Understanding Inventory Valuation in Accounting for Car Dealerships

Accounting for a car dealership is a detailed process. It covers tracking sales, costs, and the value of every car in stock. The inventory of cars is the largest asset for most dealerships. Correct valuation is critical for showing the true health of the business.

When stock value is correct, the dealership can plan better, price cars fairly, and pay the right taxes. Wrong values can lead to loss of profit, higher tax bills, or even legal problems. This is why car dealership accounting places a strong focus on accurate and fair inventory valuation.

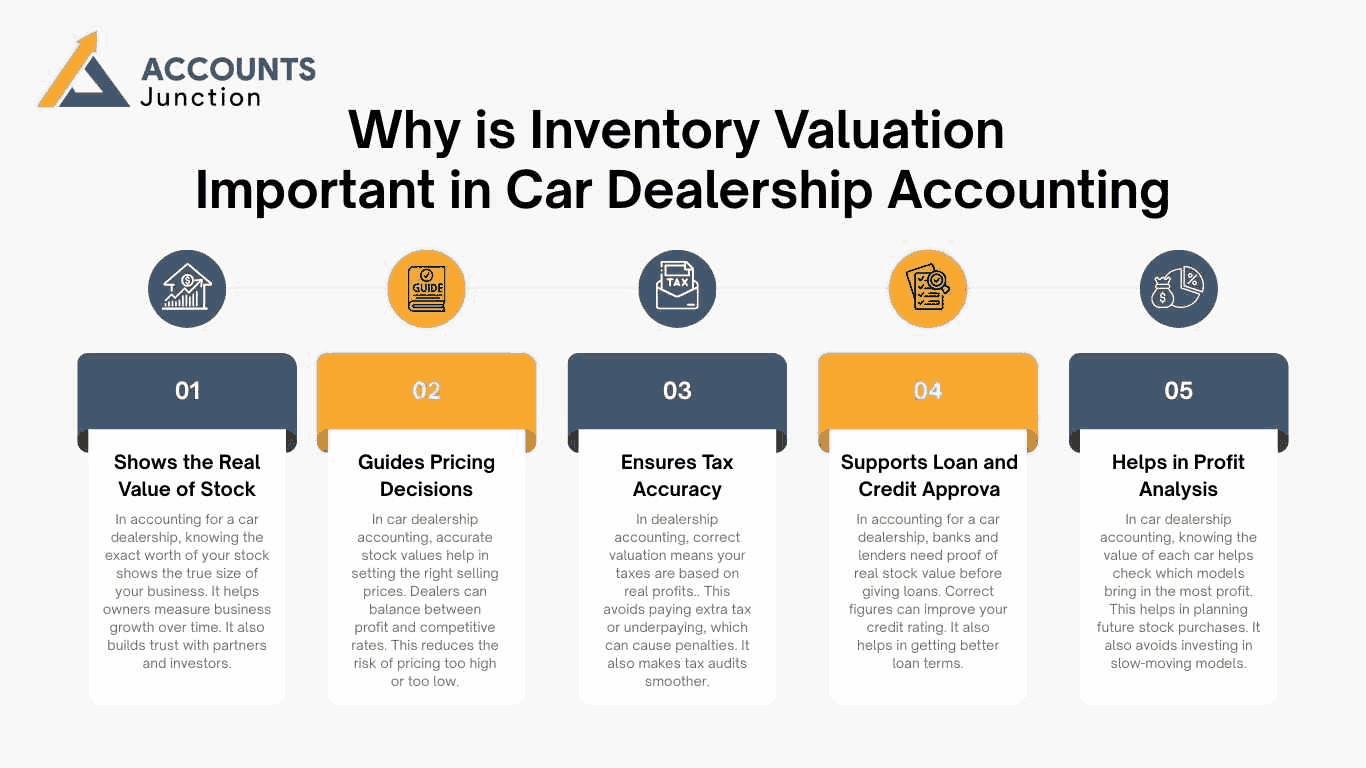

Why is Inventory Valuation Important in Car Dealership Accounting

-

Shows the Real Value of Stock

In accounting for a car dealership, knowing the exact worth of your stock shows the true size of your business. It helps owners measure business growth over time. It also builds trust with partners and investors.

