Top Benefits of Cloud-Based Accounting Software for Modern Businesses

Managing money is key for every business. The benefits of cloud-based accounting software help firms handle this work with ease. It lets them track costs, check accounts, and view data quickly. Using cloud accounting software cuts mistakes and saves time, helping businesses grow.

In the modern business environment, companies need fast tools to handle money. Old accounting is slow and often wrong. Cloud solutions let all work be done online, safely, and in real-time. This blog shows the main benefits of cloud-based accounting software and why firms now use it.

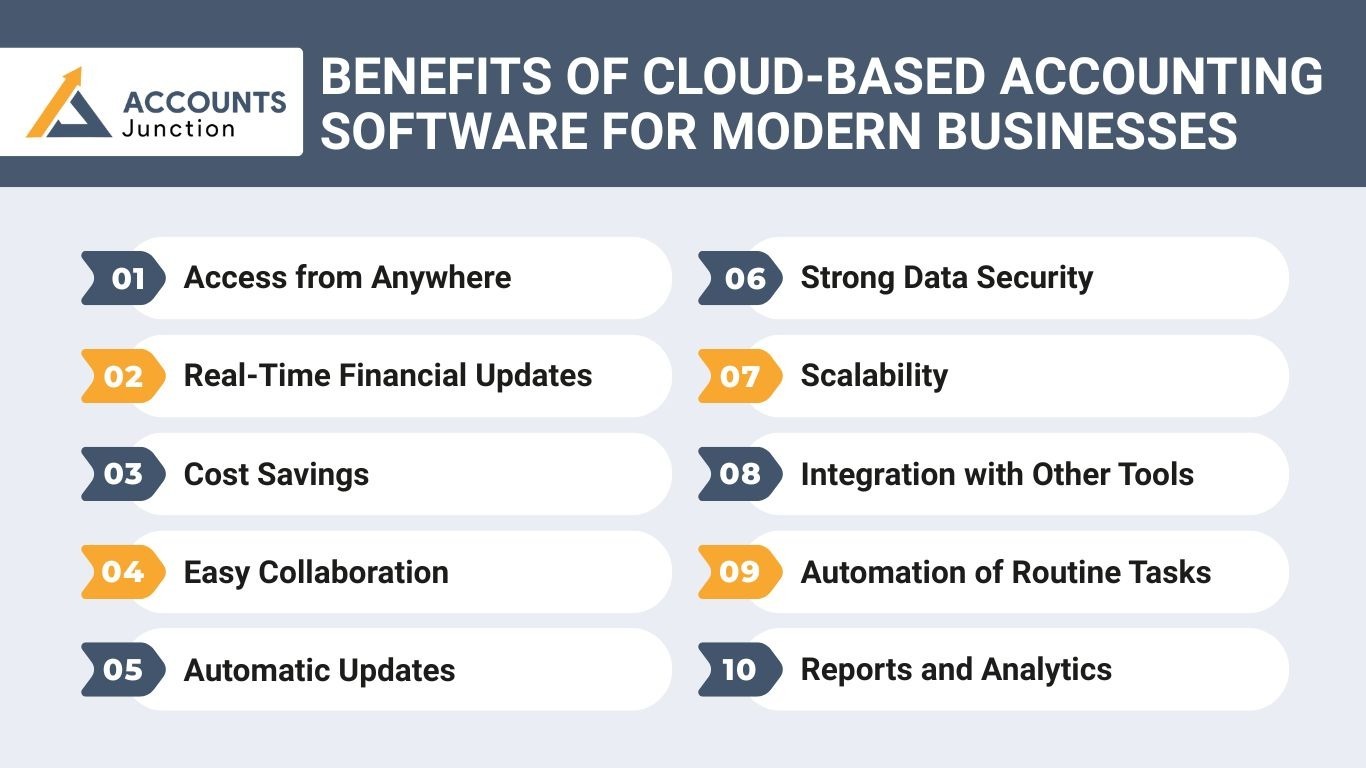

Benefits of Cloud-Based Accounting Software for Modern Businesses

1. Access from Anywhere

Cloud accounting lets users check data on any device. One of the main benefits of cloud-based accounting software is the ability to manage accounts anytime, anywhere. This ensures fast decisions and keeps track of finances all the time.

2. Real-Time Financial Updates

Transactions update instantly. You can check balances, track costs, and create reports without delay. Real-time updates lower mistakes and give clear insight into cash flow and income.

3. Cost Savings

Traditional accounting needs servers, licenses, and IT staff. One key benefit of cloud-based accounting software is reduced costs and fewer upfront investments. Cloud software removes these costs. Businesses pay a subscription and get full features without high upfront fees. This suits small and medium-sized firms.

