Outsourced Bookkeeping Year-End: Streamlining Your Financial Close in 2026

As 2026 approaches, business owners across the USA begin reviewing the past year while preparing for the next. Year-end is more than a calendar milestone. It is the moment when your financial records must be finalized, verified, and aligned for future planning.

Every transaction must be reconciled. Payroll must match. Accounts payable and receivable must be cleaned up. Reports must reflect the true financial position of the business.

For many SMEs, this process creates pressure, overtime, and unnecessary risk.

That is why outsourced bookkeeping year-end has become a strategic solution in 2026. Instead of relying solely on internal teams, businesses are partnering with experts to manage the close efficiently, accurately, and without disruption.

At Accounts Junction, we provide tailored Outsourced Bookkeeping Services that help USA businesses close strong and start the new year with clarity. In this guide, you’ll learn the benefits, trends, and step-by-step process for implementing outsourced bookkeeping year-end successfully.

Why Outsourced Bookkeeping Year-End Is Gaining Momentum in 2026

Year-end financial close is not just administrative work. It directly impacts:

- Budget planning

- Cash flow forecasting

- Investor discussions

- Loan approvals

- Strategic growth decisions

In-house year-end processes often lead to:

- Delays due to limited staff capacity

- Errors from rushed reconciliations

- Higher costs from overtime or temporary hires

- Inconsistent reporting

Outsourced bookkeeping services offer a scalable solution that adapts to workload spikes during year-end.

Industry projections show continued expansion in business process outsourcing, especially in accounting functions. USA businesses are increasingly choosing outsourced bookkeeping for year-end to reduce operational costs while improving accuracy.

When you partner with Accounts Junction, you gain access to experienced professionals who manage transaction categorization, reconciliations, reporting, and payroll integration without the expense of full-time hiring.

The Financial Advantage of Outsourced Bookkeeping Services

Cost control is one of the primary reasons businesses switch to outsourced bookkeeping services.

Companies outsourcing accounting functions typically reduce operational expenses by 25%–40%. In 2026, with rising labor costs and competitive hiring markets, these savings are even more valuable.

Instead of committing to salaries, benefits, training, and overhead, businesses pay only for the services they need during peak periods like year-end.

Beyond savings, outsourced bookkeeping services provide real-time access to financial data through cloud-based platforms such as QuickBooks and Xero. This allows business owners to:

- Review updated reports instantly

- Identify cash flow issues early

- Adjust expenses before the new fiscal year

- Make faster, data-driven decisions

Outsourced Bookkeeping for Startups: Building a Strong Foundation

For early-stage companies, outsourced bookkeeping for startups during year-end can be transformative.

Startups often lack structured financial systems. Year-end discrepancies can negatively impact funding rounds, investor confidence, and compliance requirements.

Outsourced bookkeeping for startups ensures:

- Accurate bank and credit card reconciliations

- Clean accounts payable and receivable records

- Proper revenue tracking

- Compliance with US GAAP standards

- Audit-ready financial statements

2026 Trends Shaping Outsourced Bookkeeping Year-End

Financial operations continue evolving. In 2026, several key trends are redefining outsourced bookkeeping year-end.

Real-Time Reconciliation

The traditional big bang year-end close is being replaced by continuous reconciliation. Transactions are reviewed throughout the year, making year-end a final review rather than a cleanup crisis.

AI Bookkeeping Outsourcing

AI bookkeeping outsourcing tools now automate:

- Transaction categorization

- Duplicate detection

- Anomaly alerts

- Journal entry suggestions

- Predictive forecasting

Accountants are saving an average of 7–10 days during close cycles due to AI integration. At Accounts Junction, we incorporate AI bookkeeping outsourcing into our workflows to deliver faster and more accurate results.

Cloud Bookkeeping Outsourcing

Cloud bookkeeping outsourcing enables secure, remote collaboration. USA businesses with distributed teams benefit from:

- Live dashboards

- Secure data access

- Real-time reporting

- Reduced administrative burden

If your current system feels outdated, transitioning to cloud bookkeeping outsourcing may dramatically improve efficiency.

