Outsourced Accounting Firms: Expectations vs. Reality

Outsourced Accounting Firms may reduce costs for many businesses. They help manage money tasks without hiring full-time staff. Many companies expect perfect service, but reality may differ. Understanding the differences can save time, effort, and stress. These firms may handle bookkeeping, payroll, taxes, and reports.

Today, many small and mid-sized firms choose Outsourced Accounting Firms. They want speed, lower costs, and expert support for finances. These firms work remotely and use cloud tools for efficiency. Still, some companies have high hopes that may be unrealistic.

What Are Outsourced Accounting Firms

Outsourced Accounting Firms are third-party teams that handle money. They can manage daily tasks, reports, payroll, and tax filings. Some also give advice to help with growth and plans. Businesses hire them to save time, reduce costs, and effort. These firms serve small, medium, or large companies globally.

Types of Outsourced Accounting Firms

- Bookkeeping firms keep track of all business money records.

- Payroll firms handle pay, taxes, and employee benefits.

- Tax firms prepare filings and keep companies within the rules.

- Full-service firms handle bookkeeping, payroll, tax, and reports.

- Virtual CFO firms give advice on money plans and growth.

Different firms suit different business types, size, and budgets. Some focus on industries like retail, service, or small startups. Others handle general businesses with standard accounting and tax rules.

Common Expectations of Outsourced Accounting Firms

Businesses may expect complete accuracy, speed, and perfect support. They often expect answers quickly and work done without delays. Some think all reports will be ready instantly and correct. Others believe firms provide advice for all growth decisions. Many expect costs to be low while quality stays high.

Expectation 1: Full-Time Support

- Some businesses think firms work twenty-four hours every day. They expect all questions answered and issues fixed immediately. In reality, most firms follow normal work hours only. Requests outside hours may need prior notice or extra cost.

Expectation 2: Error-Free Reports

- Companies expect all reports to be perfect without mistakes or review. Even skilled accountants may need corrections due to client errors. Minor mistakes may occur, but most are fixed quickly.

Expectation 3: Advice for Growth

- Some expect firms to suggest ways to grow their business. Not all Outsourced Accounting Firms provide advice beyond bookkeeping.

- Only firms with senior staff or a CFO service give guidance.

Expectation 4: Cost Savings

- Businesses expect low cost without affecting work quality. General services save money, but special advice may cost extra. Clients must know which services are included in the package.

Expectation 5: Handling All Rules

- Many think firms handle all laws automatically without effort. In reality, clients must give correct data and stay aware. Firms can advise, but final duty rests with the company.

Reality of Outsourced Accounting Firms

Outsourced Accounting Firms give many benefits, yet some limits exist.

Knowing them helps companies work better and avoid stress.

Reality 1: Limited Hours

- Most firms work only on weekdays and during normal office hours. Requests outside hours may take longer or require an extra payment. Expecting constant availability can lead to mistakes and frustration.

Reality 2: Cost vs Expertise

- Outsourcing saves money but may limit expert-level advice. High-level advice usually comes from senior accountants or CFO services. Clients must balance needs with available budget carefully.

Reality 3: Minor Errors

- Even skilled accountants can make small mistakes at times.

- Errors often happen from bad client data or unclear directions.

- Frequent checks and reconciliation reduce errors effectively and safely.

Reality 4: Advice Limits

- Not all firms provide advice for growth or cost reduction.

- Many focus only on bookkeeping, payroll, taxes, and reports.

- Senior staff or virtual CFO services provide business guidance.

Reality 5: Technology Dependence

- Most firms rely on cloud tools for accuracy and speed.

- Clients may need training to use the software properly at first.

- Technology helps track money, tasks, and share reports quickly.

Key Areas of Expectations vs Reality

Bookkeeping Accuracy

Expectation: Every transaction recorded perfectly without delay daily.

Reality: Accuracy is high, but minor fixes may be needed. Good data from clients reduces errors and improves report quality.

Payroll Management

Expectation: Fully hands-off payroll without mistakes or delays ever.

Reality: Payroll works well, but client info must be correct. Missing or wrong info can slow payroll processing significantly.

Tax Preparation

Expectation: Perfect filing with maximum saving every year guaranteed.

Reality: Filing is timely, but planning may need extra advice. Complex taxes require proper guidance from experts to reduce risk.

