Healthcare Accounting Tips for Small and Medium Medical Practices

Running a medical practice is not easy. Good healthcare accounting helps small and medium medical practices track money and plan well. Doctors and staff spend time on patients, but money matters cannot be ignored.

Using proper accounting for healthcare professionals makes it easy to pay bills, pay staff, and avoid mistakes. You can also see where money goes and plan for growth. Small errors in accounting can lead to big problems.

With smart tools and clear records, healthcare can save time and stress. It also helps you stay compliant with laws. For small and medium practices, learning key tips and rules in accounting for healthcare professionals is very important.

Importance of Accurate Accounting in Medical Practices

Accurate healthcare accounting is key for a medical practice. It helps track money in and out. Small mistakes can grow into big problems. Proper records make it easy to pay bills and staff on time. Doctors and staff need to know what money comes in and goes out. This makes it easier to plan for growth. Without good accounting for healthcare professionals, practices may miss payments or pay too much tax. Accurate accounting also shows where money is wasted. You can cut costs and save funds for important needs. It helps with insurance claims, tax reports, and audits.

By using simple tools and clear records, small and medium practices can avoid stress. Clinic accounting keeps the practice running smoothly. It also helps you make smart choices for the future.

Why Small and Medium Medical Practices Need Healthcare Accounting

Small and medium medical practices face many money challenges. They do not have large finance teams. Good medical bookkeeping helps track income, expenses, and payments. It makes work easier for doctors and staff.

Without proper accounting for healthcare professionals, mistakes can happen. Insurance claims may be late. Bills may go unpaid. Staff may not get paid on time.

Good accounting helps practices:

- Track money from patients and insurers

- Plan budgets and pay bills on time.

- Reduce waste and save funds

- Stay ready for audits

Using simple tools can make accounting easier. Even a small practice can run smoothly with clear records. Healthcare accounting is not just about numbers. It helps the practice grow and stay safe.

Common Challenges in Accounting for Healthcare Professionals

Accounting in healthcare is not easy. Small and medium practices face many challenges.

- Complex billing: Many insurers and patients mean more work.

- Insurance delays: Claims can take weeks or months.

- Regulations: Laws require careful records.

- Limited staff: Few practices have finance experts.

- Multiple payments: Patients, insurance, and government programs create many streams.

These challenges show why accounting for healthcare professionals is important. Proper tools and clear records can reduce errors and stress. Healthcare accounting helps you manage these tasks with ease.

Understanding the Basics of Healthcare Accounting

Medical accounting is not the same as normal accounting. It tracks cash, pay, and bills in medical offices. It follows extra rules for health and taxes. Small and medium offices must know the basics to run smoothly and avoid errors.

Key Principles Every Medical Practice Should Know

- Record income right – Note cash when work is done. Keep each pay clear to know what comes in.

- Track expenses – List all costs for bills, pay, and tools. Clear notes help see where money goes.

- Manage cash flow – Make sure cash can pay bills and staff. Check weekly to keep funds safe.

- Follow rules – Keep work in line with health and tax laws. This helps avoid fines or checks.

- Plan budgets – Set money aside for needs and growth. Plan well to keep the office smooth.

These steps help offices run smoothly, cut mistakes, and keep cash clear.

Difference Between General Accounting and Healthcare Accounting

General accounting tracks basic business money. Healthcare accounting adds extra needs:

|

Aspect |

General Accounting |

Healthcare Accounting |

|

Purpose |

Tracks simple money for any business. It helps to know what comes in and goes out. |

Tracks money for clinics and medical offices. It helps pay staff, bills, and plan growth. |

|

Revenue Tracking |

Focuses on money from sales or services. It is easy to see the income. |

Focuses on money from patients, payers, and other sources. Clinics must track all payments carefully. |

|

Expense Tracking |

List costs like rent, bills, and tools. Easy to see where money goes. |

Lists costs like staff pay, tools, lab fees, and supplies. Helps clinics control costs. |

|

Billing & Claims |

Simple invoices for work or goods. A few steps are needed. |

Must track patient payments and payer claims. Errors can delay money. |

|

Rules & Law |

Follows basic tax and law rules. Keeps business legal. |

Follows clinic rules, tax law, and local regulations. Mistakes can cost money or fines. |

