Everything You Need to Know About Filing an Individual Tax Return

Filing an individual tax return is a basic money task for most workers. You must know how tax filing works if you earn money from a job, freelance work, or a business. It helps you follow tax rules and keeps you safe from fines. It helps you follow the rules and avoid extra charges. Missing this step can lead to fines or stress during tax season.

In many places, the tax office looks after all income tax tasks. The process is based on trust. You must report what you earn and spend to lower your taxes. This is done using tax forms. You can send these forms online using a portal or by mail if you prefer paper.

What is an Individual Tax Return?

An individual tax return is a form used to report your income to the tax office. You also list any tax breaks or credits you claim. In the U.S., this is sent to the IRS. Your return helps the tax office check how much tax you should pay or get back. This is based on your yearly income and tax payments.

In some places, the form is filled out for you. In others, you must add all your details by hand. Some countries let you file online. Others ask for a paper form. No matter where you file, the goal stays the same. You show your income, subtract any tax breaks, and report what you’ve already paid.

How to Understand Your Tax Filing Categories

When you file your tax return, your income and marital status matter. The IRS has five filing statuses:

- Single: You are not married and file your taxes on your own. This is for people who live alone or are not married.

- Married Filing Jointly: You and your partner submit one combined tax return. This allows both of you to combine your incomes for tax benefits.

- Married filing separately: You and your spouse file your taxes separately. This may be helpful if one spouse has a lot of deductions or debts.

- Head of household: You are unmarried and take care of a dependent. This status can give you a higher standard deduction if you support others.

- Qualifying widow(er): You are widowed and meet specific IRS rules. This allows you to keep the same tax benefits as a married person for two years after your spouse’s death.

Each status has different tax rates and deductions. This impacts the amount of individual income tax you owe when you submit your tax return. Individual tax filing is essential when your income is high or comes from sources like wages, interest, or dividends.

Key Forms Used in Individual Tax Return Filing

Form 1040

-

Form 1040 is the main form for reporting individual income tax. It’s a two-page form that covers income, deductions, tax credits, and taxes already paid.

You may also need extra schedules with Form 1040 to report:

- Capital gains

- Business income

- Self-employment tax

- Tax credits

- Itemized deductions

Anyone can use Form 1040. It is the most flexible choice for individual tax return filers.

Form 1040EZ – For Simple Returns

-

Form 1040EZ was for people under age 65 with no dependents. It was used by those who earned only wages, interest, or unemployment income. Though no longer active, its easy format is now part of the new Form 1040.

Other Forms for Special Tax Cases

Some tax situations need extra forms. If your finances are more complex, you might also need to file:

- Form 709 – Used to report gift tax when gifts go over a certain amount

- Form 8862 – Filed to reclaim tax credits once denied

- Form 8889 – For contributions or payouts from a Health Savings Account (HSA)

- Form 1116 – For claiming credit for taxes paid to another country

These forms may be needed with your individual income tax return.

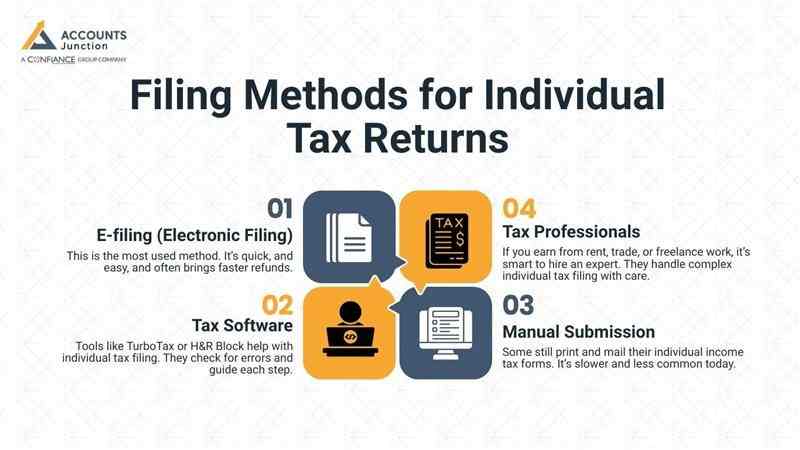

Filing Methods for Individual Tax Returns

There are various methods to file your tax return. Pick the one that best fits your needs.

1. E-filing (Electronic Filing)

-

This is the most used method. It’s quick, and easy, and often brings faster refunds.

2. Tax Software

- Tools like TurboTax or H&R Block help with individual tax filing. They check for errors and guide each step.

3. Manual Submission

- Some still print and mail their individual income tax forms. It’s slower and less common today.

4. Tax Professionals

- If you earn from rent, trade, or freelance work, it’s smart to hire an expert. They handle complex individual tax filing with care.