-

Guides Pricing Decisions

In car dealership accounting, accurate stock values help in setting the right selling prices. Dealers can balance between profit and competitive rates. This reduces the risk of pricing too high or too low.

-

Ensures Tax Accuracy

In dealership accounting, correct valuation means your taxes are based on real profits.. This avoids paying extra tax or underpaying, which can cause penalties. It also makes tax audits smoother.

-

Supports Loan and Credit Approval

In accounting for a car dealership, banks and lenders need proof of real stock value before giving loans. Correct figures can improve your credit rating. It also helps in getting better loan terms.

-

Helps in Profit Analysis

In car dealership accounting, knowing the value of each car helps check which models bring in the most profit. This helps in planning future stock purchases. It also avoids investing in slow-moving models.

Types of Inventory in Car Dealerships

-

New Cars

These are fresh from the manufacturer and have a full warranty. They often have the highest value in the inventory. The prices are more stable compared to used cars.

-

Used Cars

Bought from trade-ins, auctions, or individuals. Their value depends on age, condition, and demand. A good valuation here can increase resale profit.

-

Demo Cars

Used for test drives or display, but still part of the stock. They usually sell at a discount due to mileage. Proper tracking avoids overvaluing them.

-

Loaner Cars

Given to customers during service or repair work. Their value drops faster due to regular use. They need regular updates in the records.

-

Spare Parts

Includes tires, accessories, and service parts. They may have lower value per unit, but still affect the total stock worth. Accurate tracking prevents loss.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Common Methods of Inventory Valuation

-

FIFO (First In, First Out)

The oldest cars bought are sold first. Works well when prices are stable or slowly rising. Helps match old costs with current sales prices.

-

LIFO (Last In, First Out)

The latest cars bought are sold first. Can lower taxable profit when prices are rising. Not allowed in some countries, so check local rules.

-

Specific Identification

Each car is valued separately. This method works well in dealership accounting because cars have unique VIN numbers. Ideal for high-value or custom vehicles.

-

Weighted Average Cost

Takes the average cost of all cars in stock. Makes it simple to value large inventories. Reduces the effect of price changes.

-

Retail Method

Value stock based on selling price minus expected profit margin. Common in some retail businesses but less used in dealerships.

Factors Affecting Inventory Valuation

-

Market Demand

High demand increases stock value. Dealers can sell certain models for more during peak seasons. Demand also changes quickly with new trends.

-

Depreciation

Cars lose value with time, even if unused. This is faster for models that are less popular. Adjusting for depreciation keeps records accurate.

-

Car Condition

Better condition means higher resale value. Damage, rust, or missing parts can lower the worth. Repairs before sale can increase value.

-

Seasonal Trends

Certain cars sell better at specific times. SUVs may sell more in winter, convertibles in summer. Stock planning should match these trends.

-

Economy

Interest rates, fuel prices, and the job market all affect sales. In weak economies, values may drop faster. In strong economies, they may rise.

Steps to Value Inventory in a Car Dealership

-

Prepare a Stock List

In accounting for a car dealership, list every car with full details. Include VIN, make, model, and cost. Keep this list updated at all times.

-

Group by Type

Separate new, used, demo, and parts. This makes valuation easier. It also helps in tracking profit by category.

-

Choose a Method

Select FIFO, LIFO, or another method. In car dealership accounting, stay consistent each year for clear records. Switching often can confuse reports.

-

Add All Costs

Include shipping, preparation, and advertising costs. These are part of the real value. Ignoring them lowers true profit.

-

Adjust for Depreciation

Lower value for older or less popular cars. Check market rates often to stay updated. This ensures fair selling prices.

-

Record in Books

Enter final values into accounting software. Keep proof of all cost calculations. This helps during audits or reviews.

Step-by-Step Accounting Process for Car Dealerships

1. Record All Sales

- Log every vehicle sale in the accounting system.

- Include sale price, taxes, and fees.

