Using Receipt Bank for Payables Accounting

In the modern business environment, managing payables can be complex. Businesses may often struggle to keep track of multiple invoices, receipts, and bills. Receipt Bank for Payables Accounting may offer a way to simplify this process. By using automation and cloud-based tools, companies can potentially improve efficiency and reduce errors. This blog explores how businesses may leverage Receipt Bank for payables accounting and what benefits it may bring.

What is Receipt Bank?

Receipt Bank is a cloud-based platform that may help businesses manage expenses. It can capture invoices, receipts, and other financial documents digitally. This reduces manual data entry and may save significant time for accounting teams. The software may also integrate with various accounting systems to streamline workflows.

Businesses may find that using Receipt Bank for Payables Accounting can reduce paperwork. It may ensure that all bills and invoices are stored safely in a digital format. Companies can then access documents anytime, anywhere, which may improve visibility and tracking.

What is Receipt Bank Software and How Does it Work?

Receipt Bank software makes it easy for businesses to manage receipts and invoices. It cuts down manual work and saves time. There is no need for businesses to enter every receipt by hand. They can use Receipt Bank to capture, extract, and upload all information directly into the accounting system.

Here is how it works:

You can submit documents by taking a photo, emailing, or scanning them. The software reads important information like supplier name, date, amount, and tax. Receipt Bank organizes the data and sends it to your accounting platform, like Xero or QuickBooks.

This helps reduce manual work and avoids errors in data entry. The software also stores documents securely for future access and audits.

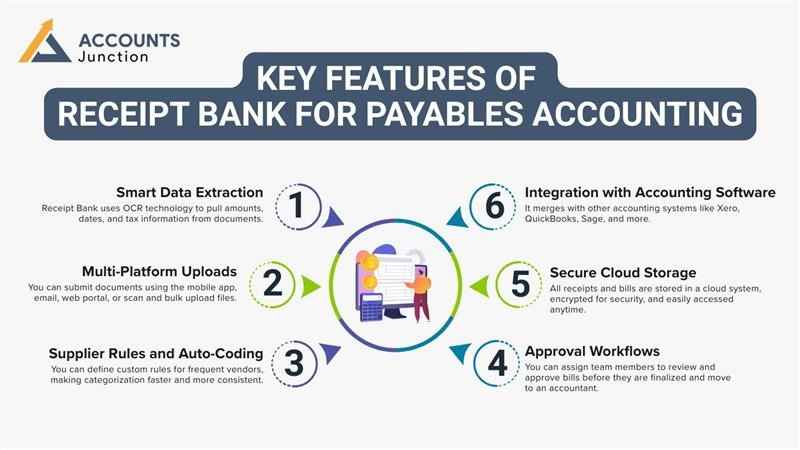

Key Features of Receipt Bank for Payables Accounting

1. Smart Data Extraction

- Receipt Bank uses OCR technology to pull amounts, dates, and tax information from documents. It identifies key fields like invoice numbers and due dates, reducing manual input for finance teams.

2. Multi-Platform Uploads

- You can submit documents using the mobile app, email, web portal, or scan and bulk upload files. This flexibility allows both office and field staff to submit documents instantly, improving processing time.

3. Supplier Rules and Auto-Coding

- You can define custom rules for frequent vendors, making categorization faster and more consistent. It also remembers past coding patterns, reducing repetitive data entry for recurring expenses.

4. Approval Workflows

- You can assign team members to review and approve bills before they are finalized and move to an accountant. You can track who approved your bill. When it is approved. This ensures accountability in the payable process.

5. Secure Cloud Storage

- All receipts and bills are stored in a cloud system, encrypted for security, and easily accessed anytime. It reduces the headache of physical storage and simplifies audit preparation.

6. Integration with Accounting Software

- It merges with other accounting systems like Xero, QuickBooks, Sage, and more. It allows a quick reconciliation process and helps keep financial reports consistently updated.

Advantages of Using Receipt Bank in Your Accounts Payable Workflow

Businesses utilizing receipt bank software in their payables process give several benefits:

1. Time Savings

- Instead of spending hours manually inputting invoices, staff can focus on more valuable activities. The automated extraction of information means quicker turnaround times for data entry and payment processing.

2. Improved Accuracy

- Manual data entry is prone to mistakes. Using Receipt Bank for Payables Accounting minimizes errors by pulling data directly from the source.

3. Better Organization

- All receipts and invoices are stored securely and categorized properly, making audits and financial reviews much simpler.

4. Cash Flow Visibility

- Having up-to-date payable information helps businesses manage cash flow better, ensuring that obligations are met without surprises.

5. Compliance and Recordkeeping

- Since Receipt Bank archives documents digitally, staying compliant with tax and audit requirements becomes easier.

Receipt Bank for Payables Accounting: Step-by-Step Guide

Starting with Receipt Bank for Payables Accounting is easy and quick. Here’s a simple step-by-step process :

Step 1: Set Up Your Account

- Sign up and set up your company profile. Choose your accounting system and connect it to Receipt Bank.

Step 2: Upload Receipts and Invoices

- Take pictures with the app, send documents by email, or scan them. Receipt Bank will read and process the information.

Step 3: Review and Approve

- Check the gathered data for accuracy. If needed, set up supplier rules to automate categorization going forward.

