Types of Audits for Nonprofits: An Overview for Beginners

Running a nonprofit needs clear money management and trust. Proper audits help show honesty and openness. A Nonprofit Audit Checklist helps groups check that all records are right. Knowing the types of audits for nonprofits is key for both new and growing groups. A clear guide helps plan and prepare well.

Audits do more than check numbers. They help keep a nonprofit’s good name. They show donors, boards, and fans that the group acts right. Knowing the audit types helps a group plan and get ready. This guide shows each type, why it counts, and how to prepare.

What is a Nonprofit Audit?

- A nonprofit audit is a full review of financial records. Understanding the types of audits for nonprofits can help organizations know what to expect. It checks that all numbers are correct.

- It makes sure the nonprofit follows laws and rules. This keeps the organization legal and safe.

- Audits show donors, boards, and stakeholders that the nonprofit is trustworthy. They prove transparency in how money is used.

- A Nonprofit Audit Checklist helps prepare for audits. It ensures nothing is missed and saves time.

Why Nonprofit Audits Are Important

- Audits make sure a nonprofit follows all laws and rules. Knowing the types of audits for nonprofits helps in picking the right audit for your needs. This helps avoid fines or legal problems.

- They find mistakes, fraud, or wrong use of funds quickly. This keeps the nonprofit safe.

- Audits show donors, boards, and funders how money is spent. They make financial details clear and simple.

- They improve internal reporting and money management. This helps the nonprofit work better and stay organized.

- Regular audits build trust and credibility. They also help the nonprofit get grants and donations in the future.

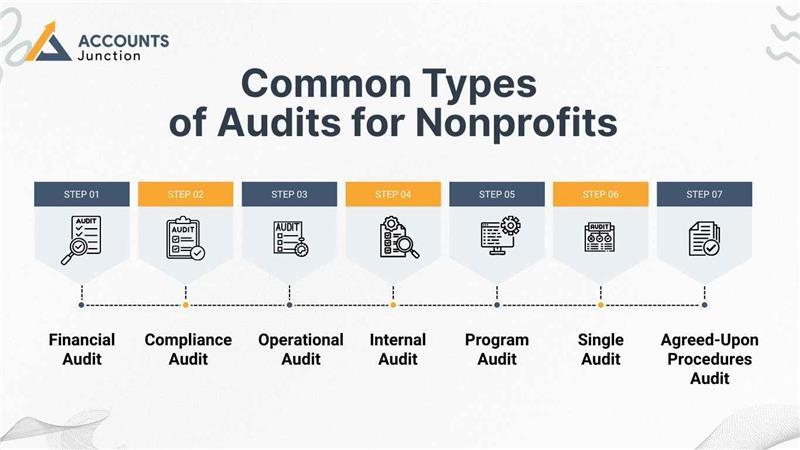

Common Types of Audits for Nonprofits

1. Financial Audit

- Financial audits check statements in full.

- They review income, costs, and assets for truth.

- Audits make sure rules and standards are met.

- Donors, the state, and grant groups often ask for audits.

- These checks give all parties trust in the nonprofit’s funds.

2. Compliance Audit

- Compliance audits check if the nonprofit follows all laws and rules. They reduce legal and financial risks.

- They ensure funds are spent the right way as donors intend. They help keep trust with supporters.

- This audit reviews contracts, reports, and internal policies for compliance. It also checks staff practices.

- Regular compliance audits help avoid fines or loss of funding. They improve overall governance and control.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

3. Operational Audit

- Operational audits study how programs and resources are used. They check processes and team efficiency.

- They review policies, procedures, and internal controls for better results. They also spot gaps in work.

- These audits suggest ways to cut costs and improve outcomes. They help make operations more effective.

- They help nonprofits use resources wisely and reach their goals. They support long-term growth and impact.

4. Internal Audit

- Internal audits are done by staff to catch issues early. They prevent small problems from growing large.

- They review daily transactions, accounting entries, and internal controls. They ensure all records are correct.

- Internal audits help management make better decisions for finances. They improve operations and resource use.

- They prepare the nonprofit for smooth external audits later. They build trust with donors and boards.

5. Program Audit

- Program audits focus on projects to check their true effectiveness. They track progress and measure results.

- They verify that funds are used as grants or donors intend. They ensure money is spent properly.

- These audits provide accountability to donors, boards, and staff. They build trust and confidence in the nonprofit.

- They give insight to improve future programs and planning. They help guide strategy and decisions.

6. Single Audit

- Single audits are needed when federal funding is very high. They follow all government rules closely.

- They check both finances and compliance with all laws. They ensure records are correct and complete.

- Single audits confirm federal funds are spent properly and legally. They protect the nonprofit from penalties.

- They help nonprofits meet strict reporting standards set by the government. They build trust with officials and donors.

7. Agreed-Upon Procedures Audit

- These audits focus on areas requested by nonprofits or funders. They check only what is needed.

- Auditors perform the agreed tasks and report results clearly. They do not review everything else.

- They are often used for grant reports or special projects. They save time and reduce effort.

- These audits give assurance without a full financial review. They help build trust with stakeholders.

Key Components of a Nonprofit Audit

- Financial Statements: Show the nonprofit’s money, bills, and cash flow. They tell if the funds are sound.

