How to Choose the Best Financial Software for Your Business?

Running a business needs proper financial control. Without it, your business may face losses or confusion. Choosing the best financial software helps manage all money tasks easily. This includes tracking income, expenses, and creating reports.

There are many software tools in the market. But picking the right one can be hard. In this guide, we will help you select the best business financial software that fits your needs.

Why Financial Software Is Important

Financial software makes money management easy. It helps you keep records, generate reports, and save time. You no longer need to manage everything manually. This reduces errors.

It also helps with:

- Budget planning

- Invoicing

- Tax calculation

- Expense tracking

- Payroll management

The best financial tracking software ensures all tasks are completed efficiently. You get a clear view of your money anytime.

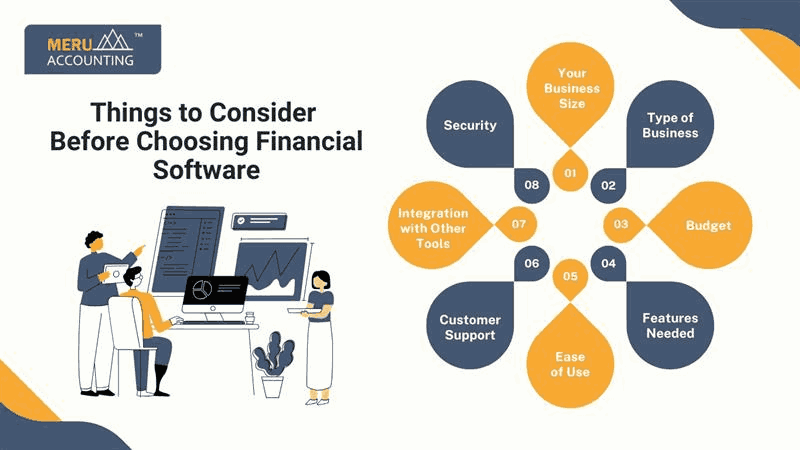

Things to Consider Before Choosing Financial Software

Before you buy any software, consider these points:

1. Your Business Size

Small businesses may not need complex software. Big companies may need more features. Choose as per your business size.

2. Type of Business

A retail store and a service business need different features. Pick one that matches your type of work.

3. Budget

Software comes in many price ranges. Some are free with limited features. Some are paid with full tools. Always check your budget first.

4. Features Needed

Make a list of what you want. Some features may include:

- Billing and invoicing

- Cash flow tracking

- Profit and loss reporting

- Inventory management

You should select the best financial tracking software that has the above features.

5. Ease of Use

The software should be easy to use. You should not need a tech expert. A clean dashboard and simple menu are good signs.

6. Customer Support

You may need help with software setup or bugs. Good support matters. Choose one with 24/7 support or at least a fast response.

7. Integration with Other Tools

The software must work well with your bank, payroll tools, and CRM. It saves time and avoids data entry.

8. Security

You will store financial data in the software. Make sure it has good security, like encryption and backup.

Top Features to Look For

The best financial software should offer key features to help you grow your business. Here are some of them:

1. Automated Bookkeeping

This saves time and reduces errors. Your daily transactions are recorded without manual entry.

2. Real-Time Reporting

Get reports at any time. Know your profit, loss, and cash flow in real-time.

3. Tax Calculation

It should help you calculate taxes and even file returns. This avoids late fees or mistakes.

4. Multi-User Access

If your business has a team, go for software that allows access to multiple users. Set roles for each user to protect data.

5. Mobile Access

The best business financial software allows mobile access. You can check reports or send invoices anytime.

Benefits of Using the Best Financial Software

Using the right software helps in many ways:

- Saves Time: No need for manual entries. Everything is automated.

- Avoids Errors: Fewer human error means better records.

- Better Decisions: You can quickly view your financial data at any time.

- Improved Cash Flow: Know when to collect and pay.

- Easy Tax Filing: Auto reports make tax time simple.

The best financial tracking software also gives alerts on due bills, low stock, or budget limits.

Top 5 Popular Financial Software for Businesses

Here are some good software options you can explore:

1. QuickBooks

Ideal for small to medium businesses. It is easy to use and has many features.

2. Xero

Good for businesses needing a simple UI. Cloud-based with strong reporting.

3. Zoho Books

Affordable and feature-rich. Suitable for growing businesses.

4. FreshBooks

Best for freelancers and service providers. Easy invoicing and tracking.

5. Wave

Free option for very small businesses. Basic features with good value.

These are examples of the best financial software options in the market.

Mistakes to Avoid While Choosing Software

- Don’t pick the most expensive one, thinking it's the best.

- Avoid software with too many features you don’t need

- Don’t forget to check reviews.

- Never skip the free trial if available.

- Don’t ignore update and support policies.

How to Start Using the Chosen Software

Here is a simple step-by-step guide:

- Choose and Buy: Pick the right software as per your needs.

- Setup and Install: Install or sign up online.

- Connect Bank: Add your bank and cards for tracking.

- Add Data: Enter customers, vendors, and products.

- Start Using: Begin tracking expenses and sending invoices.

You’re now ready to manage money like a pro using the best business financial software.

Strategies to Maximize the Benefits of Financial Software

- Use it daily to stay updated.

- Set alerts for due payments.

- Reconcile bank statements monthly.

- Take help from an accountant when needed

- Keep software updated for security.

Conclusion

Choosing the best financial software takes time. But it is worth it. Good software helps you grow and manage your business. Always pick software that fits your needs, is easy to use, and gives real value.

The best business financial software can transform the way you manage your finances. With the right tool, you stay organized and stress-free. Choose wisely, and you’ll be set for success.

Remember, the best financial tracking software is not just about cost. It's about ease, support, and features that matter to your business.

FAQs

1. What is financial software?

Financial software helps manage business money, track expenses, and create reports.

2. Is free financial software good?

Yes, for small needs. But paid software gives more features and better support.

3. Can I use one software for billing and payroll?

Yes, many tools offer both billing and payroll in one place.

4. Do I need a tech expert to use it?

No. Most tools are simple and made for non-tech users.

5. What is the best software for a small business?

QuickBooks, Zoho Books, and Wave are good for small businesses.

6. Is it safe to store data on financial software?

Yes. Trusted software uses encryption and cloud backup.

7. Can I switch software later?

Yes, but moving data may take time. Choose carefully at the start.