Why is accounts receivable reconciliation important?

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

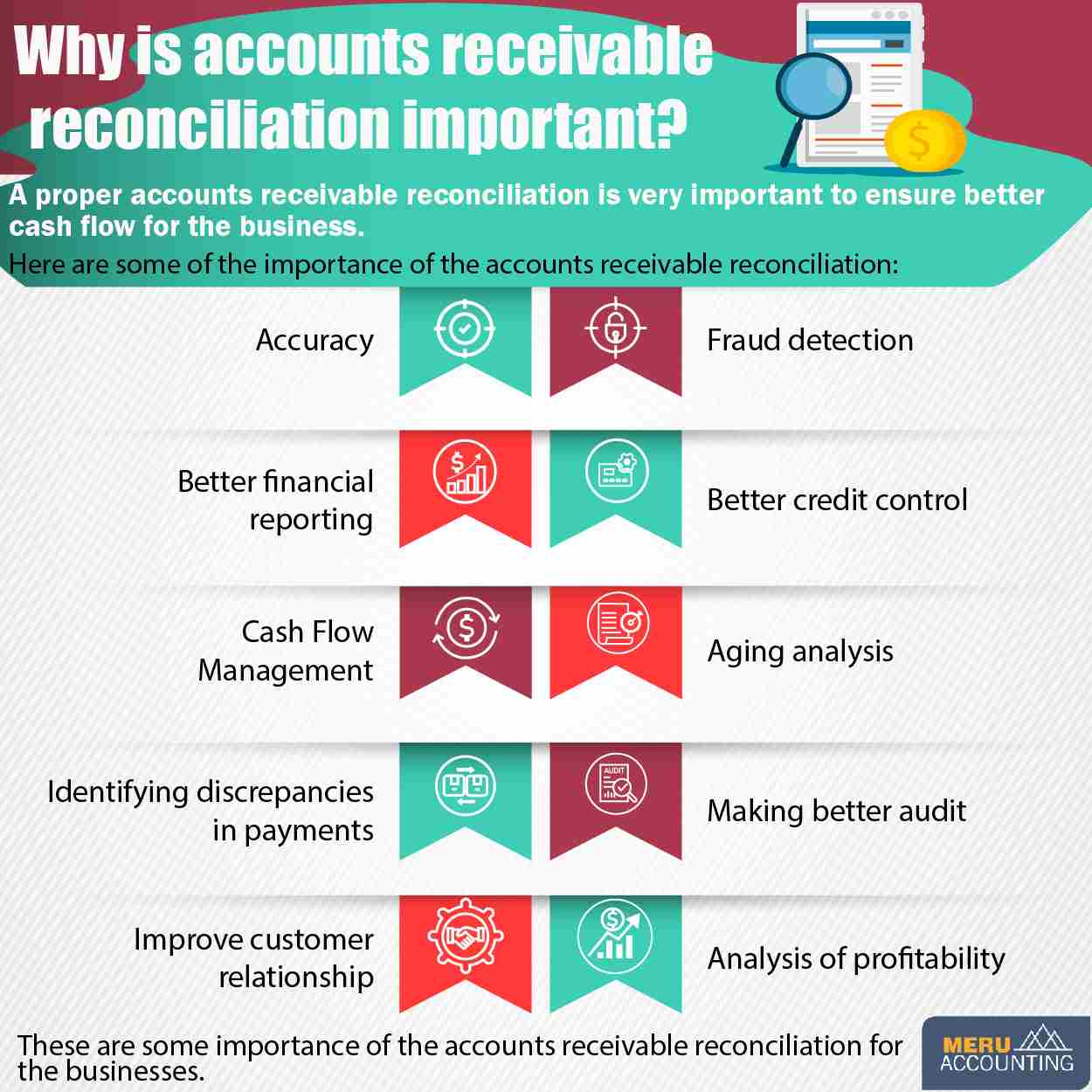

Cash Flow Management

- Reconciliation helps you understand when you can expect to receive payments, aiding in cash flow planning. This can improve the cash flow management of the organization.

Identifying discrepancies in payments

- It helps identify discrepancies, such as missed payments or errors in invoicing. It can be further rectified promptly.

Improve customer relationship

- Prompt resolution of discrepancies maintains good customer relationships by demonstrating your commitment to accuracy and fairness. It builds trust among the customers.

Fraud detection

- Reconciliation can uncover irregularities or signs of fraud in accounts receivable, protecting your business from financial losses.

Better credit control

- Monitoring accounts receivable assists in making informed decisions about extending credit to customers. Further, it is also easier to set the credit limit.

Aging analysis

- It helps in creating aging reports, which classify outstanding invoices by how long they've been outstanding, enabling you to prioritize collection efforts.

Making better audit

- Well-documented and reconciled accounts receivable make financial audits smoother and less prone to errors.

Analysis of profitability

- Reconciliation helps you determine the profitability of different customers or segments, aiding in strategic planning.

Accounts receivable reconciliation is essential for maintaining financial accuracy, managing cash flow, fostering healthy customer relationships, and making informed business decisions.

The above mentioned importance of account reconciliation clearly shows that it helps in improving the cash flow as well as revenue of the business.

If you struggle to do account reconciliation in your business, then outsource it to the experts. Accounts Junction provides accounts receivable reconciliation services for businesses. Their team has experts who can magnificently do the comparing and matching in the reconciliation for accounts receivable. Accounts Junction is a proficient accounts receivable reconciliation services company around the world.