- Internal Controls: Rules to stop mistakes and fraud. They keep money safe.

- Compliance: Follow laws, rules, and donor terms. It cuts risk and builds trust.

- Board Oversight: Board checks and okays policies and budgets. It makes governance strong.

- Documentation: Keep all receipts, invoices, and bank slips. They prove how money is used.

How to Prepare for a Nonprofit Audit

- Use a Nonprofit Audit Checklist to organize tasks and documents. It makes preparation easier.

- Keep financial records correct, updated, and easy to access. Organized records save time.

- Review internal controls and policies for gaps or errors. This avoids problems later.

- Make sure all donations, grants, and expenses are properly documented.

- Train staff about audit processes to avoid mistakes and delays.

- Communicate with auditors early to clarify requirements and expectations.

Benefits of Conducting Nonprofit Audits

- Understanding the types of audits for nonprofits and conducting them builds trust with donors, stakeholders, and funders. Confidence helps secure support.

- Detects weaknesses in financial reporting and operations. Fixing them prevents bigger issues.

- Improves overall management, planning, and decision-making processes.

- Ensures legal compliance and reduces risk of penalties.

- Strengthens credibility and increases chances of getting grants or donations.

Role of a Nonprofit Audit Checklist

A Nonprofit Audit Checklist helps nonprofits get ready for audits. It also keeps finances under control and organized. Some important items are:

- Financial statements must be complete and correct. They show the true results of all activities.

- Bank statements should match the accounting records. Checking them carefully prevents mistakes and tracks money well.

- Grant and donor funds must be recorded clearly. Good records make the nonprofit more transparent and trustworthy.

- Expense reports should have all receipts attached. Checking them with rules keeps expenses accurate and proper.

- Policies and internal controls should be reviewed often. Updating them reduces risks and keeps the nonprofit safe.

- Board meeting minutes should be neat and easy to find. Proper records help with governance and oversight.

Using a checklist makes audits easier. It helps nonprofits follow rules, track money, and show donors that they are responsible.

How Often Should Nonprofits Conduct Audits?

- Small nonprofits may have audits every two to three years. Choosing the right types of audits for nonprofits ensures proper oversight. The need depends on funding.

- Medium and large nonprofits should do audits each year to ensure proper checks.

- Grants or federal funds usually need yearly audits with no exceptions.

- Regular audits help keep transparency, accountability, and donor trust high.

Common Mistakes Nonprofits Make During Audits

- Waiting until the last minute can cause errors. Plan early to avoid stress.

- Missing receipts, bills, or partial records slow the audit. Keep all records ready.

- Ignoring internal controls can lead to errors or fraud. Review controls on time.

- Staff not trained on audit rules may report incorrect information. Give clear guidance.

- Skipping the Nonprofit Audit Checklist may cause steps to be missed. Always use it.

Choosing the Right Auditor

- Choose an auditor who knows nonprofit rules and needs. This ensures work is done right. They can spot mistakes before they grow.

- Check their certificates, training, and past work with other nonprofits. This shows they have real experience.

- Make sure the auditor is fair and free from bias. This keeps the audit trusted. An unbiased view builds confidence with donors.

- Agree on the audit scope, cost, and timeline before work begins. Clear terms help avoid confusion later.

- A good auditor helps the nonprofit complete the audit smoothly. They also guide staff on what is needed.

Tips to Make Audits Easier

- Keep your financial records current all year. Regular updates cut errors.

- Use simple accounting software to track grants, donations, and costs. This boosts accuracy.

- Sort receipts, bills, and proof documents in advance. Ready records save time.

- Hold board meetings often to keep checks and rules in place. Good governance builds trust.

- Check the Nonprofit Audit Checklist before the audit. It helps cover all points.

Audits help nonprofits stay clear, honest, and trusted. They are key to smooth operations. Knowing the types of audits for nonprofits helps plan work and avoid errors. A Nonprofit Audit Checklist makes prep simple and ensures nothing is missed. Careful planning builds efficiency, donor trust, and legal compliance.

Every nonprofit needs to understand the types of audits for nonprofits. A Nonprofit Audit Checklist guides the process step by step. Regular audits find mistakes, maintain rules, and strengthen donor confidence.

At Accounts Junction, we offer expert nonprofit audit services. We make custom Nonprofit Audit Checklists, sort records, and guide nonprofits through each audit type. Our team keeps them in line with rules, improves workflow, and builds trust. Working with us gives nonprofits peace of mind and earns the confidence of donors and stakeholders.

FAQs

Q1: What is a Nonprofit Audit Checklist?

- It is a guide for preparing audit documents. It ensures accuracy and completeness.

Q2: How many types of audits for nonprofits exist?

- Seven common types: financial, compliance, operational, internal, program, single, and agreed-upon procedures audits.

Q3: Do small nonprofits need audits?

- Yes, for grants or donor needs. Frequency may be less than larger nonprofits.

Q4: How long does an audit take?

- Audits usually take weeks or months, depending on size and records.

Q5: Can staff conduct internal audits?

- Yes, trained staff can perform internal audits. They prepare for external audits.

Q6: Why is a compliance audit important?

- It ensures the following laws and grant rules. This prevents penalties and issues.

Q7: What documents are essential for audits?

- Financial statements, bank records, receipts, grant reports, and board minutes are key.