How Accounting for Healthcare Professionals Simplifies Tax Management

Running a clinic or hospital means handling money well. Doctors, nurses, and managers often find it hard to track cash and pay taxes on time. Accounting for healthcare professionals makes the task easy. It helps track income, watch costs, and plan for growth without worry.

Simple records show where money goes and where it can be saved. This makes tax work quicker and lowers mistakes. It also helps plan for needs like buying tools, hiring staff, or adding services. Clear reports give staff the facts to make smart choices and spend more time on patients.

Accounting also helps set budgets and check progress. Knowing what comes in and goes out keeps clinics from debt and helps save for goals. Small spending changes can add up, and clear records make them easy to spot. With steady, simple accounting, healthcare workers can focus on care, not money.

Understanding Accounting for Healthcare Professionals

Healthcare professionals face special money challenges. They handle many income streams, patient bills, insurance claims, and daily costs. Accounting for healthcare professionals keeps all of this organized and correct.

1. Why Accounting Matters

Accounting in hospitals helps healthcare workers:

- Track Money: Keep clear logs of cash in and out. Know what you earn and what you spend.

- Follow Tax Rules: Stick to tax laws to avoid fines and problems.

- Reduce Waste: Spot ways to save money and avoid extra costs.

- Make Smart Choices: Use simple reports to plan for the clinic’s needs and growth.

2.Common Accounting Tasks

Some routine accounting tasks in hospitals include:

- Log Patient Fees: Keep a clear list of money from services and visits.

- Track Staff Pay: Watch wages, bonuses, and other staff costs.

- Pay Suppliers: Keep bills and invoices up to date and paid on time.

- Make Reports: Create simple sheets to review income and spending.

- Check Accounts: Compare records with bank statements to ensure they match.

- Watch Cash Flow: Track money in and out to avoid shortages and plan spending.

