The Role of a Hospital Accounts Receivable Company in Optimizing Revenue Cycle Management

Hospitals face many challenges in handling their money. One of the most important tasks is making sure payments come in on time. A hospital accounts receivable company helps hospitals manage this process. They make smooth billing, reduce mistakes, and speed up payments.

Managing finances alone is tough. Late bills, payment errors, and rejected insurance claims can hurt cash flow. With a hospital accounts receivable company, hospitals can care for patients while experts manage billing and claims, and overall revenue cycle management.

Understanding Revenue Cycle in Hospitals

The revenue cycle is how a hospital tracks care and gets paid. It covers all steps from patient check-in to getting money. A good cycle helps the hospital get paid fast and cuts errors. It keeps the cash flow smooth.

The key steps in revenue cycle management are:

1. Patient Check-In and Health Plan Check

- First, the staff check in the patient. They get name, birth date, phone, and health plan info. They check that the plan will pay. If the info is wrong, claims may not pay. A hospital accounts receivable company checks all information. The team also checks copays and fees to avoid problems.

2. Coding Care and Billing

- After care, each service is given a code. Codes tell the plan what care was done. Mistakes can stop payment. Bills must match codes. The company uses trained staff to code correctly. Bills are simple for patients and plans.

3. Sending Claims and Follow-Up

- Once coded, claims are sent fast. Late claims slow pay. Some claims may not pay at first. Follow-up finds errors and sends claims again. The AR team tracks each claim, calls the plan, and fixes issues. This helps the hospital get money fast.

4. Posting Payments and Checks

- When money comes, it is added to the correct account. Any gap between billed and paid is fixed. Staff check all accounts to make sure care is paid. The team posts money correctly, finds mistakes, and makes simple reports.

5. Handling Claims Not Paid

- Some claims are not paid at first. Staff check why and ask the plan to pay. The AR team does this fast. More claims get paid this way.

6. Reports and Simple Insight

- Hospitals need to know which claims are paid and which are not. Reports show trends, like repeated unpaid claims or slow payers. The company gives easy reports. Hospitals use them to fix problems and earn more.

A Hospital AR Company handles all these steps efficiently, reducing delays and errors.

How a Hospital Accounts Receivable Company Optimizes Revenue Cycle Management

A hospital accounts receivable company helps hospitals run their revenue cycle smoothly. Hospitals face slow payments, claim errors, and denied bills. By bringing in experts, these companies fix problems and speed up money flow.

