Lawyer Bookkeeping 101: Mastering IOLTA Compliance to Protect Your License and Your Profit

Lawyer bookkeeping often feels heavy for many firms, yet some lawyers say that clear trust care eases daily work. Many also feel that trust steps shape how safe a firm is. When lawyer bookkeeping blends with calm trust habits, teams gain space to think and act. The ideas here aim to share views that firms may find useful. These views do not claim fixed truths. They offer paths that lawyers can shape in their own way.

IOLTA compliance sits at the center of trust care. Some firms note that small steps help them guide an IOLTA attorney trust account without stress. Others feel that trusted care lets them move with more order. This guide explores these thoughts with a simple tone for firm owners and team members.

Core Role of Lawyer Bookkeeping

Lawyer bookkeeping shapes daily work more than many lawyers expect. The way trust funds move can shift the mood of a firm.

Some teams claim that small, clear steps help them avoid stress. Others feel that clean trust notes guide better talks with clients. These ideas may help lawyers frame their own lawyer bookkeeping and trust care path.

-

Daily Tasks

Daily trust tasks shape how things flow in a firm. Some lawyers say that quick notes keep them calm. Others feel that short checks ease work stress. These steps often help staff stay alert and steady.

-

Trust Rules

Trust rules set a line that firms try to follow. These rules guide how trust funds stay safe. Clear IOLTA compliance steps help firms follow these rules. Many lawyers feel that trust rules keep their firm's name strong. A clear rules-based base also gives teams more peace.

-

Team Roles

Team roles often shape the trust work. Some firms use set roles for each task. One person handles trust notes for lawyer bookkeeping.

Another checks bank files to keep IOLTA compliance in line. This reduces mix-ups. It also brings calm to teams.

-

Client Needs

Client needs to shape trust work more than many firms expect. Some clients want clear notes on trust funds. Others want short talks on their funds. Firms that offer clear trust care often feel clients stay longer.

-

Firm Growth

Firm growth can be linked with trust care. When trust work stays clean, staff spend less time searching past notes. This gives more time for growth tasks. Some firms feel that this helps profit over time.

-

Risk Avoidance

Risk avoidance stands as a key part of lawyer bookkeeping and trust work. Without clean trust notes and lawyer bookkeeping, firms may face issues.

Some lawyers feel that small checks help stop risk. Trust care often acts as a safe shield for many lawyers.

Meaning of IOLTA Compliance

IOLTA compliance guides how lawyers care for client funds. Clean lawyer bookkeeping makes this care simple.

Many lawyers share that this work feels heavy at first. Yet others say that small steps make it smooth. These ideas aim to show simple ways that firms may try.

-

Basic Lines

Basic lines guide IOLTA compliance in many firms. These lines ask lawyers to place client funds in safe trust places. Some lawyers feel that clear lines help them rest with ease. Others say they give a simple shape for daily work.

-

Fund Control

Fund control forms a core part of trust care and lawyer bookkeeping. Some lawyers say that trust funds must stay separate in all cases.

When a firm keeps control clear, trust flow stays smooth. This helps teams avoid common errors.

-

Short Checks

Short checks often guide good IOLTA compliance. Firms that check trust notes often find small issues with ease. These checks do not claim to fix all things. Yet they can guide teams toward steady trust care.

-

Clear Notes

Clear notes act as the base of trust care. Some firms say that notes made on the same day help them track funds. Others feel that clear notes build client faith. These notes keep trust moves easy to trace.

-

Bank Match

Bank match steps often bring more calm to teams. When trust notes match bank files, teams feel safe. Some firms do this each week. Others pick a monthly cycle. Both paths aim to reduce errors.

-

Staff Support

Staff support shapes trust care in many firms. Teams that learn trust rules often feel more ready. Some firms set short team talks. These talks give staff a space to ask and learn.

