Should a CPA firm needs account outsourcing

Outsourcing accounting services is now a top choice for many CPA firms. It helps firms work better, spend less, and tap into expert skills. Outsourcing accounting services for CPA firms cuts costs by removing the need for in-house staff. Outsourcing helps CPA firms focus on what they do best, like client service and advice. Meanwhile, specialists take care of the accounting tasks.

What is Outsourcing Accounting?

Outsourcing accounting means hiring another company to handle some accounting work. This can include bookkeeping, payroll, taxes, and reports. It helps CPA firms spend more time on their main work. Trained experts take care of daily accounting tasks. Outsourcing accounting services for CPA firms gives access to expert knowledge, ensuring correct records and tax rule compliance. An outsourcing firm offers top tools and tech, improving the quality of accounting and reports for the firm.

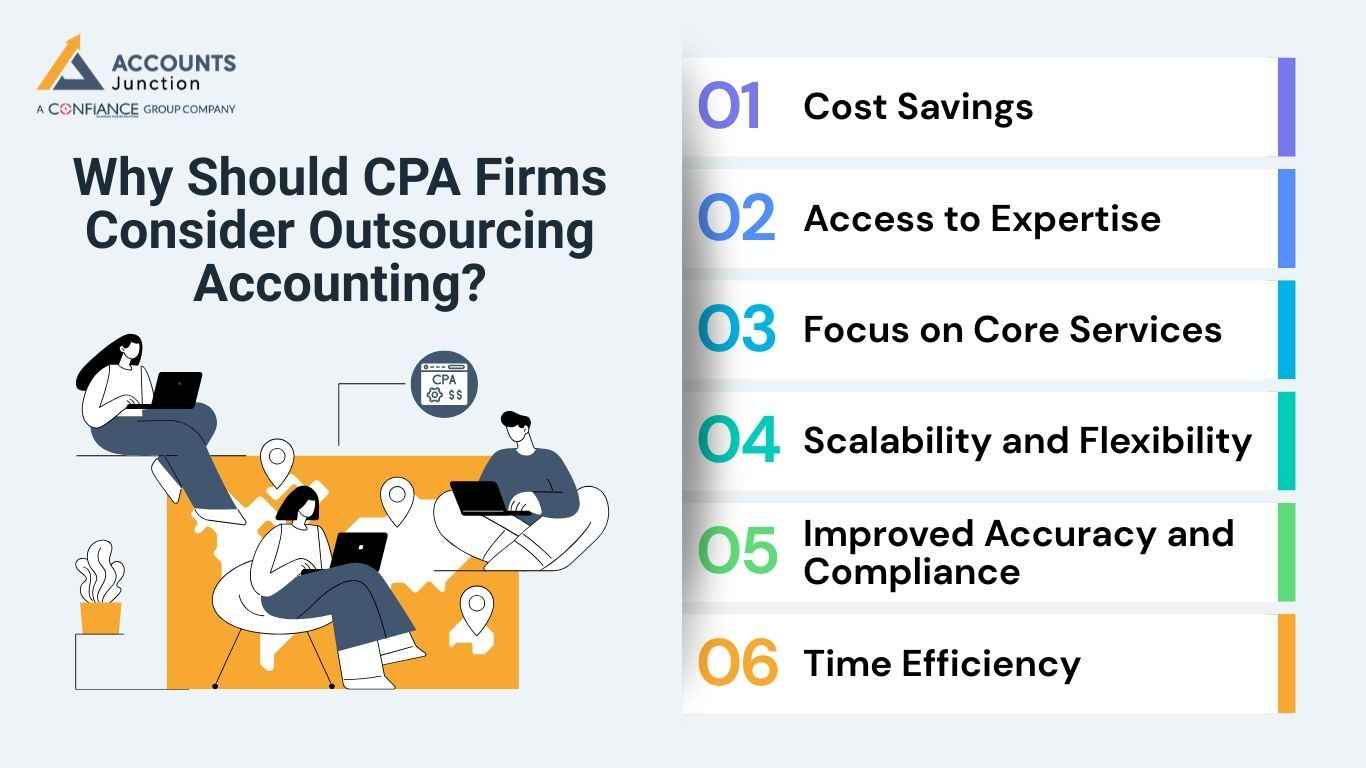

Why Should CPA Firms Consider Outsourcing Accounting?

1. Cost Savings

- Cuts extra costs: Outsourcing means no need to hire full-time staff. It saves on pay, perks, and space.

- Low-cost plans: Outsourcing firms give pay-as-you-use deals, so you spend only when needed.

2. Access to Expertise

- Expert help: Outsourcing gives your firm skilled accountants who know the latest tax rules and laws.

