Top Resources to Help You Complete the 1040 Form in 2025

Filing taxes can feel tough for many people. Each year, taxpayers must file their income tax returns on time. The 1040 form in 2025 is the key tax form. Right tools can save time and reduce mistakes. Tax rules change often, so clear help is vital. Even skilled filers can make errors without support. IRS guides and online tools make filing easier. Tax apps and software show each step with care. Trusted resources help you follow the rules. They also ensure you claim all credits and write-offs.

What Is the 1040 Form in 2025?

The 1040 form in 2025 is the main tax form for U.S. residents. It is used to report all income, such as wages, salaries, and interest. You can also list deductions and credits. This helps the IRS check your tax and any refund you may get.

The form has sections for personal details, income, deductions, and credits. You must report all earnings and follow IRS rules. Filling it right can save money and avoid problems.

Why You Need Help Completing the 1040 Form in 2025

- Tax rules change each year. This can make them hard to follow. Missing a rule can raise your taxes.

- Errors on the form can cause fines, fees, or audits. Small mistakes can bring big delays.

- Many deductions and credits are easy to miss. Without help, you may lose money.

- Online tools or a tax expert make filing easy. They help ensure all details are included.

- Good help saves time, cuts stress, and can save money. It also makes the process smooth and fast.

- It ensures your form is complete and correct. Accurate filing gives peace of mind.

Key Documents You Need

Gather your documents before filing. It makes the process fast and safe.

- W-2 Forms: Show your wages and taxes taken out. Keep all copies ready for review.

- 1099 Forms: Show freelance income, interest, and dividends. Include every 1099 you received.

- Receipts: Keep bills for costs you can deduct, like medical or work expenses. Sort them by type to stay organized.

- Bank Statements: Show interest, dividends, and other payments. Make sure every month is included.

- Social Security Numbers: Include numbers for all dependents. Check each number to avoid errors.

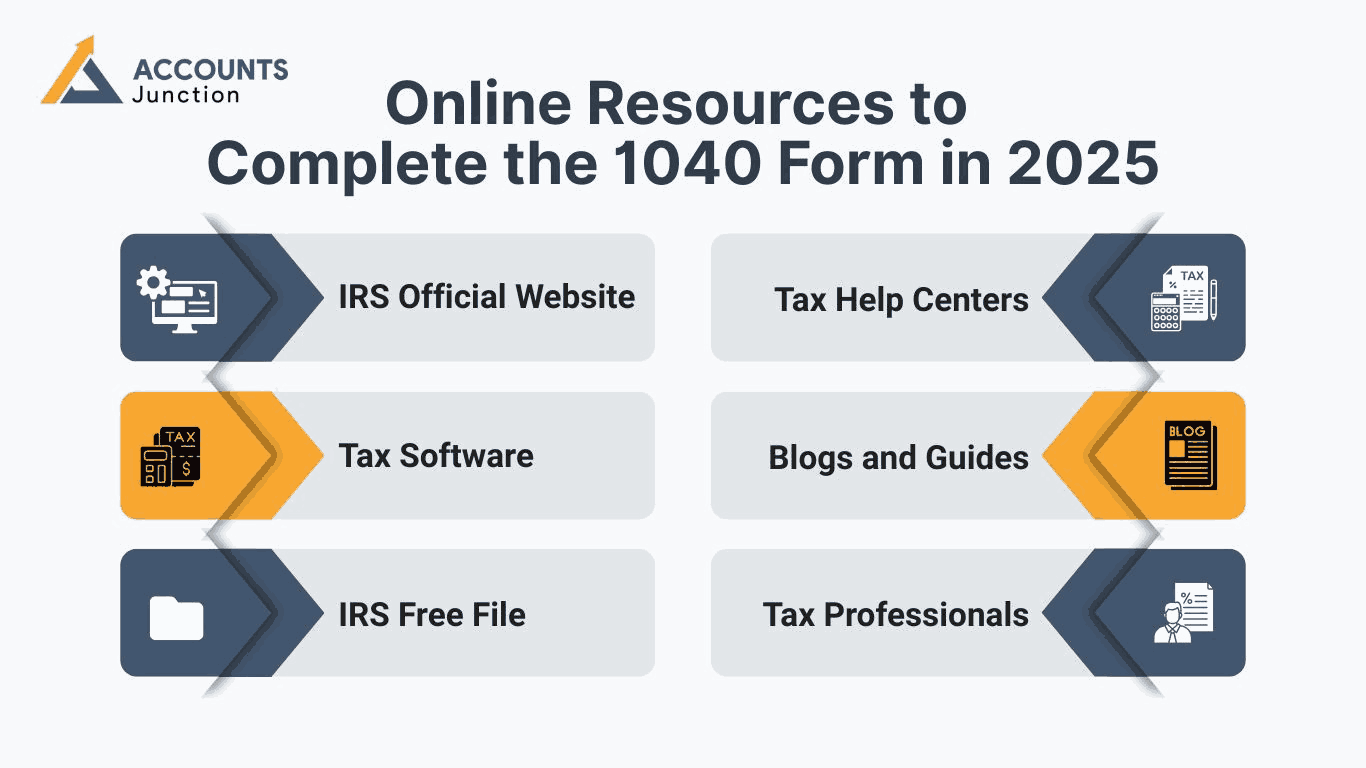

Online Resources to Complete the 1040 Form in 2025

- IRS Official Website

Download the 1040 form and read free guides.

Check refund status and fix errors online. - Tax Software

TurboTax, H&R Block, and TaxAct guide you step by step.

They suggest credits and cut mistakes. - IRS Free File

Free for taxpayers under a set income limit.

Helps file online with built-in error checks. - Tax Help Centers

IRS offices give in-person help with returns.