4. Easy Collaboration

Multiple users can work on accounts at once. Managers, accountants, and owners can view records, approve payments, and check reports together. This avoids miscommunication and keeps financial work organized.

5. Automatic Updates

Cloud accounting software updates itself. Users always get the newest version. Security patches, new tools, and rules compliance happen automatically. Data stays safe and systems run smoothly.

6. Strong Data Security

Financial data is sensitive. Enhanced protection is a key benefit of cloud-based accounting software, including encryption, backups, and controlled access. Businesses can protect data from loss or theft. Regular backups ensure data is safe in any case.

7. Scalability

As a business grows, accounting needs grow too. Cloud systems expand easily. You can add users, tools, and storage without installing new software. Growth is smooth and worry-free.

8. Integration with Other Tools

Cloud software can link with payroll, inventory, and CRM systems. A notable benefit of cloud-based accounting software is seamless integration across business tools. This lowers repeated work and keeps records correct across tools. Integration saves time and improves reporting.

9. Automation of Routine Tasks

Tasks like invoicing, bank checks, and expense tracking can run automatically, which is a major benefit of cloud-based accounting software. Automation lowers human error and saves hours of work. Teams can focus on planning and growth instead of repeating work.

10. Reports and Analytics

Cloud tools give reports on income, costs, and cash flow. A big benefit of cloud-based accounting software is clear analytics that help plan budgets and track trends. Clear reports support smart decisions and financial health.

Types of Cloud Accounting Software

- SaaS-Based Software

Works online, paid monthly, simple to grow and scale. Good for small teams needing little IT support. Updates happen automatically without staff doing extra work. - Private Cloud Software

Made for one company, more secure and safe. Best for firms handling sensitive or private financial data. Data can stay local while still using cloud tools. - Hybrid Cloud Software

Mix of online and local systems for more flexibility. Helps firms move systems slowly without causing downtime. Supports both old tools and new online features easily. - Choosing the Right Type

When selecting a solution, understanding your needs highlights the benefits of cloud-based accounting software, ensuring smooth operations for your team. Choosing the right type saves money and time daily. Ensures smooth work and less manual effort overall.

How to Choose Cloud Accounting Software

- Identify Business Needs

Know your needs, like billing, payroll, or stock. Pick features that support your most important daily tasks. Decide which tasks must run automatically or manually. - Check Integration

Check if it links to your current business tools. Linking reduces duplicate work and prevents common mistakes. Make sure software can share data with other systems. - Ease of Use and Mobile Access

Make sure it is simple and works on phones. Software should be easy so staff learn it quickly. Mobile access allows work from anywhere at any time. - Pricing and Trial

Look at prices, fees, and monthly subscription options. Read reviews and try the software before purchasing. Compare options to avoid hidden fees or extra costs. - Customer Support and Training

Good support reduces downtime and helps staff adapt. Training ensures fewer mistakes in daily accounting work. Look for providers offering clear tutorials and guides.

Common Challenges in Cloud Accounting

- Internet Dependency

Needs internet to work and some features fail offline. Slow or weak connections can delay accounting tasks greatly. - Data Security

Data must stay safe with strong passwords and backups. Hackers may try to access accounts without strong protection. - User Adoption

Staff may need help learning how to use software. Training is important to reduce mistakes and save time. - Integration Issues

Old tools may not link; extra apps can help. Sometimes setup or middleware is needed for full connection. - Continuous Updates

Updates come often; staff must learn new features. New features may require process changes or extra training. - Cost Management

Subscription costs can grow with more users or features. Plan budget carefully to cover software and add-ons.

Cloud Accounting Trends in 2025

- AI and Automation

AI tools check numbers and finish tasks on their own. Automation cuts errors and saves staff time each day. - Mobile Apps

Mobile apps let staff work on phones or tablets. They help manage money from any place at any time. - Strong Security

Strong security keeps your business safe from online threats. It adds backups, locks, and two-step login for safety. - Blockchain Records

Blockchain keeps all records safe, clear, and easy to view. It stops fraud and makes sure data stays correct. - Dashboards and Reporting

Dashboards show key info fast for smarter business choices. Reports can be changed to show what matters most. - Cloud Collaboration

Teams can edit files and share work in real time. It helps remote teams track tasks and stay in sync.