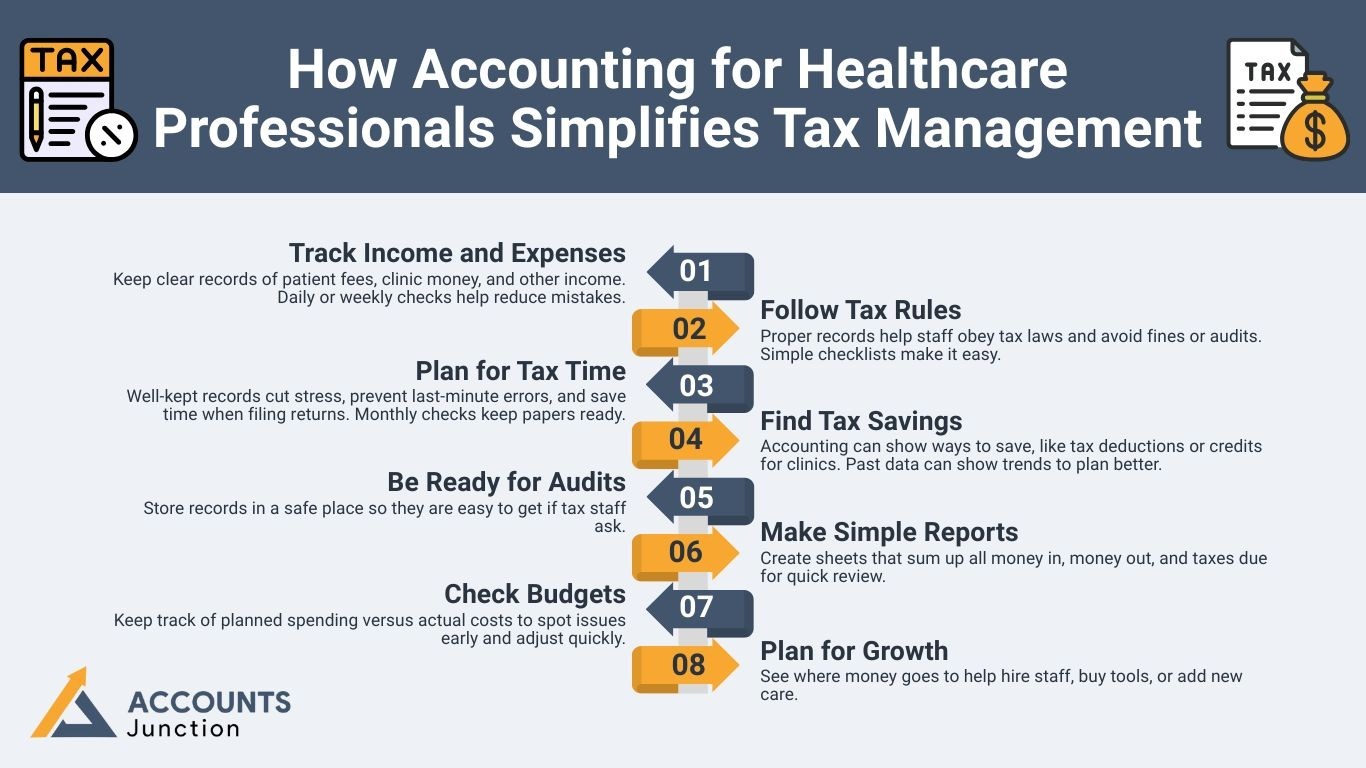

How Accounting for Healthcare Professionals Simplifies Tax Management

Healthcare workers deal with many types of income, insurance claims, and hospital money. Accounting for healthcare professionals helps make tax work clear and simple by:

- Track Income and Expenses: Keep clear records of patient fees, clinic money, and other income. Daily or weekly checks help reduce mistakes.

- Follow Tax Rules: Proper records help staff obey tax laws and avoid fines or audits. Simple checklists make it easy.

- Plan for Tax Time: Well-kept records cut stress, prevent last-minute errors, and save time when filing returns. Monthly checks keep papers ready.

- Find Tax Savings: Accounting can show ways to save, like tax deductions or credits for clinics. Past data can show trends to plan better.

- Be Ready for Audits: Store records in a safe place so they are easy to get if tax staff ask.

- Make Simple Reports: Create sheets that sum up all money in, money out, and taxes due for quick review.

- Check Budgets: Keep track of planned spending versus actual costs to spot issues early and adjust quickly.

- Plan for Growth: See where money goes to help hire staff, buy tools, or add new care.

Key Benefits of Accounting in Hospitals

Accounting in hospitals does more than keep books. It gives a clear view and control over money.

1. Better Tax Planning

- Applies deductions and credits the right way to help hospitals save cash.

- Checks all tax entries each month to cut mistakes and avoid fines.

- Follows tax rules to apply changes as soon as they come.

- Helps staff know their tax duties and benefits for a smooth payroll.

2. Simpler Financial Reports

- Makes balance sheets, income sheets, and cash flow logs easy.

- Gives hospital leaders facts to make good choices for work.

- Gives clear sums for boards or audits.

- Shows trends in money in, money out, and costs to guide next steps.

3. Better Resource Use

- Tracks costs for tools, staff pay, and stock to cut waste.

- Plans repairs and purchases based on real-time info.

- Puts resources where they are needed most.

- Watches supply used to improve budgets and avoid extra spending.

4. Improved Staff Planning

- Keeps track of work hours, pay, and shifts to avoid overwork.

- Helps assign staff where they are most needed.

- Supports smooth payroll and fair workload distribution.

5. Enhanced Cost Control

- Shows where money is spent most and where it can be saved.

- Helps cut extra costs without affecting patient care.

- Highlights areas to plan better spending in the future.

How Accounting for Healthcare Professionals Saves Time

Time is precious in healthcare. Outsourcing or using expert accounting services can free professionals from tedious financial work.

1. Delegating Accounting Tasks

- Handles pay, tax work, and bills in a smooth, quick way.

- Let's health staff spend more time on care and clinic work.

- Gives clear monthly notes to help leaders see money flow fast.

- Meets all due dates with ease, avoiding stress or a late rush.

2. Reducing Errors

- Cuts down tax and record errors, lowering audit risks.

- Adds checks to keep all numbers right and clear.

- Stores digital files that are simple to find and read.

Using Technology in Accounting for Healthcare Professionals

Modern tools make accounting faster and easier.

1. Cloud Accounting Solutions

- Real-time tracking of hospital finances, allowing multiple users to access safely.

- Accessible anytime for transparency and decision-making.

- Automatic updates to ensure reports are always current.

- Secure storage of records reduces the risk of data loss.

2. Automated Tax Management

- Software calculates tax liabilities automatically, saving time.

- Simplifies tax preparation and reduces human error.