FAQs

1. How does AR reconciliation help find missing cash?

- It tracks due funds from each client. You can spot gaps in bills or late pay fast. This shows where your cash flow slows and helps fix it.

2. What issues can AR reconciliation expose in invoices?

- It points out double bills, wrong sums, or missed notes of funds due. Fixing them fast avoids wrong reports and lost income.

3. How can AR reconciliation help boost client trust?

- Quick fixes on errors show that you value fair deals. This builds trust and keeps your client ties firm.

4. Why do late AR checks hurt cash flow?

- Late checks mean you miss the due funds for a long. This slows cash flow and makes it hard to plan pay and spend right.

5. Can AR reconciliation stop fraud in my books?

- Yes. You can catch fake ads or false client deals fast. This stops fraud loss and keeps your books clean.

6. How often should a small firm run AR checks?

- Most small firms do it each month. Firms with more deals may check each week to keep data clear and stop late payments.

7. How does AR reconciliation help in audits?

- When AR data is clean, audits take less time. You avoid last-minute fixes and cut audit costs.

8. What tools can make AR reconciliation easy for owners?

- Cloud apps or linked AR tools track dues and flag errors fast. They cut manual work and save time for small teams.

Every business intends to achieve better cash flow management to ensure financial growth. However, despite making better sales and growth some organizations experience relatively less cash flow.

They find it difficult to understand the money where they are missing. Here, they miss on doing account reconciliation efficiently, making it difficult for them to collect the cash they are supposed to get.

So, making a proper matching process of reconciliation of the accounts receivable is necessary. A proper accounts receivable reconciliation can help to improve the cash flow and revenue of the business.

This guide will help you know more about the importance of reconciliation in accounts receivables.

What are accounts receivable reconciliation?

Accounts receivable reconciliation is a financial process that involves comparing and matching the records of a company's accounts receivable (AR) to other relevant financial documentation to ensure accuracy and consistency.

Accounts receivable refers to the money that is owed to a business by its customers or clients for products or services that have been provided on credit.

By comparing different sources of financial information, discrepancies or errors can be identified. These discrepancies might include duplicate invoices, unapplied payments, or missing records.

What is the importance of accounts receivable reconciliation?

Here are some importance of account reconciliation for the business:

Accuracy

- Reconciliation ensures that the accounts receivable balances in your books are accurate. This is done by preventing overstatements or understatements.

Better financial reporting

- Accurate accounts receivable balances are crucial for producing accurate financial statements. They are extremely essential for decision-making and compliance.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Cash Flow Management

- Reconciliation helps you understand when you can expect to receive payments, aiding in cash flow planning. This can improve the cash flow management of the organization.

Identifying discrepancies in payments

- It helps identify discrepancies, such as missed payments or errors in invoicing. It can be further rectified promptly.

Improve customer relationship

- Prompt resolution of discrepancies maintains good customer relationships by demonstrating your commitment to accuracy and fairness. It builds trust among the customers.

Fraud detection

- Reconciliation can uncover irregularities or signs of fraud in accounts receivable, protecting your business from financial losses.

Better credit control

- Monitoring accounts receivable assists in making informed decisions about extending credit to customers. Further, it is also easier to set the credit limit.

Aging analysis

- It helps in creating aging reports, which classify outstanding invoices by how long they've been outstanding, enabling you to prioritize collection efforts.

Making better audit

- Well-documented and reconciled accounts receivable make financial audits smoother and less prone to errors.

Analysis of profitability

- Reconciliation helps you determine the profitability of different customers or segments, aiding in strategic planning.

Accounts receivable reconciliation is essential for maintaining financial accuracy, managing cash flow, fostering healthy customer relationships, and making informed business decisions.

The above mentioned importance of account reconciliation clearly shows that it helps in improving the cash flow as well as revenue of the business.

If you struggle to do account reconciliation in your business, then outsource it to the experts. Accounts Junction provides accounts receivable reconciliation services for businesses. Their team has experts who can magnificently do the comparing and matching in the reconciliation for accounts receivable. Accounts Junction is a proficient accounts receivable reconciliation services company around the world.

FAQs

1. How does AR reconciliation help find missing cash?

- It tracks due funds from each client. You can spot gaps in bills or late pay fast. This shows where your cash flow slows and helps fix it.

2. What issues can AR reconciliation expose in invoices?

- It points out double bills, wrong sums, or missed notes of funds due. Fixing them fast avoids wrong reports and lost income.

3. How can AR reconciliation help boost client trust?

- Quick fixes on errors show that you value fair deals. This builds trust and keeps your client ties firm.

4. Why do late AR checks hurt cash flow?

- Late checks mean you miss the due funds for a long. This slows cash flow and makes it hard to plan pay and spend right.

5. Can AR reconciliation stop fraud in my books?

- Yes. You can catch fake ads or false client deals fast. This stops fraud loss and keeps your books clean.

6. How often should a small firm run AR checks?

- Most small firms do it each month. Firms with more deals may check each week to keep data clear and stop late payments.

7. How does AR reconciliation help in audits?

- When AR data is clean, audits take less time. You avoid last-minute fixes and cut audit costs.

8. What tools can make AR reconciliation easy for owners?

- Cloud apps or linked AR tools track dues and flag errors fast. They cut manual work and save time for small teams.