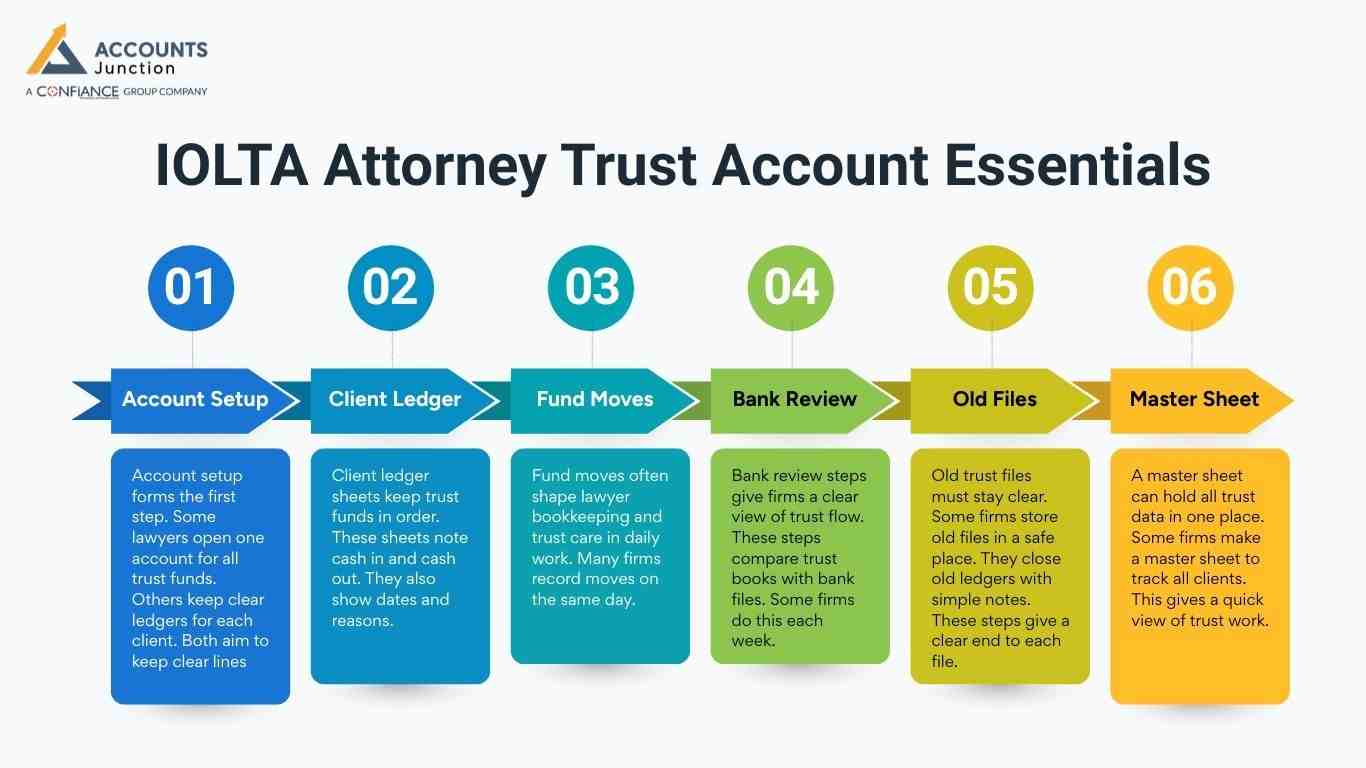

IOLTA Attorney Trust Account Essentials

The IOLTA attorney trust account holds client funds that lawyers must guard. Lawyer bookkeeping steps help track each trust move with care.

Firms often craft a simple plan to track this account. These steps aim to share views that lawyers may shape for their own work.

-

Account Setup

Account setup forms the first step. Some lawyers open one account for all trust funds.

Others keep clear ledgers for each client. Both aim to keep clear lines. A clean setup leads to easier checks later for each IOLTA attorney trust account.

-

Client Ledger

Client ledger sheets keep trust funds in order. These sheets note cash in and cash out. They also show dates and reasons. Some firms claim that ledgers help them avoid mix-ups. Others feel they can track funds with more ease.

-

Fund Moves

Fund moves often shape lawyer bookkeeping and trust care in daily work. Many firms record moves on the same day.

Some teams say that this keeps risk low. Clear notes show why moves occurred. This gives teams a clear path to follow.

-

Bank Review

Bank review steps give firms a clear view of trust flow. These steps compare trust books with bank files. Some firms do this each week. Others wait for the month's end. Both ways aim to lock trust care in place.

-

Old Files

Old trust files must stay clear. Some firms store old files in a safe place. They close old ledgers with simple notes. These steps give a clear end to each file. This helps teams when they check past moves.

-

Master Sheet

A master sheet can hold all trust data in one place. Some firms make a master sheet to track all clients. This gives a quick view of trust work. Staff can see totals and dates with ease.

How Lawyer Bookkeeping Supports Profit and Firm Growth

Lawyer bookkeeping aims to care for trust funds, yet many firms feel it can shape profit too. Some lawyers claim that clean trust care saves time. Others say it gives more room for growth. These ideas do not claim fixed truths. They aim to share paths that firms may try.

-

Time Use

Time use often shapes profit. When trust work stays clean, teams use less time on search tasks. Strong lawyer bookkeeping cuts search time even more. Some lawyers feel this gives space for real work. More time for real work often leads to more client care.

-

Client Faith

Client faith shapes how firms grow. When clients see clear trust care, they feel safe. Some clients stay longer when trust notes stay clean. This may help profit grow over time. Trust care often builds lasting ties.

-

Team Calm

Team calm helps firms move smoothly. Staff who feel safe in trusting tasks often act with more focus. Less stress gives teams more space to think. Some firms feel that this calm moves the whole firm forward.

-

Task Flow

Task flow improves when trust care stays clean. Files move fast. Teams avoid long talks on unclear notes. Some firms note that this lifts daily work. A clear flow often helps firms earn more.

-

Long View

A long view helps firms plan their path. Some lawyers feel that trust care shapes the long view. A clean past gives a clear future path. This view helps firms move with more ease.

-

Staff Trust

Staff trust builds when firms show care in their trust work. Staff feel more confident when tasks are clear. This helps teams stay strong. Some firms think that strong teams lift profits.

