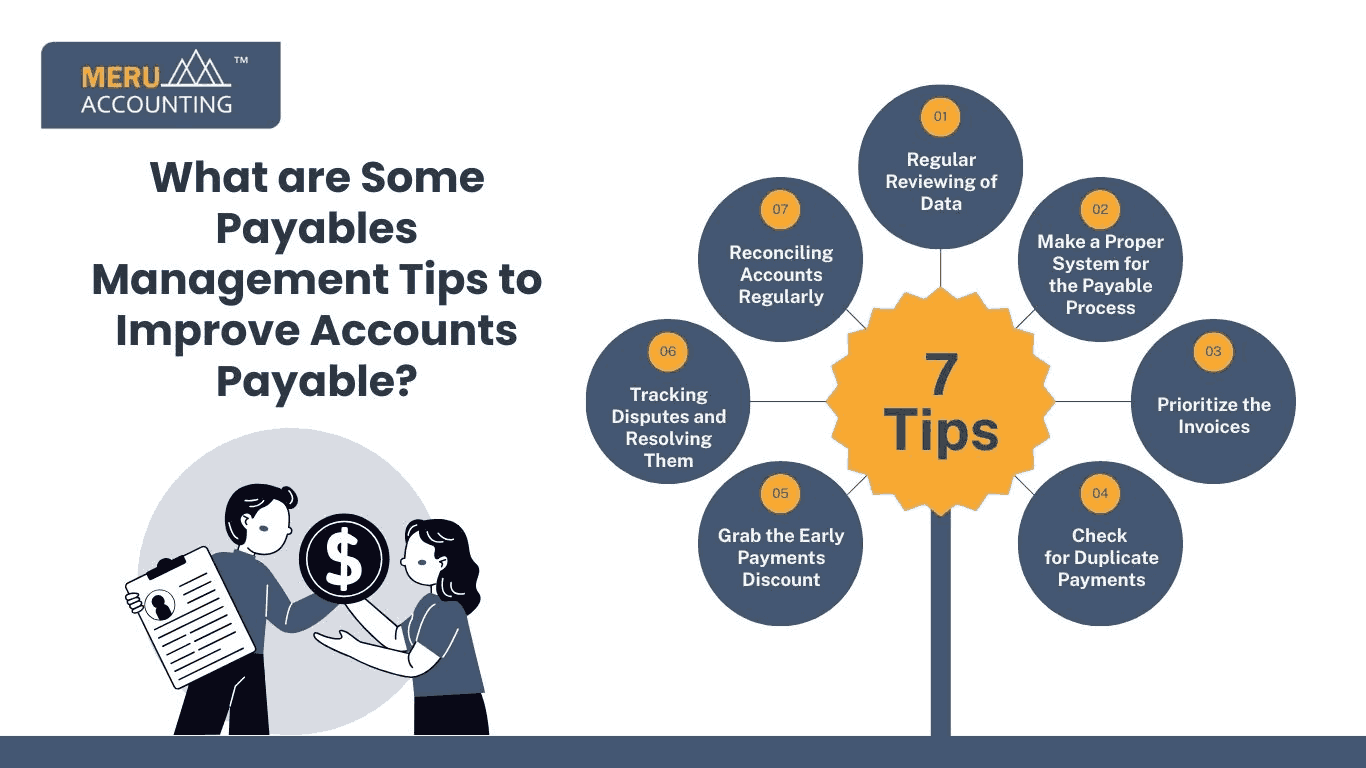

What are Some Payables Management Tips to Improve Accounts Payable?

In 2025, use the right methods to improve the accounts payable process. This can help keep your business financially strong.

Here are some of the important payables management techniques to improve it:

1. Regular Reviewing of Data

You cannot remain uninformed when you have just closed for the repayment of your payables. So, regularly review the data and all the latest dates for your payables.

This will ensure that all the payments are made on time and there is efficient payable management. It's one of the basic yet effective accounts payable tips that helps avoid delays and penalties.

2. Make a Proper System for the Payable Process

Making a proper system for the payable process is one of the most important accounts payable management tips. You can use a spreadsheet or relevant software that can automate most of the processes in accounts payable.

It must give you proper notifications when the payment dates come near. Such systems help in improving the accounts payable process and reducing manual errors.

3. Prioritize the Invoices

When you have several invoices to be processed regularly, one of the best ways is to prioritize them. This will reduce confusion about which payment to make first.

It also ensures timely payments and proper accounts payable management. Always follow a consistent invoice approval workflow to avoid delays.

4. Check for Duplicate Payments

Duplicate payments are one of the common mistakes that occur during invoice processing. This impacts the accounts payable process and affects vendor relationships.

