Why Should You Go for NetSuite Bookkeeping Services?

Sometimes, numbers can tell a story better than words. But for that to happen, they must stay organized. Many business owners may find their books scattered across tools, files, and folders. NetSuite bookkeeping services can change the way you handle money, reports, and records. In this blog, we will explore what they do, how they work, and why more companies are moving toward them every day.

Understanding NetSuite Bookkeeping

What NetSuite Actually Means

NetSuite is a cloud-based platform built to manage business operations — from finance and sales to reporting and inventory. You can think of it as a single digital room where every financial detail lives neatly.

When used for bookkeeping, it may track income, expenses, and accounts with better structure and visibility.

What NetSuite Bookkeeping Services Include

A NetSuite bookkeeping service may handle:

- Daily recording of transactions

- Bank and credit reconciliation

- Invoice and bill tracking

- Monthly and yearly financial reports

- Tax-ready data organization

In short, it may do everything that a normal bookkeeper does — but within an automated, cloud-based system that runs faster and cleaner.

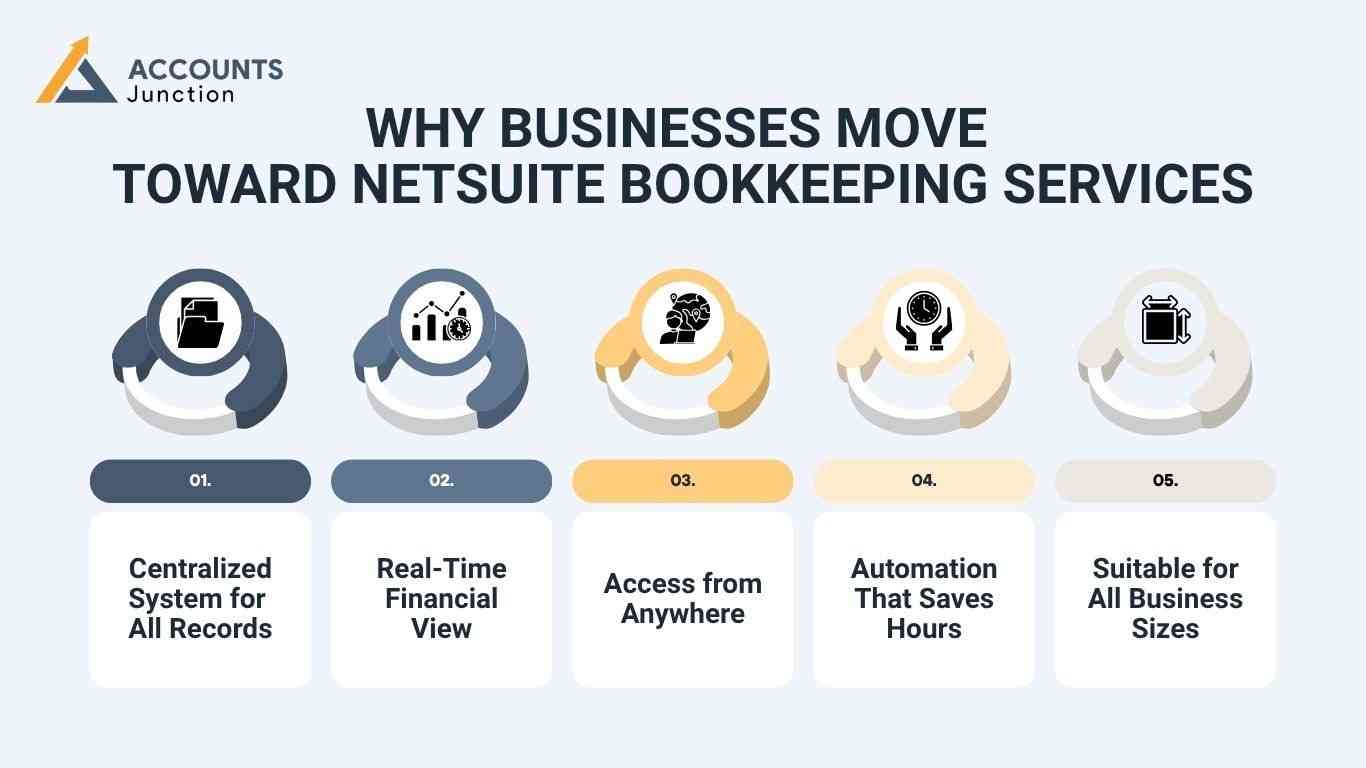

Why Businesses Move Toward NetSuite Bookkeeping Services

Change may come slowly, but it often begins with a need — a need for order, time, and control. Businesses that once depended on spreadsheets often start feeling the weight of manual errors and delayed reports. That is when they look for something more capable.

Let us see why many business owners now choose NetSuite bookkeeping services.

1. Centralized System for All Records

Instead of using several apps and files, NetSuite can gather all data in one space. You may see sales, expenses, payroll, and budgets side by side. This may make it easier to see the full picture and spot where things go wrong.

When numbers live together, decision-making may become smoother.

2. Real-Time Financial View

Have you ever waited till month-end just to find out what went wrong? NetSuite bookkeeping services may solve that. With real-time data updates, you can track income and spending anytime you wish.

This instant visibility can help you plan, forecast, and prevent small mistakes from turning into big ones.

3. Access from Anywhere

In the old days, bookkeeping files sat on one office computer. Now, the whole setup may live in the cloud.

NetSuite bookkeeping lets you log in from anywhere — home, office, or even while traveling. As long as there’s an internet connection, your books can stay open.

4. Automation That Saves Hours

