How Taxidermists Can Simplify Their Accounting – A Guide to Taxidermists Accounting

Taxidermy is a special job that mixes art and science. Along with creativity, taxidermists accounting responsibilities are an essential part of running a business. Taxidermists work hard to make animals look real and lifelike after they have passed away. Their job needs patience, skill, and a good eye for detail. But besides their creative work, taxidermists also need to take care of money matters. This includes keeping track of how much they earn and spend.

Many taxidermists enjoy their craft but feel stressed when it comes to accounting. Paperwork, bills, and taxes can be confusing. Still, handling money properly is important for running a successful business. With the right steps and tools, taxidermists can make accounting easier and have more time to focus on their work.

What Is Accounting for Taxidermists?

Accounting means keeping track of money, how much comes in and how much goes out. For taxidermists, this includes:

- Writing down payments from customers

- Keeping track of costs for materials like hides, chemicals, and foam

- Saving receipts for tools, rent, or delivery services

- Figuring out profits and paying taxes

Taxidermists bookkeeping is all about writing down these money details clearly and neatly. This helps taxidermists see how their business is doing, plan better, and avoid trouble with taxes. Whether they work alone or run a shop, every taxidermist needs to understand the basics of accounting.

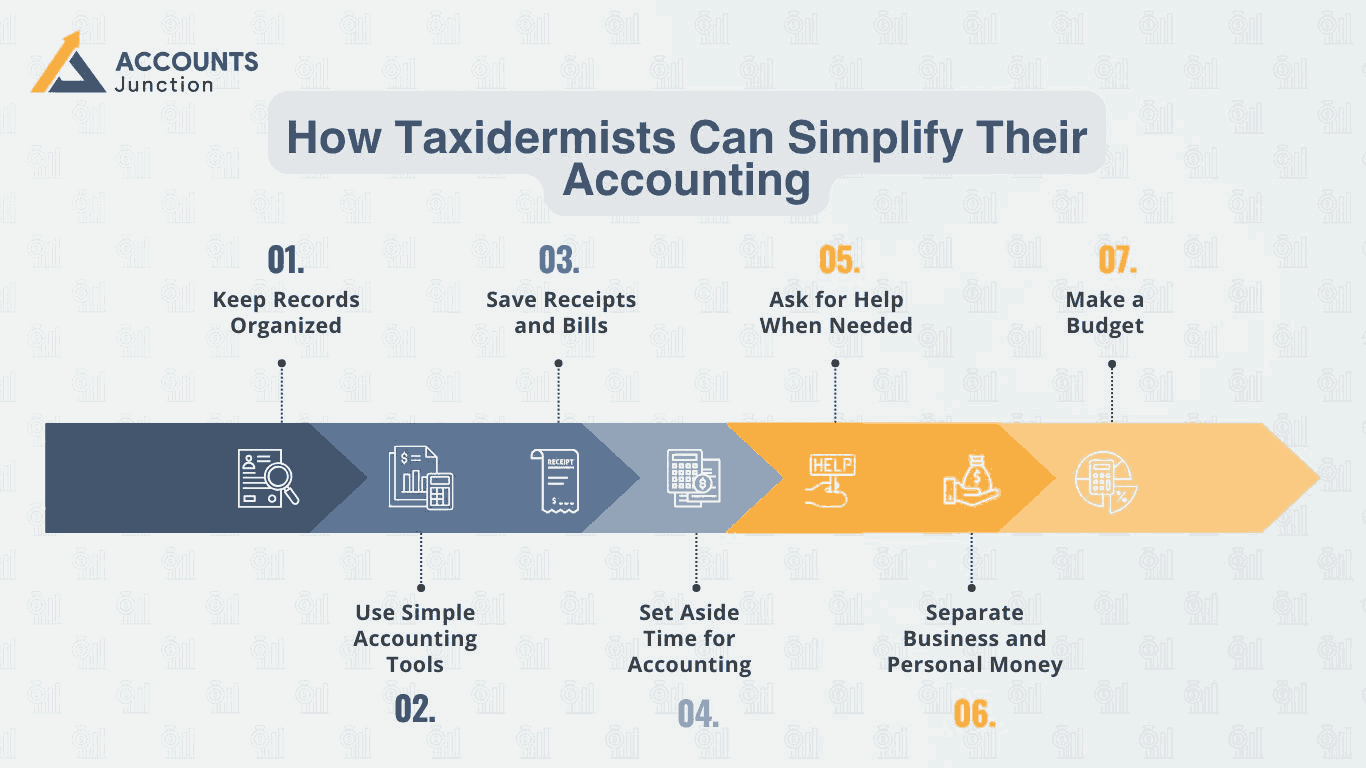

How Can Taxidermists Make Accounting Easier?