|

Cash Flow |

Tracks cash in and out. Helps pay bills on time. |

Tracks cash from all sources. Ensures staff, bills, and needs are paid on time. |

|

Complexity |

Less complex, fewer money streams. Easy to manage. |

More complex with many streams and rules. Needs careful records. |

|

Importance |

Helps staff and managers see money flow. |

Very key for doctors and staff. Mistakes cost time and money. |

This makes accounting for healthcare professionals different and important for medical offices. Medical offices must maintain accurate records. Proper healthcare accounting ensures smooth operations, fewer errors, and better growth.

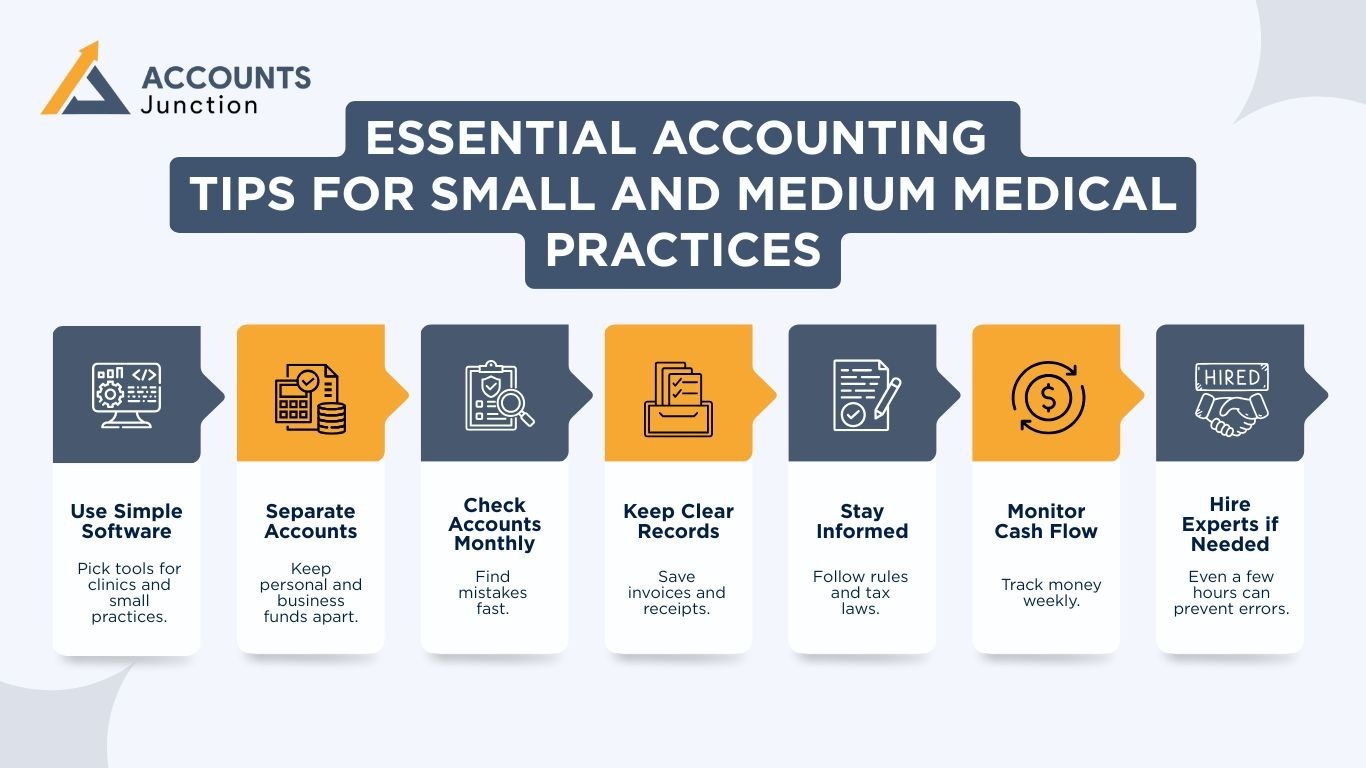

Essential Accounting Tips for Small and Medium Medical Practices

Here are key tips for small and medium practices:

- Use Simple Software: Pick tools for clinics and small practices.

