Law Firm Accounting Services vs. In-House Bookkeeping: Which Works Better?

Running a law firm takes many tasks, but few are as key as keeping your books right and up to date. Law firm accounting services help firms save time, cut mistakes, and focus on clients. Many owners still ask if it is best to hire outside help or do the work in the firm.

This guide looks at both options in detail. You’ll learn how legal firm accounting services compare with in-house bookkeeping, what each method offers, and which one fits your firm best.

Understanding Law Firm Accounting

Law firm accounting is not like general business accounting. It needs special care and strict rule-following. It covers client trust funds, case costs, income tracking, and tax planning.

Let’s look closer at what makes accounting in a law firm so unique.

Why Law Firm Accounting Is Different

Law firms handle both client money and business income. Each must stay separate. Mismanaging trust funds can lead to legal issues and even loss of a license. Many firms now use law accounting firm services because they offer skills, strong systems, and secure handling of funds.

Key Duties in Law Firm Accounting

A good accounting setup in a law firm handles:

- Trust account management

- Expense tracking for each case

- Payroll and staff expenses

- Tax filing and planning

- Financial reporting and budgeting

When done right, these steps help law firms stay compliant, improve profit, and make better business moves.

What Are Law Firm Accounting Services?

Law firm accounting services are bookkeeping and accounting solutions made for law firms. They are run by experts who know the legal field and its strict rules.

These services often use cloud systems, give real-time updates, and provide financial insights built for lawyers and law firms.

Main Benefits of these accounting services

Here is what most firms gain by using these services:

- Time Savings: Lawyers can spend more hours with clients and less on spreadsheets.

- Error Reduction: Skilled accountants find and fix mistakes quickly.

- Compliance Assurance: Legal accounting experts ensure every rule is followed.

- Better Insights: Access to reports that show how the firm is doing financially.

- Scalability: As your firm grows, your accounting can grow too.

Many small and mid-size firms now use Accounting Services because they give support without a full-time in-house team.

What Is In-House Bookkeeping?

In-house bookkeeping means keeping all financial work inside the firm. You or a hired bookkeeper handles daily records, invoices, and reports. This works well for small teams or new firms with simple finances.

As the firm grows, it can become harder to keep up with the work and with new tax and law rules. However, as the firm grows, it can get harder to keep up with the workload and new tax or compliance laws.

Pros of In-House Bookkeeping

Let’s look at what makes in-house bookkeeping good for some law firms:

- Direct Control: You can check or change records at any time. You see all entries and can act fast without waiting for anyone else.

- Personal Touch: The team knows your firm and clients well. They can spot small issues and give care that fits your work style.

- Instant Access: You do not need to call an outside service for data. Reports and answers are ready when you need them most.

These benefits are nice, but there are also clear challenges.

Cons of In-House Bookkeeping

Even with full control, in-house bookkeeping has limits:

- Time-Consuming: It can take hours each week to keep books up to date, track payments, and make reports while running daily work.

- Costly: Paying skilled bookkeepers adds wages and benefits that small or mid-size firms may find hard to cover.

- Compliance Risks: Mistakes in handling client funds or taxes can lead to fines, legal trouble, or even risk a lawyer’s license.

- Lack of Skill: Not every in-house bookkeeper knows the rules for law firms. Mistakes can cost money and cause serious problems.

Law firm accounting services can fill the gap and help firms save time, reduce errors, and stay compliant.