Data entry and reconciliation often eat up time. NetSuite can automate many such parts — invoice matching, expense updates, and even payment tracking.

This automation may cut down human mistakes and give you time to focus on growing your business rather than fixing records.

5. Suitable for All Business Sizes

You do not need to be a large company to use it. Small and mid-size businesses may also find it helpful because it can scale.

When your business grows, NetSuite can grow with it — adding more modules, reports, and features without moving to another system.

How NetSuite Bookkeeping May Improve Daily Operations

When used properly, it can do more than keep records. It can change how your teams work every day.

Easier Record Management

Transactions may flow into NetSuite automatically from connected accounts and tools. This reduces manual entry and keeps books up to date.

No more end-of-month chaos — everything can stay sorted throughout the month.

Seamless Integration

NetSuite connects with CRM, payroll, or inventory systems. So, all your departments may work from the same source of truth.

This integration means fewer errors, less duplication, and more clarity between teams.

Better Financial Reports

You can generate reports anytime. Whether it’s profit and loss, cash flow, or expense summary, it may take only a few clicks.

For business owners, that means faster insight and less dependency on someone else to interpret data.

Collaboration Made Simple

Because everything runs online, multiple people can access the same data at once. Accountants, managers, and consultants may work together without sending files back and forth.

This shared access keeps everyone aligned and speeds up decisions.

Key Features of NetSuite Bookkeeping Services

Below are a few major features that may come with NetSuite bookkeeping services.

- Cloud storage – Secure and easy access to financial data anytime.

- Multi-currency handling – Helpful for businesses dealing with clients across countries.

- Bank synchronization – Automatic bank feeds keep records current.

- User permissions – Different roles can be given different access rights.

- Report customization – Tailored dashboards and insights for your goals.

- Audit support – Clean records ready for audits anytime.

- Regular updates – Continuous improvements by NetSuite without system downtime.

Advantages of Using NetSuite Bookkeeping Services

The more you use the system, the more benefits it may bring.

1. Reduced Human Error

- When numbers move automatically between systems, the risk of mistakes may drop.

2. Saves Valuable Time

- Automated entries and reconciliations can free hours every week that used to go into manual bookkeeping.