Common Trust Account Mistakes to Avoid

Many firms make small trust mistakes. These mistakes may feel small at first, yet some grow into large issues. These points aim to show paths firms can watch for.

-

Mixed Funds

Mixed funds often cause risk. Some lawyers place firm cash with client cash. This breaks trust lines.

A clear plan can stop this. Lawyer bookkeeping rules help keep the IOLTA attorney trust account clean.

-

Late Notes

Late notes can hurt trust in work. Some firms wait days to record moves. This slows checks. A daily note plan can help. This gives a clean view of trust flow.

-

Bank Gaps

Bank gaps rise when firms skip bank checks. Without a check, errors stay for weeks. A firm can pick a weekly or monthly check. This keeps files in line.

-

Old Files

Old files can cause mix-ups. Some firms leave old trust files open too long. This adds clutter. A clear, close step can help. Close old files with a final note.

-

Wrong Moves

Wrong moves occur when teams guess on trust actions. A short talk with the staff can fix this. Teams with clear steps avoid wrong moves. This brings calm to trust in work.

-

Team Gaps

Team gaps form when no one knows who does what. A clear role plan helps. One staff member records trust. Another checks banknotes, a third reviews files.

Building an Effective Lawyer Trust System

A clean trust system gives firms a base to grow. Some lawyers claim that simple steps guide most trust tasks. These views aim to show paths that firms may shape.

-

Clear Plan

A clear plan guides trust work. A plan that links lawyer bookkeeping with IOLTA compliance keeps the firm safe.

This plan lists steps for trust moves. It also sets who does what. Firms that use a clear plan often feel calmer.

-

Staff Guide

A staff guide shapes trust care in daily work. This guide lists trust rules in simple words. Teams can read it with ease. This guide keeps the firm in line.

-

Review Steps

Review the step guide, trust care over time. These steps check files and notes. Some firms do this each month. Reviews help teams fix small gaps. They also guide long-term trust care.

-

Tool Use

Tools help firms handle trust care with ease. Some firms use simple book tools. Others use sheets for client notes. Tools give teams a place to track trust steps.

-

Team Talks

Team talks shape trust care. These talks give staff a place to share and ask. Teams that talk often find small trust gaps early. This keeps trust care smooth.

-

Client View

The client's view shapes how trust care feels from the outside. Clients often feel safe when trust notes stay clear. A firm can share short trust reports. These small steps build client faith.

Long-Term Strategies for Lawyer Trust Management

Lawyer bookkeeping blends best with a long-term view. This view helps firms avoid stress and stay calm in trusted work. Firms can shape their path to fit their own aims.

-

Growth Plan

A growth plan helps firms move with ease. This plan shows goals and trust steps. Teams use this plan to guide daily tasks. Many firms feel this helps them stay in line.

-

Skill Build

Skill build steps lift trust care. Staff may learn new ways to check trust moves. Some firms use short skill talks. These steps make staff more ready.

-

Trust Culture

Trust culture and lawyer bookkeeping shape firm life. A firm with a trust culture treats trust care as core. Staff value clear notes. This culture grows over time.

-

Calm Pace

A calm pace helps trust care. Firms that rush often miss small things. A calm, steady pace gives a clean view. This pace keeps trust care safe.

-

File Order

File order guides trust care in daily tasks. Clear files help teams act fast. When files stay in order, checks move smoothly. Some teams feel this gives peace.

-

Ongoing Check

Ongoing check steps hold trust Work Safe. These steps look at trust data on a set cycle. This keeps the firm in a safe line.

Lawyer bookkeeping and IOLTA compliance are not just rules to follow, but tools that shape the overall stability of a law firm. Clear trust records, proper client ledgers, and routine checks help lawyers protect client funds and reduce errors. When these steps are taken seriously, firms often see improved team efficiency, higher client trust, and smoother daily operations. Maintaining an organized IOLTA attorney trust account also prevents risk to the firm’s license and helps preserve its reputation in the long run.

At Accounts Junction, we offer trusted accounting and bookkeeping services for law firms designed to keep finances clear and stress-free. Our experienced team ensures accurate lawyer bookkeeping, maintains proper trust account records, and supports ongoing IOLTA compliance. By handling financial details with care and precision, we help law firms stay organized, protect client funds, and focus on growth and client satisfaction. Looking for a simpler and more reliable way to manage your firm’s finances? Explore how Accounts Junction can support your law practice with confidence.

FAQs

1. What steps help lawyers maintain lawyer bookkeeping for trust funds?

- Daily notes keep trust records clear and well-arranged. Short checks show issues early and ease trust reviews.

2. How can firms improve IOLTA compliance in daily work?

- Clear rules guide staff toward simple trust care steps. Regular reviews help teams shape calm trust habits.

3. Why does an IOLTA attorney trust account need strict control?

- It holds client funds that demand a clear order always. Strong control keeps moves clean and reduces major stress.

4. What errors appear often in lawyer bookkeeping for trust accounts?

- Late entries cause confusion and lead to unclear files. Mixed funds create a risk that most firms try to avoid.

5. How can lawyers track trust funds with simple systems?

- Clean ledgers show client flows in a clear layout. Short reports help staff read moves with quick ease.