2. Track Purchases

- Record purchases from manufacturers or auctions.

- Include transport and other costs.

3. Manage Inventory

- Keep an updated list of cars in stock.

- Record changes when cars are sold or purchased.

4. Track Financing Deals

- Many customers buy cars with financing.

- Record loans, interest rates, and payment terms.

5. Record Trade-Ins

- Check the value of traded-in cars.

- Deduct from the sale price if applicable.

6. Track Other Income

- Include income from repairs, parts, and warranties.

7. Manage Expenses

- Record rent, salaries, marketing, and utility costs.

Role of Accounting Software in Inventory Valuation

-

Real-Time Updates

Changes in stock are recorded instantly. This avoids delays in reporting. It also helps sales teams see updated values.

-

Fewer Errors

Automated systems reduce human mistakes. This improves accuracy in stock reports. Fewer errors mean better planning.

-

Tax Reports

Software can prepare tax-ready reports. This saves time during filing. It also reduces the chance of tax errors.

-

Sales Integration

Links sales and stock data in one system. This keeps inventory numbers accurate. It also helps in quick decision-making.

-

Historical Data

Stores records of past sales and costs. In dealership accounting, this helps in market analysis. Also useful for year-on-year comparisons.

Challenges in Car Dealership Inventory Valuation

-

Price Changes

Car prices can rise or fall in weeks. This makes it hard to set fixed values. Regular updates are needed.

-

Depreciation

Values can drop quickly for certain models. Some cars lose value as soon as they arrive. This must be factored in.

-

Demo and Loaner Cars

These cars have unusual wear and tear. Their value drops faster. Accurate tracking is needed to avoid loss.

-

Trade-Ins

Each trade-in must be valued fairly. Overvaluing can cut profit. Undervaluing may loss of customers.

-

Old Stock

Older models take longer to sell. Their value drops with every passing month. Clearing them early reduces losses.

Best Practices for Inventory Valuation in Accounting for Car Dealerships

-

Keep Methods Consistent

Stick to one valuation method unless there is a good reason to change. This keeps reports clear and fair.

-

Review Often

Market prices change fast. Review stock values monthly or quarterly. Adjust if needed for accuracy.

-

Keep Detailed Records

Save all invoices, receipts, and expense notes. These records help in audits. They also prove the value you record.

-

Add Hidden Costs

Include small costs like cleaning and display. Over time, these costs add up. Ignoring them lowers profit.

-

Use Professional Help

Experts like Accounts Junction ensure accuracy. They also help with tax compliance. This saves time and reduces risk.

Inventory valuation is central to accounting for a car dealership. It impacts pricing, tax, loans, and profits. Dealers who manage it well stay ahead of market changes. They can sell smarter, avoid losses, and grow steadily. With expert car dealership accounting, stock values are always correct. At Accounts Junction, we bring accuracy, skill, and industry knowledge to every dealership we work with. Our focus is on making valuation simple yet effective, so your business runs at its best.

At Accounts Junction, we understand that dealership accounting requires skill and precision. We work with dealerships to record the right value for each car, from purchase to sale. Every small cost is included, from transport to preparation. This ensures your records reflect the real cost and value of stock. We also help dealerships choose the right valuation method. Whether it is FIFO, LIFO, or specific identification, our goal is to provide accurate and clear reports. With our car dealership accounting services, you can avoid errors, follow tax laws, and plan for steady growth.

FAQs

Q1: What is inventory valuation in car dealership accounting?

- It is the process of finding the current value of all cars in stock.

Q2: Which method is best for car dealerships?

- Specific Identification works well because each car is unique.

Q3: How often should inventory be valued?

- At least yearly, but monthly or quarterly is better.

Q4: Can a wrong valuation affect taxes?

- Yes, it can lead to overpaying or underpaying tax.

Q5: Do demo cars count as inventory?

- Yes, until they are sold or removed from stock.

Q6: Is software needed for valuation?

- Not required, but it improves accuracy.

Q7: Does depreciation apply to unsold cars?

- Yes, especially for used and demo cars.