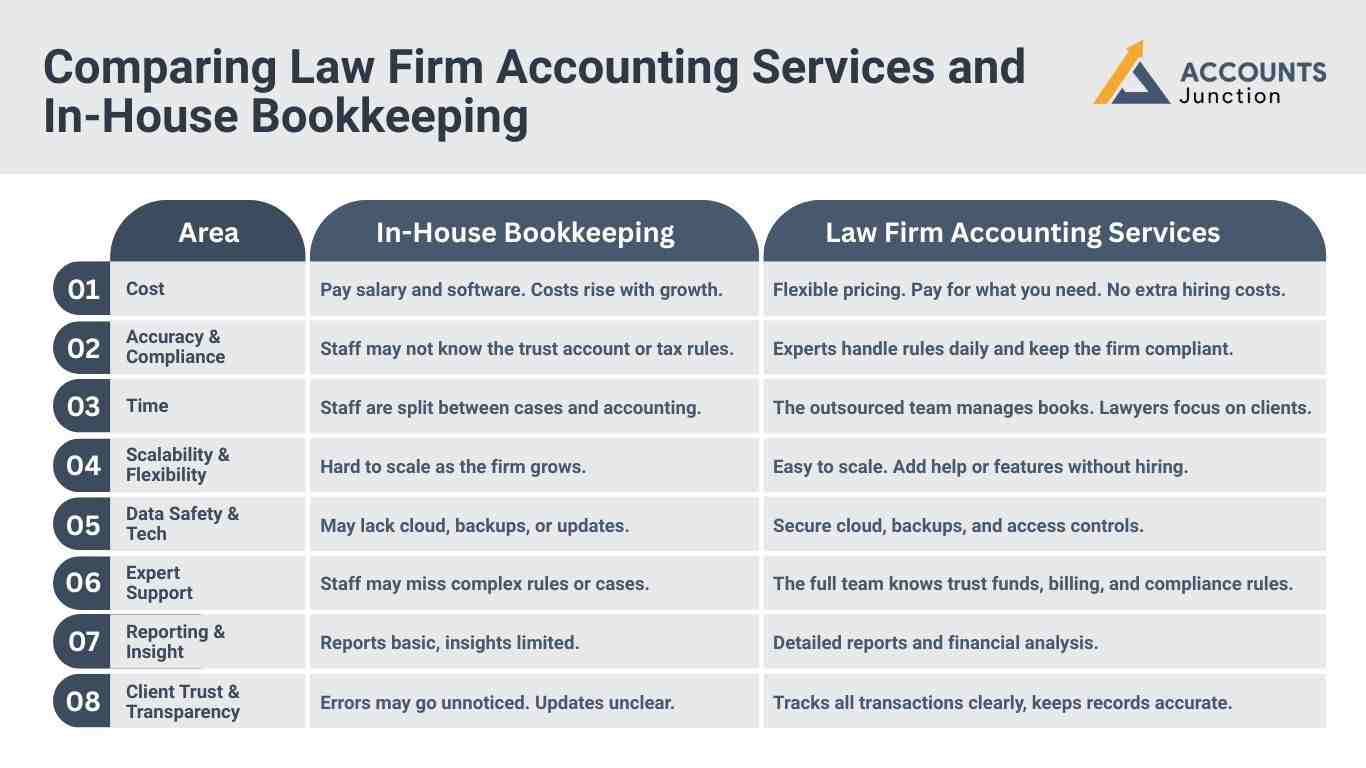

Comparing Law Firm Accounting Services and In-House Bookkeeping

To help you choose which works best, let’s look at key areas that matter most for law firms.

|

Area |

In-House Bookkeeping |

Law Firm Accounting Services |

|

Cost |

Pay salary and software. Costs rise with growth. |

Flexible pricing. Pay for what you need. No extra hiring costs. |

|

Accuracy & Compliance |

Staff may not know the trust account or tax rules. |

Experts handle rules daily and keep the firm compliant. |

|

Time |

Staff are split between cases and accounting. |

The outsourced team manages books. Lawyers focus on clients. |

|

Scalability & Flexibility |

Hard to scale as the firm grows. |

Easy to scale. Add help or features without hiring. |

|

Data Safety & Tech |

May lack cloud, backups, or updates. |

Secure cloud, backups, and access controls. |

|

Expert Support |

Staff may miss complex rules or cases. |

The full team knows trust funds, billing, and compliance rules. |

|

Reporting & Insight |

Reports basic, insights limited. |

Detailed reports and financial analysis. |

|

Client Trust & Transparency |

Errors may go unnoticed. Updates unclear. |

Tracks all transactions clearly, keeps records accurate. |

For most law firms, law firm accounting services save time, cut mistakes, give expert support, improve reporting, and offer better flexibility, safety, and cost control than in-house bookkeeping.