Step 4: Publish to Accounting Software

-

Once verified, the data can be exported directly into your accounting system, matched with bank transactions, and reconciled.

Step 5: Store and Access Records

- All uploaded documents are securely stored in the cloud for future access whenever needed.

Common Mistakes to Avoid with Receipt Bank

Receipt Bank is easy to use. Still, a few mistakes can make it less effective. Below are common issues and how to avoid them:

|

Mistake |

What Can Go Wrong |

Simple Fix |

|---|---|---|

|

Not Setting Up Supplier Rules Early |

Expenses may be sorted wrong. This adds delays and manual work. |

Set rules early to help Receipt Bank sort bills faster and better. |

|

Ignoring Approval Workflows |

Bills may be paid without checks. You might pay twice or miss errors. |

Use an approval process. Make sure someone checks each bill. |

|

Skipping Regular Reviews |

Small errors build up and make reports wrong. |

Review data often. Fix errors before they become big problems. |

|

Uploading Incomplete Documents |

Blurry or cropped receipts won’t scan well. Data may be wrong or missed. |

Upload clear, full images to help the system read them right. |

|

Delaying Receipt Uploads |

If you wait too long, receipts can go missing and tax benefits might be lost.

|

Send receipts quickly through the mobile app or email. To avoid delays. |

Real-World Use Cases for Receipt Bank

Many businesses utilize Receipt Bank software to manage payables more easily. Let’s look at how it helps in different industries:

1. Retail Stores

-

Retail stores deal with lots of receipts every day. Receipt Bank helps organize them faster and with less effort.

Example: A retail shop snaps photos of supplier receipts using the app. This cuts down time spent entering and sorting invoices.

2. Consulting Firms

- Consultants have many types of expenses. Receipt Bank helps track costs like meetings, travel, and supplies.

Example: A consultant uploads travel receipts with the app. The software sorts them automatically, saving time and reducing errors.

3. Restaurants

- Restaurants often get daily invoices from food and supply vendors. Receipt Bank helps speed up this task.

Example: A restaurant manager takes a photo of invoices. The app reads the data and files it quickly, saving time and effort.

Receipt Bank for Payables Accounting makes managing invoices and receipts easy. The software automatically collects data and works with your accounting system. It keeps your documents secure in the cloud. At Accounts Junction, we provide services to optimize your payables process with Receipt Bank. Our team manages the setup, sign-up, and integration to match your business needs. We have certified experts to ensure smooth operations. Partner with us for seamless payables management.

FAQ

1. How can Receipt Bank simplify accounts payable?

- Receipt Bank may automate invoice capture and coding. This reduces manual work in your payables process.

2. Can Receipt Bank help reduce late payments?

- By tracking due dates automatically, businesses may avoid missed deadlines. Notifications can prompt timely approvals.

3. How does Receipt Bank improve invoice organization?

- Invoices are stored digitally and categorized automatically. This may make retrieval and reporting faster.

4. Can Receipt Bank integrate payables with accounting software?

- Yes, it can sync directly with systems like Xero or QuickBooks. This may streamline reconciliation and reporting.

5. Does Receipt Bank allow approval workflows for bills?

- You can assign bills for review before posting. This may prevent duplicate or incorrect payments.

6. How does Receipt Bank handle recurring supplier invoices?

- Supplier rules may automatically code recurring bills. This may save time and maintain consistency in payables.

7. Can Receipt Bank improve cash flow visibility?

- Up-to-date invoice data may provide insight into outstanding payments. This helps businesses manage cash flow more effectively.

8. Can Receipt Bank help track invoice approval status?

- Yes, it may show which invoices are pending, approved, or paid. This can improve visibility in your payables process.

9. Can Receipt Bank prevent errors in payables accounting?

- Automated data extraction may reduce manual entry mistakes. Small errors may still need occasional review.

10. How does Receipt Bank store invoice records securely?

- All invoices are encrypted in the cloud. Businesses can access them anytime for audits or reviews.

11. Can Receipt Bank track payment history for vendors?

- Yes, past invoice data may be accessed quickly. This can help analyze vendor payment trends.

12. Is Receipt Bank suitable for small and mid-size businesses?

- Even smaller teams may manage payables efficiently. Scaling without adding extra staff may be possible.

13. How does Receipt Bank support audit preparation?

- Invoices are stored digitally with organized categories. This may make audits smoother and faster.

14. Can Receipt Bank speed up invoice approvals?

- The approval workflow may notify assigned staff automatically. This may reduce delays in payable processing.

15. Does Receipt Bank help reduce paper invoices in accounts payable?

- Yes, invoices can be submitted digitally via app or email. Paper storage needs may be minimized.

16. How does Receipt Bank handle late payment risks?

- The system may highlight overdue invoices and upcoming due dates. This can help businesses avoid penalties or interest charges.

17. How can Receipt Bank impact payable reporting?

- Digital records may be exported to accounting software quickly. This may make financial reporting more accurate.

18. Can Receipt Bank handle invoices in multiple currencies?

- It may process multi-currency invoices depending on the integration. This can help international payables management.

19. Does Receipt Bank help spot overdue invoices?

- The system may flag unpaid bills automatically. Alerts may prompt follow-up before penalties arise.

20. How quickly can a business start managing payables with Receipt Bank?

- Setup may be completed within a few days. Integration with accounting systems ensures payables can run smoothly.