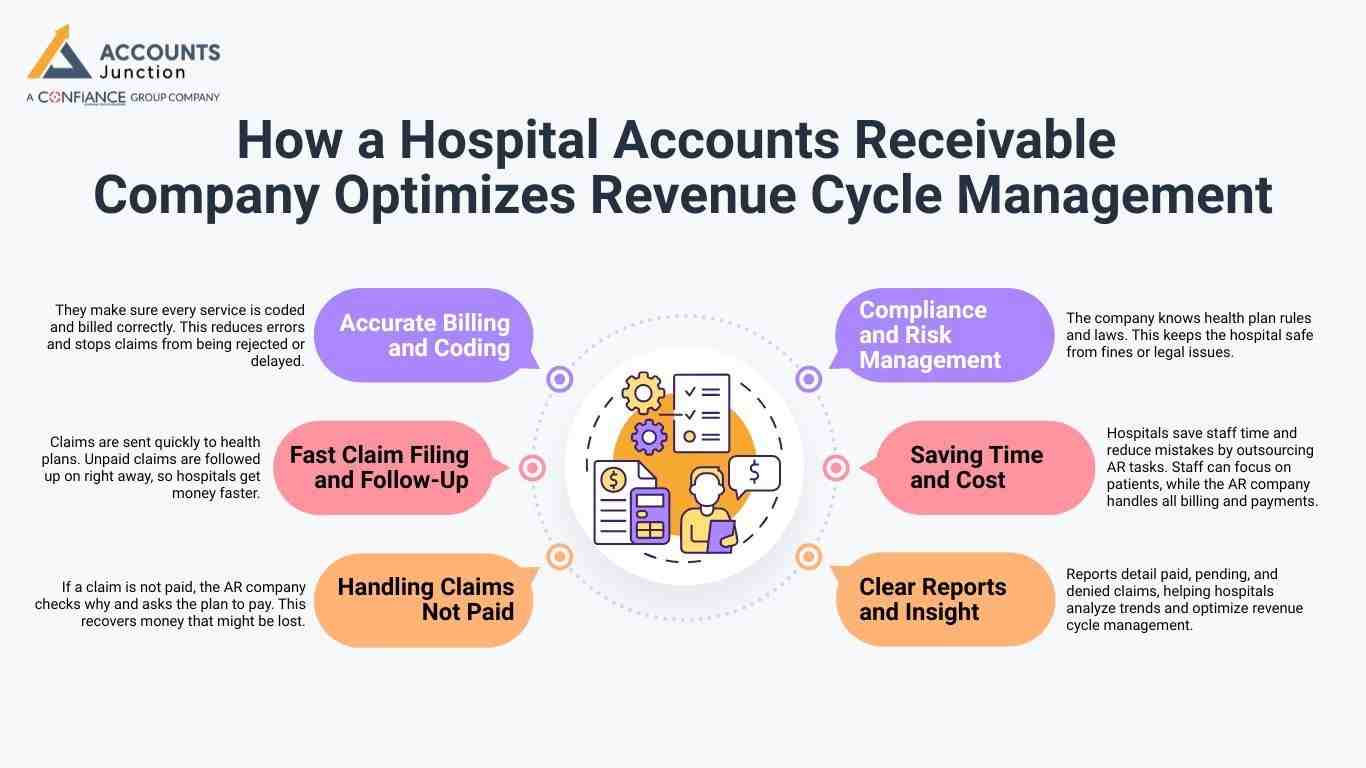

Accurate Billing and Coding

- They make sure every service is coded and billed correctly. This reduces errors and stops claims from being rejected or delayed.

Fast Claim Filing and Follow-Up

- Claims are sent quickly to health plans. Unpaid claims are followed up on right away, so hospitals get money faster.

Handling Claims Not Paid

- If a claim is not paid, the AR company checks why and asks the plan to pay. This recovers money that might be lost.

Clear Reports and Insight

- Reports detail paid, pending, and denied claims, helping hospitals analyze trends and optimize revenue cycle management.

Saving Time and Cost

-

Hospitals save staff time and reduce mistakes by outsourcing AR tasks. Staff can focus on patients, while the AR company handles all billing and payments.

Compliance and Risk Management

- The company knows health plan rules and laws. This keeps the hospital safe from fines or legal issues.

Benefits of Working with a Hospital Accounts Receivable Company

Partnering with experts offers many benefits:

-

Accurate Billing

Specialists reduce mistakes in coding and billing, which leads to faster payments.

-

More Focus on Patients

Outsourcing billing lets staff focus on care, not money issues.

-

Cost Savings

Hiring an in-house billing team costs more than outsourcing to a hospital accounts receivable company.

-

Useful Reports

They give reports that show trends, pending claims, and financial health, helping hospitals make smart choices.

Key Services Provided by a Hospital Accounts Receivable Company

They offer many services to manage clinic money. These services help clinics get paid fast, cut errors, and keep cash flow smooth.

Patient Registration Help

- The AR team checks all patient info. This includes name, birth date, phone, and plan. They make sure the plan will pay. They also check fees, so bills are paid fast.

Expert Medical Coding

- Staff give each service a code. Codes tell the plan what care was done. The right codes stop bills from being unpaid. This helps the clinic get money fast.

Billing and Claim Management

- The team sends bills and tracks the unpaid ones. If a bill is wrong, they fix it and send it again. This keeps cash flow steady.

Denial Handling and Appeals

- If a bill is not paid, the team checks why. They find mistakes and ask the plan to pay. This gets money that could be lost.