Common Mistakes to Avoid When Filing an Individual Tax Return

Filing your individual tax return may seem simple, but small errors can cause delays, penalties, or missed benefits. Being aware of common mistakes helps you avoid unnecessary stress and ensures your return is processed smoothly.

1. Missing or Incorrect Signatures

- Always sign your tax form before submitting.

- Unsigned returns can delay refunds or cause rejection.

2. Incorrect Personal Information

- Ensure your Social Security number is accurate. Mistakes can lead to delays or rejection.

- Double-check your bank account details if you are receiving a refund via direct deposit. Wrong info may send the refund to the wrong account.

3. Skipping Tax Credits

- Don’t overlook eligible credits like the Earned Income Tax Credit (EITC).

- Other credits to check include child tax credits, education credits, and other applicable deductions. Missing these can increase your tax owed.

4. Choosing the Wrong Filing Status

- Selecting an incorrect filing status may reduce deductions or increase your tax liability.

- Review your marital status, dependents, and household situation before finalizing your return.

5. Errors in Figures

- Carefully review all income, deduction, and credit amounts.

- Small miscalculations can delay processing or lead to audits.

Tips for a Smooth Individual Tax Filing Process

- Keep your papers in one place. Save W-2s, 1099s, and past returns. You can also store copies online.

- Use a checklist to track what you need. It helps avoid missing steps during individual tax filing.

- Use all the tax breaks you can. Deduction such as interest on loans or charitable gifts reduces the amount of individual income tax you owe.

- File early to avoid stress. You’ll get extra time to correct mistakes or include missing documents.

- If you need help, try tax tools or talk to an expert. This makes individual tax filing fast and easy.

Submitting your tax return can be straightforward and hassle-free. Good planning and early action can make it simple. Know the forms you need, like the 1040. This helps you stay on track with IRS rules and deadlines.

You can file on your own or ask for help. Accurate and timely individual income tax filing helps avoid fines and may lead to a refund. With Accounts Junction, we will guide you step by step, making your tax filing clear, fast, and accurate.

FAQs

1. Who must file an individual tax return?

- Anyone with taxable income, such as wages, freelance work, or investment earnings, may need to file. Rules vary by income level and age.

2. What is included in an individual tax return?

- It reports income, deductions, credits, and taxes already paid. This ensures the IRS can calculate your final tax.

3. Can self-employed individuals file their individual tax return online?

- Yes, online filing or tax software can handle freelance and self-employment income. Extra forms like Schedule C may be required.

4. What is the deadline for submitting an individual tax return?

- Most U.S. taxpayers file by April 15 each year. Extensions may be requested, but payments must still be made on time.

5. What forms are used for individual tax return filing?

- Form 1040 is the main form, with schedules for capital gains, business income, or tax credits. Other forms may apply for special cases.

6. How do I choose the right filing status for my individual return?

- Consider your marital status, dependents, and household situation. The right status can reduce taxes and increase deductions.

7. Can I claim deductions on my individual tax return?

- Yes, deductions for mortgage interest, student loans, and charitable donations may reduce taxable income if eligible.

8. What are tax credits, and how do they affect my return?

- Credits directly lower the tax owed. Child tax credits or education credits can significantly reduce individual income tax.

9. Is e-filing safe for individual tax returns?

- Yes, IRS-approved portals and software use encryption. Always verify the site and keep login info private.

10. Can mistakes on an individual tax return be corrected?

- Yes, file Form 1040X to amend errors like wrong income, deductions, or filing status. Do it promptly to avoid penalties.

11. How do I track my individual tax return after filing?

- The IRS “Where’s My Refund?” tool can show status using your Social Security number, filing status, and refund amount.

12. Do I need professional help for complex individual tax returns?

- Complex cases like rental income, investments, or business earnings may benefit from an accountant or tax professional.

13. Can I file a paper return instead of e-filing?

- Yes, mailing paper returns is allowed but slower. E-filing is faster, more secure, and may speed up refunds.

14. What supporting documents should I keep for filing?

- Keep W-2s, 1099s, receipts for deductions, and past returns for at least three years in case of audit.

15. Can I claim health savings account contributions on my return?

- Yes, contributions or withdrawals from an HSA may need to be reported on Form 8889 to adjust taxable income.

16. Are capital gains included in an individual tax return?

- Yes, profits from selling stocks or property must be reported. Schedule D is typically used for these calculations.

17. Can I file jointly with my spouse on an individual return?

- Yes, married couples may file jointly to combine income and maximize deductions, but separate filing may apply in some cases.

18. How does early filing affect my individual tax return?

- Filing early reduces stress, allows more time for corrections, and often speeds up refunds.

19. Are gifts taxable on my individual tax return?

- Large gifts above the IRS threshold may require Form 709. Reporting ensures taxes are calculated correctly.

20. How does missing a credit affect my individual tax return?

- Skipping eligible credits like the Earned Income Tax Credit may increase the tax owed. Carefully review all potential credits before filing.