Some need appointments for complex cases. - Blogs and Guides

Online blogs share tax tips and simple steps.

They explain new rules and common errors. - Tax Professionals

Experts ensure correct filing and IRS compliance.

They also plan ahead to reduce future taxes.

Hire A Dedicated Team

That Grows With You, Flexible, Scalable and

Always On Your Side

Steps to Complete the 1040 Form in 2025

- Personal Information

Enter your name, address, and Social Security number.

Add all dependents accurately.

- Income

Report wages, salary, freelance pay, interest, and dividends.

Include every source to be correct.

- Deductions

Use standard deduction or list mortgage, medical, and charity expenses.

These reduce your taxable income.

- Tax Credits

Include all credits you qualify for.

Credits lower tax or increase refund.

- Taxes

Check tax owed and compare it with withheld tax.

Pay any balance or claim a refund.

- Sign and Submit

Sign the form and submit online or by mail.

Keep a copy for records.

Tips for Avoiding Mistakes

1. Double-Check Social Security Numbers

- Check every number carefully. One wrong digit can cause delays or errors.

2. Report All Income

- Include all income sources. Freelance work, investments, or side jobs must be listed.

3. Review Calculations

- Go over all totals. Small math mistakes can lead to penalties or extra questions.

4. Keep Records Safe

- Store digital and paper copies of tax forms. They help if proof is needed later.

5. Organize Receipts and Documents

- Sort bills and receipts clearly. It makes filing faster and reduces errors.

6. Use a Checklist

- Track forms, deductions, and credits with a simple list. This prevents missed items.

7. Review Past Returns

- Look at prior returns for reference. Avoid repeating past mistakes.

8. Confirm Deadlines

- Check all dates carefully. Late filing can lead to fees or penalties.

Benefits of Using Professional Help

- Reduce Errors

Experts cut mistakes on your 1040 form in 2025. This helps you avoid fines and delays.

- Save Time

They save time and make filing less hard. You can focus on work or life tasks instead.

- Maximize Deductions and Credits

Professionals guide you on credits, deductions, and tax steps. This helps you claim all the benefits you can get.

- Expert Support for IRS Notices

Experts are key if you get IRS letters or face audits. They respond fast and right.

- Tax Planning Advice

Professionals give tips for future tax planning. This can cut your taxes and help you save more.

- Peace of Mind

Hiring experts gives peace of mind. You know your tax work is done right, and stress is low.

Key Sections of the 1040 Form in 2025

- Personal Information

Add your name, address, Social Security number, and filing status.

Check all details to avoid mistakes. - Income Reporting

Report wages, salaries, and all other income.

Every source must be included. - Adjustments to Income

List items like student loan interest or retirement plans.

These reduce taxable income. - Tax and Credits

Figure the tax owed and apply the credits you can claim.

Some credits may raise your refund. - Payments

Enter tax withheld and any extra payments made.

This shows if you owe or get a refund. - Signature

Sign and date the form to make it valid.

Both spouses must sign if filing together.

Common Mistakes to Avoid

- Wrong Personal Details

Wrong name or Social Security can delay your return.

Check all personal details before filing.

- Missing Income

Include all income, like freelance work or rent.

Leaving out income can trigger fines or audits.

- Math Errors

Errors in addition or subtraction cause IRS notices.

Double-check totals before submitting.

- Unsigned Forms

Forms without signatures are rejected.

Sign your return or use an e-signature.

- Missing Credits or Deductions

Not claiming credits increases taxes owed.

Check all deductions to lower taxable income.

Filing Tips to Maximize Refunds

- Claim Deductions

Add mortgage interest, medical costs, and gifts.

Deductions lower tax and may boost refunds. - Use Tax Credits

Apply credits for school or child care.

Some credits can pay back more than the tax owed. - Report Income Correctly

List all W-2s, 1099s, and other income.

Correct reports help you avoid IRS issues. - Check Withholding

Match your paycheck to your tax needs.

This helps prevent shocks at tax time. - File Early

Send your returns soon to get refunds fast.

Early filing also cuts errors and stress.

Special Situations for 1040 in 2025

- Self-Employed

Report income and costs on Schedule C.

Pay self-employment tax with your income tax. - Investors

Report gains from stocks, bonds, or real estate.

Capital gains or losses change your total tax. - Retirees

List pensions, Social Security, and other income.

Some tax breaks may cut your taxable amount. - Students

Some grants or scholarships may be taxable.

Education credits, like American Opportunity, can reduce taxes.

Filing your 1040 form in 2025 is easy with the right help. IRS tools, safe tax apps, and clear guides make it smooth. Filing right stops errors, fines, and missed tax credits. Expert help also saves time and keeps forms correct.

At Accounts Junction, we file your 1040 with care. Our team checks income, write-offs, and credits in detail. We guide you step by step and prevent mistakes. We also share tax tips to help you save more in the future. With us, filing is fast, simple, and stress-free. Clients trust us for support that is expert and reliable.

FAQs

1. What is the 1040 form in 2025?

- It is the main U.S. tax form for income. You use it to file taxes or get a refund.

2. Why should I get help with the 1040 form?

- Help keeps errors low and saves you time. It also makes sure you claim all credits.

3. What papers do I need for the 1040 form?

- You need W-2s, 1099s, bills, bank slips, and SSNs. Keep them in order before you start to file.

4. Can I use tax software for the 1040 form?

- Yes, tools guide you step by step with ease. They also check math and show credits to claim.

5. What errors should I avoid on the 1040 form?

- Do not miss income, math, or a sign. Check each part to stop IRS delays.

6. How do pros help with the 1040 form?

- They check work, add breaks, and fix issues. Pros also plan taxes to help you save more.

7. Are there rules for self-employed or investors?

- Yes, self-employed file with Schedule C. Investors must list gains and losses each year