Here are some easy ways to make taxidermists accounting simpler and less stressful:

1. Keep Records Organized

- Keep all records in one place. This includes receipts, bills, and payment slips. You can use folders, boxes, or digital files. Organized records help with taxidermists bookkeeping and save time during tax season.

2. Use Simple Accounting Tools

- There are many easy-to-use tools like QuickBooks, Wave, or even Excel. These programs help track income and expenses. Some can even scan receipts and do the math for you.

3. Save Receipts and Bills

- Always keep receipts when you buy supplies or tools. You’ll need these when you file taxes or check your spending. You can keep paper copies or take pictures and save them in folders on your computer.

4. Set Aside Time for Accounting

- Pick one day each week or month to update your records. This way, you won’t forget things or have a big mess later. Regular updates make taxidermists bookkeeping much easier.

5. Ask for Help When Needed

- Accounting can be tricky. If you feel stuck, it’s okay to ask a professional. An accountant who understands taxidermists accounting can help you do things right and save money.

6. Separate Business and Personal Money

- Use a different bank account for your business. Don’t mix it with your personal money. This makes it clear how much you earn and spend on your business.

7. Make a Budget

- A budget is a plan for your money and decides how much you will spend on materials, tools, and other costs. Budgeting helps you avoid overspending and make better choices.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Common Challenges in Taxidermists Bookkeeping

Even with good tools, taxidermists may still face problems.

1. Tracking Cash Payments

Some customers pay in cash. If these payments aren’t written down, it can lead to problems like underreporting income.

Solution: Write down every payment, even cash. Keep a notebook or app to record the amount, date, and customer name.

2. Knowing What’s Tax-Deductible

Not every item you buy for your business can be claimed on your taxes. But some can! These are called deductible expenses.

Examples include:

- Tanning chemicals

- Taxidermy mannequins

- Freezers and storage tools

- Travel to shows or for picking up animals

Solution: Ask an accountant which items can be deducted. By using this you will stay within the rules.

3. Seasonal Income

Taxidermy work often goes up during hunting season or holidays. This means you may earn more in some months and less in others.

This can make it hard to:

- Make a budget

- Pay estimated taxes

- Decide when to buy tools

Solution: Track your income monthly. With help from a bookkeeper, you can plan better and avoid surprises.

4. Inventory Management

Taxidermists need to keep track of materials, unfinished work, and finished pieces. If things are not recorded, it’s easy to forget or misplace items.

Solution: Use a simple list or inventory tool to track what you have, what’s being worked on, and what’s done.

5. Keeping Up with Tax Deadlines

Missing tax deadlines can lead to fees or trouble with the IRS. Taxidermists who are self-employed must:

- File taxes quarterly

- Send in business tax returns

- Handle state tax forms too

Solution: Mark deadlines on a calendar. Better yet, hire an accountant to help you meet them on time.

Conclusion

Taxidermy is a creative and detailed job. But to do it well, you need to take care of your business too. That means keeping track of money and saving receipts. With it you can pay taxes on time. It may seem hard at first, but with the right tools and a little help, it gets easier.

Taxidermists accounting is not just about numbers. It’s about making sure your business is healthy and strong. That way, you can keep preserving wildlife and creating amazing mounts.

At Accounts Junction, we understand the unique needs of taxidermists. We offer simple and friendly bookkeeping services made just for you. Our experts handle taxes to organize your money. We’re here to help you grow your business with less stress. Let us handle the books, so you can focus on your craft.

FAQs

1. What’s the best accounting software for taxidermists?

- QuickBooks, Wave, or Excel are good choices. An accountant can help you choose what’s best for your business.

2. Do I need to charge sales tax?

- It depends on where you live. Some states require tax on services. An accountant can check the rules in your area.

3. Should I keep paper or digital receipts?

- Either is fine. Just make sure they are neat and easy to find.

4. Can I deduct part of my home for tax purposes?

- Yes, if you use part of your home only for work. This is called the home office deduction.

5. How often should I update my records?

- Weekly or monthly is best. This keeps everything organized and ready for tax time.