So, make a proper process to avoid duplicate payments and ensure better cash flow. Double-check records before making any payment to ensure data accuracy.

5. Grab the Early Payments Discount

Every vendor wants to get the payment for their invoice quickly. Several of them also offer discounts for early payments.

This will help you make payments at a discount and within the given duration. It's a smart accounts payable tip that saves money and builds better vendor relationships.

6. Tracking Disputes and Resolving Them

Taking all invoice-related disputes as a priority is one of the important ways of properly managing accounts payable. This will avoid further hassles and keep you on the right side of the matter.

It also maintains the organization’s credibility and trust with vendors. Always have a team or person assigned to handle disputes quickly.

7. Reconciling Accounts Regularly

One of the top accounts payable management Tips for any organization is proper reconciliation of accounts regularly. This avoids errors while making payments and ensures vendor balances are accurate.

A regular check on your books can prevent fraud and mistakes from slipping through.

Additional Accounts Payable Tips and Insights for 2025

To make your accounts payable process more effective in 2025, consider these extra insights:

Automate Where Possible

Manual data entry leads to human error. Use automation tools that extract invoice data, track approval status, and schedule payments. Using tools is a smart way to make the accounts payable process better.

Integrate With Your Accounting Software

Link your accounts payable system to your accounting software. It cuts down double entry and keeps your data accurate.

Train Your Staff

Keep your team trained regularly to stay current with process changes, software tools, and rules. A skilled team helps run accounts payable with ease.

Centralized Vendor Communication

Maintain one communication channel for all vendor queries and confirmations. This avoids misunderstandings and helps in faster dispute resolution.

How to Handle the Accounts Payable Process

Receive and Record the Invoice

When a seller sends a bill, check if it matches the order. Then record it in your system with the correct date and amount. This ensures no bill gets missed or paid twice.

Verify the Invoice Details

Review the invoice to confirm it is accurate. Check if the quantity, price, and terms match what was ordered. Only proceed if everything looks correct.

Get Internal Approval

Before making a payment, get approval from the right person. Assign approval roles based on invoice amounts. Among the many accounts payable management tips, this one stands out as highly useful.

Schedule the Payment

Once approved, schedule the payment according to the due date. If early payment discounts are offered, plan to use them. Timely scheduling is key in improving the accounts payable process.

Process the Payment

Pay using your chosen method—bank transfer, check, or online. Always check if the vendor got the payment.

Record the Transaction

Update your books to show the payment has been made. Save the invoice and the proof of payment for future reference or audits.

Common Challenges in Managing Accounts Payable

Even with a strong process, many companies face issues like:

- Late payments due to approval delays

- Disorganized records and lost invoices

- Duplicate or incorrect payments

- Poor visibility on outstanding liabilities

You can follow accounts payable management tips such as using automation and doing regular checks. These steps can reduce common problems.

Benefits of an Efficient Accounts Payable Process

Improving your accounts payable process helps your business save time and avoid errors.

- Ensures timely payments

- Improves vendor relationships

- Helps maintain a strong credit score

- Prevents penalties and late fees

- Increases financial visibility and planning

- Saves money through early payment discounts

Best Accounts Payable Tips for Small Businesses

Small businesses need simpler methods. Here are tips made just for you:

- Use basic accounting software

- Negotiate better payment terms

- Review bills weekly

- Set alerts for due dates

- Avoid cash payments unless recorded properly

By following these small steps, you’ll be improving accounts payable process easily.

Conclusion

If handling accounts payable is becoming complicated, it’s wise to outsource it. Outsourcing gives you expert guidance, automation tools, and faster processing.

Accounts Junction is one of the better options for outsourcing accounts payable management. The expert team uses proper payables management tips to improve accounts payable. They automate most processes to bring efficiency. Whether you use software, automate tasks, or create better internal rules, all of these lead to improving accounts payable process and achieving peace of mind.

Accounts Junction is a well-known accounting service provider serving clients across the globe. Our team knows that correct records and timely payments is important.

FAQs

1. Why is accounts payable management important?

It helps maintain cash flow, avoid penalties, and build better vendor relationships.

2. What are common accounts payable mistakes?

Late payments, wrong invoices, and data errors are the most common.

3. How can automation help in payables?

Automation helps reduce mistakes, process payments faster, and reminds you when bills are due.

4. What’s an early payment discount?

Vendors offer a discount if you pay before the due date.

5. Can I outsource my accounts payable process?

Yes, outsourcing to firms like Accounts Junction ensures faster and more accurate processing.