- Generates alerts for due dates and compliance requirements.

- Provides historical comparisons to improve future planning.

Cost Control in Hospitals

Keeping costs low is key for hospitals to stay strong. Accounting helps track money and spot waste. Key points include:

- Staff Costs: Track pay, overtime, and benefits to avoid extra spend. Regular checks find overpay.

- Tools and Supplies: Watch buys and use to cut waste. Study past trends to stop needless spending.

- Daily Expenses: Track lights, repairs, and office costs to plan budgets well. Set checks for energy and stock use.

- Supplier Deals: Compare prices and get fair deals to lower costs. Keep records of discounts and pay dates.

- Financial Reports: Use clear logs to see overspending and points to fix. Monthly sheets show progress and issues.

Focusing on cost control helps hospitals save cash, use resources well, and spend on patient care without losing quality.

Financial Decision Support

Accounting for healthcare workers gives solid help for money decisions. Well-kept records show leaders what is needed now and in the future. Key points include:

- Budget Planning: Clear logs let hospitals plan budgets and put money where it is needed. Forecasts help avoid shortages.

- Revenue Forecasting: Estimate future revenue from patients, insurance, and other sources. Helps plan for busy and slow times.

- Investment Choices: Decide when and where to spend on new tools, tech, or expansion. Check expected gains before spending.

- Risk Checks: Spot money risks early so hospitals can act fast. Keeps the hospital stable.

- Performance Review: Look at different departments, services, and staff using money data. Helps fix weak spots and reward good work.

- Cost Control Support: Shows where money is spent most and where it can be saved. Helps leaders cut waste and plan better spending.

Strong financial support helps hospitals grow safely, cut waste, and improve patient care, making accounting a key tool for planning.

Accurate accounting makes tax filing easy, keeps money use clear, and shows where to save. Hospitals can check costs, review results, and plan for steady growth with ease. Expert help saves time, cuts mistakes, and gives calm and trust.

At Account Junction, we help healthcare professionals with all aspects of accounting, especially tax management. Our team tracks income, expenses, and deductions to make sure taxes are correct and filed on time. We prepare clear reports that show tax obligations and highlight possible savings. By using our services, hospitals and clinics can focus on patient care while we handle all financial tasks, making tax management simple, accurate, and stress-free.

Choose Account Junction today to ensure smooth tax management and clear, accurate accounting for your healthcare practice.

FAQs

1: How does accounting help healthcare professionals manage taxes?

- Tracks money in, money out, and deductions to make sure taxes are correct.

2: What is the role of accounting in healthcare?

- Manages money, makes reports, and ensures funds are used the right way.

3: Can outsourcing accounting save time for healthcare professionals?

- Yes, outsourcing does routine tasks, giving staff more time for patient care.

4: How does technology improve accounting in healthcare?

- Cloud tools let staff track money in real time and make reports fast.

5: How often should hospitals review financial reports?

- Check reports each month or quarter to make timely decisions.

6: Can accounting services help in cost savings for hospitals?

- Yes, tracking costs and resources shows areas to cut waste.

7: Is accounting for healthcare professionals different from regular accounting?

- Yes, it handles patient bills, insurance claims, and hospital resources in a specific way.

8: What skills are important for healthcare accountants?

- Strong math, clear records, and good knowledge of tax and billing rules.

9: What common errors can professional accounting prevent?

- Errors in tax filing, payroll, and financial statements can be minimized.

10. How does accounting help plan hospital budgets?

- It shows income and costs to set budgets and track spending.

11. Can accounting track staff pay and overtime?

- Yes, it logs wages, bonuses, and extra hours accurately.

12. Does accounting help monitor tools and supplies?

- Yes, it tracks purchases and uses to reduce waste.

13. Can hospitals spot overspending early?

- Yes, clear reports show where money is spent most.

14. How does accounting support tax preparation?

- It keeps records ready, checks deductions, and tracks due dates.

15. Does accounting help with revenue forecasting?

- Yes, it estimates future income from patients, insurance, and services.

16. Can accounting improve decision-making in hospitals?

- Yes, clear financial data helps leaders plan staff, tools, and growth.

17. Is it easy to find past financial records?

- Yes, digital accounting stores files safely and makes them quick to access.

18. How does accounting reduce audit risks?

- It keeps accurate logs, tracks all money, and flags errors early.