Year-End Outsourced Bookkeeping Services: Payroll and AP/AR Integration

Year-end accuracy depends heavily on payroll and accounts management.

Payroll reconciliation must include:

- Wages and bonuses

- Benefits and deductions

- Tax calculations

- Accrual adjustments

Through our payroll services, Accounts Junction ensures payroll aligns seamlessly with financial statements.

Accounts payable outsourcing also plays a critical role. Missed invoices or incorrect accruals can distort your balance sheet. By integrating accounts payable outsourcing into year-end processes, businesses prevent discrepancies and strengthen vendor relationships.

Comprehensive year-end outsourced bookkeeping services ensure every component of your books works together accurately.

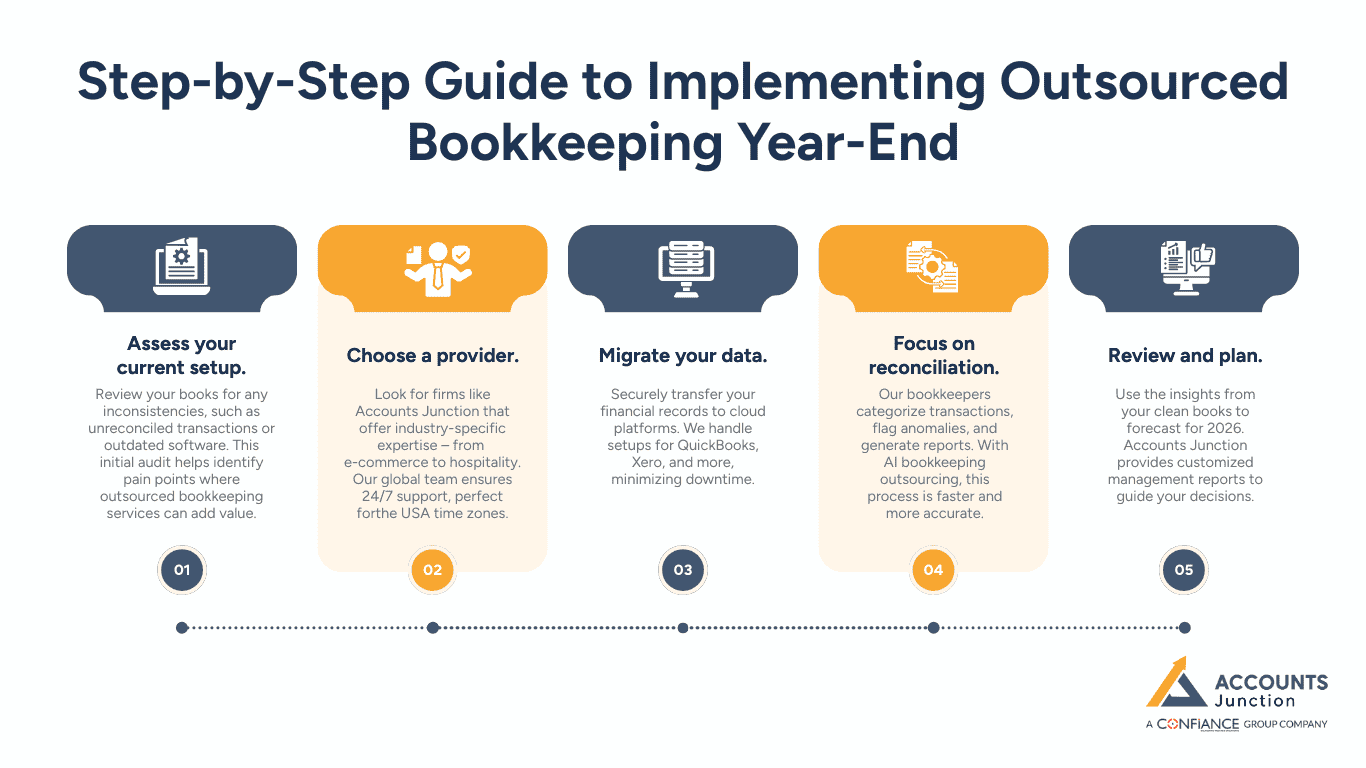

Step-by-Step Guide to Implementing Outsourced Bookkeeping Year-End

Ready to make the switch? Here's a practical roadmap for leveraging outsourced bookkeeping year-end in your USA operations.