Financial Reporting

Expectation: Reports ready instantly for all decision-making purposes.

Reality: Reports take time for checks, compilation, and review. Dashboards help clients track money metrics in real time.

Strategic Guidance

Expectation: Regular suggestions for growth, saving, and investing decisions.

Reality: Only some firms provide advanced advice beyond bookkeeping. Standard firms focus on reports, payroll, and tax filing work.

Compliance and Rules

Expectation: All legal and tax rules handled automatically by firms.

Reality: Clients must provide correct data and follow firm advice. Firms alert on issues, but the final duty remains with businesses.

Benefits of Outsourced Accounting Firms

- Lower costs: No need to hire full-time accountants.

- Scalable services: Grow services as the business grows over time.

- Certified experts: Skilled accountants manage complex money tasks.

- Time saving: Companies focus on core work efficiently.

- Better reports: Regular reports help in budgeting and planning.

- Flexible options: Services can adjust based on client needs.

Small businesses often gain from outsourcing instead of hiring staff. Large companies use them for task handling and report management. Startups save money and focus on product or service growth.

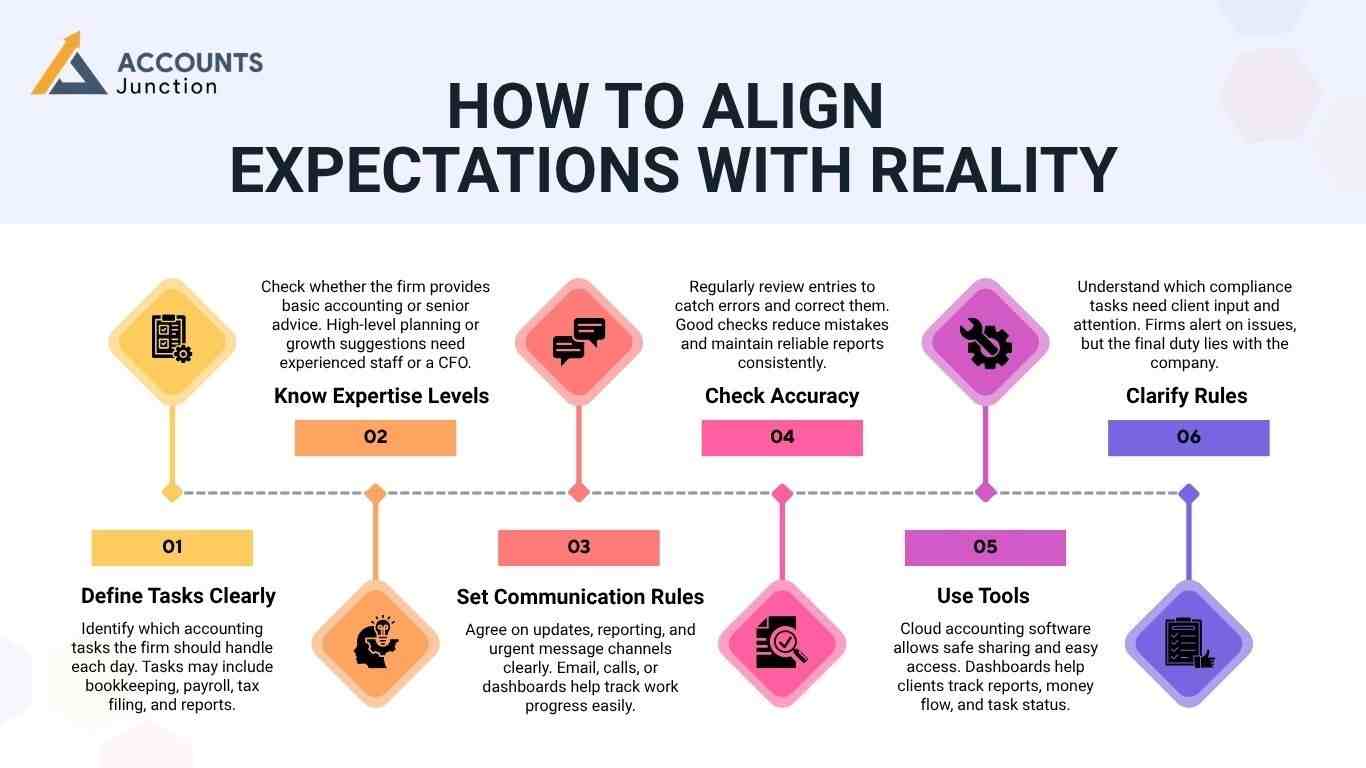

How to Align Expectations With Reality

Step 1: Define Tasks Clearly

- Identify which accounting tasks the firm should handle each day. Tasks may include bookkeeping, payroll, tax filing, and reports. Clear scope avoids confusion and ensures smooth firm collaboration.