- Top-quality work: Outsourced pros make sure all tasks are accurate and follow the rules.

3. Focus on Core Services

- Less distraction: Outsourcing tasks like payroll and bookkeeping lets your firm focus on key services like tax work and audits.

- Smart growth: More time means your firm can focus on areas that help grow the business.

4. Scalability and Flexibility

- Flexible help: Outsourcing can grow or shrink based on your firm’s needs. It’s great for busy times or growth.

- No big commitment: Adjust contracts as your firm’s work changes, so you only pay for what you need.

5. Improved Accuracy and Compliance

- Professional care: Outsourcing keeps your accounting in line with tax laws, lowering the risk of mistakes.

- Less audit risk: Outsourced experts ensure your records are correct, cutting the chance of audits and fines.

6. Time Efficiency

- Save resources: Outsourcing lets your team focus on clients and important tasks.

- Quicker results: Outsourced experts finish tasks faster due to their skill and focus.

Which accounting services can CPA firms outsource?

1. Bookkeeping

- Routine tracking: Outsourced bookkeeping helps track daily money tasks, match accounts, and keep records.

- Accuracy: Experts make sure all money records are right and current.

2. Payroll Management

- Payroll processing: Outsourced providers handle payroll, tax withholdings, and compliance, ensuring timely and accurate payments.

- Tax filings: They ensure that payroll taxes are filed correctly and on time.

3. Tax Preparation

- Accurate filings: Outsourced tax prep makes sure your firm’s returns are filed right and on time, cutting the risk of mistakes.

- Tax planning: Outsourcing gives clients smart tax tips to help them save more.

4. Financial Reporting

- Financial analysis: Outsourced teams can create full money reports for both inside and outside use.

- Insightful data: They give reports that help leaders make smart business choices.

5. Auditing

- Support during audits: Outsourcing specific aspects of auditing can speed up the process and provide more comprehensive results.

- Expert analysis: External auditors bring fresh perspectives and can offer valuable insights.

How to Choose the Right Outsourcing Provider?

Selecting the right outsourcing partner is crucial. Here are key factors to consider: Outsourcing accounting services for CPA firms gives flexibility, letting firms adjust to workload changes without adding staff. With experts handling accounting, CPA firms work more smoothly, offering better service to clients and helping the business grow.

1. Experience and Expertise

- Industry experience: Pick a team that has worked with CPA firms before.

- Certifications: Ensure they possess the necessary qualifications and expertise.

2. Security and Confidentiality

- Data protection: Make sure the team follows strong safety rules to guard client data.

- Confidentiality agreements: Sign deals that promise privacy and stop data leaks.

3. Scalability

- Adaptable services: The provider should be able to scale their services as your firm grows and as your needs evolve.

- Flexible contracts: Look for providers who offer flexible terms and services based on your firm’s workload.

4. Communication and Support

- Easy communication: Pick a team that replies fast and shares clear, open messages.

- Ongoing support: Make sure they give steady help and share updates on your accounting work.

5. Cost-Effectiveness

- Compare prices: Get quotes from multiple outsourcing providers to ensure you are getting a fair price for the services.

- Value for money: Ensure that the provider offers a good balance of cost and quality of service.

Challenges of Outsourcing Accounting

Outsourcing accounting has many benefits. However, it also comes with a few challenges to consider.

1. Loss of Control

- Managing expectations: You may feel like you’re losing control, but clear talks and set goals can help.

- Accountability: Establish clear deals or contracts and check-ins to keep the team on track.

2. Integration with Existing Systems

- System compatibility: Check that the provider’s system works well with your firm’s accounting software.

- Smooth integration: Work closely with the provider for a seamless service setup.

3. Miscommunication

- Clear communication: Misunderstandings happen when expectations aren’t clear. Establish regular communication to avoid this.

- Frequent updates: Ask for regular check-ins and make sure all teams agree on jobs and due dates.

Benefits of Outsourcing Accounting

Cost-effectiveness:

-

Outsourcing accounting helps reduce costs. It removes the need to do regular tasks in-house. Skilled experts handle the work. This means CPA firms do not need to train staff for technical jobs. The work is done right and at a lower cost.

Speedy turnaround:

- With fast tools and software, clients need up-to-date numbers. Outsourcing accounting services for CPA firms helps give real-time reports. It meets the needs of different clients. It also supports better and quicker decisions.

Virtual access and tools:

- Outsourcing teams use many tools and cloud software. This makes it easy to talk, share, and get data fast. CPA firms can serve clients from any place. Virtual help also saves time and supports smooth work.

How Outsourcing Can Improve Client Relationships

When CPA firms spend less time on data entry or payroll, they can focus more on their clients. Outsourcing gives the firm room to think, plan, and talk more with clients about their goals. This shift can build deeper trust and long-term bonds.