Assess your current setup: Review your books for any inconsistencies, such as unreconciled transactions or outdated software. This initial audit helps identify pain points where outsourced bookkeeping services can add value.

Choose a provider: Look for firms like Accounts Junction that offer industry-specific expertise from e-commerce to hospitality. Our global team ensures 24/7 support, perfect forthe USA time zones.

migrate your data: Securely transfer your financial records to cloud platforms. We handle setups for QuickBooks, Xero, and more, minimizing downtime.

Focus on reconciliation: Our bookkeepers categorize transactions, flag anomalies, and generate reports. With AI bookkeeping outsourcing, this process is faster and more accurate.

Review and plan: Use the insights from your clean books to forecast for 2026. Accounts Junction provides customized management reports to guide your decisions.

Post Year-End Outsourced Bookkeeping: Maintaining Financial Health

Closing the books is only the beginning.

Post-year-end outsourced bookkeeping ensures ongoing accuracy and prevents future backlogs. Regular reviews help USA SMEs maintain healthy cash flow and consistent reporting.

Businesses using post-year-end outsourced bookkeeping often report 50%–90% savings compared to maintaining in-house teams.

At Accounts Junction, we offer flexible plans and free trial options so businesses can continue forward without unnecessary commitments.

Case Studies: Success with Outsourced Bookkeeping Year-End

A USA-based eCommerce company struggling with inventory reconciliation reduced errors by 80% after switching to our outsourced bookkeeping services. They gained real-time visibility into sales trends and improved stock planning for the new year.

A franchise owner managing complex payroll during the close adopted our payroll bookkeeping outsourcing. The integration reduced weekly administrative hours and delivered accurate year-end reporting without stress.

These examples demonstrate that outsourced bookkeeping year-end is not just operational support; it is a strategic advantage.

Addressing Challenges in Outsourced Bookkeeping Year-End

Common concerns include:

Data Security

Choose providers with encryption protocols and compliance standards. At Accounts Junction, we prioritize GDPR and US data protection regulations.

System Integration

Migration challenges are common, but experienced teams ensure smooth transitions.

AI Transparency

With AI bookkeeping outsourcing, we provide clear reporting and explainable outputs to maintain trust and clarity.

Future-Proofing with Outsourced Bookkeeping Year-End

The future of outsourced bookkeeping year-end includes increased automation, predictive insights, and enhanced scalability. Market growth projections of 11%–13% reflect strong demand for these services.

Businesses adopting advanced outsourcing models in 2026 position themselves for sustained competitiveness.

Accounts Junction remains at the forefront, delivering AI-enhanced outsourced bookkeeping services that prioritize accuracy, efficiency, and real-time visibility.

Final Thoughts

At Accounts Junction, we help USA startups finish year-end closes with clear workflows and accurate reconciliations. This prevents mistakes and builds a strong financial foundation.

Try our free 6-hour trial to experience professional support without committing long-term.

Outsourced bookkeeping year-end helps businesses close confidently, save costs, and plan strategically. Start 2026 with smoother, stress-free financials by scheduling a consultation or starting your free trial today.

FAQs

1. What is outsourced bookkeeping year-end?

It’s when Accounts Junction handles your year-end financial close, including reconciliations, payroll, and reporting.

2. Why should my business outsource year-end bookkeeping?

Outsourcing saves time, reduces errors, provides real-time insights, and eases stress for USA businesses.

3. Can payroll and AP/AR be included?

Yes. Accounts Junction integrates payroll and accounts payable/receivable seamlessly into your year-end close.

4. How fast is the outsourced year-end close?

Most businesses complete year-end in 5–10 days with outsourced services versus 15–30 days in-house.

5. Is my financial data secure?

Absolutely. Accounts Junction uses encryption, SOC 2 compliance, and secure cloud systems to protect your data.

6. How do I start outsourced bookkeeping year-end?

Review your books, choose Accounts Junction, migrate your data, execute reconciliation, and set up ongoing support.