Table of Contents

- 1 What are common sole trader bookkeeping mistakes?

- 1.1 1. Poor handling of accounts receivable

- 1.2 2. Improper bank reconciliation

- 1.3 3. Mixing business finances and personal finances

- 1.4 4. Not restoring the receipts

- 1.5 5. Not using proper accounting software

- 2 Importance of Accurate Bookkeeping for Sole Traders

- 2.1 Tax Compliance

- 2.2 Expense Tracking

- 2.3 Financial Planning

- 2.4 Audit Preparation

- 2.5 Time Management

- 2.6 Business Insights

- 3 Key Tips to Improve Your Sole Trader Bookkeeping

- 3.1 Keep It Simple

- 3.2 Stay Consistent

- 3.3 Know Your Tax Dates

- 3.4 Reconcile Your Bank Accounts

- 3.5 Review Your Books Regularly

- 3.5.1 Conclusion

- 3.5.2 FAQs

5 Sole Trader Bookkeeping Mistakes to Avoid

As a sole trader, you might be busy with several important business activities, tending to neglect bookkeeping. It is observed that there are some common sole trader bookkeeping mistakes. They often occur and later become a cause of many complications. If the staff is not proficient, then there can be repetitive bookkeeping mistakes that can impact the accounting.

However, it can be very problematic for accounting and overall business if the bookkeeping is not done properly. If you want to maintain steady finances and proper growth of the business, then you have to bring accuracy to bookkeeping.

It would be worth looking at some of the common mistakes that are observed in sole traders' bookkeeping activities. In this blog, we’ll explore the common sole trader bookkeeping mistakes to avoid and how you can keep your finances clean and clear.

What are common sole trader bookkeeping mistakes?

If the bookkeeping activities of a sole trader are not done properly, then there can be some common mistakes. Mixing personal and business expenses is one of the most common bookkeeping mistakes. It makes your records unclear and harder to manage.

Here are some common bookkeeping mistakes observed in sole traders:

1. Poor handling of accounts receivable

Accounts receivable are very important to ensure that a business receives its money properly over a given period.

Sole traders are observed to pay less attention and priority to the receivables that they are supposed to receive. This impacts the cash inflow, causing a lower cost despite business growth.

2. Improper bank reconciliation

Proper checking of the bank statements against the accounting books is essential. It ensures that there is no fraud and no missing financial information. Not matching your bank records with your books is also listed under common bookkeeping mistakes. It can hide problems that go unnoticed for months.

Sole proprietors tend to have improper bank reconciliation. This later causes a lot of mess-ups in the accounting books.

3. Mixing business finances and personal finances

Sole proprietors tend to neglect the line between business finances and personal finances. It might look fine when the business is small and handled by sole traders.

However, if this is neglected, it becomes difficult to demarcate the cost and revenue in the business. It also becomes difficult during tax calculations during tax filing. Getting any credit or loan also becomes difficult when both finances are not demarcated properly.

4. Not restoring the receipts

Receipts are very important for bookkeeping they help to calculate the cost incurred. It also helps to claim the tax deducted and pay fewer taxes wherever applicable in the business. Sole traders commonly neglect the restoration of all the important receipts, which then further causes a lot of mess and impacts their profits. Not saving receipts is among the common bookkeeping mistakes that lead to missing expense details and tax errors.

5. Not using proper accounting software

This is one of the common sole trader bookkeeping mistakes where they tend not to understand the importance of accounting software. They consider their business too small to use accounting software.

However, accounting software minimizes the time and effort of every business for bookkeeping, irrespective of its size. Many bookkeeping activities can be automated with software to bring accuracy.

These are some of the common bookkeeping mistakes observed among sole traders. If you could avoid these common mistakes, then you could achieve a lot of efficiency in bookkeeping.

Being a sole trader, it is advisable that you get totally relieved from bookkeeping tasks by simply outsourcing bookkeeping services for traders. You can outsource this task to any expert bookkeeping services providing agency.

Importance of Accurate Bookkeeping for Sole Traders

Accurate bookkeeping is vital for managing a sole trader business effectively. It helps keep your financial records clean and supports smarter decision-making.

Tax Compliance

- Helps avoid late filing penalties and stay compliant with tax rules.

- Keeps you ready with correct figures during tax season.

Expense Tracking

- Ensures all income and expenses are recorded correctly.

- Helps claim all eligible deductions and reduces mistakes.

Financial Planning

- Makes it easier to plan budgets and control cash flow.

- Helps you prepare for future growth or changes.

Audit Preparation

- Keeps your business ready for audits or funding reviews.

- Builds confidence with banks, investors, and tax authorities.

Time Management

- Saves time by reducing admin work and confusion.

- Makes business operations smoother with easy access to data.

Business Insights

- Shows which areas are doing well or need attention.

- Helps you make informed business decisions regularly.