- Separate Accounts: Keep personal and business funds apart.

- Check Accounts Monthly: Find mistakes fast.

- Keep Clear Records: Save invoices and receipts.

- Stay Informed: Follow rules and tax laws.

- Monitor Cash Flow: Track money weekly.

- Hire Experts if Needed: Even a few hours can prevent errors.

Following these tips makes medical accounting easier and accurate.

Common Mistakes to Avoid in Healthcare Accounting

Avoid these errors in small and medium practices:

- Ignore small mistakes – Small errors in bills, reports, or payments may seem minor, but they grow into big problems that hurt cash flow and trust.

- Mix personal and practice funds – Using personal money for practice expenses or vice versa causes confusion, makes records unclear, and may lead to tax issues.

- Delay insurance claims – Late submission of patient or payer claims slows down money flow, delays planning, and can cause stress for staff and doctors.

- Skip monthly checks – Not reviewing accounts monthly allows errors to remain hidden. Mistakes in billing, payroll, or reports can build up quickly.

- Neglect taxes – Failing to plan or pay taxes on time can result in fines or penalties. Setting aside funds early prevents issues.

Avoiding these mistakes keeps your practice smooth. Accounting for healthcare professionals requires care and attention to detail.

Best Practices for Accounting for Healthcare Professionals

- Keep detailed records – Track every payment, expense, and invoice. Clear records help spot mistakes, plan budgets, and keep your clinic organized.

- Review reports often – Check reports weekly or monthly. Catch errors early, spot trends, and make fast decisions to improve clinic finances.

- Automate tasks – Use simple software for billing, payroll, and reporting. Automation saves time, cuts mistakes, and makes healthcare accounting easier.

- Train staff – Teach staff basic accounting skills. When your team understands bills, payments, and reports, the practice runs smoothly and avoids errors.

- Plan for taxes – Set aside funds monthly for taxes. Planning early avoids surprises, penalties, and keeps your small or medium practice secure.

Following these practices ensures clinics run smoothly, reduce mistakes, and maintain strong healthcare accounting systems.

Small and medium medical clinics often spend too much time on financial work like tracking pay, bills, and staff pay. We At Account Junction make this easy by doing these tasks fast and right. Our system handles billing and insurance claims, tracks pay and cost, does payroll on time, and makes clear reports that show clear cash flow. We also keep your clinic within the rules and tax law so you avoid fines or checks. Our service shows trends and spots areas to fix, helping clinics plan budgets and grow well. We manage clinic money so doctors and staff can focus on care and avoid errors. We manage clinic money so doctors and staff can focus on care and avoid errors.

FAQs

1. What is healthcare accounting?

- Healthcare accounting is how a site tracks all cash, pay, and bills. It keeps funds clear and shows where money goes.

2. Why do small clinics need it?

- Small clinics must track cash for pay and bills. Good bookkeeping helps them plan, avoid mistakes, and run work smoothly.

3. What mistakes should be avoided?

- Do not mix personal and office cash. Do not skip checks or ignore small errors. Delay in pay or bills can cost money.

4. How can staff save time?

- Use a tool to track cash, pay, and bills. Staff can spend more time with patients while the tool handles money fast.

5. What tips help with bookkeeping?

- Keep notes clear, check cash flow, track pay and bills, and plan for taxes. Use short tools. These steps cut errors.

6. How is healthcare accounting different from normal work?

- It tracks patient pay, office cash, and bills. Offices must follow extra rules and handle many money streams at once.

7. How can a tool help offices?

- A tool tracks pay, bills, and staff pay. It shows cash flow, spots errors, and helps plan budgets. Staff save time.

8. How does good bookkeeping help an office?

- It keeps cash clear, stops fines, makes sure staff get paid, and lets doctors and staff spend more time with patients.

9. Can small clinics do it alone?

- Yes, but it takes time. A tool or help cuts work, stops mistakes, and keeps cash clear fast.

10. How does good bookkeeping save money?

- Good bookkeeping stops errors, avoids late fees, and helps staff pay on time. It also shows waste, so offices can cut costs fast.