3. Cost Efficient in the Long Run

- Initial setup may cost more, but the savings from fewer errors and less staff time can cover it soon.

4. Real-Time Decision Making

- Updated dashboards can help you act faster when business conditions change.

5. Easier Tax and Compliance

- Built-in reports may make tax season less stressful and more predictable.

6. Flexibility and Growth

- You may add new modules as your business expands — inventory, HR, CRM, or more.

When a Business Might Need NetSuite Bookkeeping

Not every business starts with cloud systems. Some signs, though, may hint that it is time to consider one.

- When spreadsheets start breaking or crashing

- When reports take too long to prepare

- When financial data looks unclear or repeated

- When your team works from multiple locations

- When you start dealing with global transactions

If these sound familiar, NetSuite bookkeeping might be the right step forward.

Selecting the Right NetSuite Bookkeeping Partner

Even the best software can fail without proper setup. Choosing the right partner makes all the difference.

What to Look For

- Experience in NetSuite systems

- Understanding of your industry type

- Clear pricing and service scope

- Responsive customer support

- Regular system training for your team

What to Avoid

- Lack of communication

- No data backup plan

- Unclear reporting methods

- Limited customization options

Your provider should act like a financial teammate, not just a service vendor.

Common Challenges During Transition

Moving from a manual or older system may come with small bumps.

- A short learning curve at the start

- Data cleaning before migration

- Initial setup time for reports

- Need for proper onboarding sessions

These are temporary, and most businesses overcome them quickly once the new system starts showing results.

Best Practices for Using NetSuite Bookkeeping Services

Getting value from the system depends on consistent use and simple routines.

- Reconcile bank accounts every month

- Review cash flow weekly

- Update vendor and client details regularly

- Use automation for recurring transactions

- Keep backups even though the system is cloud-based

- Run monthly reports for performance tracking

These small habits may keep your books healthy and your decisions sharp.

Numbers may look dull until they start impacting the business. NetSuite bookkeeping services can bring your entire financial life under one roof — clean, connected, and accessible. For businesses that want to grow without losing control, NetSuite can be a quiet but strong companion. It may not change what you do, but it can surely change how smoothly you do it.

FAQs

1. What are NetSuite bookkeeping services?

- They involve managing and tracking company finances using the NetSuite cloud platform.

2. Can small businesses use NetSuite?

- Yes, it can scale for small, mid, or large companies easily.

3. Is NetSuite safe to use?

- It uses advanced security layers to keep financial data protected.

4. Can NetSuite bookkeeping reduce errors?

- Automation may lower manual mistakes and improve accuracy.

5. Does it need an internet connection?

- Yes, as it works entirely on the cloud.

6. Can NetSuite connect with other tools?

- It integrates with CRM, payroll, and eCommerce systems.

7. Does it support multiple currencies?

- Yes, making it suitable for international businesses.

8. How often should I reconcile accounts?

- It’s good practice to do it monthly within NetSuite.

9. Can NetSuite create tax-ready reports?

- Yes, built-in features prepare compliance-friendly reports.

10. Does it help with forecasting?

- It can generate projections based on real-time financial data.

11. How long does it take to set up?

- Setup time depends on data size but often takes a few weeks.

12. Can I view reports on mobile?

- Yes, NetSuite supports access through mobile devices.

13. Do I need an in-house accountant?

- Not always, as service providers can manage books remotely.

14. What if my data needs migration?

- Your service partner can move and organize it during setup.

15. Does NetSuite bookkeeping cost a lot?

- Prices vary, but long-term savings often outweigh initial costs.

16. Can it work for eCommerce stores?

- Yes, NetSuite is ideal for online business bookkeeping.

17. Does it need regular updates?

- Yes, but updates happen automatically in the background.

18. Can reports be customized?

- You can design custom dashboards and reports as needed.

19. Does it handle payroll?

- It includes modules or can integrate with payroll systems.