Step 2: Know Expertise Levels

- Check whether the firm provides basic accounting or senior advice. High-level planning or growth suggestions need experienced staff or a CFO.

Step 3: Set Communication Rules

- Agree on updates, reporting, and urgent message channels clearly. Email, calls, or dashboards help track work progress easily.

Step 4: Check Accuracy

- Regularly review entries to catch errors and correct them. Good checks reduce mistakes and maintain reliable reports consistently.

Step 5: Use Tools

- Cloud accounting software allows safe sharing and easy access. Dashboards help clients track reports, money flow, and task status.

Step 6: Clarify Rules

- Understand which compliance tasks need client input and attention. Firms alert on issues, but the final duty lies with the company.

Selecting the Right Outsourced Accounting Firm

- Check certifications: Ensure accountants are trained and skilled.

- Review feedback: Client reviews show reliability and past performance.

- Evaluate tools: Cloud software improves speed, tracking, and accuracy.

- Check experience: Knowledge of your business type helps with reporting.

- Match costs: Understand pricing and included services before hiring.

The right firm choice reduces errors, improves money tracking, and builds confidence.

Outsourced Accounting Firms save money and give skilled support. Clients must adjust expectations for speed, accuracy, and advice. Clear tasks, good communication, and checks improve collaboration greatly. Accounts Junction delivers services suited to each business’s needs. We have certified experts who handle money tasks professionally. Partner with us to manage finances efficiently and safely.

FAQs

1. What tasks do Outsourced Accounting Firms mainly handle?

- They do bookkeeping, payroll, taxes, and money reports.

2. How can Outsourced Accounting Firms help cut costs?

- They reduce staff needs and save office space expenses.

3. Can Outsourced Accounting Firms manage payroll for small firms?

- Yes, they pay staff, take taxes, and track benefits.

4. How do Outsourced Accounting Firms keep records correct daily?

- They log transactions, check numbers, and make simple reports.

5. Do Outsourced Accounting Firms file taxes for businesses?

- Yes, they follow rules and send forms on time.

6. Can Outsourced Accounting Firms make reports for business use?

- Yes, they create monthly, quarterly, and yearly money reports.

7. How do Outsourced Accounting Firms check records are correct?

- They match accounts and fix errors quickly and carefully.

8. Are Outsourced Accounting Firms good for startups or small firms?

- Yes, they give cheap, fast, and simple money solutions.

9. How are Outsourced Accounting Firms different from in-house staff?

- They work from afar, cost less, and can scale.

10. Can Outsourced Accounting Firms help follow laws and rules?

- Yes, they track rules and flag errors for the firm.

11. Which firms get the most help from Outsourced Accounting Firms?

- Small shops, service firms, retail, and fast-growing start-ups benefit.

12. How do Outsourced Accounting Firms track money flow?

- They note income, bills, and cash flow each month.

13. Can Outsourced Accounting Firms give advice for growth plans?

- Some firms with seniors give guidance to plan money wisely.

14. Is financial data safe with Outsourced Accounting Firms?

- Yes, they use safe cloud tools and strong password locks.

15. How do Outsourced Accounting Firms handle urgent tasks fast?

- They take top-priority tasks first and work within hours.

16. Can Outsourced Accounting Firms work with existing business tools?

- Yes, most firms use cloud apps or common business tools.

17. How do Outsourced Accounting Firms manage business expenses?

- They log bills, receipts, and track spending by each category.

18. Can Outsourced Accounting Firms make custom reports for clients?

- Yes, they create reports to match each firm’s needs clearly.

19. How should businesses pick the right Outsourced Accounting Firms?

- Check skill, reviews, tools, cost, and past client success.

20. Can Outsourced Accounting Firms grow services as the business grows?

- Yes, they scale bookkeeping, payroll, and report tasks easily.