When Should You Choose Legal Firm Accounting Services?

Outsourcing your accounting doesn’t mean giving up control; it means working smarter. Here’s when hiring law firm accounting services makes sense:

- Your firm is growing and needs advanced financial management.

- You struggle to meet accounting deadlines.

- You want clear insights into firm performance.

- Your staff spends too much time on bookkeeping.

- You need expert help with trust account rules or tax compliance.

When any of these apply, it’s time to bring in professionals who specialize in law firm finances.

How to Move from In-House to Law Firm Accounting Services

Switching from in-house bookkeeping to law firm accounting services can be easy if you follow these steps:

Step 1: Check Your Current System

See what works and what does not. Find gaps, like missed checks or unclear reports.

Step 2: Pick the Right Provider

Choose a service that knows law firm accounting. Ask about skills, tools, and how they keep data safe.

Step 3: Plan the Data Move

Work with your new team to move the records safely. Set access rules to protect client data.

Step 4: Train Your Staff

Make sure lawyers and staff know how to use the new system for smooth work.

Step 5: Review Often

Check reports, budgets, and updates. Use the data to make smart choices for firm growth.

The Future of Law Firm Accounting

Tech is changing how law firms manage their books. Cloud accounting, AI data entry, and live dashboards make finance work faster and easier.

Law firm accounting services are leading this change. They provide flexible, tech-based solutions that help law firms of all sizes stay ahead.

Soon, more firms will use these services to handle rules, speed, and insights all in one place.

Managing a law firm’s books is not easy. In-house bookkeeping may work for small teams, but as firms grow, rules, transactions, and risks rise. At Accounts Junction, we help law firms handle their books with ease. Our team uses secure cloud systems and real-time updates so lawyers can focus on clients and make smart choices. With our support, firms stay accurate, compliant, and ready to grow. Partner with us and get your accounting done quickly while keeping your finances safe and clear.

FAQs

1. What are Law Firm Accounting Services?

- These are bookkeeping and accounting services made for law firms. Experts handle trust accounts, payroll, taxes, and reports.

2. How are they different from in-house bookkeeping?

- They use trained staff, cloud tools, and real-time updates. In-house bookkeeping depends on your own staff and may lack skill.

3. When should a firm hire outside help?

- If your firm is growing, misses deadlines, or needs clear reports, outside services save time and cut mistakes.

4. Can small firms use in-house bookkeeping?

- Yes. If finances are simple, you have a trusted staff member, and you want full control, in-house work can be enough.

5. How do these services improve accuracy?

- Experts know legal rules and trust account laws. They find errors fast and keep your firm safe.

6. Do they save time?

- Yes. Experts handle books, reports, and compliance. Lawyers can focus on clients instead of paperwork.

7. Are these services secure?

- Yes. They use cloud systems with encryption, backups, and controlled access to keep data safe.

8. Can they grow with the firm?

- Yes. You can add more help or features without hiring more staff, making growth smooth.

9. What insights do they give?

- They give clear reports and financial summaries. This helps lawyers plan budgets and make smart choices.

10. How easy is it to switch from in-house to these services?

- The process is simple. Firms can assess their system, pick a provider, move data safely, and train staff.

11. Can these services help with compliance?

- Yes. Experts follow all legal rules and trust fund laws, which reduces the risk of fines or legal trouble.

12. Why do many law firms prefer outsourcing?

- Outsourcing saves time, reduces mistakes, gives expert guidance, and allows lawyers to focus on clients.

13. How easy is the switch from in-house?

- It is simple. Check your system, pick a service, move data safe, and train staff.

14. Can these services help with rules?

- Yes. Experts follow trust fund laws and legal rules. This cuts the risk of fines.

15. What insights do they give?

- They show clear reports and summaries. Lawyers can plan budgets and spend smart.

16. Can small firms use them?

- Yes. Even small firms can use Law Firm Accounting Services to save time and keep their books right.