How Cloud Accounting Helps Planning

- Cash Flow and Budgeting

Helps predict cash flow and set a simple budget. One of the key benefits of cloud-based accounting software is better forecasting and financial planning. - Expense Tracking

Tracks costs to show where savings are possible clearly. Identify unnecessary spending and improve efficiency of resources. - Real-Time Data

Gives real-time numbers so decisions can be made quickly. Immediate access helps leaders respond faster to all changes. - Goal Setting and Monitoring

Helps set goals and track progress each month clearly. Tracking ensures plans stay on target successfully every time. - Scalable Solutions

Works as your business grows without extra setup needed. Supports new teams, locations, or products easily over time. - Profit Analysis

Shows which products or services are most profitable. Helps focus efforts on high-return tasks for growth.

Cloud Accounting for Small Businesses

- Cost Savings

Reduces need for full-time accountants, saving money monthly. Among the top benefits of cloud-based accounting software is cost efficiency for small businesses. - Automation

Handles all bills, payments, and costs to save time. Cuts mistakes and makes every task quick and easy. - Ease of Use

Staff can run accounts without tech skills or help. The software is clear, simple, and easy to use. - Competitive Advantage

Small firms can now compete with larger firms easily. Cloud tools help businesses stay fair and work well. - Insights for Growth

Gives data to help owners plan and grow smart. Shows clear facts without extra cost or effort needed. - Custom Reports

Makes reports on key numbers fast and clear. Owners can see results quick and make wise choices.

Training and Support

- Tutorials and Guides

Step-by-step guides help staff learn software fast. Clear instructions cut mistakes and build confidence. - Customer Support

Support fixes issues quickly to reduce downtime. Keeps work running smoothly with no delays. - Training

Training cuts errors, so work is faster and correct. Make sure staff can use the software safely. - Ongoing Help

Support keeps software safe and working well. Updates and tips help operations stay steady. - Provider Reliability

Choose a provider with good support to avoid issues. Reliable partners prevent interruptions. - Community Help

Many providers have forums and online groups. Staff can get tips and help from peers fast.

Compliance and Rules

- Tax Tracking

Software tracks taxes on its own to cut filing mistakes. Helps avoid errors and late submissions each time. - Reporting

Makes reports that follow local audit rules. Makes audits and record-keeping simple. - Local Tax Support

Handles local tax rules to file taxes right. Manages VAT, GST, or other local taxes correctly. - Risk Reduction

Cuts the risk of fines by keeping records in order. Helps stay within government rules. - Audit Trails

Keeps all transaction history safe and easy to check. Gives clear records for reviews. - Record Retention

Stores past financial records safely. Useful for audits, reviews, or later reference.

Future of Cloud Accounting

- AI Forecasting

AI tools predict results and make money decisions easy. This is a forward-looking benefit of cloud-based accounting software for smarter financial management. Helps plan cash flow and costs right every time. - Task Automation

Repeats tasks on its own so staff can focus on other work. Cuts manual work and boosts productivity. - Mobile Access

Work from anywhere using phones or laptops. Supports remote teams and flexible schedules. - Data Insights

Gives clear information from data for better business choices. Helps leaders act on facts, not guesses. - Security Improvements

Security gets better all the time, keeping data safe. Updates guard against new risks. - AI Suggestions

Software may suggest steps to improve money health. Helps owners act on time to save more.

Cloud accounting software gives a clear view, speed, and safety. Accounts Junction offers services with live updates, cost cuts, easy teamwork, and growth options. Firms can cut errors, simplify work, and reach data anytime. With certified experts on our team, we deliver correct reports, smooth finance control, and full compliance. Partner with us for smart finance solutions and steady growth.

FAQ's

1. What is cloud accounting software?

- It is a system to manage financial records online.

2. How does cloud accounting help?

- It improves accuracy, saves time, and gives live data access.

3. Is cloud accounting safe?

- Yes, it uses encryption, backups, and access control.

4. Can small businesses use it?

- Yes, it is affordable, scalable, and fits any business size.

5. Does it reduce costs?

- Yes, it removes servers, licenses, and IT maintenance.

6. Can multiple users work at once?

- Yes, many team members can update accounts together.

7. Does it help with taxes?

- Yes, it calculates taxes and ensures compliance.

8. Can it link with other software?

- Yes, it connects with payroll, CRM, and inventory systems.

9. Is training needed?

- Most systems are simple and offer guides and help.

10. Can it work on mobile devices?

- Yes, apps let you access accounts anywhere.

11. Does it support global business?

- Yes, it handles multiple currencies and global standards.

12. How does it improve accuracy?

- Automation and live updates reduce errors in records.

13. Are updates automatic?

- Yes, the provider updates the system regularly.

14. Can it support remote teams?

- Yes, employees can work from any location.

15. How does it help cash flow?

- It gives live data to track payments and costs.

16. Does it grow with the business?

- Yes, you can add users, features, and storage easily.

17. Can it improve decisions?

- Yes, reports and analytics guide financial planning.