Clients may notice that their CPA has more time for them. They can ask questions and get better advice. The firm, in turn, gets to play a bigger role in shaping each client’s success. It’s not only about numbers—it’s about guidance and insight.

By letting experts handle routine accounting, CPA firms can turn client service into a personal and strategic process. This may lead to better client satisfaction, repeat business, and even more referrals.

Common Mistakes CPA Firms Should Avoid When Outsourcing

While outsourcing can work wonders, there are a few traps that firms should avoid.

1. Picking price over quality: Some firms may pick the lowest quote and end up with poor results. Cost matters, but value matters more.

2. Weak communication: Gaps in updates or unclear roles can slow everything down. A good outsourcing plan needs steady check-ins and open talks.

3. No data checks: Firms should always keep a close eye on what is shared and stored. Data safety must be a shared goal.

4. No training for staff: Even with outsourcing, your in-house team needs to know how the process flows. A short training can make a big difference.

Avoiding these simple mistakes can help the partnership stay smooth, safe, and successful. It’s not only about handing over the task—it’s about managing it the smart way.

Outsourcing accounting services for CPA firms brings many clear benefits. It helps reduce costs and gives access to skilled experts. Firms can grow faster with flexible support and better work accuracy. When tasks like bookkeeping, payroll, and tax filing are outsourced, CPA firms can focus more on helping their clients. This also improves speed and keeps work in line with the rules. A trusted outsourcing partner can help your firm work better and keep your clients happy. Accounts Junction offers trusted outsourcing accounting services for CPA firms. We give fast, clear, and safe support to help your firm grow. Our skilled team works like a part of your own staff.

FAQs

1. What is outsourcing accounting for CPA firms?

- It means hiring an outside team to handle accounting tasks. This helps CPA firms focus on client advice and business growth.

2. Why do CPA firms outsource accounting services?

- It helps them cut costs, save time, and use expert help. Outsourcing may also improve accuracy and client service.

3. How does outsourcing benefit CPA firms?

- It gives access to skilled accountants, flexible support, and faster results. Firms can take on more clients with ease.

4. What accounting functions can CPA firms outsource?

- Tasks like bookkeeping, payroll, tax prep, and financial reports can all be outsourced to expert providers.

5. Can outsourcing help CPA firms handle peak tax seasons?

- Yes, it adds extra hands when workloads rise. CPA firms can scale help up or down as needed.

6. Is outsourcing accounting cost-effective for CPA firms?

- It may reduce staff, training, and tech costs. You pay only for the work done, not full-time salaries.

7. How can outsourcing improve accuracy and compliance?

- Outsourced teams stay updated with tax laws. They help CPA firms avoid errors and stay compliant.

8. Does outsourcing affect client data security?

- Trusted providers use strict data safety systems. Always pick one with secure tools and privacy rules.

9. How can CPA firms choose the right outsourcing partner?

- Check their skill, tools, and industry experience. Ask about data safety, support, and response time.

10. Can CPA firms outsource tax preparation and filing?

- Yes, outsourcing tax prep ensures timely filing and fewer mistakes. Experts handle forms and compliance rules.

11. How does outsourcing help CPA firms grow faster?

- With less admin work, firms can focus on client strategy. That leads to higher revenue and long-term growth.

12. Can outsourcing improve client satisfaction for CPA firms?

- Yes, clients get quicker responses and better reports. Freed-up time means stronger relationships and trust.

13. What software tools do outsourcing firms use for CPA work?

- Most use tools like QuickBooks, Xero, or Sage. They also work on cloud platforms for easy sharing.

14. How do outsourced teams work with in-house CPA staff?

- They act as remote extensions of your team. Clear roles and updates help both sides stay aligned.

15. What challenges may CPA firms face in outsourcing accounting?

- Possible issues include poor communication or loss. These can be fixed with set goals and check-ins.

16. How can CPA firms monitor outsourced accounting tasks?

- Regular reports, dashboards, and video calls help. Set timelines and review points for steady tracking.

17. Can outsourcing help CPA firms manage more clients?

- Yes, it lets them take extra projects without hiring more staff. That’s key for scaling up smoothly.

18. Is outsourcing good for small CPA firms too?

- Absolutely. It helps small firms cut workload stress and work like bigger players without high costs.

19. What should CPA firms check before signing an outsourcing deal?

- Review contracts, data rules, and service limits. Ensure terms fit your goals and client needs.

20. How can Accounts Junction support CPA firms with outsourcing?

- Accounts Junction offers full outsourced accounting for CPA firms. We provide expert help, accuracy, and peace of mind.