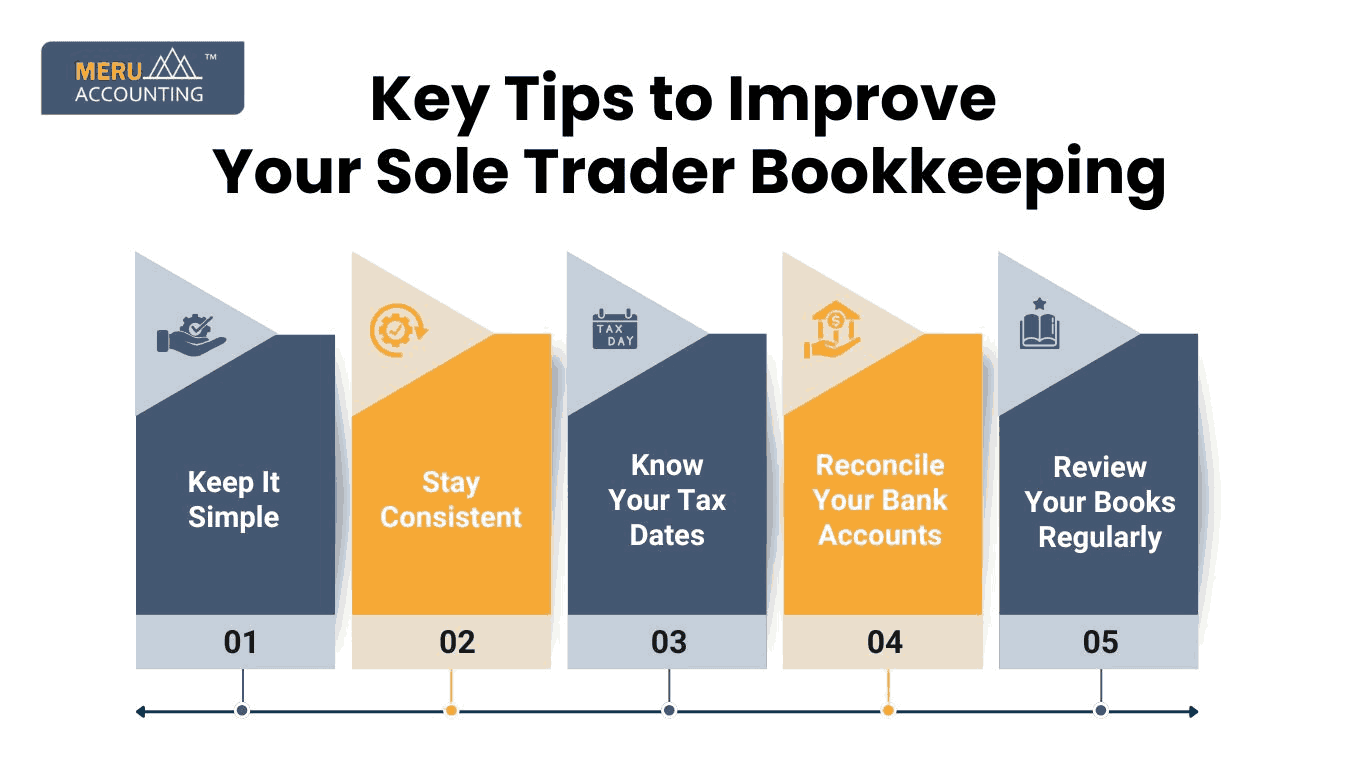

Key Tips to Improve Your Sole Trader Bookkeeping

Keep It Simple

- Use simple tools if you are not tech-savvy. Even a clean spreadsheet is better than no records.

- Start with basic templates and build your system gradually as your business grows.

Stay Consistent

- Make bookkeeping a weekly habit. Consistency helps you avoid errors.

- Set a fixed time each week to update your records to stay organized.

Know Your Tax Dates

- Late submissions lead to penalties. Mark important tax dates in your calendar.

- Set reminders in advance to prepare and file all documents on time.

Reconcile Your Bank Accounts

- Always match your records with bank statements. This finds mistakes early.

- It also helps spot missing entries or duplicate transactions quickly.

Review Your Books Regularly

- Check your income and expenses each month. It helps you plan better.

- Monthly reviews help identify trends and improve financial decisions.

Conclusion

Avoiding these common sole trader bookkeeping mistakes can help you maintain accurate records and avoid costly errors. At Accounts Junction, we specialize in helping sole traders streamline their bookkeeping with expert guidance and reliable support. Our team ensures your books stay up-to-date, compliant, and stress-free. Let us handle your sole trader bookkeeping while you focus on growing your business.

FAQs

Q1: What is sole trader bookkeeping?

It is the process of recording business income and expenses for sole traders.

Q2: Can I do my own bookkeeping as a sole trader?

Yes, but using tools or getting help makes it easier and safer.

Q3: Why should I separate personal and business finances?

It keeps your records clear and makes tax filing simple.

Q4: How often should I update my books?

Ideally, every week, but at least once a month.

Q5: What software is good for sole trader bookkeeping?

Options like Xero, QuickBooks, or simple spreadsheets work well.

Q6: What happens if I forget to track a small expense?

You may miss a tax deduction and your profit report will be off.

Q7: Is it necessary to back up my bookkeeping data?

Yes, to avoid data loss and protect important records.