Reports and Simple Look

- The AR team makes short lists. The lists show which bills are paid or not. It provides concise reports showing claim status, helping hospitals improve revenue cycle management.

Challenges in Hospital Revenue Management

Hospitals face many problems in handling money:

- Complex Insurance – Different rules for each insurer.

- Manual Errors – Mistakes in billing or claims slow payments.

- Slow Payments – Insurance can take weeks or months.

- Changing Rules – Hospitals must adapt to new laws constantly.

A hospital accounts receivable company solves these problems with knowledge, systems, and tech.

Technology in Accounts Receivable Management

Technology is key in modern billing:

- Automates coding and billing

- Tracks claims in real-time

- Produces reports and insights

- Finds errors before claims are sent

With technology, a hospital's accounts receivable department makes billing accurate and fast.

Choosing the Right Hospital Accounts Receivable Company

Picking the right partner is key to smooth revenue. The right AR team helps the clinic get paid fast, reduce mistakes, and keep money flowing steadily.

Experience

- Choose a team with a strong record in clinic billing. Staff should know how to handle bills and codes. A team with experience solves problems faster and reduces unpaid bills.

Tools

- Look for a team that uses smart software for sending bills and tracking money. Good tools help track which bills are paid and which are not. This saves time and cuts errors.

Transparency

- Regular lists and clear updates are important. The AR team should show which bills are paid, pending, or not paid. Clinics can then see trends and fix problems fast.

Compliance

- The team should know all clinic rules and plan rules to avoid fines. They follow rules when sending bills and fixing errors. This keeps the clinic safe from trouble and keeps money flowing.

A Hospital Accounts Receivable Company is vital for a smooth revenue cycle. It helps clinics track bills, cut errors, fix unpaid claims, and keep cash on hand. By letting experts handle billing, codes, claim follow-up, and reports, staff can spend more time on patients. At Accounts Junction, we provide these services with skilled teams and smart tools. We help hospitals collect payments faster, reduce delays, and keep cash flow reliable. Partnering with us makes the revenue cycle simpler, more efficient, and predictable, supporting long-term financial health and stable operations.

FAQs

1. What does a Hospital Accounts Receivable Company do?

- They help hospitals track money, bill correctly, and get paid fast.

2. Why do hospitals need an AR company?

- Hospitals face slow payments, errors, and denied bills. AR teams fix these issues.

3. How does an AR company improve cash flow?

- They send bills fast, follow up on unpaid ones, and reduce errors.

4. What is revenue cycle management?

- It is how a hospital tracks care and collects money for it.

5. How does patient registration help revenue?

- Correct patient info and plan check, make sure claims are paid fast.

6. What is medical coding?

- It is giving codes to each service so insurance knows what care was done.

7. Why is billing accuracy important?

- Wrong bills get denied or paid late. Accurate billing speeds up the money.

8. How do AR teams handle denied claims?

- They check why a bill was not paid, fix mistakes, and ask the plan to pay.

9. What reports does an AR company provide?

- They show which bills are paid, not paid, or late, and highlight problem areas.

10. Can outsourcing AR save hospital staff time?

- Yes. Staff can focus on patients while the AR team handles billing.

11. How do AR teams keep hospitals compliant?

- They follow clinic rules and plan rules to avoid fines or legal issues.

12. What technology do AR companies use?

- They use software to code, send bills, track claims, and make reports.

13. How can an AR company reduce manual errors?

- They use trained staff and tech to check bills and claims before sending.

14. How do hospitals choose the right AR company?

- Look for experience, smart tools, clear reports, and compliance knowledge.

15. What benefits do hospitals get from AR services?

- Faster payments, fewer errors, better cash flow, and clear financial insight.

16. Can AR teams handle complex insurance rules?

- Yes. They know the rules of different plans and handle claims correctly.

17. How often do AR companies report to hospitals?

- Most give regular lists or reports so hospitals can track paid and unpaid bills.